2025 Crop Insurance Harvest Prices for Corn and Soybeans

The harvest price discovery period for Federal crop insurance for corn and soybeans in the Midwest concluded on October 31st, 2025. Harvest prices are $4.22 per bushel for corn and $10.35 per bushel for soybeans. Both are below their projected prices. The corn harvest price is 10.2% lower; the soybean harvest price is 1.8% lower.

For individual revenue policies, yields will need to be below a farm’s actual production history (APH) guarantee yield to trigger payments. For the Enhanced Coverage Option (ECO) on corn acres, payments are likely in counties with average corn yields near trend guarantees for 90% coverage and yields slightly above trend guarantees for 95% coverage. Payments from SCO on corn acres and from SCO or ECO on soybean acres will require average county yields to be below trend guarantees. Overall, insurance payments will occur for some Illinois farms and counties but are not expected to be widespread or large.

Corn

The 2025 harvest price for corn is $4.22 (projected and harvest prices can be found at RMA’s price discovery webpage_. This is based on average settlement prices for the December 2025 corn futures contract over the month of October. The $4.22 harvest price is $0.48, or 10.2%, below the 2025 projected price for corn of $4.70.

The 10.2% price decline on corn implies that an individual farm’s yield for an insurance unit would need to be:

- more than 5.3% below its APH yield to trigger payments on an 85% revenue protection (RP) or revenue protection with the harvest price exclusion (RP-HPE) policy,

- more than 10.9% below APH to trigger payments on revenue policies with an 80% coverage level, and

- more than 16.5% below APH to trigger payments on revenue policies with a 75% coverage level.

The latest 2025 yield estimates for Illinois from the USDA are 219 bushels per acre for corn, representing a record yield for corn in Illinois. As a result, one would expect most farms to not experience yield losses large enough to trigger payments. However, there will be areas, primarily in southern Illinois, where insurance payments will occur.

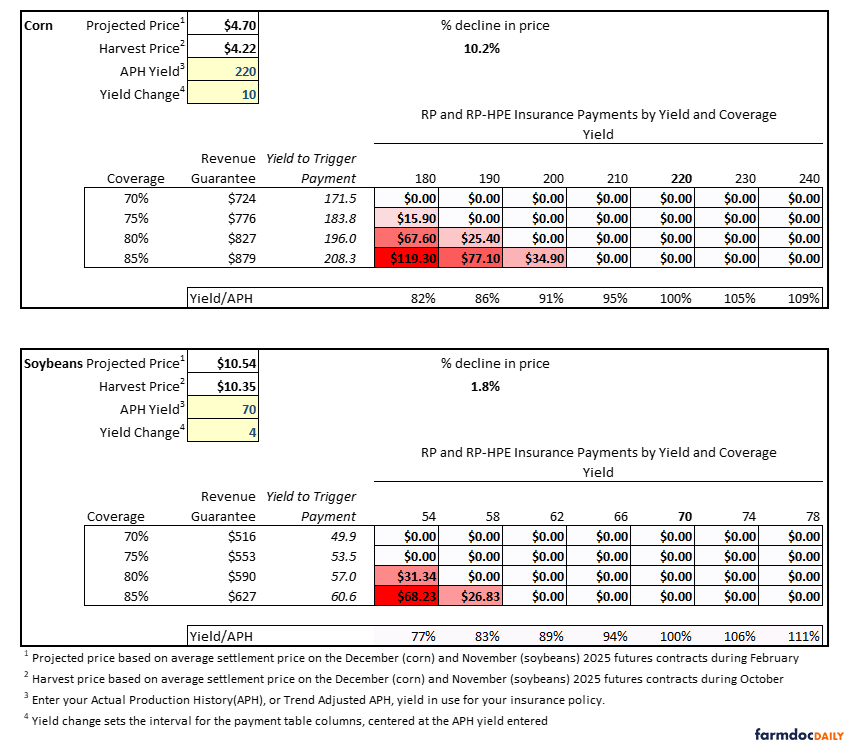

The upper panel of Table 1 provides example indemnity payment scenarios for a farm with a 220 bushel per acre APH corn yield guarantee. Revenue policies at 85% coverage would trigger payments with a corn yield of 208.3 bushels or lower. At a 200 bushel corn yield the indemnity would be $34.90 per acre, increasing to $77.10 per acre with a corn yield of 190. Revenue policies at 80% coverage would trigger payments for this farm with yields at or below 196 bushels per acre, while yields would need to be at or below 183.8 to trigger payments on 75% coverage level revenue policies.

