The Transition to Sustainable Aviation Fuel: Understanding Demand Response to Jet Fuel Price Changes

Note: This article was written by University of Illinois Agricultural and Consumer Economics Ph.D. student Sohyeon Ryu and edited by Joe Janzen. It is one of several excellent articles written by graduate students in Prof. Janzen’s ACE 527 class in advanced agricultural price analysis this fall.

Renewable fuels policy has linked agricultural markets to the demand for transportation. (Irwin, 2019) For example, the US renewable fuels standard (RFS) mandates blending specific quantities of ethanol (mainly derived from corn) into the US gasoline fuel supply. Setting and meeting these blending requirements has become complicated in an era when gasoline consumption growth has been limited.

More recently, renewable fuels policy has turned its attention to aviation. Air travel using jet fuel is a major contributor to greenhouse gas emissions. As the number of air travelers has and is expected to continue growing, greenhouse gas emissions from the aviation sector have been rising. Traditional petroleum-derived jet fuel use has been the target of climate and environmental policy. Such policy aims to reduce emissions created by jet fuel use by encouraging a switch to lower-emission sustainable aviation fuels (SAF) made from plant biomass, vegetable oils, sugars, and alcohols including ethanol. For US agriculture, corn and soybean oil markets view SAF as a potentially significant source of future demand (Swanson, 2024).

The success of SAF-focused policies in both reducing environmental damage and driving demand for feedstocks like corn ethanol or soybean oil depends in part on how airlines respond to market changes caused by such policies. Federal and state initiatives to encourage the shift from jet fuel to SAF include sales taxes on jet fuel and tax credit subsidies for SAF. For example, Illinois has a Sustainable Aviation Fuel Purchase Credit that gives favorable sales tax treatment to SAF relative to sales taxes imposed on jet fuel. Both taxes and subsidies aim to make SAF more attractive by increasing the price of jet fuel relative to SAF. With price as a policy instrument, the sensitivity of airlines and other jet fuel buyers to price changes is a crucial factor in achieving policy objectives.

This article characterizes airlines’ responses to changes in jet fuel prices. Descriptive evidence suggests jet fuel demand is relatively unresponsive to price. The demand for aviation fuel may also respond differently to price increases compared to decreases and respond differently in the long run relative to the short run. Policies targeting aviation fuels, either by encouraging SAF use or discouraging jet fuel consumption, are likely to increase the overall price of blended aviation fuel. Understanding how airlines adjust their fuel consumption in response to price changes provides insights into the expected policy and market impacts.

