Current Fertilizer Prices, Natural Gas, and Longer-Run Supply

According to the Agricultural Marketing Service (AMS), the average anhydrous ammonia price in Illinois currently is $853 per ton, an increase over the $815 per ton price at the beginning of August. Diamonnium Phosphate (DAP) price is $628 per ton and potash price is $599 per ton. Both DAP and potash prices have been stable since August.

Relatively Stable Fertilizer Prices in 2012

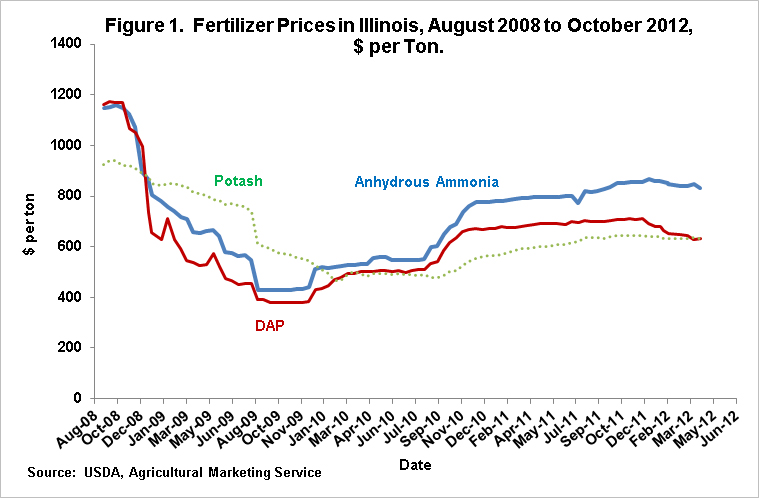

Relative to 2008 through 2010, fertilizer prices have been stable since 2011. Anhydrous ammonia prices were $1,151 per ton in August 2008, declining to $428 in August 2009 (see Figure 1). From August 2009, anhydrous ammonia prices increased, reaching a plateau in 2011. In 2011 and 2012, average anhydrous ammonia prices in Illinois have varied in a band with a low of $774 per ton to a high of $867 per ton. The current $853 per ton price is toward the high end of the 2011-2012 range.

DAP and potash prices exhibit similar trends. Since 2011, DAP prices have varied in a range from $616 per ton to $710 per ton. The current DAP price of $628 per ton is toward the bottom end of the 2011-2012 range. Since 2011, potash prices have ranged from $565 per ton to $646 per ton. The current price of $599 per ton is in the middle of the range.

DAP and potash prices exhibit similar trends. Since 2011, DAP prices have varied in a range from $616 per ton to $710 per ton. The current DAP price of $628 per ton is toward the bottom end of the 2011-2012 range. Since 2011, potash prices have ranged from $565 per ton to $646 per ton. The current price of $599 per ton is in the middle of the range.

Recent Natural Gas Price Increases

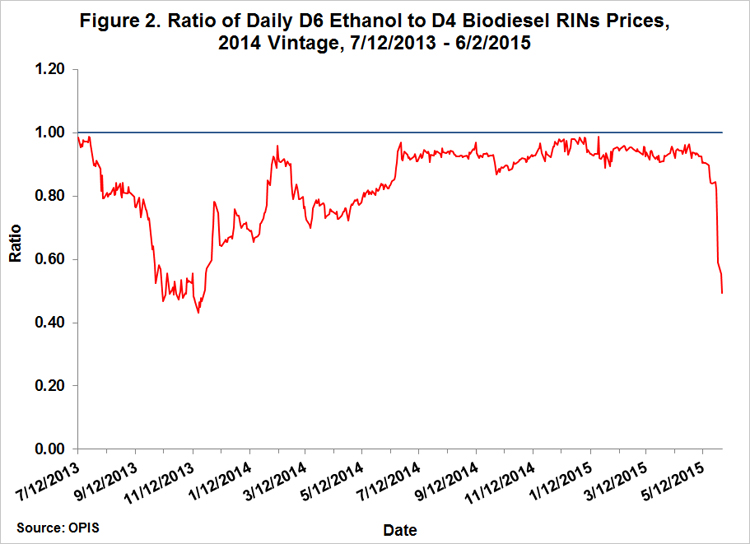

In recent months, anhydrous ammonia has seen price increases. These price increases have been attributed to natural gas price increases. Natural gas prices at Henry Hub have increased from an average in August 2012 of $2.84 per million BTUs up to an average during October of $3.28 per million BTUs, an increase of 16% (see Figure 2).

<

<

Recent natural gas price increases has been attributed to expectations of more normal winter weather this year, leading to higher use of natural gas than last year. Still, natural gas prices may come under downward pressure. Recent reports from the U.S. Energy Information Administration indicate that natural gas in storage is reaching high levels and prices on natural gas futures contracts in recent weeks have declined. Natural gas prices will be highly influenced by winter weather, with other supply, demand, and economic outlook factors also playing a role.

Given this, anhydrous ammonia prices for the spring of 2012 are somewhat uncertain, with price near $900 per ton possible and prices near $800 per ton possible as well. Natural gas prices will influence anhydrous ammonia prices. Acres planted to corn will influence ammonia prices as well. It is reasonable to expect relatively high corn plantings, leading to solid demand for anhydrous ammonia. At this point, though, evidence does not suggest that anhydrous ammonia prices will spike up as they did in 2008. Much higher anhydrous ammonia prices likely would require some world event to occur that is difficult to anticipate.

Longer-term Anhydrous Ammonia Outlook

Even given recent natural gas price increases, natural gas prices currently are lower than they were during much of the mid to late-2000s (see Figure 2). The introduction of fracking has led to large increases in reserves that can be economically produced, leading to expectations of continued lower natural gas prices into the foreseeable future.

Lower price expectations are leading to firms to invest in industrial production that uses natural gas, including production of nitrogen fertilizer. Recently, Orascom Construction Industries announce plans to build a nitrogen fertilizer plant in Iowa. According to an October 24th Wall Street Journal Article (see here – subscription required), CF Industries also is building fertilizer capacity. The ability to build capacity will be influenced by regulatory burdens, as well as “Not in My Backyard” concerns (see here). While long-term in nature, additional nitrogen fertilizer production would likely lead to the ability to more adequately meet nitrogen fertilizer needs, causing lower nitrogen prices.

Summary

Anhydrous ammonia prices are currently around $850 per ton, with uncertainty about prices in the spring of 2013. A colder winter and more corn plantings likely will lead to higher prices and vice versa. Longer-term, nitrogen fertilizer production capabilities mayl be increased, leading to downward pressure on nitrogen prices.

DAP is currently in the low $600 per ton ranges and potash is near $600 per ton. These ingredients have not varied in price much in recent months.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.