Solving the Commodity Markets’ Non-Convergence Puzzle

This is a reprint of an article from August 2013 version of the USDA-ERS ‘Amber Waves’ website. It is available online here

The Non-Convergence Problem

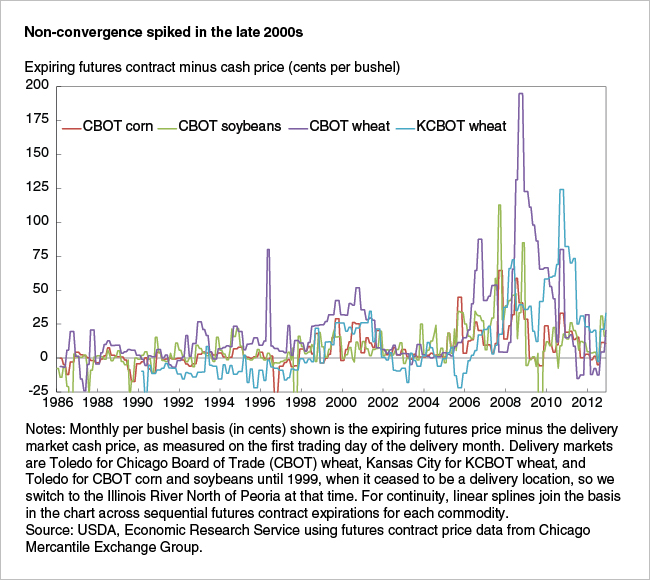

From 2005 to 2010, expiring corn, soybeans, and wheat futures contracts routinely settled at prices significantly higher than their cash market counterparts. For example, on July 1, 2008, the price for the July 2008 Chicago Board of Trade (CBOT) wheat futures contract closed at $8.50 per bushel. Even though that contract was eligible for immediate physical delivery–the process by which futures contracts can be converted into the cash commodity–that day’s per bushel cash price in the Toledo delivery market was only $7.18, a difference of $1.32 per bushel. Because expiring futures contracts for these commodities can be exchanged for the underlying physical product, their prices should converge with the going cash price in the delivery market.

This sustained, unprecedented level of non-convergence raised concerns among market participants, policymakers, and other observers that the ties between futures and cash markets for corn, soybeans, and wheat were weakening. Properly functioning derivatives markets serve to efficiently transmit fundamental information about the commodity, enable participants to manage risks, and encourage efficient storage decisions (dampening the impact of supply or demand shocks). For market observers, non-convergence in these markets signaled trouble.

What explains the origin, level, and duration of recent non-convergence episodes? Some observers argue that non-convergence was a direct impact of the actions of passive, nontraditional futures market participants known as commodity index traders (CITs–see box, “What Are Commodity Index Traders?”). These firms enter futures contracts to provide commodity market exposure in their customers’ portfolios; their influence has grown substantially since the mid-2000s in terms of the percentage of open contracts held. This theory, however, has several logical flaws. For one, it mischaracterizes the trading behavior of speculative traders as “demand” that pressures futures away from cash prices. In reality, because the “supply” of futures contracts is not fixed (without some very strong assumptions), on its own, greater derivatives trading activity on the part of speculators cannot be said to increase futures prices. Moreover, although they emerged as large traders around the same time that non-convergence became a problem, the empirical evidence casts doubt on the possibility that CITs caused non-convergence.

Instead, non-convergence in domestic markets is most likely a consequence of the way the market was set up in the first place. Crucially, firms seeking to convert grain futures contracts into the physical commodity receive a new derivative, called the delivery instrument, not actual physical grain. Because the storage rates on the cash commodity and the delivery instrument were allowed to diverge, a market shock that increased the former over the latter caused the futures price to exceed the cash price. Delivery instruments can be held indefinitely and converted into grain at any time, so they provide an alternative method to obtain grain on some future date. Rather than buy the physical grain and pay to store it, firms can instead hold delivery instruments. Under this arrangement, firms must pay a storage fee, but this fee can be lower than the cost of physical grain storage, which makes delivery instruments attractive and drives up their price. Thus, expiring futures contracts carried a higher price than physical grain for much of 2005-10 because the storage fees charged on delivery instruments were less than the cost of physically storing grain.