You can examine payment scenarios for individual revenue insurance coverage by plugging your APH yield into a simple Excel calculator that can be downloaded here.

Table 1. Payment Scenarios for Individual Revenue Policy Coverage for Corn and Soybeans in 2025

Soybeans

The 2025 harvest price for soybeans is $10.35. This harvest price is based on average settlement prices for the November 2025 soybean futures contract over the month of October. The $10.35 harvest price is $0.19, or 1.8%, below the 2025 projected price for soybeans of $10.54.

The 1.8% price decline for soybeans implies that an individual farm’s yield for an insurance unit would need to be:

- more than 13.4% below the APH yield to trigger payments on an 85% revenue protection (RP) or revenue protection with the harvest price exclusion (RP-HPE) policy,

- more than 18.5% below APH to trigger payments on revenue policies with an 80% coverage level,

- more than 23.6% below APH to trigger payments on 75% coverage level policies.

The latest 2025 yield estimates for Illinois from the USDA is 65 bushels per acre for soybeans, a record yield. Similar to corn, few insurance payments should be expected except in southern Illinois.

The lower panel of Table 1 provides some example indemnity payment scenarios for a farm with a 70 bushel per acre APH soybean yield. Revenue policies at 85% coverage would trigger payments with a soybean yield of 60.6 bushels or lower. At a 58 bushel soybean yield the indemnity for this farm would be $26.83 per acre, increasing to $68.23 per acre with a soybean yield of 54. Revenue policies at 80% coverage would trigger payments for this farm with soybean yields at or below 57 bushels per acre, while soybean yields would need to be at or below 53.5 to trigger payments on 75% coverage level revenue policies.

Supplemental Insurance Plans – SCO and ECO

Coverage levels of 95% and 90% are available for ECO coverage while the SCO policy provides 86% coverage. Both ECO and SCO provide area-based coverage. Payments are not determined until the Risk Management Agency finalizes and releases area (in most case county-level) yields, which typically occurs in June.

Based on the harvest price of $4.22 for corn, ECO or SCO payments will occur for the following area yield scenarios:

- For 95% ECO coverage, payments begin at an area corn yield 5.8% above trend guarantee.

- For 90% ECO coverage, payments begin at an area corn yield at 0.2% above trend guarantee.

- For SCO coverage (86% coverage level), payments begin at an area corn yield 4.2% below trend guarantee.

Based on the harvest price of $10.35 for soybeans, ECO or SCO payments will occur for the following area yield scenarios:

- For 95% ECO coverage, payments begin at an area soybean yield 3.3% below trend guarantee.

- For 90% ECO coverage, payments begin at an area soybean yield 8.3% below trend guarantee.

- For SCO coverage (86% coverage level), payments begin at an area soybean yield 12.4% below trend guarantee.

Conclusions

The 2025 harvest prices for crop insurance are 10.2% and 1.8% below projected prices for corn and soybeans, respectively. For corn, yield losses relative to a farm’s APH will need to occur to trigger individual revenue coverage payments even on 85% coverage level policies. Area corn yields at or above trend could trigger ECO payments, while area corn yield losses would be needed to trigger SCO payments. For soybeans, larger yield losses will be needed to trigger payments on both individual revenue policies and the ECO and SCO supplemental plans.

The latest 2025 yield estimates for Illinois from the USDA are 219 bushels per acre for corn and 65 bushels per acre for soybeans. Both would represent record yields for the state and are above simple trend yield estimates based on the previous 30 years (1995-2024) of 212.3 and 63.8 bushels per acre.

As always, yield experience across individual farms and counties across Illinois (and in other States) will vary considerably. Payments will occur for some farms for individual insurance coverage, but payments are not expected to be widespread in Illinois given expectations for excellent yields. The most likely chance for insurance payments in Illinois is for 95% ECO coverage on corn acres.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.