The House Reconciliation Bill Proposal for SCO: Income Support for High-Risk Farmland

The House Reconciliation Bill includes provisions to modify the Supplemental Coverage Option (SCO), a crop insurance product providing county coverage above Revenue Protection (RP) and other farm-level products purchased by farmers. This article examines what the payments would have been from 2015 to 2023 under the proposed structure and finds that the proposed SCO product would have limited benefits to corn and soybean production in many Midwest states. On the other hand, more benefits would have flowed to riskier production regions. By subsidizing a percentage of total premiums, greater income support tends to flow to riskier regions with higher premiums. That issue is magnified further by the low loss ratios in other parts of the country where insurance payoffs tend to be below the stated goals of the Risk Management Agency (RMA) to be near 1.0.

What is Supplemental Coverage Option (SCO)?

Supplemental Coverage Option (SCO) is an add-on crop insurance product providing county-based coverage above a farm-level policy. Farmers first purchase a farm-level policy such as Revenue Protection (RP), RP with harvest price exclusion (RPhpe), Yield Protection (YP), or Actual Production History (APH), and then SCO provides coverage from 86% down to the coverage level of the underlying farm-level product. Farmers can also purchase additional coverage above 86% using the Enhanced Coverage Option (ECO), either to a 90% or 95% coverage level. Farmers using SCO/ECO with RP get two types of coverage:

- Farm-level coverage that begins at the RP coverage level, and

- County coverage from 86% down to the RP coverage level, with the option of adding ECO to further increase the county coverage level to 90% or 95%.

What is the House Reconciliation Bill Proposal?

The House Reconciliation Bill modifies SCO in two ways:

- The premium support rate is increased from 65% to 80%. This change would reduce the costs of the insurance product to the farmer while simultaneously increasing Federal outlays on the product.

- The coverage level is increased from 86% to 90%. In essence, the revised SCO combines the current SCO and ECO at the 90% coverage level. That change has the additional implication that the farmer would need to enroll in PLC. ECO currently allows a farmer to enroll in either commodity title alternative: Price Loss Coverage (PLC) or Agricultural Risk Coverage (ARC). To be eligible to use SCO requires enrollment in PLC.

Changes proposed in the House Reconciliation Bill would make SCO very similar to the cotton STAX program. STAX was introduced for cotton in the 2014 Farm Bill. At that time, upland cotton base acres were excluded from the two Commodity title programs (ARC and PLC) in response to a settlement of the World Trade Organization (WTO) dispute over cotton subsidies (farmdoc daily, April 13, 2017; January 11, 2018). STAX was effectively an alternative to the two Commodity title programs. When Commodity title programs were again initiated through seed cotton, cotton farmers were prohibited from receiving both STAX and seed cotton Commodity title benefits. Because participants if SCO can participate in PLC, the House Reconciliation Bill will allow cotton producers to get the equivalent of STAX coverage through SCO and still enroll in PLC.

Subsidy Impacts of SCO

All Risk Management Agency (RMA) crop insurance products are subsidized. In setting premiums, the RMA estimates the expected insurance payments from the product. Total premium then equals the expected insurance payments, plus a small loss reserve. That reserve is typically operationalized at 12%. That means the loss ratio — indemnity payments divided by total premiums — should equal 0.88. Premium support then reduces the premium to the farmer. As a result, farmers should receive more back in insurance payments than they pay in farmer-paid premiums if total premiums are set to achieve the target loss ratio plus a reserve.

Consider the example of SCO in McLean County in 2025 where an 80% RP product is purchased. The total premium for county-level coverage from a 90% to an 80% RP policy is $33.94 per acre. Farmer-paid premiums and subsidies under the existing and proposed premium support rates are:

- Current 65% premium support rate: $11.88 farmer-paid premium. The premium support on this would be $22.06 per acre.

- Proposed 80% rate under House Reconciliation Bill: $6.79 in farmer-paid premium. The premium support would be $27.17 per acre.

