Release of an Updated FAST Tool: Balance Sheet & Historical Financial Statements Program

An updated balance sheet & historical financial statements program is available from farmdoc. This tool allows users to generate financial statements for a one-year (simple balance sheet) or two-year period (beginning and ending year). Financial statements include: beginning and ending balance sheets, income statement, statement of cash flows, and a report of the user’s financial ratios, as well as deferred tax calculation. This tool can be downloaded from the FAST section of farmdoc.

Like other FAST tools, input items appear in blue text.

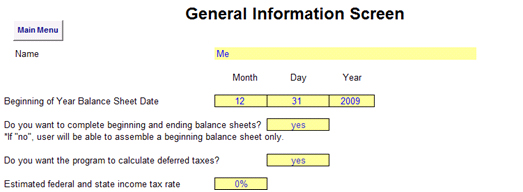

The data entry begins with information about the user on the “Farm Information” sheet. A screen shot of this sheet is provided below. There are five items that need to be completed:

- User’s name

- Beginning of the year balance sheet date

- Determine whether you would like to complete beginning and ending balance sheets, or just a single balance sheet

- Determine whether you would like the program to calculate deferred taxes

- If you would like to calculate deferred taxes, you need to enter the federal and state income tax rate

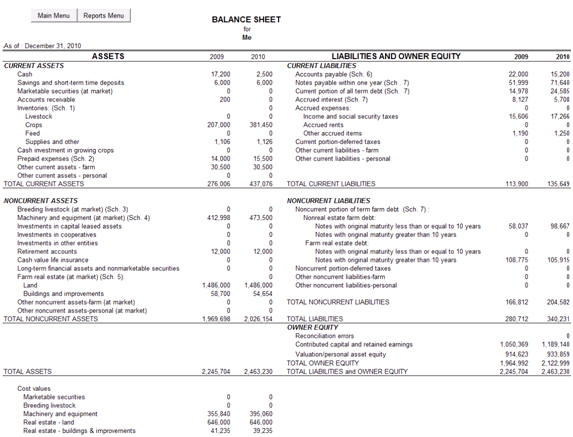

Next, the user assembles the beginning balance sheet by completing the individual schedules and cash flow information. Some items may be entered directly on the balance sheet (where the text appears in blue). Other items require that you select the box for the appropriate schedule. For example, select the box for schedule 1 to enter information about inventories.

Finally, the user will repeat the steps in assembling the balance sheet for the ending balance sheet.

Once the data is entered, the user may view and print the reports. Reports include: a balance sheet summary, an income statement, a statement of cash flows, a cash flow budget, a statement of owner’s equity, financial ratio analysis, and a calculation of deferred taxes for the beginning and ending year.

We hope to soon complete a version of this tool that allows the user to database information for multiple years and multiple users.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.