Market Oriented vs. Fixed Supports and the 2012 Farm Bill

Background

A key issue framing debate on the 2012 Farm Bill is whether farm supports should be market oriented or fixed by Congress. The issue is most clearly seen in the debate over target prices fixed by Congress vs. a shallow loss program, such as ACRE, with assistance levels tied to market revenue. Similar debates have occurred throughout the history of U.S. farm policy. This article first reviews these historical debates, often referred to at the time as a debate over flexible vs. fixed farm supports. An explanation is then proposed for why the U.S. has consistently chosen flexibility and market orientation. The article then discusses the 2012 Farm Bill debate.

At 3 key points in the history of U.S. policy, debate occurred over fixed supports.

- In the late 1940s debate began over whether to continue high, fixed price supports implemented during World War II. The debate was resolved by replacing a high fixed rate with a rate that could vary within a range and somewhat by crop. In addition, the formula used to determine what were called parity support prices was changed from using a benchmark fixed at the 1910-1914 period to a benchmark that moved with the most recent 10 years. As a result of these 2 policy decisions, support rates declined. Corn?s loan rate was $1.06 in 1960 vs. $1.60 in 1952 while wheat?s loan rate was $1.78 in 1960 vs. $2.40 in 1952.

- Despite lower prices from the flexible parity system, stocks continued to build due to rapid yield increases. For example, U.S. wheat stocks carried into the year exceeded U.S. production every year from 1959 through 1963. The debate over how to control stocks and their costs centered on 2 options: (1) high price supports with high mandatory acreage controls and (2) lower price supports with voluntary acreage controls. The debate was resolved when the Agricultural Act of 1964 and the Food and Agriculture Act of 1965 extended the lower price, voluntary acreage control program that had evolved for corn since World War II to wheat and cotton.

- Large surpluses emerged in the early 1980s due to large crops around the world and slower economic growth. Because the U.S. had raised support prices during the boom period of the 1970s, support rates now exceeded market prices. Once again, in the Food Security Act of 1985, the U.S. chose to reduce price supports. Also, the Secretary of Agriculture was allowed to customize acreage set-asides for each crop within a range established by Congress. For example, set-asides for the 1987 crops ranged from 20% for corn (feed grains) to 35% for rice.

To summarize, when confronted with the high cost of farm programs at each of these 3 decision points, the U.S. chose to keep a common framework for most program crops but to allow program parameters to be customized for individual crops. The U.S. also chose to reduce price support levels even when it meant reversing previous decisions to raise them. In short, U.S. farm policy has trended toward more program flexibility and greater market orientation.

Explaining Program Flexibility and Market Orientation -The Role of Price Prediction and Elimination of Set Asides

The assistance provided by fixed supports depends on market conditions and the level at which Congress sets the fixed support. In setting a fixed support, Congress essentially determines a politically acceptable target that falls within budget constraints. In essence, Congress makes a forecast based on information available when it sets a fixed support. The fixed support will end up providing no assistance if market price ends up higher than expected when the fixed support was set. On the other hand, the fixed support will end up making frequent and potentially large payments if price ends up lower than expected when the fixed support was set.

It is well established in the academic literature that predicting price is difficult to do accurately. Thus, it should not be surprising that the occurrence and amount of payments from fixed supports can vary strikingly among crops. A solution for this outcome is program flexibility, thus, in part, customizing the program to each crop?s situation, and making the program more market oriented. As noted above, the U.S. has chosen this solution when the cost of farm supports became too high.

A relatively recent policy change further enhanced the importance of prediction accuracy. In the Federal Agriculture Improvement and Reform Act of 1996 Congress eliminated acreage set asides. While Congress gave farmers greater freedom to make planting decisions, it also eliminated a policy instrument that could be used to adjust farm programs and their cost on an on-going basis. In particular, if market price was lower than expected, set aside could be increased to reduce supply and thus reduce the cost of the fixed support program. In short, eliminating set asides increased the importance of Congress making an accurate prediction when setting fixed supports.

