SCO and ECO Choices in 2026

The One Big Beautiful Bill (OBBB) Act, passed in July 2025, dramatically increased the premium support on Supplemental Coverage Option (SCO) crop insurance policies from 65% to 80%. The Risk Management Agency of the USDA then announced in August of 2025 that premium support would also be increased to 80% for the Enhanced Coverage Option (ECO) and other similar programs. As a result, farmer-paid premiums for SCO and ECO will be reduced in 2026. If the Risk Management Agency (RMA) rates SCO and ECO properly, farmers should expect to receive more in insurance payments than they pay in premium over time in addition to the risk benefits the products provide. However, this has not been the experience to date for all crops and regions. Historic loss experiences suggest that the income-enhancing features associated with SCO and ECO are lower for Midwest farmers than implied by the direct premium subsidy rates.

What did the OBBB Act do?

The OBBB Act had three direct impacts on SCO:

- The OBBB Act eliminated the requirement that farmers must enroll in Price Loss Coverage (PLC) as the commodity title alternative for those acres to be eligible for SCO coverage. Beginning in 2026, farmers can select the Agriculture Risk Coverage (ARC) program and still use SCO. Now, farmers can make a commodity title choice without considering limitations on SCO use.

- The premium subsidy rate on SCO increased from 65% to 80%. This change will reduce the farmer cost of SCO insurance products while increasing Federal outlays for the SCO products.

- The coverage level on SCO was increased from 86% to 90%. This specific change will not be in effect until the 2027 crop year, but farmers will still have the option of 90% supplemental area coverage through the ECO program in 2026.

What Choices Will Farmers Have in 2026?

SCO and ECO are add-on crop insurance products that provide area-level coverage to supplement farm-level coverage. Note that in most cases the area coverage is based on a county and its expected yield. Farmers must first purchase a farm-level policy such as Revenue Protection (RP), RP with the harvest price exclusion (RPhpe), Yield Protection (YP), or Actual Production History (APH). SCO then provides coverage from 86% down to the coverage level of the underlying farm-level product. Farmers can also purchase additional coverage above 86% using the Enhanced Coverage Option (ECO), either to a 90% or 95% coverage level. Farmers using SCO/ECO with RP can select the following types of coverage:

- RP farm-level revenue protection up to their elected coverage level, which can be as high as 85%,

- Supplemental area revenue SCO coverage from 86% down to the coverage level they selected for their underlying RP policy,

- Additional ECO area revenue coverage from 90% or 95% down to the SCO coverage of 86%.

Several notes about SCO and ECO coverage are important to understand:

- SCO and ECO policies are based on area-level revenue or yield rather than farm-level experience. Therefore, indemnities triggered by SCO or ECO will not always match losses experienced by the farm. A farmer could experience a farm-level loss and not receive a payment from the supplemental area products; or an SCO or ECO payment could be triggered even if the individual farm does not experience a loss (see farmdoc daily articles from May 5, 2021 and May 6, 2021).

- SCO/ECO are based on expected yields and the resulting actual area yields from RMA. The actual area yields used to determine losses are typically released in June following the year in which the production and losses occurred, which delays payments relative to the underlying farm-level policies. That is, SCO/ECO payments for the 2026 insurance year will not be paid until June 2027 whereas payments from an underlying RP policy would typically be received months earlier, often in the year of the loss.

- Farmers do not have to purchase both SCO and ECO, but can only purchase ECO or SCO with their allowable bands of coverage.

