Is RP with the Harvest Price Exclusion a Good Option for 2012?

I have been asked whether Revenue Protection with the Harvest Price Exclusion (RPwExcl) should be considered as an alternative to Revenue Protection (RP). Unlike RP, RPwExcl does not allow its guarantee to increase if harvest price is above projected price. If RPwExcl is used, I suggest considering a coverage level 5 percent higher than the RP product. These two products have roughly the same premiums. However, payments will vary between the two alternatives. RPwExcl will provide more price protection while RP will provide more yield protection.

Macon County Illustration

Tradeoffs are illustrated for a Macon County farm having a Trend Adjusted Actual Production History (TA-APH) yield of 185 bushels. The projected price used in the illustration is $5.75, close to the average for the first two weeks of February 2012. The illustration assumes that RPwExcl will be purchased at an 85% coverage level. The RPwExcl-85% guarantee is equal to $904 per acre (185 bushel TA-APH yield x higher of $5.75 projected price x 85% coverage level).RPwExcl-85% will be compared to an RP-80%. RP-80% product has a guarantee equal to:

- RP-80% guarantee = 185 bushel TA-APH yield x higher of $5.75 projected price or harvest price x 80% coverage level.

RP-80s guarantee will be the lowest when harvest price is below the projected price. The minimum guarantee resulting from RP-80% is $851 per acre (185 x $5.75 price x .80). Harvest prices above $5.75 will result in higher guarantees. (Harvest price cannot exceed two times the projected price.)

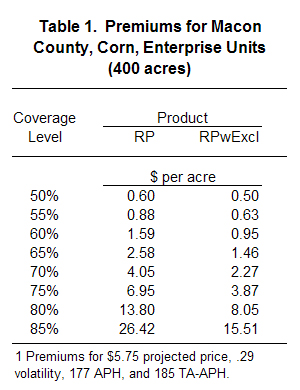

These two products have comparable premiums, as illustrated in Table 1 which shows premiums for a 400 acre enterprise unit using a $5.75 projected price and a .29 volatility. RP-80% has a $13.80 per acre premium while the RPwExcl-85% coverage level has a $15.51 per acre premium, $1.71 per acre higher than the RP-80% premium.

Difference in Payments

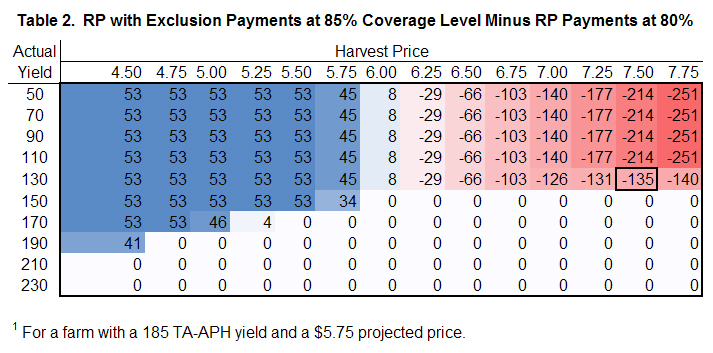

Differences in payments are shown in Table 2. Numbers in this table equal RPwExcl-85% payments minus RP-80% payments. Positive numbers indicate that RPwExcl-85% pays more than RP-80% and vice versa. For example, there is a $53 per acre difference at a 160 bushel yield and a $4.75 harvest price. This indicates that RPwExcl-85% pays $53 more per acre than RP-80%. At a $4.75 price, the guarantee for RP-Excl-85% is $904 per acre while the guarantee for RP-80% is at its minimum of $851 per acre. At a 160 bushel yield, revenue equals $760 per acre. RP-Excl-80% has a payment of $144 per acre ($904 guarantee – $760 revenue) while RP-80% has a payment of $91 per acre ($851 guarantee – $760 revenue). The difference between $144 RPwExcl-85% payment and the $91 per acre RP-80% payment is $53 per acre.

There is a pattern to differences in Table 1. RPwExcl-85% has higher payments when the harvest price is below the $5.75 projected price and yields are low enough to trigger payments. This occurs because RPwExcl-85% has a higher guarantee than RP-80% at harvest prices below the projected price. At harvest prices above the $5.75 projected price, RP-80% guarantee increases. At high enough harvest prices, the guarantee for RP-80% exceeds the guarantee for RPwExcl-85%. As a result RP-80% has higher payments at low yields and “high” harvest prices. These differences can become large.

What Would 1988 Look Like?

There is a block around the difference associates with a 130 bushel actual yield and a $7.50 harvest price. This combination simulates 1988 conditions given that they occur in 2012. In 1988, yields in Macon County would have averaged 31 percent below the TA-APH yield while harvest price was 33 percent higher than the projected price. The 31% reduction in yield was applied to arrive at the 130 bushel actual yield and the 33 percent increase was applied to arrive at the $7.50 harvest price. This scenario is meant to simulate one of the worst yielding years, thereby providing an estimate of how large the differences can be between RPwExcl-85% and RP-80%.

For the 130 bushel actual yield and $7.50 harvest price, RPwExcl085% pays $135 less than RP-80. For this yield and price, RPwExcl-85% would not make a payment while RP-80% would make a $135 per acre payment.

Summary

At a 5% difference in coverage levels, RPwExcl will make higher payments when compared to RP at low prices. However, RP will make higher payments when yields are low and harvest price are above projected prices. Overall, this suggests that farmers desiring more price protection may wish to use RPwExcl while farmers wanting more yield protection would choose RP.

RP is designed for farmers who hedge production during the pre-harvest period. If a farmer is aggressive with hedging – hedging something over 40 percent of production in spring – use of RP likely will be preferred, as RPs payments increase in period of low yields and high prices which will partially offset losses occurring from hedging.

The farmdoc Crop Insurance section is available at: http://www.farmdoc.illinois.edu/cropins/index.asp

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.