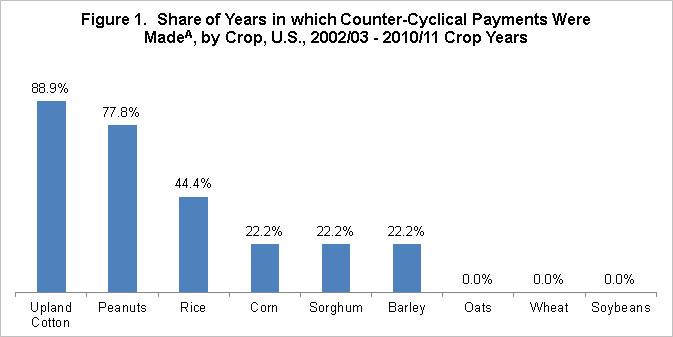

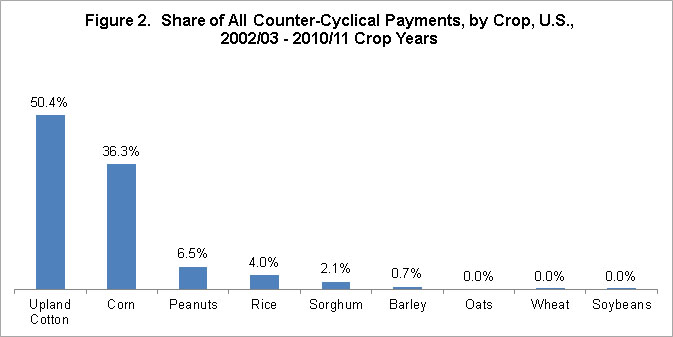

Performance of the price counter-cyclical program, since being enacted in the Farm Security and Rural Investment Act of 2002, is consistent with the preceding discussion. Over the 2002/03 through 2010/11 crop years, of the 9 crops included in Figures 1 through 3:

- only 1 received payments in approximately half of the years: rice (44%)

- only 1 had a share of payments within 10% of its base acre share: corn (36% vs. 33%)

- 2 received payments in more than three-quarters of the years: cotton and peanuts

- cotton accounted for 50% of all counter-cyclical payments, but 7% of all base acres

- peanuts accounted for 6.5% of all counter-cyclical payments, but 0.6% of all base acres

- 3 received no counter-cyclical payments: oats, soybeans, and wheat

2012 Farm Bill Debate over Market Oriented vs. Fixed Support

Despite the historical trend toward program flexibility and market orientation, fixed parameters remain an important feature of some U.S. farm safety net programs. In fact, the degree of fixity varies notably across the programs.

At present, most policy observers expect direct payments to be eliminated. Such a decision eliminates the safety net program with the most fixity. The counter-cyclical program also has a number of fixed parameters, notably target prices and base acres. As discussed above, since its enactment, the counter-cyclical program has tended to provide either little assistance or extended assistance. This outcome is to be expected since prices are difficult to predict accurately. A market-oriented option to determine target prices is to use a moving average of recent prices. Because a moving average follows the market rather than attempting to predict the market, it has the potential to generate a more equitable distribution of payments among crops, as well as, prevent extended periods of assistance. Such an option will be examined in a subsequent article.

This article is also available at: http://aede.osu.edu/publications.

References

Source and Notes for all Figures

NOTE: (A) To count as a year of payment, payments to all U.S. farms for a crop had to exceed $100,000.

SOURCE for Figures 1 and 2: Original calculations using data from U.S. Department of Agriculture, Farm Service Agency at: http://www.fsa.usda.gov/FSA/webapp?area=about&subject=landing&topic=bap-bu-cc

SOURCE for Figure 3: Original calculations using data from U.S. Department of Agriculture, Economic Research Service, Statistical Indicators at: http://www.ers.usda.gov/Publications/AgOutlook/AOTables/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.