Higher 2011 GRIP Premiums Still Below Expected Payments

Group Risk Income Plan with the harvest price option (GRIP-HR) will have higher premiums in 2011 as compared to 2010. Premiums were estimated for corn using a projected price of $6.00 and a volatility of .29. This price and volatility will not be final until the end of February. Hence, actual premium could vary from estimates shown in this paper. Over all counties in Illinois, GRIP-HR premiums will be about 75% higher in 2011 as compared to 2010. Even with these increased premiums, the estimated expected payments exceed farmer-paid premium in most counties of Illinois.

GRIP-HR premium for 2011

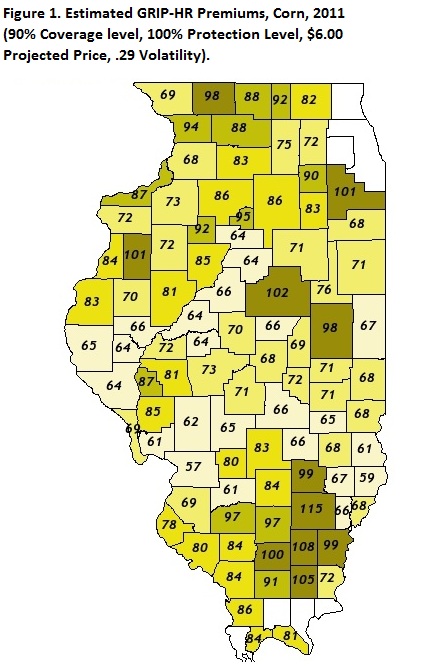

GRIP-HR for a 90% coverage level and a 100% protection level are shown in Figure 1. Lowering either the coverage or protection level will lower farmer-paid premiums. More detailed estimates of GRIP-HR premiums can be obtained from the 2011 Crop Insurance Decision Tool, a Microsoft Excel spreadsheet available for download from the farmdoc website.

As shown Figure 1, GRIP-HR premiums are high and vary across counties. Five counties have premiums over $100 premium per acre: Wayne ($115 per acre), Hamilton ($108), Saline ($105), McLean ($102), Warren ($101), and Will ($101) counties. Higher cost counties tend to be located in southeast Illinois, although McLean, Warren, and Will Counties are located in central Illinois. The five counties with the lowest premiums are Madison ($57), Lawrence ($59), Jersey ($61), Clinton ($61), and Crawford ($61) counties.

In some cases adjacent counties have large differences in premiums. A good example is McLean and Champaign counties, located in central part of Illinois. Both McLean and Champaign counties are large corn producing counties. In 2009, McLean ranked 1st and Champaign ranked 5th in total corn production in Illinois. McLean County has an estimated 2011 premium of $102 per acre while Champaign County has a $98 per acre premium. These counties have significantly higher premium costs than adjacent counties. For example the three counties immediately south of McLean County have premiums of $70 per acre (Logan County), $66 per acre (DeWitt County), and $69 per acre (Piatt County). Difference in premium may influence crop insurance decisions. Farmers in Logan, Dewitt and Piatt counties which have lower premiums likely will find GRIP more attractive than farmers in Champaign and Logan Counties where premiums are higher.

Higher premiums

Higher 2011 premiums result because of four causes:

- Higher rates. The Risk Management Agency (RMA) increased the rates associated with GRIP-HR policies. These higher rates account for 2% of the estimated increase in 2011 premiums over 2010 premiums.

- Higher expected yields. In many counties, RMA increased the expected yields between 2011 and 2010. An increase in the expected yield increases the guarantee associated with GRIP, thereby also leading to increases in premium. Higher expected yields account for 4% of the estimated increase in 2011 premiums over 2010 premiums.

- Higher projected prices. Projected prices in 2011 are estimated at $6.00 per bushel while the 2010 premium was $3.99 per acre. The higher projected premiums result in 76% of the estimated increase in 2011 premiums over 2010 premiums.

- Higher volatilities. Volatility is a measure of price variability, with higher volatility indicating higher price variability. Higher price variability increases the chance that payments will be made under revenue products. As a result, RMA increases the premium when volatility is estimated to be higher. The estimated 2011 volatility of .29 is above the 2010 volatility of .26. The increased volatility accounts for 22% of the premium increase.

Expected Payments minus Premiums

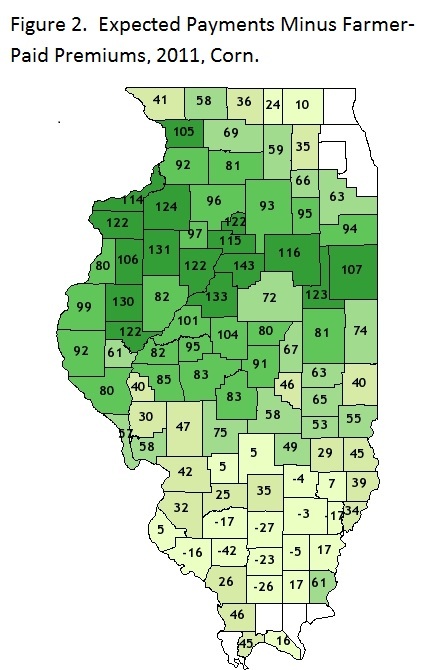

Figure 2 shows expected payments minus premiums. Positive numbers indicate that expected payments exceed farmer-paid premiums. Most counties in Illinois have positive expected payments minus premiums. This is as it should be. GRIP-HR, as are all multi-peril crop insurance program offered by RMA, are subsidized such that farmers pay less for the product than the product is expected to pay.

Positive expected payments do not mean that GRIP-HR will have positive returns every year. In over half the years, GRIP-HR will not make payments. Payments will be lumpy, with large payments happening in a few years. For example, if a major drought year like 1988 happened again, GRIP-HR would make large payments, exceeding $800 per acre in central Illinois counties.

Summary

Like all crop insurance products, GRIP-HR will cost more in 2011 as compared to 2010. While having higher premiums, the expected payments from GRIP-HR still exceed payments. Hence, some farmers may wish to consider GRIP-HR. GRIP-HR likely will be preferred by farmers who are more concerned with price risk than with yield risk. Because GRIP allows a 90% coverage level, GRIP offers better price protection than is offered by farm-level revenue products that have a highest coverage level of 85 percent. Moreover, expected yields used in GRIP do not lag production as Actual Production History (APH) yields for COMBO products. Hence, GRIP does not lower effective coverage like a typical COMBO.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.