Compared to current subsidies, the House Reconciliation Bill would provide a $5.09 per acre switch: farmer-paid premiums would decrease by $5.09, and premium support paid by the Federal government would increase by $5.09.

Both the premium support and farmer-paid premium would go to private crop insurance companies, who would then manage their risk through both public and private reinsurance agreements. The increase in premium support would not change per-acre receipts to crop insurance companies, only the proportions coming from the Federal government and farmers. The House Reconciliation Bill would decrease the portion coming from farmers and increase the portion coming from the Federal government. Crop insurance companies could benefit from the House Reconciliation Bill if acres enrolled in SCO increases. Often, the use of a crop insurance product increases with higher subsidies.

In the McLean County example, the total premium is $33.94 per acre, meaning that farmers should expect to receive $29.87 ($33.94 x (1 – .12 loss reserve) in indemnities, on average, over time. Under an 80% subsidy, a farmer would pay $6.79 in premiums. Net indemnity payments – insurance payments minus farmer-paid premiums – should equal $23.08 per acre ($29.87 – $6.79 = $23.08). That is, farmers should receive $23.08 per acre more in payments than are paid in farmer-paid premium, over time, if an .88 % loss ratio is maintained.

The SCO program, as proposed in the House bill, is relatively costly in terms of premium support. When purchased with enterprise units, the underlying RP-80% coverage level has premium support of $19.95 per acre, less than the current premium support of $22.06 for SCO/ECO and also below the $27.15 proposed in the House Reconciliation Bill. Moreover, the proposed $27.15 in premium support would be higher than average commodity title payments in recent years. From a Federal outlay perspective, SCO has higher per-acre costs than the underlying COMBO product or actual payments in recent years of the Commodity title program.

