Projected Price and Volatility for Wheat Crop Insurance

The discovery period for determining projected prices and volatiles for wheat has ended and the Risk Management Agency (RMA) has released these factors. In Illinois and many other Midwestern states, the 2012 projected price for wheat is $8.20 per bushel. The volatility is .27.

The 2012 projected price of $8.20 is $1.01 higher than the 2011 price of $7.19. As a result, guarantees will be higher for the same coverage level in 2012 as compared for 2011. Take, for example, a 75 percent Revenue Protection (RP) policy for a unit having an Actual Production History (APH) yield of 55 bushels. In 2012, the minimum coverage level is $338 per acre (75% coverage level x 55 bushel APH x $8.20 projected price). The 2012 minimum guarantee is $41 per acre higher than the 2011 minimum guarantee of $297 per acre (75% coverage level x 55 bushel APH x $7.19 projected price). For the same APH yield and coverage level, 2012 minimum guarantees will be 14 percent higher than in 2011.

The 2012 volatility of .27 is below the 2011 volatility of .32. Volatilities are an important factor determining crop insurance premium. All else being equal, the lower .27 volatility will lower premium for 2012.

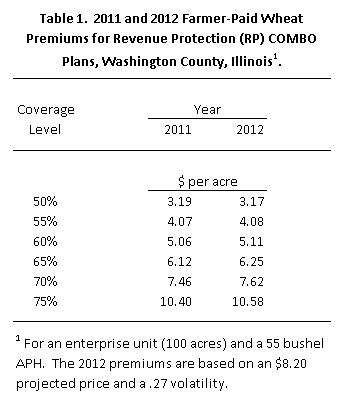

Table 1 shows farmer-paid RP premium for a farm located in Washington County, Illinois. These premiums are for an enterprise unit having 100 acres with a 55 bushel APH. Insurance premiums in 2012 are close to those for 2011. At the 75% coverage level, for example, the 2011 premium is $10.40 per acre and the 2012 premium is $.18 higher at $10.58 per acre.

Nearly identical premiums for RP suggest that farmers may find wheat insurance more cost effective in 2012 relative to 2011. For roughly the same premium in 2012, a farmer will on average receive a 14 percent higher premium.

While more cost effective, one of the reasons for purchasing crop insurance comes to an end in 2012. The Supplement Revenue Assistance Payments Program, more commonly called SURE, was authorized in the 2012 Farm Bill for the 2008 through 2011 crop years. This program required all acres to be insured before payments are received. Since SURE is not authorized for 2012, the incentive to purchase crop insurance offered by SURE ends. Still, however, there may be an incentive to purchase crop insurance to take part in Federal ad hoc disaster programs. Ad hoc disaster programs have been legislated in the past. These ad hoc programs typically make higher payments to purchasers of crop insurance.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.