Comparing Crop Insurance Scenarios with SCO and ECO for 2026

Significantly reduced farmer-paid premiums for Supplemental and Enhanced Coverage Option (SCO and ECO) policies suggest that farmers should consider using these products in their 2026 crop insurance portfolios. Adding SCO and ECO to higher coverage level farm-level plans such as Revenue Protection (RP) will increase expect returns and reduce risk, while also increasing total premium costs. Expected returns can be increased more by reducing RP’s coverage level while still using ECO and SCO. Those results are illustrated using farmdoc’s Crop Insurance Payment Evaluator.

Expected Return and Risk Measures

For each insurance coverage scenario we compute measures of expected return and risk for the farmer based on the simulation model underlying the Crop Insurance Payment Evaluator tool (see farmdoc daily from February 10, 2026 for more details on the tool).

Net benefit, often called expected returns in finance, is the difference between expected insurance payments and farmer-paid premium. Since federal crop policies are subsidized, farmers should expect to receive more in indemnity payments, over time, than they pay in premiums. In other words, expected returns to federal crop insurance should be positive. Historical loss experience shows that this has not necessarily been the case, suggesting that crop insurance are too high in many areas, particularly throughout the Midwest (see farmdoc daily articles from January 17, 2023 and July 16, 2024).

The risk measure used is referred to as the (worst case) net revenue and represents the net revenue for the farmer for the 5% worst simulated outcomes. In finance this would be referred to as the 5% value-at-risk (VaR) of the farmer’s possible revenue outcomes. Another way to interpret this risk measure is as a 1-in-20 chance that revenue could fall below this level. The higher the net revenue (worst case) measure, the lower the risk associated with the insurance coverage.

Crop Insurance Coverage Scenarios

The Crop Insurance Payment Evaluator was used to measure benefits and risks associated with each unique coverage combination a farmer could put together using Revenue Protection (RP) and the Supplemental and Enhanced Coverage Options (SCO and ECO). The Evaluator tool also allows users to examine scenarios involving Revenue Protection with the Harvest Price Exclusion (RP-HPE) and Yield Protection (YP) but we limit our comparisons here to scenarios with RP given it is the most widely used by farmers. Coverage levels considered for RP range from 55% to 85%. SCO provides coverage from 86% down to the coverage level for the underlying RP plan and ECO can be used with either a 90% or 95% coverage level down to 86%. This results in 42 different coverage combinations, each with their own measures of expected return and risk.

Below we illustrate and discuss the results for corn and soybean insurance coverage for 2026. using McLean County, Illinois as the example. While the specific values (expected indemnities, premiums, net revenues, etc.) will vary across farms and regions, the general results tend to hold across counties we have examined across Illinois.