Airlines’ Jet Fuel Use and Response to the Price Fluctuations

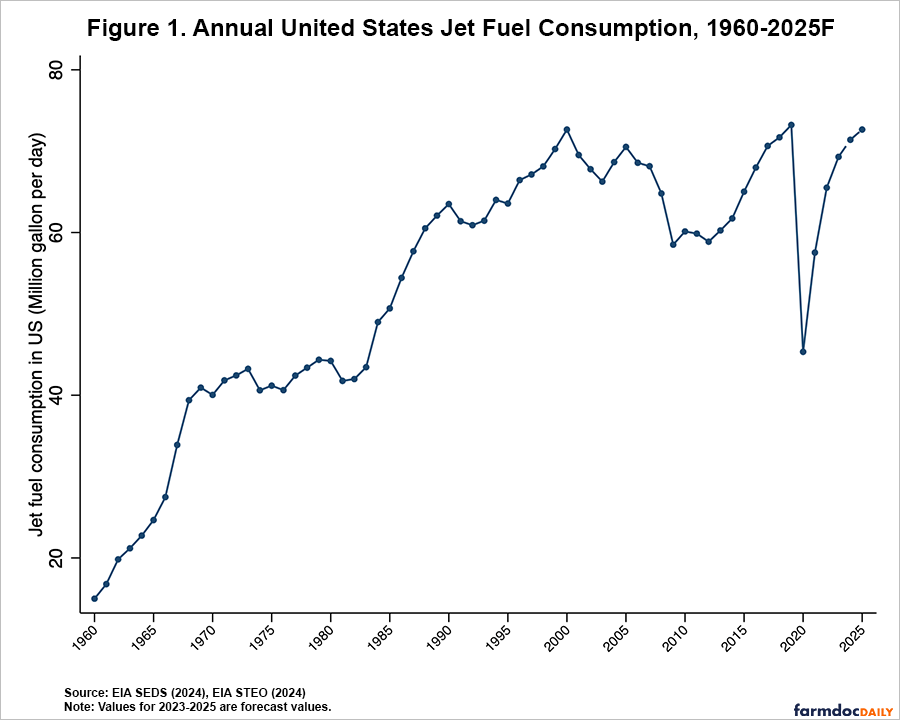

How have U.S. airlines historically consumed jet fuel, and how have they responded to price changes? We may get some understanding about the characteristics of jet fuel demand by looking back at the previous record on how they behaved. The U.S. Energy Information Administration (EIA) provides historical data on jet fuel consumption. As Figure 1 illustrates, over the past few decades, jet fuel use has increased, driven in part by growing demand for air travel and air freight. While jet fuel consumption is closely tied to individual travelers’ willingness to fly more, it is not the only factor that determines the fuel use and other factors also influence its use. Airlines observe fuel prices and adjust input purchases based on ticket demand of travelers and their operational needs. In theory, as fuel prices rise, consumption should decline.

Despite the overall upward trend as from Figure 1, there have been large decreases in jet fuel consumption reflecting specific historical events. In most cases, these events have included changes in traveler willingness to fly, that is shifts in demand, rather than just a response to increasing prices. For example, the Gulf War in the early 1990s reduced air travel due to economic uncertainty while crude oil prices rose because of disrupted production in the Middle East. In this case, reduced air travel demand and fuel price increase made the fuel consumption drop.

Other events are more closely associated with demand shifts. The 9/11 attacks in 2001 led to a short-term suspension of flights and long-term reductions in air travel due to safety concerns. The 2008 financial crisis reduced consumer spending and business activity, leading to lower demand for air travel. Finally, the COVID-19 pandemic caused an unprecedented drop in fuel consumption due to travel restrictions and lockdowns. Figure 1 shows jet fuel consumption has just now returned to pre-pandemic levels.

Characterizing Airlines’ Responses to Jet Fuel Price Changes

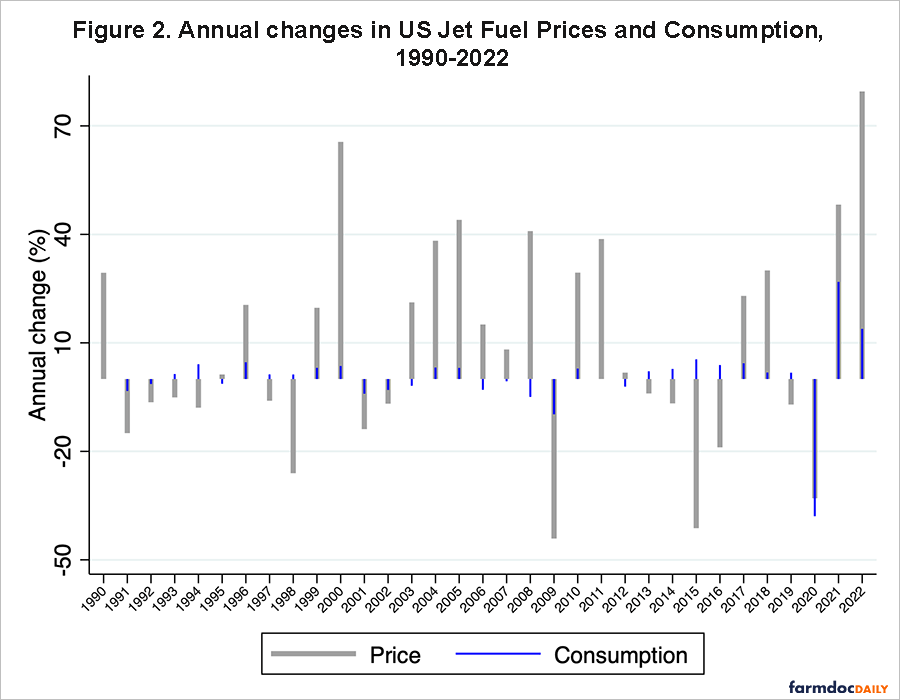

The price responsiveness of demand appears low: Since taxes or subsidies to encourage a transition to SAF may impact prices but do not shift willingness to pay for air travel, policymakers should understand airlines responsiveness to price changes. Broadly, the data suggest airlines’ change in quantity demanded may be small compared to the size of the price changes. Figure 2 shows the annual year-over-year percentage change of jet fuel prices and consumption. The average annual price change, in absolute terms regardless of direction, is 9.5%, whereas the average absolute consumption changes is just 0.6%. Consumption changes are even much smaller if we exclude the pandemic period when consumption dropped significantly.

