The Land of “MILC and Honey”

Key Finding

- The choice for a dairy safety-net can be a win-win for all.

- Offering farmers a choice among an expanded MILC program and a limited IOFC margin insurance program would double the support of existing programs yet could cost 40-60% less than the current stand-alone margin insurance program.

- IOFC support capped at $6.50 would allow farmers to receive market signals attributable to low IOFC margins. In response, though reductions in output, not whole herd liquidations as was the case in 2009, milk supply would naturally adjust to return margins to average levels. A safety-net without the need for a supply management program.

- Farms would no longer have an incentive to opt-out of the margin insurance and would instead opt for the no-cost MILC program when margins appear favorable. This would allow all farms to participate in a government sponsored safety net program and may prevent ad-hoc disaster payments in the future.

Background

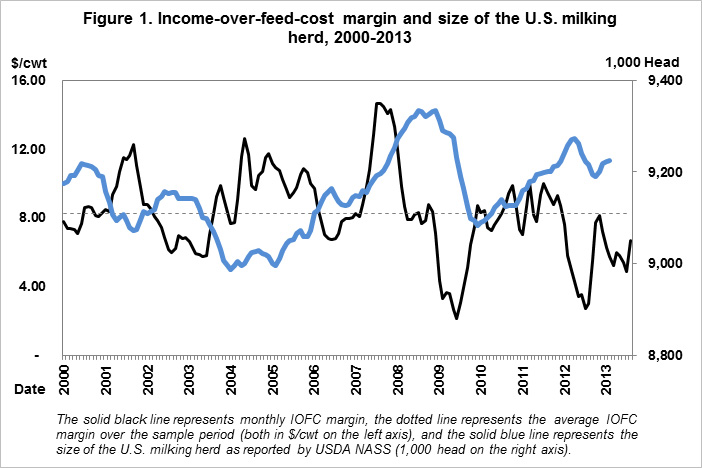

The hardships experienced across the dairy sector in 2009, where U.S. dairy farmers rapidly liquidated more than 250,000 dairy cows from the national herd (Figure 1), brought about a consensus among dairy industry participants that a new risk management solution was needed. As an alternative to price and revenue support several new safety net programs with an emphasis on government sponsored income-over-feed-cost (IOFC) margin insurance have been proposed. Dairy subtitles in both House and Senate 2013 Farm bills discontinue MILC and DPPSP programs and institute a Dairy Producer Margin Protection Program (DPMPP). The DPMPP is a highly subsidized IOFC margin insurance program designed to pay an indemnity to a participating farm when the difference between the national average all-milk price and the formula-derived estimate of feed costs falls below a farmer-selected margin trigger. The House bill (Dairy Freedom Act) includes only the DPMPP. If enacted into law, the Senate bill (Dairy Security Act) would require farms enrolling in DPMPP to also participate in a Dairy Market Stabilization Program (DMSP). The DMSP is a supply management-type program designed to enhance milk prices by reducing the rate of growth in U.S. milk production when IOFC margins fall below a specified threshold. Farms must either reduce the quantity of milk sent to market or face milk revenue penalties on milk shipped over their assigned production base.

Why Dairy Market Stabilization

During times of low margins, it is in the collective interest of dairy producers to reduce production to boost margins quickly to sustainable levels. However, even in absence of coordinated collective action, periods of low margins are generally a temporary phenomenon. Through herd liquidations, milk supply naturally adjusts to return margins to average levels, as evidenced by historic IOFC margin patterns and the term structure of forward IOFC margins (Bozic et al. 2012). The downside of relying exclusively on markets to govern the supply correction is that the recovery may be delayed for as long as revenue from milk production covers at least variable costs. Thus, to expedite IOFC recovery Dairy Security Act couples DPMPP with a supply management-type program.

Additionally, supporters of Dairy Security Act argue that a highly subsidized stand-alone margin insurance program offering coverage only $0.30 per cwt less than the historical average of $8.30 per cwt will make the milk supply less responsive to negative price signals, and in the long run result in lower average milk prices and higher indemnity payments from the taxpayer to the dairy farmer. Such a scenario may be undesired, but would not be unforeseen.