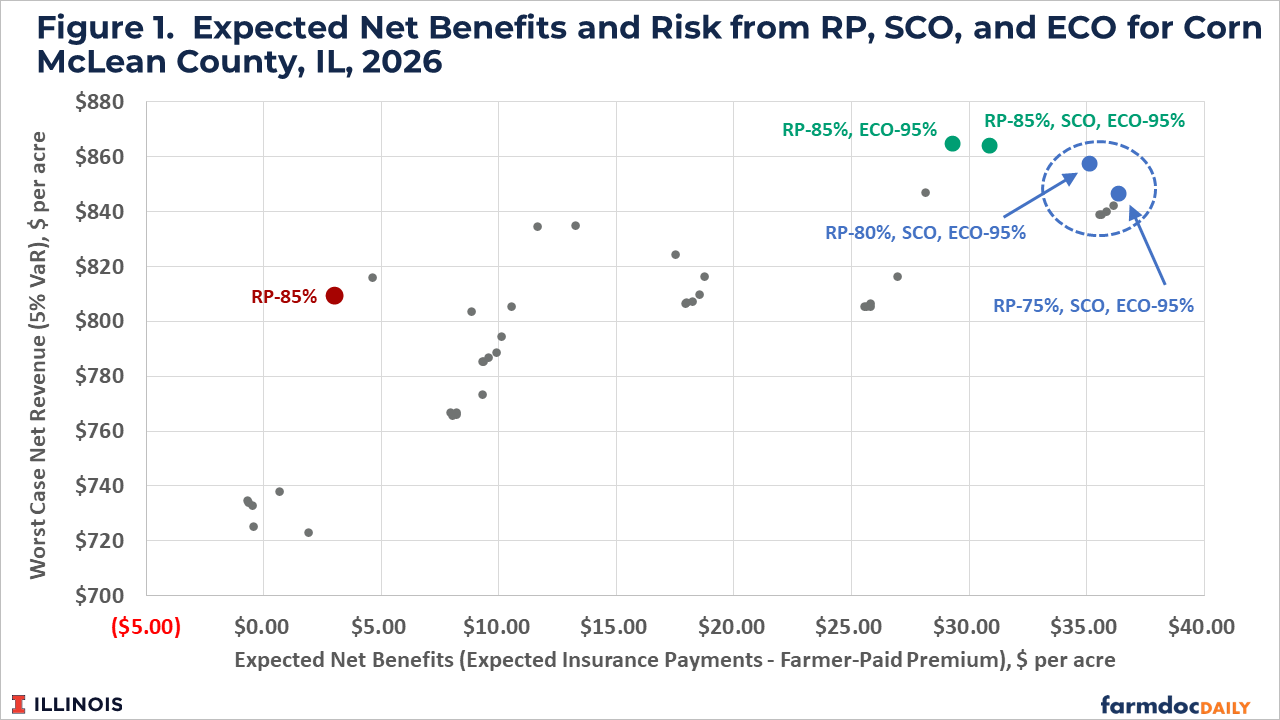

Corn

Figure 1 summarizes the results for corn in McLean County, Illinois. Each dot in the figure represents a specific coverage combination. Values on the horizontal axis (x-axis) represent the net benefit, or expected insurance payments minus farmer premium, in dollars per acre. Values on the vertical axis (y-axis) are the risk measure – net revenues (worst case) in dollars per acre. Coverage combinations resulting in larger expected returns (dots further to the right in the figure) and/or lower risk (dots vertically higher in the figure) should be more desirable for the farmer.

RP at an 85% coverage level is useful as a baseline to which other coverage combinations can be compared. RP-85% is labeled in red in Figure 1 and has a $14.59 farmer premium, a net benefit of $3 per acre and a worst-case net revenue of $809 per acre.

Adding supplemental coverage with ECO 95% (RP-85%, ECO-95%) increases the expected return to the farmer to $29 per acre and increases the worst-case net revenue (reduces risk) to $864 per acre. Also including SCO coverage (RP-85%, SCO, ECO-95%) further increases expected return to nearly $31 per acre with a similar worst case net revenue as the combination without SCO. The addition of the supplemental coverage to 85% RP maximizes risk benefits but also results in the highest premium cost to the farmer of around $24 per acre in these scenarios. These coverage scenarios are provided in green in Figure 1.

The dots in the circle of Figure 1 and provided in blue represent coverage combinations with lower levels of RP coverage with SCO and ECO. These combinations increase net benefits to $35 or more per acre. These scenarios also increase risk benefits compared with the baseline case of RP-85% and only slightly lower risk benefits (lower worst case net revenues) than the combinations of 85% RP with supplemental coverage. Importantly, they also reduce total premium cost compared with the scenarios with 85% RP and supplemental coverage. In fact, they have farmer-paid premium costs which are quite similar to RP-85% with no additional supplemental coverage.

Reducing RP coverage to 80% with both SCO and 95% ECO results in an expected return of $35 per acre, a worst-case net revenue of $858 per acre, and a farmer premium of $18 per acre. Expected return is maximized at just over $36 per acre with RP coverage at 75% combined with SCO and 95% ECO. The worst-case net revenue falls to $846 per acre while premium cost declines to $15 per acre.