The disclaimer to this is that since the quantity of consumption and price are affected by many other factors, these changes do not represent a true price elasticity estimate. However, price volatility greater than changes in consumption suggests that airlines may not significantly reduce fuel use in response to rising prices. To the extent that a switch to higher-cost SAF might raise the overall price of aviation fuel for airlines, past responses from Figure 2 imply that airlines may not reduce jet fuel use much. If this is the case, it is likely that the policy goal of reducing carbon emissions through SAF use may be limited. From the perspective of SAF feedstock suppliers, the relatively limited change in consumption in response to changes in price may be positive, since it implies that cost increases due to a switch in fuels can be passed through to consumers.

Price responsiveness may not be uniform across time and direction: Another possible interesting property of jet fuel demand is its asymmetric response to the price increases and decreases. The reduction in jet fuel demand due to a $1 per gallon price increase may differ from the increase in demand caused by a $1 per gallon price decrease. Policymakers therefore must understand the net price impact of the stack of policies applied to the aviation fuel market. Otherwise, they might overemphasize or underemphasize the possible consumption change after implementing the policy. This behavior stems from the time- and capital-intensive nature of aviation operations, which make it difficult for airlines to reverse adjustments made in response to price hikes (Wadud, 2014). Airlines may tolerate short-term fuel price increases without making significant operational changes, but sustained price hikes often lead to operational adjustments, such as investing in fuel-efficient aircraft or revising flight schedules. Once these changes are made, reversing them when fuel prices decline is difficult, as airlines are unlikely to forgo efficiency gains and profitability improvements.

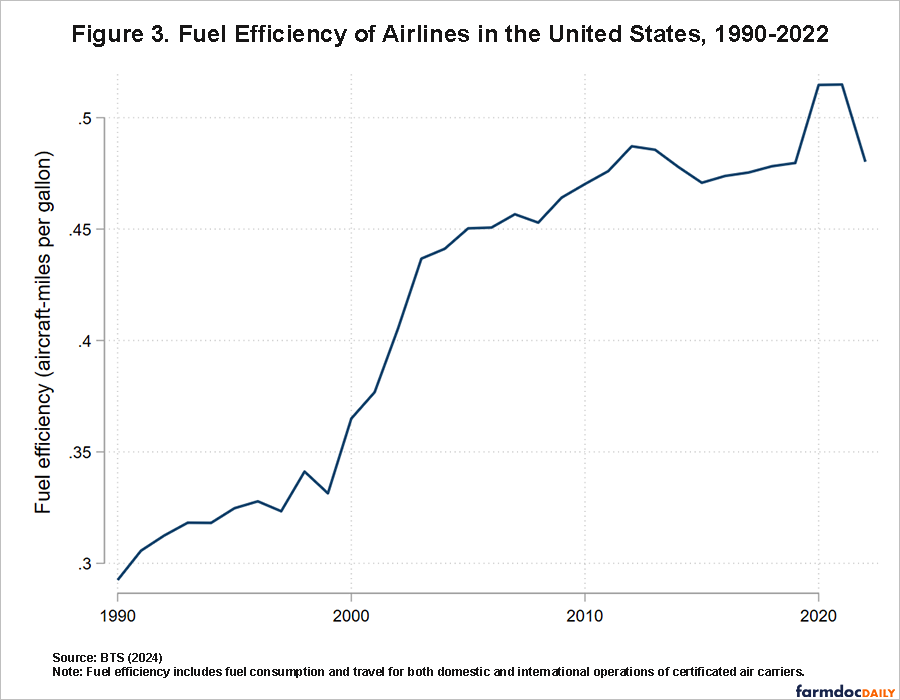

One interesting reason to explain the asymmetry in the long run is a rebound effect on fuel use from the adoption of fuel-efficient aircraft. Airlines have been generally improving their fuel-efficiency over time as highlighted in Figure 3. To the extent they believe price increases will be sustained over the life of an aircraft, airlines can invest in planes with greater fuel efficiency. With planes that require less fuel per mile travelled, airlines have remaining capital to expand their business and buy more fuel than before (Miyoshi & Fukui, 2018; Wadud, 2015). This rebound effect may hinder the intention to reduce greenhouse gas emissions from aviation.