Grain Futures Markets Under Non-Convergence

Futures markets provide several important economic functions for agricultural commodities (see box, “How Do Futures Contracts Work?”). Through competitive buying and selling, traders on these exchanges incorporate new fundamental information about commodities into their market price, a process known as “price discovery.” Futures markets also enable participants to manage risks: trading strategies known as hedging can help insulate firms and producers from adverse price changes. In addition, the difference between futures contract prices at sequential expiration dates, known as the term spread, or “carry,” is interpreted as a signal of how much the market is paying to store the commodity between those dates. A large carry is a strong storage signal because it tells a farmer that his or her grain will be relatively more valuable in the future. On the other hand, if near-expiration futures prices exceed distant prices, the market is shouting “Sell!”

Unpredictable convergence undermines confidence in the market’s ability to perform each of these functions and can have severe economic consequences. When the market fails to converge, a commodity’s expiring futures price lies somewhere above or below its corresponding price in the cash market. As a result, non-convergence may imply that prices discovered in a futures market are an inaccurate representation of expected cash market prices in the expiration month. When futures prices are decoupled from grain prices in this way, the term spread can send misleading storage signals to market participants, so more or less than the optimal amount of grain can be stored, inefficiently increasing or depressing market prices. If non-convergence is further characterized by an erratic relationship between futures and cash prices, the risk management functions of these markets may be compromised: hedgers may choose not to hedge in the first place. As a result, risk-averse producers and commercial firms may engage in less economic activity than if they were more confident in the effectiveness of hedging. Persistent nonconvergence can even threaten the viability of a futures market if hedgers lose interest in trading.

Why Did Convergence Fail?

One possible explanation for convergence failure can be called the distortive CIT trading theory. CITs facilitate the sale of financial instruments, like exchange-traded fund shares, to customers who seek investment exposure to commodity prices–sometimes as a hedge against inflation. To ensure that their positions increase in value as commodity prices rise, part of the CIT’s trading strategy involves purchasing long positions in corn, soybeans, and wheat futures contracts. Because futures contracts have a defined life, to stay in the market over time, CITs must roll their positions over from one contract expiration to the next. Several of these firms have applied for and received exemptions from normal speculative position limits, as they trade futures contracts to manage risk. Since the early 2000s, CITs have rapidly increased their presence in commodity futures markets, particularly over the latter half of the last decade. For example, from 2006-08, CITs on the long side of the market held between one-fifth and one-half of all outstanding wheat contracts at the Chicago and Kansas City exchanges.

According to the distortive theory, “excessive speculation” by nontraditional financial firms, like CITs, overpowered the ability of traders to balance futures and cash prices, leading to non-convergence in wheat markets. According to this theory, CIT trading activity constituted a major new source of demand for long commodity futures contracts, unrelated to underlying market fundamentals, and that by entering a large amount of long futures contracts, CITs boosted the “demand” for these contracts without increasing the demand for the underlying physical commodity. The result was a speculative bubble that drove the price of these grain futures contracts higher than the cash market price and increased the futures term spread above the level justified by a rational market. The latter distorted traditional market storage signals, leading commodity holders to store grain for profit, rather than imposing convergence by bringing their grain to market and taking advantage of the difference between futures and cash prices. A way to improve convergence, based on this theory, is to phase out existing CIT hedge exemptions.

However, the CIT-induced speculative bubble theory might raise more questions than it answers. First, equating CIT order flows with demand misrepresents the zero-sum nature of futures markets. Every contract has two parties: one expects the price to rise, and one expects the price to fall. Unlike other assets–even other financial assets such as stock shares–futures contracts are freely created and terminated based on trader interest; their “supply” is unbound. In an efficient market, the additional demand for contracts from CITs can only affect derivatives prices if other traders believe that their trades constitute new fundamental information about the commodity. If the latter is true, and sophisticated and experienced traders (like large commercial firms) believe CIT order flows constitute valuable private information about commodity supply and demand conditions, prices will change. It is more likely, however, that experienced traders have better information about these fundamentals than CITs.

