Net Payments to Farmers by Crop Insurance: Historical Trends and the 2012 Farm Safety Net Debate

Introduction

Because the public subsidizes part of the premium for crop insurance, over time payments by crop insurance to all farms who buy crop insurance exceed the insurance premiums paid by all farms. This paper examines historical trends in crop insurance from the perspective of net insurance payments and also places these payments within the 2012 farm safety net debate.

Trends in Net Crop Insurance Payments

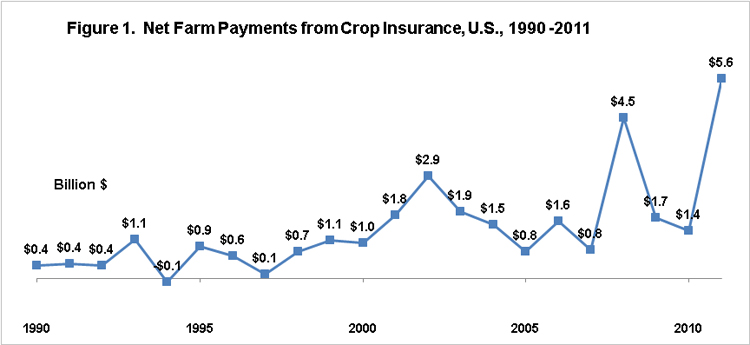

Since 1990, indemnity payments made to farms by crop insurance have exceeded the premiums paid by farms in all but one crop year, 1994 (see Figure 1). Moreover, net insurance payments to farms are trending higher. They have exceeded $1 billion in 8 of the last 10 years and $4.5 billion in 2 of the last 4 years. For the current 2011 crop year, net insurance payments exceed $5.5 billion, making 2011 the first crop year in which net crop insurance payments exceed direct payments.

Despite the size of these payments, it is important to note that insurance payments do not exceed premiums for all individual farms. If an individual farm did not experience a loss greater than its deductible in a given year, it received no insurance payment that year. The net insurance payment calculation also does not include the administrative fee paid by farms. This fee, currently $30 per insured crop per county, will somewhat reduce net insurance payments.

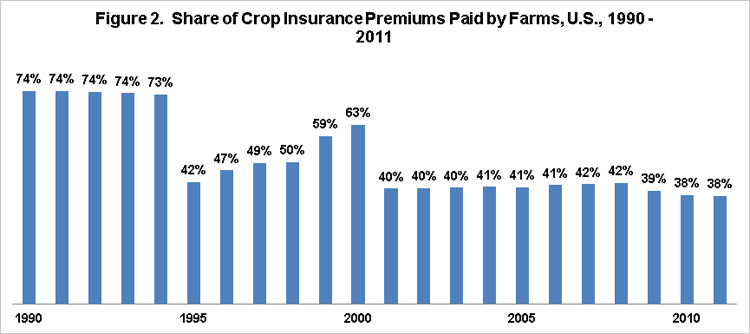

One factor behind the trend to higher net insurance payments is a higher public subsidy rate. The share of premiums paid by farms has declined from 74% in the early 1990s to 38% for the 2010 and 2011 crop years (see Figure 2). Major changes in the insurance premium subsidy rate occurred in the Agricultural Risk Protection Act of 2000 and the Food, Conservation, and Energy Act of 2008. The subsidy rate currently is as high as 80%, which applies to some coverage levels for enterprise insurance (an enterprise is all acres of a crop in a county).

Higher subsidy levels encourage more farms to buy insurance on more acres, thus increasing payments. Total insured acres increased from 100 million in the early 1990s to over 250 million during recent years.

Another reason net insurance payments have increased is the higher prices of crops in recent years. When prices are higher, insured revenue is also higher, and thus losses at a given percent coverage level of revenue are higher.