Impact on Premiums

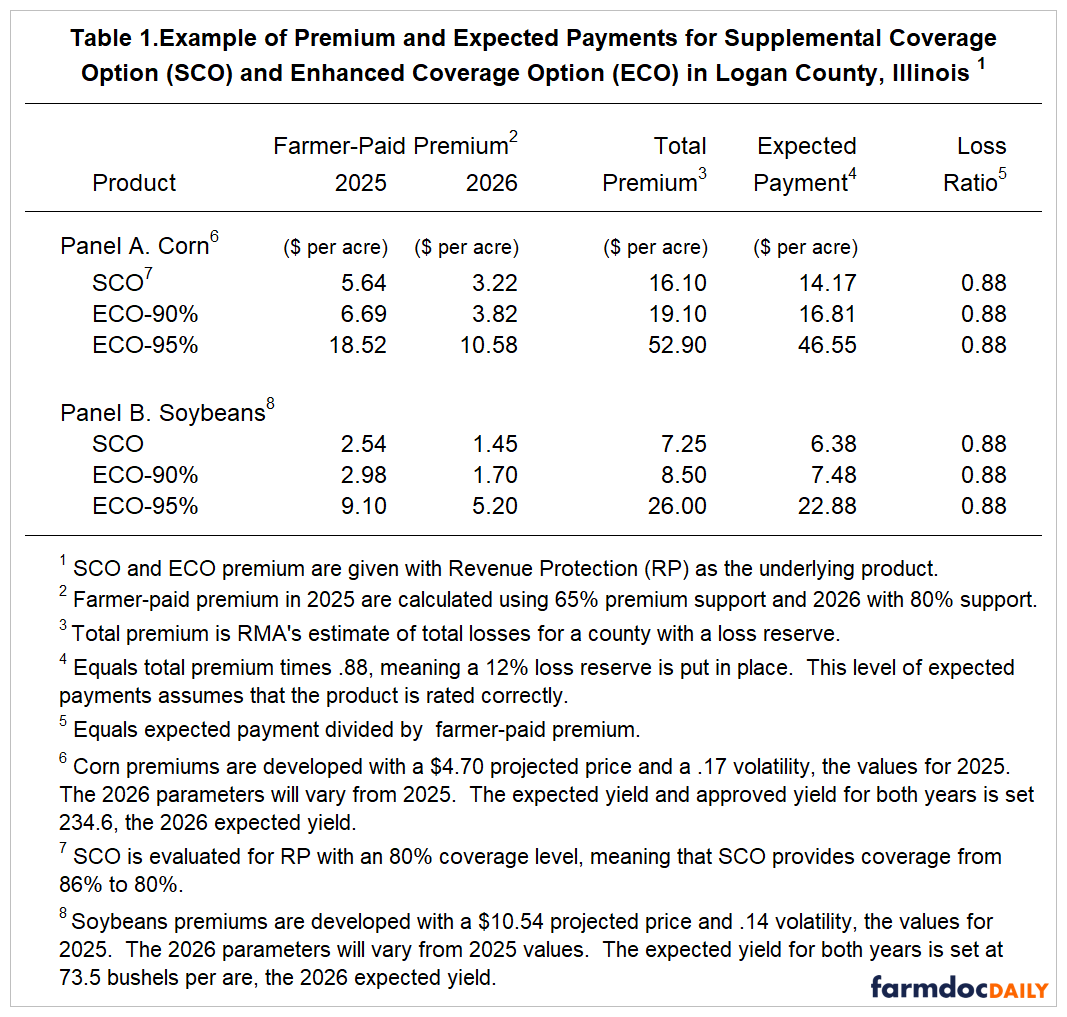

The new increases in the premium support result in a reduction in farmer-paid premium for SCO and ECO premiums by 43% from 2025 to 2026 if the projected prices, volatilities, and expected yields remain the same across years. The impacts of these changes are shown in Table 1 for corn and soybeans given that the underlying COMBO product is 80% Revenue Protection (RP). The SCO premium for corn is reduced from $5.64 per acre in 2025 to $3.22 per acre in 2026. For ECO at the 95% level, the premium for corn would be reduced from $18.52 in 2025 to $10.58 in 2026. The soybeans’ premium for ECO-95% would be reduced from $9.10 to $5.20.

Overall, farmers will pay less for the insurance premium in 2026. That reduction is offset by a corresponding increase in Federal outlays to pay crop insurance companies, assuming no change in total premium for the crop and individual farm insurance coverage level.

Impact on Returns

Over time, farmers should expect to receive more in insurance payments than is paid in farmer-paid premiums if RMA sets premiums propertly. RMA is charged with setting total premiums for federal crop insurance products to equal the expected losses from the insurance product, plus a charge for a loss reserve as a buffer for years in which losses are higher than normal.

Table 1 illustrates the premium setting for a case with a 12 percent loss reserve, and premiums are rated correctly. Consider the ECO policy with a 95% coverage level. That policy has a farmer-paid premium of $10.58 per acre, implying a $52.90 total premium (i.e., $10.58 farmer-paid premium = $52.90 total premium x ( 1 – .80 premium support). That level of total premium should result in expected payments back to the farmer to cover losses of $46.55 over time ($52.90 * (1 – .12 loss reserve)).

Note that the $46.55 expected payment will not be received every year. Payments will only occur in years when revenue from the product is less than the guarantee. Given a 95% coverage policy, losses triggering payments should occur in about 50% of the years. In other words, if 2026 were repeated many times, farmers would receive payments in some years and no payments in the remaining years, with the average payment across all years equaling $46.55, assuming accurately rated premiums.

Should Farmers Take SCO and ECO?

SCO and ECO do not fully eliminate extreme downside risks or fully cover losses for very low yields or prices. Those risks are covered by the underlying COMBO product. ECO and SCO protect against relatively small declines in prices or yields. When RP is the underlying product, a 95% ECO product will reduce losses when revenue falls 5% from the guarantee based on the county calculated revenue. That outcome would have high value given the high subsidies associated with SCO and ECO.