Second, if CIT purchases push futures higher than cash market prices, their selling behavior when rolling from one contract to the next should put downward pressure on nearby futures prices relative to cash. Also, if distortive futures prices lead market participants to take cash grain off the market (and store it for profit) rather than engage in arbitrage, delivery market cash grain prices would rise. Together, these forces should work to generate convergence. Third, markets with negligible index fund investment, like rice and Minneapolis wheat, also saw sharp price spikes at the same time as the corn, soybean, and Chicago wheat markets (which had substantial index fund participation). Why should prices for these commodities also ride a speculative bubble? The converse also provides evidence: livestock markets felt the heaviest concentration of index funds but posted far smaller price increases than other futures markets.

Furthermore, a wide range of empirical studies cast doubt on the index trader theory. Several studies have found that, across markets, speculative trades by index funds were more than offset by higher participation by commercial hedgers. That is, CIT speculation cannot really be considered “excessive” in any meaningful way, relative to trading activities by their counterparties. A new ERS study discusses recent empirical work showing that CIT trading behavior does not affect corn, soybeans, or wheat non-convergence at any acceptable level of statistical significance.

Divergence in Storage Rates Is a More Likely Explanation

Storage fees for the underlying commodity in the cash market can sometimes exceed fees for the delivery instrument, even though they both represent the same amount of grain in the future (see box, “What Are Storage Fees and How Are They Set?” ). Lower storage fees make delivery instruments attractive relative to grain, and their price diverges from the price of cash grain. The fee for physically storing grain is determined by the market–it occurs at the intersection of the demand and supply of storage services. In contrast, the maximum storage fee for the delivery instrument is set by the futures exchange and rarely changes.

When the grain market undergoes certain types of shocks, such as a large harvest that boosts the demand for grain storage, the market price of storage can actually exceed the maximum delivery instrument storage fee, depending on how the latter is set. Firms that want to store the commodity using delivery instruments use the futures market to partially subsidize their storage costs. How do they do this? They use futures contracts to issue delivery instruments to other traders who are willing to buy them. The buyers pay the delivery instrument storage fee and make a profit so long as the term spread is large enough to compensate them for their capital costs. When the market price of storage shows signs of falling below the exchange-set storage fee (as the demand for storage recedes, for example), the traders who bought the instruments use futures contracts to re-deliver the instruments back to the original firms, who in turn cancel them. In this situation, the grain never even needs to physically move out of the warehouse, and both sides benefit.

But, the expiring futures contract price no longer represents the expected cash market price. Instead, it represents the price of the delivery instrument, which has higher value than physical grain because it incurs lower storage fees and has the same future value. The market does not converge. The magnitude of this non-convergence depends on the present value of the difference between these storage fees and the length of time the difference is expected to persist. The higher the fee divergence and the longer the difference is expected to endure–perhaps until an unexpectedly small harvest reduces storage demand–the larger the non-convergence. As a result, even a small wedge between the monthly storage rates creates a substantial futures-cash divergence if it is expected to persist for a long enough time. On the other hand, if the delivery instrument storage fee is sufficiently high, firms that store grain will just do so in the physical market because it is cheaper. They will not hold delivery instruments. The futures contract once again represents the price of cash grain, and the market converges.

