2011 Illinois Farmland Values Increase 18 Percent

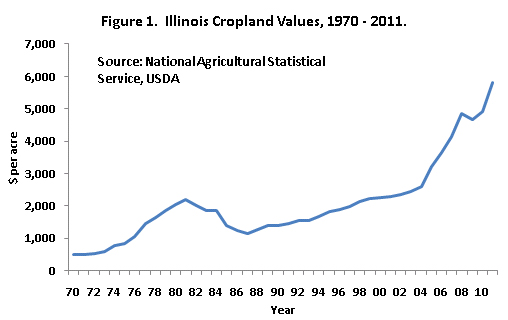

According to an August 4th report released by the U.S. Department of Agriculture, Illinois farmland price averaged $5,800 per acre in 2011, an increase of 18 percent over the 2010 level of $4,900 here. The 2011 increase continues a string of large increases that began in 2004 (see Figure 1). Since 2004, Illinois farmland prices have increased by 222 percent or, stated alternatively, Illinois farmland prices are 2.2 times higher in 2011 than in 2004. The last seven-year period in which land prices increased an equivalent amount was from 1975 through 1981. During this period, Illinois farmland increased from $846 per acre in 1975 to $2,188 per acre in 1981, resulting in farmland prices being 2.6 times higher in 1981 than in 1977.

Are Prices Too High?

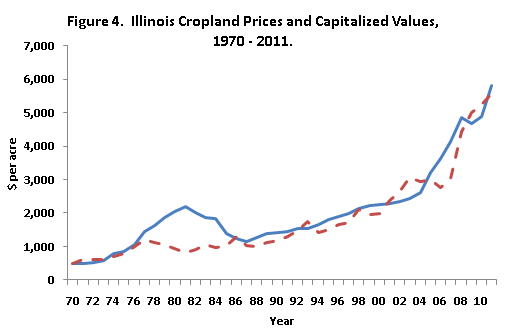

These increases lead to concerns about whether farmland prices are too high relative to the farmland returns. To evaluate this issue, capitalized values were calculated for each year from 1970 through 2011. A capitalized value equals all future returns discounted to the present. Higher returns increase the capitalized value. Lower interest rates lead to higher capitalized value. A simple capitalization model is used here: capitalized value equals average cash rent divided by an interest rate. If the farmland price is above the capitalized value, then farmland is overpriced relative to its discounted returns. Conversely, farmland is underpriced if farmland prices are below capitalized values. More detail on this approach and sensitivity is provided here.

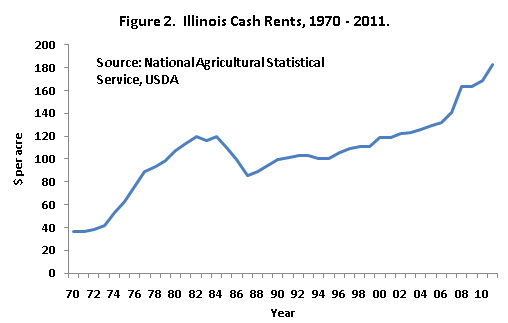

In calculating capitalized values, average cash rents are needed. The U.S. Department of Agriculture also released the average cash rent for Illinois farmland on August 4th. Average cash rent in Illinois was $183 per acre in 2011, an increase of 8 percent over the 2010 level of $169 per acre (see Figure 2). Like farmland, cash rents in Illinois have increased since 2004. The 2011 cash rent is 45 percent higher than the 2004 rent, an increase rate that lags the farmland price increase rate.

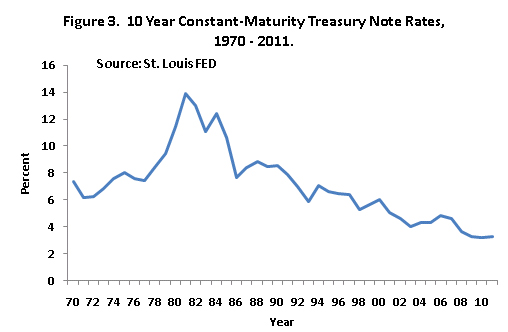

Calculating capitalized values also requires interest rates. The 10-Year constant-mature Treasury notes (CMT-10) is used to represent interest rates. Since 1981, interest rates have generally fallen, providing support for increasing farmland prices (see Figure 3). In 2010, CMT-10 averaged 3.2 percent, the low for the period since 1970. So far in 2011, CMT-10 rates have been stable, averaging 3.3 percent.

Resulting capitalized values are shown in Figure 4. As can be seen in Figure 4, capitalized values closely tracked actual farmland prices since the mid-1980s. In 2010, farmland price was below the capitalized value by $438. In 2011, the $5,800 per acre farmland price was $221 above the capitalized value of $5,579 per acre. The switch to price being above the capitalized values suggests that farmland prices are increasing quicker than there discounted returns. However, the $221 higher farmland price in 2011 is not without historical precedents. Between 2005 through 2008, the average farmland price in Illinois exceeded capitalized value.

The last time farmland price exceeded capitalized value by a large margin was in the early 1980s, immediately prior to the large decline in Illinois farmland prices that occurred from 1982 through 1987. Currently, the situation in 2011 is not like the 1980s. This suggests that either farmland returns have to decrease or interest rates have to increase before farmland prices fall.

Commentary

These are disquieting economic times. As this is being written, economic data is suggesting sluggish economic growth, raising the possibilities of a double-dip recession. The Federal Reserve has pursued policies that increased the money supply, leading to concerns of inflation in the future. The inability of the U.S., European Union countries, and several states within the U.S. to come to grips with fiscal imbalances and entitlement spending poses risks to the long-run economic future of western countries.

These economic headwinds likely provide support for U.S. farmland prices. An economic downturn likely would reduce non-farm asset returns compared to farmland returns. Moreover, the threat of inflation in the future places pressure on farmland prices as farmland and other real assets are perceived as safer stores of wealth than financial assets during inflationary times. The threat of long-run instability places a premium on real assets over financial assets. This suggests that a more stable general economic outlook would lead to less aggressive growth in farmland prices.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.