Farmer Benefits from SCO in the House Reconciliation Bill

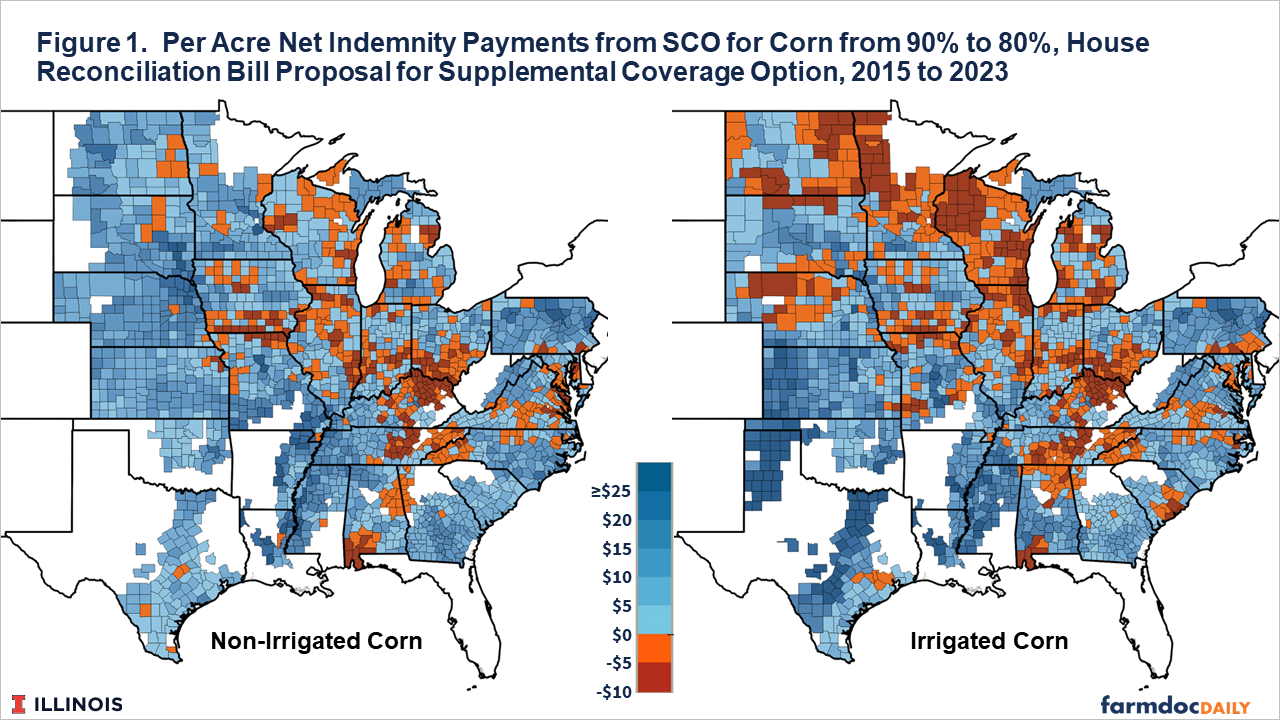

We estimated the payments that farmers would have received from SCO under the proposal in the House Reconciliation Bill from 2015 to 2023, the years in which SCO has been available. For this period, we calculated yearly insurance payments, yearly premiums, and yearly net farmer payments, given that a farmer purchased a COMBO product at an 80% coverage level. Net farmer payments equal per-acre insurance indemnities minus the farmer-paid premium. Average net farmer indemnities by county are shown in Figure 1 for both non-irrigated and irrigated corn.

For the McLean County example, there would have been no payments from 2015 to 2023. Over that time period, the average farmer paid premium would have equaled -$6.10 per acre and no indemnities would have been paid. The average premium support of $24.41 per acre would have gone to crop insurance companies. The net indemnity payment then equals -$6.10 per acre, or $0 insurance payment – $6.10 in insurance premiums.

Total premium for the McLean County case averaged $30.51 per acre. If a loss ratio of .88 had been achieved, indemnity payments would have averaged $26.85 per acre, well above the $0 per acre payment received over the period.

McLean County is not unique in having negative net insurance payments. Many counties in Illinois, Indiana, Ohio, Kentucky, and Tennessee would have had negative net insurance payments under the SCO changes proposed by the House. Overall, positive benefits would have occurred in many other areas, including much of the western Great Plains, Texas, the Mississippi Delta, and the southern Atlantic coasts.

