Revisiting the Basis Risk when evaluating SCO and ECO

Substantially increased subsidies for Supplemental Coverage Option (SCO) and the Enhanced Coverage Option (ECO) as well as the independence from Title I program choices have led farmers to evaluate adding area-based coverage to their 2026 crop insurance portfolios (see farmdoc daily, February 3, 2026). As documented in earlier articles, reducing the coverage level election on Revenue Protection (RP) and stacking SCO and/or ECO over the RP policy may present both expected return and risk benefits compared to traditional high RP coverage alone (see farmdoc daily, February 17, 2026). Shifting some underlying farm-level coverage to county-based coverage, however, comes with what is known as a basis risk or the impact of imperfect correlation between the farm-level and county-level outcomes. In this article, the concept of basis risk is evaluated in terms of the impact of a farm’s risk exposure when a portion of the individual coverage RP policy is replaced with area-based coverage.

Basis Risk

Basis risk refers to the imperfect correlation between farm-level losses and county-level losses that are used to trigger area-based insurance programs (see farmdoc daily May 5, 2021 and May 6, 2021). The effectiveness with which SCO or ECO insurance cushions against adverse farm-level outcomes depends on how closely insured losses on a farm track insured losses for the county in which the farm is located.

Under revenue products like RP, basis risk arises from two sources: (1) different changes in farm and county yield from their expected yield values over the production period, and (2) how changes in prices relate to these farm and county yield changes over the production period. From an analytical perspective, when using SCO or ECO with RP, the basis risks depend both on (1) the correlation between changes in farm and county yield and (2) the correlation of the changes in farm and county yields with changes in the insurance price over the production period. The correlation between changes farm yield and county yield on many factors, including soil characteristics, size and distribution of farm acreage, weather event concentration, and management practices.

If farm yields changes, or shocks in relation to what was expected, differ dramatically from county yields changes and move somewhat independently, the correlation tends to be lower and basis risk is higher. If farm yield changes are typically in line with county yield changes and move up and down together, their correlation is higher and basis risk is lower.

The correlation between farm and county yields do not depend on yield levels. A farm can have on average a higher yield than its county, and yet have a low correlation between its yields changes and its county yield changes. The opposite can also be true.

Holding premiums constant, basis risk does not change the expected net benefits associated with insurance (i.e. expected return), but affects how well payments align with farm-level losses. Farms with different basis risk can, over time (or on average), earn the same benefit from insurance. However, depending on the basis risk, the area-based payments might be triggered when the farm may not need the insurance payment. Or, more importantly from a risk reduction standpoint, area-payments may not be triggered when a farm does experience a localized loss. Therefore, the basis risk affects farm risk.

Another important point is that even though insurance prices (projected and harvest prices) are the same across SCO, ECO and RP, their interactions with yields matter. Although changes in aggregated yields generally drive commodity price changes, the correlation between commodity prices and farm yields is generally weaker than the correlation between prices and county yields due to localized or farm specific impacts.

Case Example

Basis risk introduces variations in downside risk protection even when farms have similar average yields and even if they have similar levels of yield variability. To isolate the role of basis risk, we simulate a set of farms that are identical in every respect except the degree to which changes in their yields track changes in county-level yields. In this example, we assume that all farms have the same correlation between their yields and insurance prices. The remaining basis risk is then purely driven by differential yield change risk.

We simulate farms with an average yield of 233 bushels per acre, equal to the expected county yield and typical for Central Illinois. Their APH is equal to the expected county yield, and all farms have the same yield variability and insurance unit acreage. Projected and harvest prices are assumed to be $4.60 per bushel and the price volatility factor is 16%. All farms are subject to a $-0.35 per bushel cash price basis.

Because farms share identical expected yields, yield variability and price exposure, their Revenue Protection (RP) policy premium is the same. SCO and ECO premiums are also the same since they are in the same county and farms share the same APH. The case presented is for a farm that purchases RP coverage at 80% plus SCO and ECO95.

