Initial Perspectives of Crop Insurance Underwriting Losses due to the 2012 Drought

Companies shares of underwriting losses have been revised from an earlier version.

There is growing interest in understanding the magnitude of losses in the Federal crop insurance program, and how those losses are to be shared between the Federal government and the crop insurance companies and their reinsurers. At this point, it is difficult to precisely estimate the size of the eventual losses; however, it is safe to assume that losses will be relatively large. Given Federal regulation and restrictions on crop insurance companies’ retained exposure, it is highly likely that there are sufficient funds to cover 2012 losses. Additional context and perspective on 2012 losses are provided below.

Historic Premiums, Indemnity, and Gains

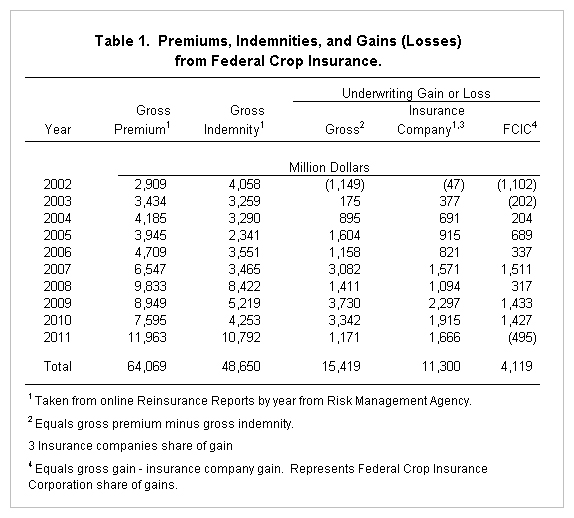

Table 1 show gross premiums, gross indemnities, and underwriting gains for Federal crop insurance for the past decade. In 2011, gross premium – which includes farmer-paid premium and Federal risk subsidies – totaled $11.963 billion, gross indemnities were $10.792 billion, resulting in $1.171 billion of gross gain ($11.963 billion gross premium – $10.792 billion). Gross gain was split between private insurance companies and the Federal Crop Insurance Corporation (FCIC), the Federal corporation that oversees crop insurance. In 2011, private companies had $1.666 billion of gains while FCIC had -$.495 billion of loss.

The size of the crop insurance program has grown over time. Gross premium was $2.909 billion in 2002, increasing to $11.963 billion in 2011 (see Table 1). A number of explanations help to understand the increase. There have been changes to the crop insurance program such as the introduction of higher subsidies for enterprise units, a unit that insures all of one crop in a county. Since this introduction, farmers have shifted to enterprise units while at the same time increasing coverage level. There also has been an increase in commodity prices in 2006, which results in higher value of crop, which in turn leads to higher premium. In addition, and perhaps most importantly, farmers perceive higher risk in agriculture due to rising input costs, which has led to more acres insured at a higher coverage levels.

The crop insurance program has had underwriting gains each year since 2003. Over the past decade, the gross gain totaled $15.419 billion. One would expect large losses in a severe drought year like 2012, which appears to be between a one-in-twenty-five and one-in-fifty year event. Over time, underwriting gain experience will operate in this fashion: most year’s there will be gains or modest losses punctuated by a small number of years in which losses will be extremely large. The existence of large loss years is one reason for Federal involvement in crop insurance as private companies have difficulty bearing the risks of large losses that periodically occur in agriculture.

Risk Sharing Between Private Crop Insurance Companies and the Federal Government

Risk sharing between private companies and the Federal government is determined largely by the decisions made by private insurance companies under the terms of the Standard Reinsurance Agreement between the insurance companies and the Federal government. This agreement describes how losses are shared between the companies and the government depending on fund assignment and the state in which the policy is originated. Private insurance companies can assign polices into either the Assigned Risk Fund or the Commercial Fund. There characteristics are described more fully below.

- Assigned Risk Fund. Private crop insurance companies bear less risk in the assigned risk fund. Private insurance companies cede 75% of gross premium to the Federal government, meaning that 75% of the premiums and associated gains or losses are born by the Federal government. Private companies’ shares of gains or losses on the remaining 25% vary with the final loss ratio. The loss ratio simply equals indemnities divided by premium. A loss ratio of 1.5, for example, indicates that there were $1.50 indemnities for each dollar of retained premium, yielding an underwriting loss of $.50. For policies in the assigned risk fund, a private company would bear $.04 of the underwriting loss while the FCIC would stand for $.46 of the loss (see Table 2). Companies’ losses per dollar of retained premium are $.08 for a 2.5 loss ratio, $.11 for a 3.5 loss ratio, $.14 for a 4.5 loss ratio, and $.15 for a 5.5 loss ratio (see Table 1). When loss ratios exceed 5.0, the Federal government bears all of the losses in excess of the maximum $.15 insurance companies bear.