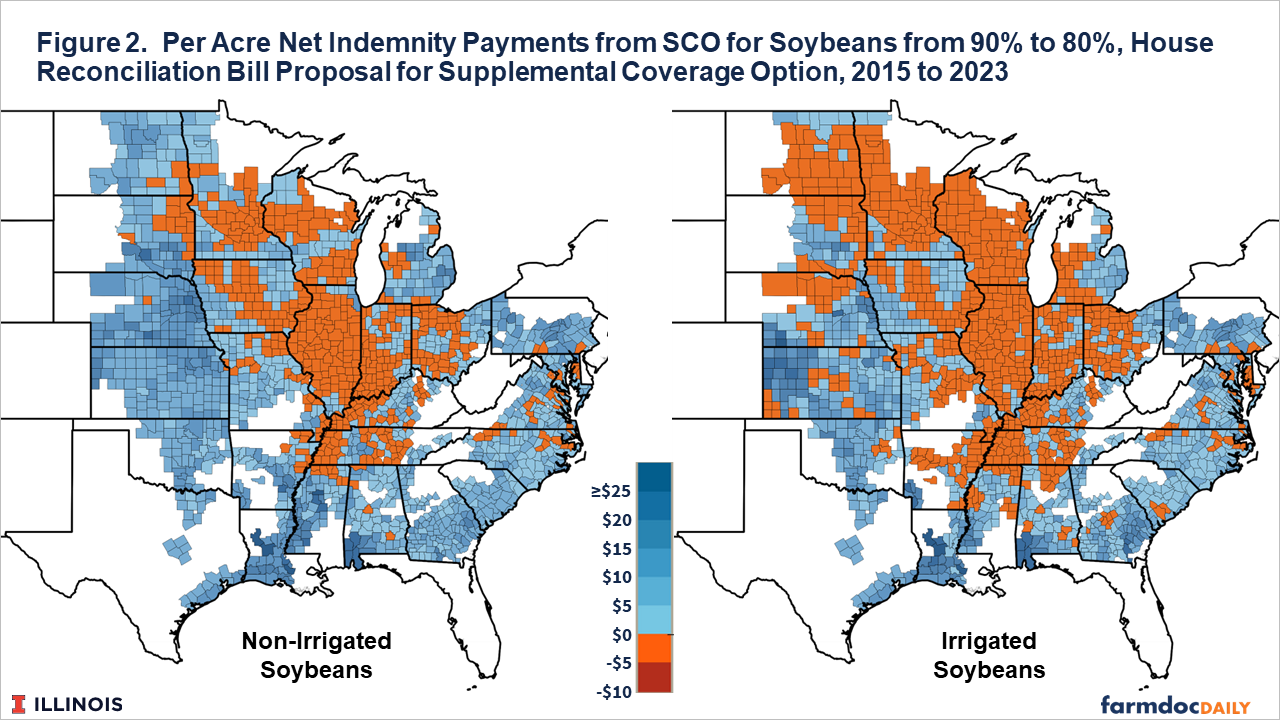

A similar analysis was conducted for soybeans (see Figure 2). Many counties in Minnesota, Wisconsin, Iowa, Illinois, Indiana, Ohio, Kentucky, and Tennessee would have had negative net farmer benefits under the House proposal. Overall, positive benefits would have occurred in many other areas, including much of the western Great Plains, Texas, the Mississippi Delta, and the southern Atlantic coasts.

As proposed in the House Reconciliation Bill, SCO from 2015 to 2023 would not have provided many payments in the heart of the corn belt on what is typically regarded as highly productive, low-risk farmland. On the other hand, more payments and benefits would have been received in higher-risk areas. Part of this is due to the design of crop insurance. Setting premium support as a percentage of total premiums, where the total premium is highly related to expected losses, will provide higher subsidies for higher-risk areas, all else being equal. Moreover, crop insurance rates in the Midwest have resulted in low loss ratios, meaning that payments are relatively low relative to total premiums (farmdoc daily, July 16, 2024). The Midwest’s low loss ratios have been a long-standing trend, partially obscured by the 2012 drought year. On the other hand, farmers from Washington to California, including Texas, the Mississippi Delta, and the South, have loss ratios consistently above 1.0. Farmers in higher-loss counties will tend to benefit the most from the proposed changes to SCO.

