The Financial Health of the Farm Credit System

In my last farmdoc daily blog, I summarized the financial health of commercial banks lending to agriculture. Similar to commercial banks, Farm Credit System (FCS) institutions navigated the financial crisis and remain strong and profitable. The Farm Credit System of institutions, established in 1916, provide approximately $160 billion in loans and related services to farmers, ranchers, rural homeowners and other agricultural related businesses.

To put the size of FCS in perspective, the big four banks in the U.S., JP Morgan Chase, Bank of America, Citigroup and Wells Fargo, each have total consolidated assets exceeding $1 trillion. Total farm sector debt in 2011 is estimated to be $241.6 billion The Farm Credit System holds approximately 43% of the real estate debt and 36% of the nonreal estate farm debt (Source USDA). Commercial banks have the highest market share of nonreal estate farm debt (51%) while lending 37% of the farm real estate loans. Commercial banks and FCS hold 84% of the total agricultural debt.

The Farm Credit System is a nationwide network comprised of five Farm Credit Banks that provide funding to 89 associations that in turn serve as direct lenders to farmers. The two associations operating in Illinois are Farm Credit Services of Illinois and 1st Farm Credit Services.

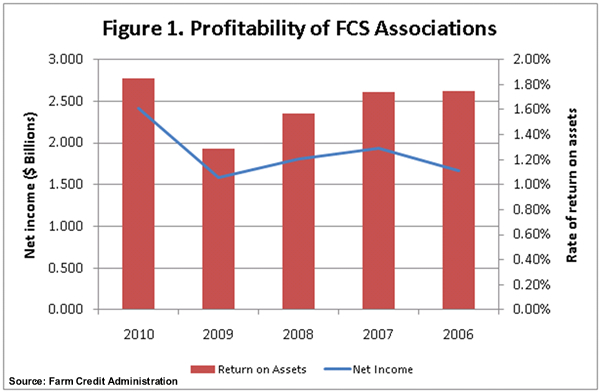

Aggregate net income of all FCS associations increased over 50% to $2.42 billion in 2010 (Figure 1). The rate of return on assets (ROA) for FCS associations increased to 1.85% for 2010. The average ROA for commercial banks lending to agriculture was less than 1.00%.

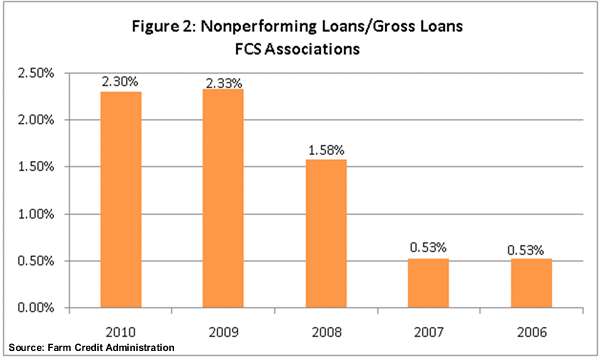

Nonperforming loans to gross loans at FCS associations declined slightly in 2010 to 2.3% of gross loans (Figure 2). Ethanol, hogs, dairy, forestry, and poultry are the portfolio segments experiencing the most stress across the Farm Credit System. Cumulatively, these segments represent about 1/5 of Farm Credit System’s portfolio. Similar to commercial banks, loan performance of grain farms has remained strong.

In summary, the profitable agricultural economy combined with strong management and capital positions of commercial banks and FCS associations have resulted in a healthy and competitive agricultural lending sector that is well-suited to continue to meet the needs of production agriculture.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.