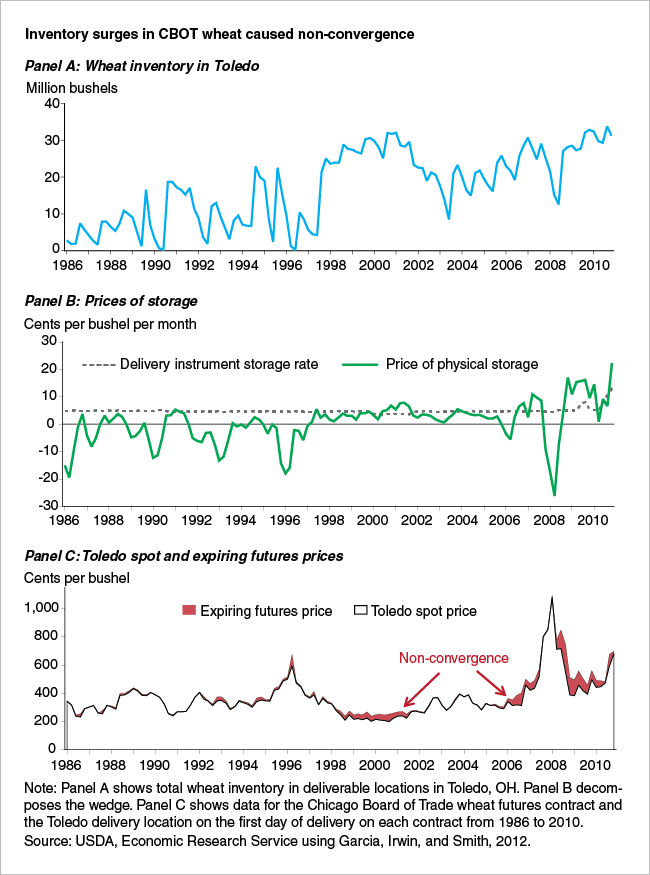

According to the market design theory, significant changes in grain inventories can generate a divergence between the value of futures contracts and cash grain (depending on the level of the storage fee for delivery instruments). A recent ERS study reports that the change in grain inventory level is the most important factor that explains changes in the magnitude of non-convergence over time–periods that see large inventory surges are the most likely to exhibit non-convergence. For example, as shown in the figure below, large inventory surges in CBOT wheat (Panel A) led the price of physical storage to exceed the delivery instrument fee (Panel B) and caused non-convergence (Panel C). Model estimates show that inventories are both statistically and economically significant predictors of corn, soybeans, and wheat non-convergence. In contrast, CIT trading has no significant impact on non-convergence for any of these commodity markets.

Preventing Non-Convergence

Non-convergence occurs when a shock increases the market-defined storage rate for physical grain above the exchange-set maximum storage rate for delivery instruments. U.S. corn, soybeans, and wheat exchanges have taken steps to address these storage rates; the effectiveness of these measures will determine the likelihood of future non-convergence episodes. Several general solutions have been proposed to maintain trader confidence in the market’s ability to perform its economic functions. A summary of these proposals follows:

- Increase the delivery instrument storage rate: Increasing the maximum delivery instrument storage fee, or allowing the fee to vary based on market conditions, helps align it with the price of physical storage. This prevents non-convergence, according to the market design theory. Maintaining the delivery process also preserves its built-in protections against market manipulation. One additional advantage of a fixed maximum fee over a variable one is that it is easily understood.

- Force load-out: By prohibiting traders from holding delivery instruments, this would have a similar effect as the prior option. But forcing physical delivery in this way could make futures contracts more susceptible to manipulation by certain types of traders.

- Make grain futures cash-settled: Changing the settlement terms from physical delivery to cash settlement would guarantee market convergence. However, it can be difficult to devise the appropriate cash price index: which prices should be used to create it? Also, this is a more complicated approach than simply aligning storage rates.

- Make the delivery process easier: Encouraging more traders to settle their contracts through the delivery process does not address the discrepancy in storage rates, so it is unlikely to avoid future non-convergence episodes.

- Apply limits on speculators: The CIT presence in futures markets can be trimmed by phasing out their existing hedging exemptions and ensuring that these firms are subject to existing speculative position limits. However, limiting CIT activity does not address the market design issues that lead to non-convergence. In addition, because they take the opposite position of hedgers, reducing the trading presence of CITs can lower market liquidity and increase derivatives trading (and so risk management) costs. Moreover, CITs who wish to maintain their investment in commodities might instead choose to trade in the cash markets, which would affect grain prices directly.