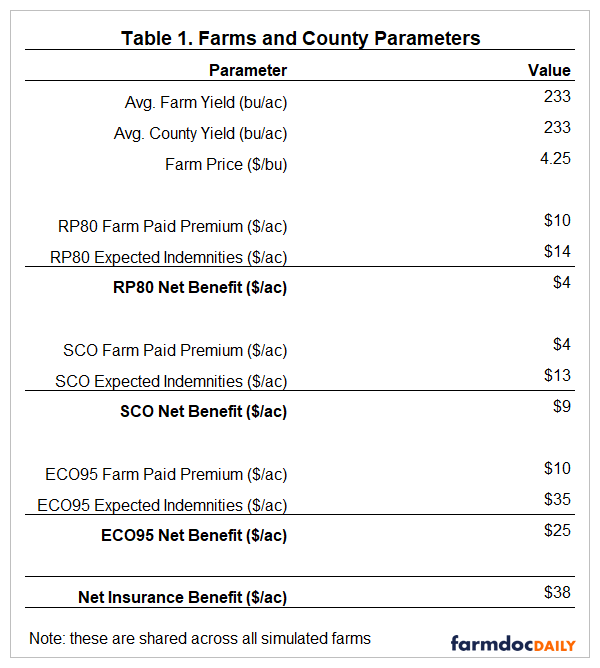

Table 1 summarizes farm characteristics, insurance premiums, expected indemnities and expected net benefits (defined as insurance payments minus farm paid premiums). These values are the same across farms.

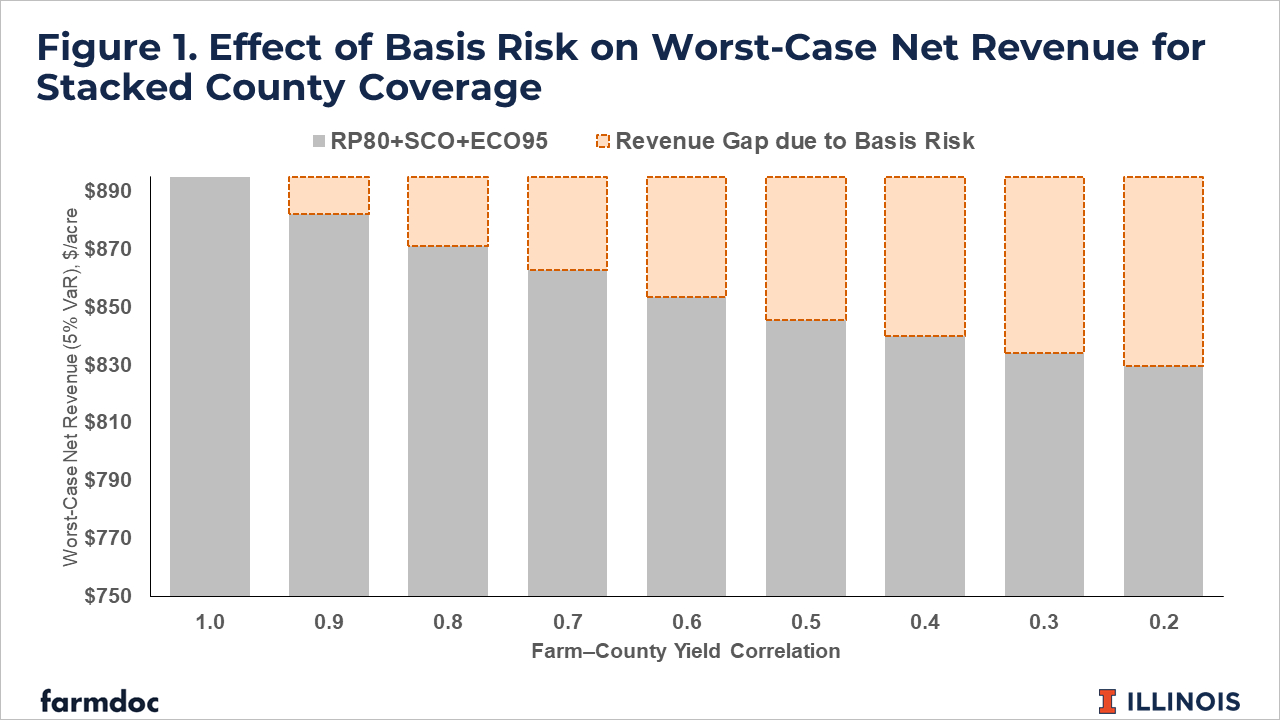

The basis risk can be viewed of as the risk of not receiving insurance payments when farm-level revenue losses occur. One way to assess the difference in risk performance is through the Worst-Case Net Revenue in the insurance evaluator tool, represented as the 5% VaR for farmer revenue, or the level whose outcome happens only 5% of the time, or a 1-in-20-year adverse event (see farmdoc daily, February 10, 2026). Higher values of this revenue measure imply greater risk reduction or lower levels of farm revenue risk as better outcomes for a 1-in-20-year adverse event would be considered more desirable.

The net payments from the county products will be the same across farms in this case study, but, due to basis risk some — perhaps many — payments will be made when farm losses did not occur at all or were very modest. Essentially, county-based payments are received in some cases where farm revenue losses did not occur, and some periods have farmer losses without triggering the county-level indemnity.

