Upside Potential Given Up by Taking Corn Prevented Planting Payments

The May 25th farmdoc daily post entitled “Economics of Prevented Planting in Corn” noted that net returns from prevented planting likely will be competitive with net returns from planting corn. A number of readers commented that upside revenue potential is given up by taking a prevented planting payment rather than planting corn. This is true. In this post, net returns from planting corn given different harvest prices and actual yields are examined.

Net returns for planting corn one day after final planting date

Table 1 shows net returns from planting corn for a situation more fully described in the May 25th post :

- Costs incurred if corn is planted equal $395 per acre,

- Revenue Protection (RP) policy with an 80 percent coverage level,

- The Actual Production History (APH) yield equals 150 bushel per acre,

- The projected price for corn is $6.01 per acre,

- Planting takes place one day after the final planting date, and

- The basis between the harvest price and the cash price at harvest is -$.30.

Net returns from planting corn equal:

- Crop revenue at harvest (i.e., actual yield at harvest x cash price at harvest)+ RP crop insurance payment – $395 cost incurred by planting corn.

Crop revenue is valued at harvest using a cash price. The RP insurance payment equals the guarantee minus revenue for crop insurance purposes, when revenue is less than the guarantee. The guarantee will increase when the harvest price is above the projected price, as RP uses the higher of the projected or harvest price when calculating the guarantee.

Note that revenue for crop insurance differs from crop revenue at harvest. In its calculations, RP uses the harvest price, which is based on futures prices. On the other hand, crop revenue uses a cash price to value actual yield. At stated above, the cash price is assumed $.30 lower than the harvest price. The difference causes what may first appear as anomalies in Table 1: revenue decreases as yield increases at low yield levels. At a $4.75 harvest price, for example, net returns are $292 for 90 bushel of actual yield while net returns are lower at $289 for 100 bushels of actual yield. At both the 90 and 100 bushel yield levels, crop insurance payments are being received. The 10 bushel increase from 90 to 100 bushels causes 10 bushels less to be valued at $4.75 for crop insurance as compared to $4.45 for cash sales.

In Table 1, net returns in red are above the $401 per acre net return from prevented planting. Net return from prevented planting equals a $433 prevented planting payment minus $15 per acre weed control costs minus $17 per acre crop insurance premium. The $433 prevented planting payment equals the 150 bushel APH yield times $6.01 base price times 80 percent coverage level times 60 percent prevented planting factor. Higher prevented planting buy-ups would result in higher prevented planting payments.

Note that net returns from planting corn exceed taking the prevented planting payment when harvest prices exceed $7.00 per bushel. Given the example, this implies a cash price of $6.70. The possibilities of prices above these levels are real, particularly if low total production of corn takes place. Somewhat ironically, the more acres that are placed in prevented planting, the more likely there will be production shortfalls, potentially leading to higher corn prices.

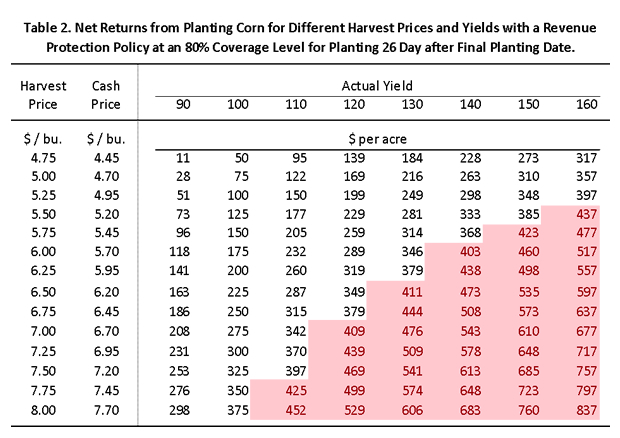

Net returns at 26 days after final planting date

Table 1 shows net returns one day after the final planting date. The revenue guarantee decreases after the final planting date by 1 percent per day for the next 25 days. After 25 days, the guarantee is 60 percent of the original, exactly the same as the prevented planting payment given no prevented planting buy-up. Because of the declining guarantee, net returns from planting corn change each day after the final planting date.

Table 2 shows the net returns when the revenue guarantee is 60 percent of its original. As can be seen, higher yields and/or higher prices are needed to cause net returns from planting corn to exceed net returns from prevented planting. Moreover, only one of the price-yield combinations in Table 2 has an insurance payment: A $5 insurance payment occurs at a $4.75 harvest price and a 90 bushel yield.

APH and planting corn

Besides net returns, another consideration is the impact of planting on APH yields. If late planting corn has a low yield, that low yield will enter into the calculation of APH yield, potentially having a negative impact on risk protection in the future.

Summary

Planting corn has upside revenue potential that does not exist if prevented planting payments are taken. This year there is a real possibility of higher corn prices that could potentially result from yield shortfalls. Because of declining crop insurance protection, downside revenue risks increase the further planting takes place from the final planting date.

Also, taking prevented planting is not an all or nothing decision. Some acres can be planted to corn and prevented planting can be taken on other acres.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.