Trading Hours and Daily Settlement Prices

Most of the recent discussion on trading hours for the grain and oilseed markets has focused on the overlap of trading with the release times for various USDA reports. In response to concerns about market and commercial impact from the release of major USDA crop and livestock reports during market hours, USDA published a request for public comment in the Federal Register here with comments due by July 9.

In contrast, there has been very little attention paid to something equally important: When – and how – should daily settlement prices be calculated? The answer to this question affects everyone who uses these markets, since daily settlement prices for futures determine end-of-day brokerage account balances, trigger margin calls, and influence option values.

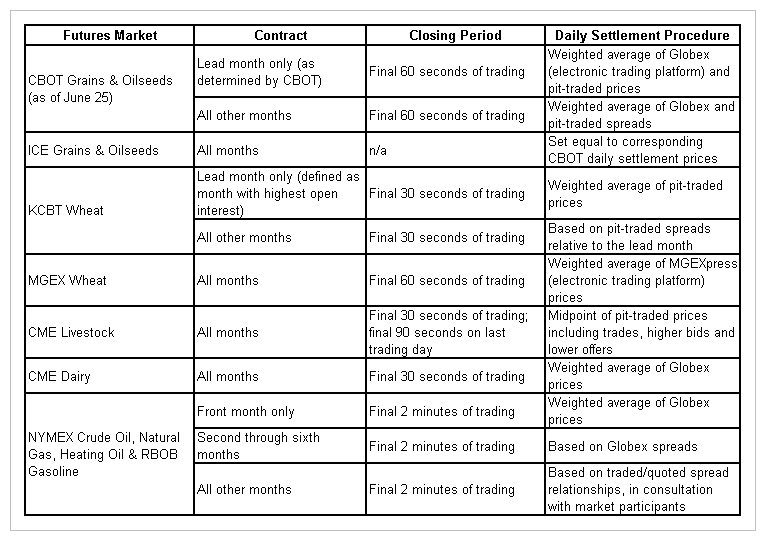

How are daily settlement prices determined? Although the settlement price is sometimes referred to as the “closing price,” it is actually the prices from the closing period that are used to determine the “settlement prices” at which all positions are “settled” each day. Somewhat surprisingly, the process used to calculate these settlement prices varies considerably across exchanges, commodities, and sometimes even contract months within the same commodity. The following table provides a brief summary of daily settlement procedures for a number of major commodities.

Prior to June 25, CBOT Wheat futures used a weighted average of Globex (but not pit) prices for the lead month, Globex (but not pit) spreads for the next 4 months, and pit (but not Globex) spreads for everything else. In contrast, CBOT Corn and Soybean futures used pit (but not Globex) prices for the lead month and pit (but not Globex) spreads for all other months.

For the period January-May 2012, pit trading accounted for just 2.07% of total CBOT Wheat futures volume, 6.48% of total CBOT Corn futures volume and 5.98% of total CBOT Soybean futures volume, so some of these settlement prices were based on a small fraction of the total trading volume. Moving to a weighted average process – sometimes called “one contract, one vote” because the price for each transaction is weighted by the number of contracts in that transaction – which includes all trading volume, both pit and electronic, during the closing period should result in daily settlement prices that are much more reflective of overall market activity.

From the table above, it should be clear that there is no single, best way to determine a daily settlement price. This small sample of markets reveals a wide range of techniques which have developed over the years to meet the needs of each particular market. For example, the time period used for the data collection and calculation process ranges from the final 30 seconds of trading (KC Wheat and CME Dairy) to the last 120 seconds (NYMEX energy futures), suggesting differing opinions about the sample size needed to obtain a representative price. Other differences reflect physical characteristics of the commodities themselves. For example, storable commodities such as grains and oilseeds commonly rely on spreads to settle months within the same crop year, while non-storable commodities like livestock and dairy establish “flat” prices for each contract month. Still other differences reflect longstanding market practices. Livestock futures take into consideration “better bid” (unmet offers to buy at a price above the last trade) and “better ask” (unmet offers to sell at a price below the last trade) prices when determining the closing range, on the principle that these bids and offers reflect where the market wants to go, while most other commodities use only transaction prices.

The primary purpose of the daily settlement process is to obtain a price that can be used to credit or debit each account at the end of the day based on changes in position values. As all markets move toward around-the-clock trading and make greater use of technology, we are likely to see further changes in daily settlement procedures.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.