Beyond the risk-benefit considerations, another important factor in deciding whether to use ECO and SCO is their potential income-enhancing effects. If rated correctly, ECO-95% for corn in Logan County will increase expected net revenue for corn by $35.97 per acre (see Table 1 and example above). Soybeans would increase expected revenue by $17.68 per acre ($22.88 expected payment in Table 1 minus $5.20 farmer-paid premium). For 2026, our budgets show a projected net return to cash rent for farmland of -$55 per acre for corn and $25 per acre for soybeans (see farmdoc daily January 13, 2026). In 2026, ECO has the potential to be an important source of additional net revenue. Of course, insurance products like SCO and ECO will not trigger payments that cover the premium cost each year. But over time and, importantly, in years when sufficient yield and price losses occur, those payments can exceed the farmer-paid premium.

Historic Loss Ratios

A key consideration in purchasing ECO and SCO is whether farmers believe that RMA accurately rated the premiums correctly, and thus if subsidy rates are likely to result in net returns of the subsidy to the purchaser of insurance. If premiums are too high, farmers will not receive the expected subsidies over time. Conversely, farmers will receive excessively high payments if loss rates are higher than targets and premiums are thus too low.

Actuarial performance of insurance is often judged by loss ratios. The loss ratio for a policy equals insurance payments divided by total premium. Given a 12% loss reserve, the loss ratio over time should equal 0.88. In the ECO-95% case above, the expected payment of $46.55 divided by $52.90 yields a loss ratio of 0.88 (see Table 1). If loss ratios are below 0.88, expected returns will be lower and the effective subsidy rate is below the stated premium subsidy rate. If loss ratios are higher than 1.0, then the effective subsidy is greater than the premiums subsidy rate. For ECO and SCO to result in a net cost to farmers, the loss ratio would have to be below .20 through time resulting in no capture of the 80% premium subsidy from the government.

Unfortunately, historical loss ratios for all RMA-rated crop insurance products in the Midwest are often below the .88 benchmark. For example, the loss ratio has averaged .40 for all insurance products sold between 2014 and 2023, well below the .88 standard (see farmdoc daily, July 16, 2024) . Some counties in central Illinois have loss ratios below .2. In fact, in many counties, Midwest farmers have paid more in premiums than they have received in return for COMBO-related programs.

That problem extends to SCO and ECO. Even with an 80% subsidy, insurance payments would not have exceeded net benefits in many counties, particularly for soybeans (farmdoc daily, June 10, 2025). In recent years, RMA has been raising expected yields which in turn increases crop insurance payouts (farmdoc daily, January 27, 2026), but not to a level that has resulted in target loss ratios being achieved. In a future farmdoc daily article, we will present up-to-date evidence of expected loss performance for 2026.

Summary

The OBBB Act increased premium support for SCO and ECO to 80% of the premium. Given accurately rated insurance products, SCO and ECO would pay farmers nearly four times as much as they paid in premiums. These benefits are in addition to the risk mitigation provided by insurance products that make payments during periods of low revenues or yields relative to guarantees. While SCO and ECO are triggered by area events rather than own-farm outcomes, farmers may wish to consider SCO and ECO solely due to the expected income transfer over time that should occur from their use.

For farmers to receive positive expected returns — or more indemnities than they pay in premiums — the SCO and ECO insurance products must be rated such that loss ratios exceed .20. That issue will be examined in a future farmdoc daily article along with evidence of the uniformity of loss ratios through time across different production regions.

References

Paulson, N., G. Schnitkey, B. Zwilling and C. Zulauf. "Revised Illinois Crop Budgets for 2026." farmdoc daily (16):6, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 13, 2026.

Schnitkey, G., B. Sherrick, C. Zulauf, J. Coppess and N. Paulson. "Crop Insurance Loss Performance in Illinois and the Midwest." farmdoc daily (14):131, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 16, 2024.

Schnitkey, G., B. Sherrick, C. Zulauf, N. Paulson and J. Coppess. "The House Reconciliation Bill Proposal for SCO: Income Support for High-Risk Farmland." farmdoc daily (15):106, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 10, 2025.

Schnitkey, G., H. Monaco, N. Paulson, C. Zulauf and B. Sherrick. "Expected Yields for SCO and ECO in Illinois." farmdoc daily (16):12, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 27, 2026.

Tsay, J., N. Paulson and G. Schnitkey. "Supplemental Area Insurance and Basis Risk Measures: Part I." farmdoc daily (11):72, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 5, 2021.

Tsay, J., N. Paulson and G. Schnitkey. "Supplemental Area Insurance and Basis Risk Measures: Part II." farmdoc daily (11):73, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 6, 2021.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.