IFES 2012: Crop Insurance – Tax Reporting Options

This is a presentation summary from the 2012 Illinois Farm Economics Summit (IFES) which occurred December 10-14, 2012 at locations across Illinois. Summaries and MP3 podcasts of all presentations will be republished on farmdoc daily. The ‘Presentations’ section of the farmdoc site has PDF presentation slides and MP3 podcasts from all presenters here.

Approximately 80% of Illinois farmers purchased various types of crop insurance on their 2012 crops. The total premiums for these policies were over $770 million. It is projected that the total claims will exceed twice the amount of the premiums.

If farmers do not defer their crop insurance proceeds until 2013, they will have an additional $1.5 billion of taxable income this year.

In the past, it was not difficult to decide to defer reporting the crop insurance income until the next year. However, with today’s tax climate, one has to wonder if it will save tax or increase the tax bill by deferring.

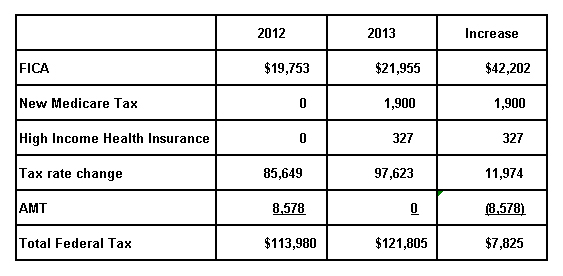

Marginal income tax rates are in a state of flux. Will they remain the same or will they increase, at least for higher income taxpayers? The 33% rate will increase to 36% and the 35% rate will increase to 39.6%

The new Medicare tax increase will begin in 2013. The new tax is based on the lesser of net unearned income or modified adjusted gross income in excess of $250,000 for joint return filers and $200,000 for single filers. The tax will be 3.8% on net unearned income including interest, dividends, annuities, rents and royalties (crop share), passive trades or businesses, and gains fromother than business property. The tax is .9% on earned income.

If the “Bush tax cuts” are allowed to expire, the IRC §179 expensing deduction will go from $139,000 in 2012 to $25,000 in 2013. There will no longer be any 100% or 50%bonus depreciation. And, unless an AMT patch is made, millions more taxpayers will be subject to the alternative minimum tax this year.

If you want to defer 2012 crop insurance proceeds until 2013, you must follow certain rules:

- There must be a history of deferring at least 50% of the crop until the following year. If multiple crops are involved, the 50% test must be satisfied for each crop.

- If you have multiple farms and keep separate records for each farm, the election need not be made on all farms. However, you will need separate tax forms for each farm.

- An election must be attached to the income tax return and must contain certain items.

- If you receive the crop insurance check for the 2012 crop in 2013, you cannot defer the income until 2014.

- You must use the cash method of accounting.

- There are many types of crop insurance.Only those payments for loss of crop qualify for deferment. Policies that insure revenue do not qualify. A policy that has both a yield and a revenue component can be separated and the yield component deferred, but it may be difficult to determine the payment due to yield loss.

Additional Resources

- The slides for this presentation can be found at:

- http://www.farmdoc.illinois.edu/presentations/IFES_2012

- For current tax information, see:

- http://www.taxschool.illinois.edu/taxbookarchive

- http://ruraltax.org

- http://www.irs.gov

- For expiring tax provisions, see:

- https://www.jct.gov/publications.html?func=startdown&id=4383

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.