To visualize the basis risk, Figure 1 shows the Worst-Case Net Revenue ($ per acre) for each farm. The farm with a farm-county yield correlation of one is free of any basis risk since any county-level payment triggered is also the farm-level payment. As the farm-county yield correlation decreases, the basis risk increases, or county-triggered payments become less aligned with farm losses. As a result, there is an increase in farm risk (lower Worst-Case Net Revenue).

Lowering Individual Coverage and Stacking County-Coverage

Stacking SCO and ECO products can increase expected net benefits, but they come with increased premium costs and as a result, farmers might consider lowering their RP coverages and adding SCO and ECO coverages in lieu of farm-level insurance (see farmdoc daily, February 17, 2026). The tradeoff might offer a comparable total premium cost and higher expected net insurance benefits, but basis risk should also be assessed.

Figure 2 shows the comparison between the Worst-Case Net Revenue for RP-85% and other insurance options. Specifically, the comparison of interest is the difference between Worst-Case Net Revenue with RP-85% and Worst-Case Net Revenue for other insurance alternatives. A positive value means that the alternative is better than RP-85% alone from a risk perspective.

Basis risk can alter the relative performance of different insurance combinations. For instance, to maintain the same level of risk protection by going from RP-85% to RP-75%+SCO+ECO95, the farm-county yield correlation needs to be at least 0.55. Further lowering the RP coverage level increases the correlation requirement between farm and county yield needed to maintain the same risk mitigation performance as RP-85%. For example, RP-70%+SCO+ECO95 would require a farm-county yield correlation of 0.65 to have the same risk mitigation performance as RP-85%.

Discussion

The example illustrates how the basis risk affects farm risk when adding or substituting away from farm-level coverage for area-based coverage. Replacing some individual coverage with county-level coverage tends to introduce a mismatch between the timing of payments from the area-based product compared to the individual farm product. Higher levels of basis risk (i.e. degree of mismatch in payments) will decrease the farm-level risk reduction effectiveness of SCO and ECO and vice versa. For farms with especially close congruence between farm and county-level yield outcomes relative to their respective expected levels, the basis risk is reduced to the point that more area coverage may be more cost-effective than additional own-farm coverage.

In the Midwest, particularly in Central Illinois, the farm-county yield correlations tend to be moderate to high, often higher than 0.70 (see farmdoc daily May 5, 2021). These levels fall within ranges where stacked SCO and ECO coverage with lower RP coverage may provide comparable or improved downside risk protection, although each case should be evaluated individually.

As we approach the end of the price discovery period for corn and soybeans, the insurance evaluator tool can be used to evaluate risk among insurance options. For that, it considers a representative farm in the county, which already incorporates the typical or average basis risk for farms in that county (see farmdoc daily, February 10, 2026). Again, individual farms can differ from those average relationships.

Conclusion

Higher subsidy rates for SCO and ECO in 2026 increase the attractiveness of their usage and the potential for replacing some RP coverage with county-level coverage. However, switching from farm-level to county-based coverage introduces basis risk because farm losses do not precisely mimic county losses. As basis risk increases, replacing RP with SCO and ECO reduces risk benefits. In regions where the basis risk is low, such as in Illinois, use of SCO and ECO with lower RP coverage levels can provide improved risk benefits at similar or lower premium cost to the farmer. This result may not hold for all farms and in other regions and the tradeoffs need to be evaluated on a case-by-case basis.

References

Monaco, H., G. Schnitkey, N. Paulson, J. Coppess, B. Sherrick, C. Zulauf, C. Navarro, P. Shan and L. Fu. "Release of Insurance Evaluator with the New SCO and ECO." farmdoc daily (16):21, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 10, 2026.

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. "The New Enhanced Coverage Option (ECO) Crop Insurance Program." farmdoc daily (10):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 24, 2020.

Paulson, N., G. Schnitkey, H. Monaco and C. Zulauf. "Comparing Crop Insurance Scenarios with SCO and ECO for 2026." farmdoc daily (16):25, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 17, 2026.

Schnitkey, G., N. Paulson, C. Zulauf, H. Monaco and B. Sherrick. "SCO and ECO Choices in 2026." farmdoc daily (16):16, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 3, 2026.

Tsay, J., N. Paulson and G. Schnitkey. "Supplemental Area Insurance and Basis Risk Measures: Part I." farmdoc daily (11):72, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 5, 2021.

Tsay, J., N. Paulson and G. Schnitkey. "Supplemental Area Insurance and Basis Risk Measures: Part II." farmdoc daily (11):73, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 6, 2021.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.