Asymmetric response to the price change and the rebound effect may prevent aviation fuel policies from reaching carbon emissions targets. In the short term, increased prices after policy may lead to reduced consumption, resulting in a decrease in carbon emissions. However, in the longer term, airlines are likely to adapt by improving fuel efficiency. This could lead to an increase in fuel consumption, potentially minimizing or even reversing the carbon reduction effects. Again, maintaining or expanding the quantity of jet fuel used when some component of the overall fuel supply contains SAF is a boon for SAF feedstock suppliers.

Conclusions

Complex characteristics of airlines’ response to the jet fuel price changes make it difficult for policymakers to anticipate the possible impact of policies to decarbonize the aviation sector. However, descriptive analysis suggests airlines’ fuel use might be relatively unresponsive to price changes. Levels of responsiveness differ depending on the direction of price changes, going up or down. Moreover, in the long-run, higher prices might spur investment in fuel efficiency and end up increasing consumption, or at least increasing it relative to what it would have been in the absence of fuel efficiency improvements. From the perspective of carbon emissions reduction efforts, these characteristics of aviation fuel usage may result in modest reductions in the short term.

Policies that encourage a shift from petroleum-derived jet fuel to SAF will increase the demand for feedstocks like corn ethanol and soybean oil, but the extent of this increase also depends on airlines’ responsiveness to fuel price changes. Price-unresponsive demand creates more opportunity for high-cost fuel producers than if fuel users would drastically cut use in response to higher prices. However, feedstock suppliers may face trade-offs between producing SAF and other products, such as food for humans and feed for livestock. The impact of the varied set of policies regarding SAF cannot be anticipated without understanding the direction and extent of airlines’ responsiveness to fuel prices.

References

Bureau of Transportation Statistics (BTS). 2024. “Certificated Air Carrier Fuel Consumption and Travel.” https://www.bts.gov/content/certificated-air-carrier-fuel-consumption-and-travel

Energy Information Administration State Energy Data System (EIA SEDS) 2024. “Comprehensive state-level estimates of energy production, consumption, prices, and expenditures by source and sector.” https://www.eia.gov/state/seds/seds-data-complete.php#Consumption

Energy Information Administration Short-Term Energy Outlook (EIA STEO). 2024. “Table 4a. U.S. Petroleum and Other Liquids Supply, Consumption, and Inventories” https://www.eia.gov/outlooks/steo/data/browser/#/?v=9&f=A&s=&start=1997&end=2025&map=&linechart=~JFTCPUS&ctype=linechart&maptype=0&id=

EIA, U.S. Supply and Disposition, Petroleum & Other Liquids (https://www.eia.gov/dnav/pet/pet_sum_snd_d_nus_mbbl_m_cur.htm)

Energy Information Administration. 2024. “Refiner Petroleum Product Prices by Sales Type” https://www.eia.gov/dnav/pet/pet_pri_refoth_dcu_nus_a.htm

Irwin, S. "Implications of Recent Trends in U.S. Gasoline Consumption for Ethanol." farmdoc daily (9):66, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 12, 2019.

Miyoshi, C., & Fukui, H. (2018). Measuring the rebound effects in air transport: The impact of jet fuel prices and air carriers’ fuel efficiency improvement of the European airlines. Transportation Research Part A: Policy and Practice, 112, 71–84. https://doi.org/10.1016/j.tra.2018.01.008

Swanson, A. "Is Sustainable Aviation Fuel the Future of Ethanol?" farmdoc daily (14):39, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 26, 2024.

Wadud, Z. (2014). The asymmetric effects of income and fuel price on air transport demand. Transportation Research Part A: Policy and Practice, 65, 92–102. https://doi.org/10.1016/j.tra.2014.04.001

Wadud, Z. (2015). Decomposing the drivers of aviation fuel demand using simultaneous equation models. Energy, 83, 551–559. https://doi.org/10.1016/j.energy.2015.02.061

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.