2014 Harvest Prices for Crop Insurance

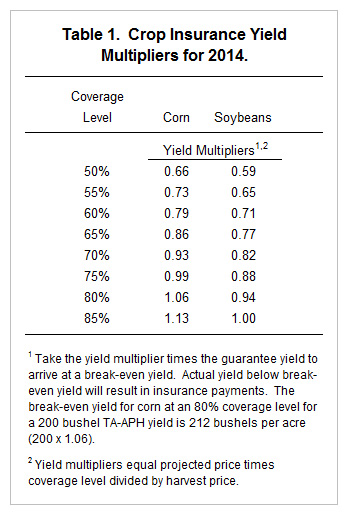

Harvest prices used in crop insurance payment calculations for corn and soybeans grown in Midwest states equal the average of settlement prices on futures contracts during October. Since October is over, harvest prices have been determined. Harvest prices are $3.49 per bushel for corn and $9.65 per bushel for soybeans. Both harvest prices are well below 2014 projected prices. As a result, farmers may receive crop insurance payments even if their yields are relatively high. Below are projected yield multipliers for calculating break-even yields. Actual yields below break-even yields will result in crop insurance payments.

Corn

The 2014 projected price for corn is $4.62 while the harvest price is $3.49. The harvest price is 76% of the projected price, meaning that the harvest price is 24% less than the projected price. This large price decrease could lead to crop insurance payments unless yield increases offset price decreases.

Multipliers in Table 1 can be used to calculate yields below which crop insurance payments will occur. Take the yield multiplier times the Actual Production History (APH) or Trend-Adjusted APH (TA-APH) to arrive at a break-even yield. Insurance payments will occur when actual yield is below the break-even yield. Suppose the TA-APH yield is 190 bushels per acre. The multiplier is 1.13 for the 85% coverage level, leading to a break-even yield of 215 bushels per acre (190 TA-APH yield x 1.13). In this case, revenue insurance will make payments if the actual yield is below 215 bushels per acre.

Soybeans

The 2014 projected price for soybeans is $11.36 while the harvest price is $9.65. The harvest price is 85% of the projected price, meaning that the harvest price is 15% less than the harvest price. Soybean prices fell relatively less than corn, which cause yield multipliers to be lower for soybeans than for corn. Soybean yields have to be relatively lower than corn yields to trigger crop insurance payments.

The yield multiplier for the 85% coverage level in soybeans is 1.00. A farm with a 50 bushel TA-APH has a break-even yield of 50 bushels per acre (50 TA-APH x 1.00).

Summary

Because harvest prices are less than projected prices, relatively high yields will result in crop insurance payments, particularly when coverage levels are 80% and 85%. Farmers should not assume that insurance payments will not occur just because yields are high. Checking actual yields against break-even yields is a prudent practice.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.