Net crop insurance payments vary by crop

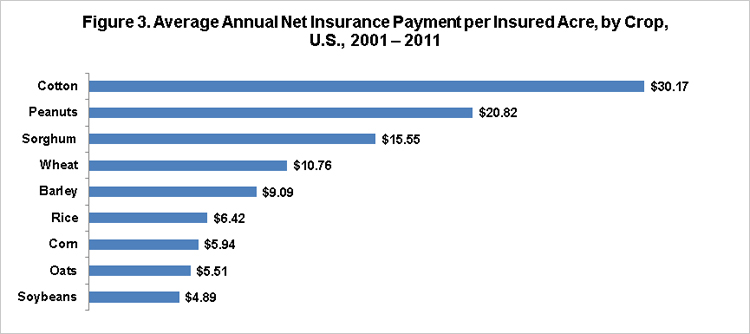

Over the 2001-2011 crops, average net insurance payment per acre ranged from $4.89 for soybeans to $30.17 for cotton (see Figure 3). Dollar payments can be deceptive since gross revenue per acre varies by crop and since gross revenue per acre has increased at different rates for different crops since 2005. Thus, for each year, the net insurance payment per insured acre was expressed as a ratio to gross revenue per acre. Gross revenue per acre was calculated as U.S. average yield per harvested acre times U.S. average price for the marketing year. The yearly ratios were then averaged. For 2001-2011, the average ratio of net insurance payment per acre to gross revenue per acre ranged from 0.9% for rice to 7.6% for sorghum (see Figure 4).

Corn, soybeans, and rice are among the 4 crops with the lowest net payment per insured acre and with the lowest ratio of net payment to gross revenue. Cotton, sorghum, and wheat are among the 4 crops with the highest values for both measures. These relative rankings largely correspond to the variability of the agro-climate in which the crop is grown. Almost all rice is irrigated, reducing yield variability. Corn and soybeans are largely grown in the Midwest, which is less subject to drought and other growing season factors than are the Plains and South. The latter areas are the principal growing areas for cotton, sorghum, and wheat.

Given the variation in net insurance payments by crop, it is not surprising that net crop insurance payments also vary by state. This is a topic for another article.

Summary: The Farm Safety Net Debate

Since 1990, net crop insurance payments have increased substantially. Moreover, if the direct payment program is eliminated, then crop insurance will likely become the central farm safety net program. Thus, understanding basic trends in crop insurance and the variation in net insurance payments, for example among crops, is important to understanding the farm safety net.

Historically, crop insurance has been able to avoid key issues associated with the farm safety net, in part because it is a risk management program and in part because of its relatively small size. However, with the increasing size of the program and its increasing centrality to the farm safety net, it is unlikely that crop insurance will be able to avoid substantive debate over these issues.

For example, the variation in payments among crops, even after adjusting for the differences in gross revenue, has raised the question of whether crop insurance distorts production by providing more incentive to produce in more risky production areas. Moreover, risky production areas are often the more environmentally sensitive production areas. The author does not believe that enough research exists on these potential distortions to reach a conclusion as to their existence and importance, but with the increasing size of the insurance program these potential distortions will become a greater focus of public debate.

Other potential issues include whether conservation compliance should be required to buy crop insurance and whether payment limits should exist for insurance. Farmers do not like to discuss these issues, but they are important issues to many non-farm participants in the farm bill. For example, the U.S. Government Accountability Office (GAO) released a report dated March 2012 that in part addressed the issue of limits on crop insurance subsidies.

In the author’s view, a policy of avoiding discussion of these issues often reduces the likelihood of the adoption of thoughtful options as well as the consideration of the full impacts of a policy. For example, if the American public decides that payment limits should exist for crop insurance, the author would suggest that it is less disruptive to managing a farm if the limit is placed on the amount of insurance subsidies a farm receives than on the amount of payments made by insurance. Crop insurance is designed to make large payments when a farm experiences a sizable shortfall in revenue or yield over the production period. Occurrence of such a shortfall is not known until after insurance is bought. Limiting payments when they are most needed undermines the safety net and makes management of farm risk much more difficult. On the other hand, limits on the subsidy would be known before the crop is planted, allowing the farm to make managerial adjustments knowing the specific form of the limit. Let me underscore this discussion is not an endorsement of payment limits on insurance. Instead, should U.S. society decide to impose such limits, it is a call for thoughtful discussion of options and careful consideration of their impact on managing a farm.

This publication is also available at http://aede.osu.edu/publications.

References

Sources for all figures calculated using data from U.S. Department of Agriculture, Risk Management Agency, Summary of Business Reports and Data, available at http://www.rma.usda.gov/data/sob.html

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.