- Commercial Fund. There are two separate schedules for loss sharing in the commercial fund, depending on which group the state is in where the policy was written. Crop insurance companies decide how much of premium and losses in the commercial fund to retain with the remainder ceded to the Federal government. Private companies must retain at least 35% of premium, but can retain more in five percent increments up to 100%. When losses occur, risk sharing differs by state. Insurance companies stand for a higher percentage of the losses in group 1 states (Illinois, Indiana, Iowa, Minnesota, and Nebraska) than in other states. In a group 1 state, insurance companies will bear $.30 of losses for each $1.00 of retained premium if the loss ratio is 1.5, $.65 for a 2.5 loss ratio, $.74 for a 3.5 loss ratio, $.83 for a 4.5 loss ratio, and $.88 for 5.0 and higher loss ratios (see Table 2). In compensation for this higher risk, insurance companies receive more of the gain when underwriting gains occur.

In both funds, the companies’ share of losses decreases as loss ratio increases. This declining risk feature as losses increase is meant to buffer companies from extreme loss years as is likely to occur in 2012. Besides insuring with the Federal government, private crop insurance also will insure underwriting losses with other private companies providing reinsurance. Hence, the losses that are likely to be incurred by private crop insurance companies in 2012 likely will be shared with private reinsurance companies.

Fund allocations results for 2012 have not yet been released, but it is likely that they will be similar to those from 2011. In 2011, 18% of all gross premiums in the United States were placed in the assigned fund, while the remaining 82% was in the commercial fund. In Illinois, 3% of premiums were placed in the assigned fund while 97% was in the commercial fund. Large losses in Illinois seem likely, meaning that crop insurance companies will bear large losses in Illinois and other Midwestern states. Hence, the large allocation of premium to the commercial fund in Illinois will exacerbate losses in this drought year.

Predicting 2012 Underwriting Losses

It is difficult to predict what insurance losses will be for 2012. Not only do overall yields matter, which are difficult to predict, but also the distribution of yields across the nation matters. As important, the levels of harvest prices for corn and soybeans, which are set based on futures prices in the fall, will greatly influence overall losses as revenue policies’ guarantees will largely reset to the higher harvest price levels.

To develop a feel for size of loss in 2012, the following assumptions are used:

- Gross premiums will total $12 billion, roughly equal to last year’s premium.

- Underwriting losses will be estimated at an overall loss ratio of 2.5. This is close to the highest loss ratio of 2.45, which occurred in 1988. The next highest overall loss ratio is 2.19, which occurred in 1993. These historical loss ratios come from an era when crop insurance programs where much different than they are today. Hence, these historical loss ratios may not be totally representative of today’s crop insurance program and are likely to be higher than what would be experienced today. However, the 2012 drought may be a worse drought than 1988 drought from a meteorological perspective, which would suggest a higher loss ratio than in 1988. To account for uncertainty, underwriting losses for 2.0 and 3.0 loss ratios are presented below to give a feel for the range of losses possible.

- Gross indemnities will equal $30 billion (2.5 loss ratio x $12 billion of gross premium).

- Underwriting losses will equal $18 billion ($12 billion premium – $30 billion indemnity).

- Crop insurance companies’ shares of losses are estimated assuming that crop insurance companies made the same allocation decisions in 2012 as in 2011; crop insurance companies choose to retain 100% of commercial fund liability; and the loss ratio equals 2.5 for each state, each fund and for each company. These assumptions likely over-state the companies’ shares of underwriting loss. However, under these assumptions, crop insurance companies’ share of losses would be $4.0 billion and the federal government would have $18.0 billion of losses.

The 2.5 loss ratio would result in $18 billion of underwriting losses, with private crop insurance companies share equal to $4.0 billion and the Federal government share of $14 billion. A 2.0 loss ratio results in $12 billion of underwriting losses, with private crop insurance companies share of $2.7 billion and a Federal government share of $9.3 billion. A 3.0 loss ratio results in $24 billion of underwriting losses, with private crop insurance companies share equal to $5.3 billion and Federal government share of $18.7 billion. These estimates depend on the assumptions used above.

Summary and Commentary

Gross underwriting losses likely will be large this year, with underwriting losses of $18 billion or more being possible. Given the nature of agriculture, these large losses from a crop insurance program of the current size and scope should be expected to occur in years like 2012.

In the past decade, there have been total underwriting gains of $15.319 billion. In some senses, these underwriting gains partially offset the losses occurring in 2012. These gains would have been larger had the size of gross premium been the same in 2002 through 2010 as in 2011. With gross premium of $12 billion per year and similar loss experience, underwriting gains would have been $25 billion over the past decade. Hence, the underwriting losses in 2012 may seem larger relative to previous gains simply because the scope of the program has increased.

Crop insurance companies will face losses in 2012. Given Federal regulations and stress testing, crop insurance companies are highly likely to have sufficient funds to cover losses. However, there may be longer run impacts of these losses for crop insurance companies. This will be the first major loss year for crop insurance since many of the larger changes in crop insurance program have been made that have resulted in larger participation. Many of the companies that provide reinsurance to crop insurance companies have not seen losses of the current size. In addition, some of the crop insurance companies are owned by public companies, who may not have realized the scope of losses that their crop insurance subsidiaries could generate. Reactions of private reinsurers and public companies to these losses could influence the profitability and number of private crop insurance companies in the future.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.