Performance of Cotton STAX

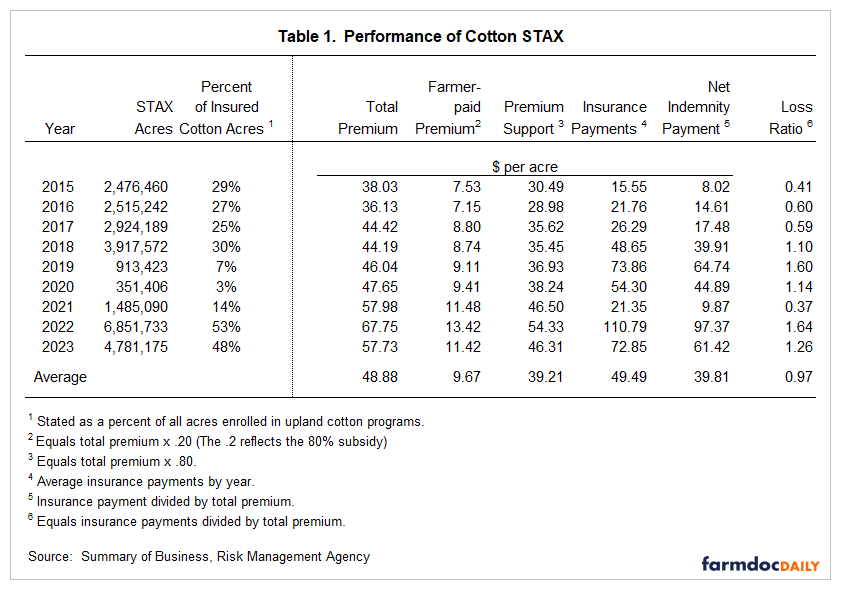

The calculated performance of corn and soybeans differs markedly from that of cotton STAX. Table 1 shows the actual performance of acres insured in STAX from 2015 to 2023. The number of acres enrolled in STAX varies throughout the years. STAX was used on 29% of all cotton-insured acres in 2015. Those acres remained steady and then declined to 7% in 2019 and 3% in 2020. That decline corresponds to the introduction of the seed cotton commodity title program in 2018. As noted above, farmers must choose between STAX for upland cotton and PLC/ARC for seed cotton but cannot elect both. This pattern reversed in recent years as acres enrolled in STAX increased. In contrast, seed cotton base acres enrolled in PLC and ARC dropped, reflecting lower expected payments from the commodity title.

From 2015 to 2023, farmers enrolled in cotton STAX paid premiums of $9.67 per acre. On average, those farmers received $49.49 per acre in insurance payments, resulting in a net indemnity payment of $39.81 per acre. Overall, the program had a loss ratio of 0.97, roughly indicating that ratings were in line with performance given the program’s objectives, and the subsidy flowed back to farmers.

Premium support for the program averaged $39.21 per acre. Those Federal outlays represent per acres subsidies that are much larger than those associated with corn or soybeans in the Midwest.

Commentary

From a historical perspective, the SCO proposal contained in the House Reconciliation Bill would have provided limited benefits to Midwest farmers, particularly those in high-yielding, low-risk areas. Low-risk areas do not benefit to the extent that high-risk areas do from a policy that ties premium support to the total premium, which measures the risk of an area. Moreover, the high-yield regions in the Midwest have tended to have low loss ratios, which further reduces the benefits of crop insurance products.

Perhaps ironically, the SCO proposal in the House Reconciliation Bill would benefit cotton producers the most. To use cotton STAX, cotton farmers are precluded from enrolling in Commodity Title programs. SCO allows enrollment in PLC. If passed, cotton farmers could switch from cotton STAX to SCO and be allowed to enroll seed cotton base acres in the Price Loss Coverage (PLC) program, for which the House also proposed increasing the reference price trigger by 14% over the current level (farmdoc daily, May 20, 2025). Cotton producers currently are purchasing STAX on over 50% of their cotton acres. That growth would likely increase without a Commodity title restriction.

On the other hand, SCO still includes a restriction that farmers cannot enroll base acres in ARC when taking SCO, although crop insurance does not cover base acres. The major crops most likely to enter ARC are soybeans, corn, and wheat. Midwest farmers tend to enroll more heavily in ARC than other farmers. That restriction will tend to keep farmers out of SCO. Hence, Midwest farmers have several impediments to the use of SCO: 1) low loss performance and 2) continued restriction on enrolling base acres in ARC, often the preferred Commodity title alternative.

There are other structural and performance issues with SCO in addition to the regional and crop disparities. If appropriately implemented, SCO will be a high-cost program. SCO performs less like a crop insurance program and more like a program to provide income support to farmers in higher-risk areas (see farmdoc daily, June 13, 2024). That fact was initially recognized by not allowing cotton producers to have cotton STAX and Commodity title programs. Other means of providing support to agriculture would likely be more efficient than through the proposed program.

References

Coppess, J., G. Schnitkey, N. Paulson and C. Zulauf. "Beneath the Label: A Look at Generic Base Acres." farmdoc daily (7):68, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 13, 2017.

Coppess, J., G. Schnitkey, N. Paulson and C. Zulauf. "Reviewing the Latest Cotton Proposal." farmdoc daily (8):5, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 11, 2018.

Schnitkey, G., B. Sherrick, C. Zulauf, J. Coppess and N. Paulson. "Crop Insurance Loss Performance in Illinois and the Midwest." farmdoc daily (14):131, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 16, 2024.

Schnitkey, G., J. Coppess, N. Paulson, C. Zulauf and B. Sherrick. "Cotton STAX and Modified Supplemental Coverage Option: Concerns with Moving Crop Insurance from Risk Management to Income Support." farmdoc daily (14):111, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 13, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.