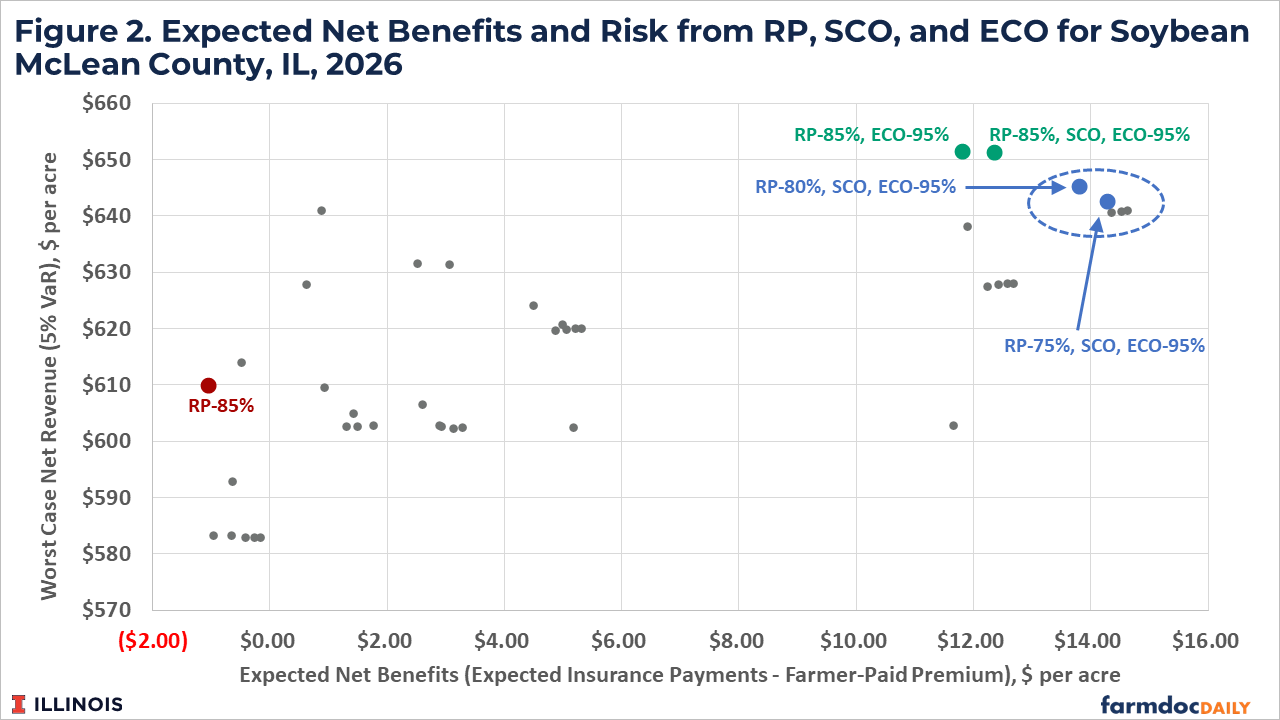

Soybean

Figure 2 summarizes the results for soybean in McLean County, Illinois. As with corn, each dot in Figure 2 represents the risk and return measures associated with a different insurance coverage combination. RP 85% for soybean provides an expected return of -$1 per acre and worst-case revenue of $610 per acre at a premium cost to the farmer of nearly $7 per acre.

Adding 95% ECO to 85% RP coverage increases the premium cost to nearly $12 per acre, increases the expected return to nearly $12 per acre, and add risk benefits by increasing the worst-case net revenue to $651 per acre. Also adding SCO coverage increases the premium and expected return to just over $12 per acre while the worst-case net revenue is virtually the same. These risk benefit coverage scenarios are shown in green in Figure 2.

The scenarios inside the blue circle in Figure 2 include combinations with lower RP coverage levels combined with supplemental coverage. Similar to corn, lowering the RP coverage level while keeping supplemental coverage can further increase net benefits and substantially lower the premium cost to the farmer. For example, 80% RP with SCO and ECO 95% lowers the farmer-paid premium to $9.50 per acre and increases net benefits to nearly $14 per acre. The worst-case net revenue of this combination at $645 per acre is slightly lower than with RP-85% plus supplemental coverage but still higher than with RP-85% alone. Further lowering RP coverage to 75% with SCO and 95% ECO brings the farmer-paid premium down to $8 per acre with net benefits of just over $14 per acre and worst-case net revenue of $643 per acre.

Summary

Analysis of all coverage combinations of RP, SCO, and ECO for 2026 using the Crop Insurance Payment Evaluator results in the following observations:

- For a given RP coverage level, adding supplemental coverage increases risk benefits to the farmer.

- Adding full supplemental coverage through SCO and ECO-95% without lowering the RP coverage level will increase premium costs substantially. However, given the high subsidy rate for SCO and ECO, expected returns also increase.

- Lowering RP coverage and adding SCO and ECO can result in farmer-paid premium costs similar to those for RP-85% on its own while providing larger net benefits and higher worst case net revenue levels.

These observations suggest that all farmers should seriously consider using SCO and ECO as part of their federal crop insurance coverage portfolios in 2026. Risk reduction benefits will be maximized with high RP coverage (i.e. 85%) combined with SCO and 95% ECO but premium costs will increase accordingly. Premium costs can be reduced by using a lower coverage level for RP in combination with SCO and ECO. Trading higher farm-level coverage for area-based coverage with the supplemental policies could cause concern with matching coverage to farm-level losses and may not be warranted in all situations (see farmdoc daily from February 10, 2026). Still, the analysis suggests risk benefits can be improved, net benefits can be increased, and total premium cost will be similar compared with carrying RP at an 85% coverage level alone.

The extent of the risk introduced by lowering RP coverage to help cover the premium cost of the supplemental plans will be further addressed in a farmdoc daily article scheduled for later this week.

References

Monaco, H., G. Schnitkey, N. Paulson, J. Coppess, B. Sherrick, C. Zulauf, C. Navarro, P. Shan and L. Fu. "Release of Insurance Evaluator with the New SCO and ECO." farmdoc daily (16):21, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 10, 2026.

Schnitkey, G., C. Zulauf, N. Paulson and J. Baltz. "Crop Insurance for Soybeans: The Low Loss Ratio Concern." farmdoc daily (13):8, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 17, 2023.

Schnitkey, G., B. Sherrick, C. Zulauf, J. Coppess and N. Paulson. "Crop Insurance Loss Performance in Illinois and the Midwest." farmdoc daily (14):131, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 16, 2024.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.