Conclusion

Convergence failures in grain and soybean markets are most likely an unintended result of the delivery market structure for these commodities. Because it confuses traditional storage signals, non-convergence may lead to welfare losses among less informed market participants, so futures exchanges and stakeholders have an interest in preventing future episodes. Tweaking the storage rate system to better align the delivery instrument storage fee with the market price of storage offers advantages over larger changes.

References

This article is drawn from...

Non-Convergence in Domestic Commodity Futures Markets: Causes, Consequences and Remedies, by Michael Adjemian, Philip Garcia, Scott Irwin, and Aaron Smith, USDA, Economic Research Service, August 2013 available here

Appendices

What Are Commodity Index Traders?

Unlike stocks, bonds, and cash, commodity prices tend to rise during periods of inflation. Although buying and storing physical commodities themselves is costly, it is far less expensive to trade derivatives for these commodities. As a result, beginning in the early 2000s, institutional investors increasingly traded commodity futures contracts passively--that is, they pooled their resources with a fund manager who entered and held positions in these markets indefinitely--as a way to protect their investment portfolios from inflation risk. Individual investors, too, anticipated some benefits from investing in these markets and began trading exchange-traded funds, which work like mutual funds by splitting the derivatives holding into shares. Together, these participants indirectly trade futures contracts through a sponsor trader known as a Commodity Index Trader (CIT). The CIT presence in commodity futures markets has grown rapidly; they are now among the largest traders of agricultural derivatives.

How Do Futures Contracts Work?

In a commodity cash market, goods are exchanged for cash on the spot. Cash markets are established regionally in the United States. In contrast, in a physically settled futures market, like those for corn, soybeans, and wheat, traders form contracts with each other by agreeing on a price at which to exchange a set amount of the commodity on a future date. Because the futures contract value is derived from the expected future cash market price of an underlying commodity, it is a derivative, rather than a real asset. The party who agrees to provide the commodity in return for payment is known as the short; the party who agrees to pay the specified price in exchange for the commodity is called the long. A short position earns value as prices fall, while long positions improve when prices rise. Futures contracts are zero-sum, since any gains (losses) made by the short equal any losses (gains) to the long.

To facilitate trading, a futures exchange standardizes the characteristics and amount of the commodity represented by each contract; the cash markets in which the contract can be terminated via exchange of commodity for cash, or physical delivery, can occur (the delivery markets); as well as the dates at which different futures contracts expire. In general, only just one domestic futures market offers futures contracts for a given commodity. Since they are heavily traded, grain futures markets serve as a forum for price discovery, meaning that commodity prices are set as informed traders compete, using fundamental information about commodity supply and demand.

Nearly all futures contracts in those markets that allow physical delivery are offset. That is, rather than engaging in the delivery process, futures traders frequently terminate their position and exit the market by taking an opposite position to the one they currently hold. Of those contracts whose traders choose to engage in the delivery process, most are actually satisfied by the transfer from short to long of another derivative (instead of the commodity itself) called a delivery instrument. The delivery instrument gives its holder the right to take possession of the commodity from a specified warehouse on demand. The price of an expiring futures contract then is equivalent to the going price of a delivery instrument.

What Are Storage Fees and How Are They Set?

The price of storing a physical commodity from one month to the next is freely set in the storage services market. That price occurs at the intersection of the supply and demand for storage services, which changes over time. As the demand for storage services rises, the price of physical storage also rises, all else equal. In contrast, the storage fee for a delivery instrument is set by its futures exchange. When a long futures contract holder receives a delivery instrument from the short, he or she pays the latter fee to the warehouse that is responsible for providing grain, until the (former) long chooses to sell the instrument or cancel it by taking physical possession of the grain (a process known as "loading-out"). Historically, the delivery instrument storage fee remains unchanged by exchanges for long periods of time.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.