Opposition to Dairy Market Stabilization Program

The DMSP portion of the DSA package has wide-spread support within the dairy farming community and its cooperative leadership, but this support is not nearly unanimous. Significant resistance with regard to the DMSP has been registered by dairy cooperatives, restaurant and food marketers, consumer groups, dairy food manufacturers, and their trade associations. These groups are concerned that artificial enhancement of milk prices through DMSP milk supply reductions will have detrimental effects on procurement costs, throughput efficiency, retail prices, consumer demand, and dairy export opportunities.

In addition, opponents fear that once DMSP becomes part of legislation it could be easily amended by Congress to be non-voluntary or more severe in the financial penalties, a slippery slope opposition groups seek to avoid.

A MILC and Honey Compromise

With both sides in the dairy policy debate set in their positions it is difficult to see a path to compromise. How can we offer a retooled dairy farm safety net that: (i) works for small and large-scale dairy farm managers; (ii) is fiscally responsible; (iii) does not mute market supply and demand signals; and (iv) does not require a market stabilization program? We propose a new policy alternative, one we decorously label “MILC and Honey”. This program would accomplish all of these goals by increasing eligibility of MILC to 4 million pounds per year and allowing farms an option to choose annually between 1) MILC participation, or 2) a stand-alone margin insurance program as their elected safety net. Specifically our proposal is for a combined program we term MILC-Insurance. This program will provide for:

- continuing to offer the MILC program and increase the MILC eligibility to 4 million pounds per fiscal/calendar year.

- farms not wishing to participate in MILC would be able to purchase margin insurance from $4.00-$6.50 per cwt.

- the choice for either MILC or margin insurance can be made each fiscal or calendar year.

In order to determine how this MILC-Insurance policy option would perform the margin insurance and MILC benefits were modeled for 5000 representative farms and four IOFC margin scenarios. Milk production data for 48 months was simulated for the representative farms. The data were structured to include consolidation trends, herd demographics, seasonal production patterns, and farm growth rates common to U.S. farms. In all of the analyses we use the milk marketings in months 1-36 to construct the production history and months 37-48 are used to analyze the performance of the margin insurance program, MILC, and MILC-Insurance.

Four beginning-of-the-year expected margin scenarios are identified that should well cover the space of likely expected margin environments:

- Catastrophic Margins. Expected margins are well below long-run average, but revert to mean by the end of the year.

- Mean-Reverting Margins. Expected margins for the first quarter of the year are well above historical average, but revert to long-run average.

- Above-Average Margins. Expected annual average margin is almost $1 per cwt above average.

- January 15, 2013. Expected margins derived using January 15, 2013 futures and options prices.

These scenarios, depicted in Figure 2, are based on actual expected margins, as observed on January 15 in one of the previous seven years. The simulation techniques used for this analysis are similar to those employed in Newton, Thraen, and Bozic (2013).

Consider first the benefits of DFA (Table 1), when anticipated IOFC margins are catastrophic the net benefits of DFA are up to three times greater than payments under a counter-cyclical payment program for the 5000 farms in this analysis. For example, given 2013 margins DFA would provide $76 million dollars in revenue support while the MILC program would provide only $23 million dollars (Note: Financial outlays reflect only the simulation results and are not indicative of total dairy farm safety net outlays by the Government). During favorable margin outcomes such as a mean-reverting margin or an above-average margin the support from DFA is less than the support received from MILC. In fact, during an above-average margin outcome MILC would still provide a marginal amount of income support while the margin insurance program support is near zero. This disparity is due to the fact that during times of low milk and low feed prices an IOFC program may not pay an indemnity, while the MILC program may still trigger a payment if the feed adjusted Boston class I price of milk is below $16.94/cwt.

As a joint program, MILC-Insurance combines the benefits of both programs and ensures a safety net on either the milk price or the IOFC margin. As a result, during favorable margin outcomes the combined program does not reduce the expected benefits compared to a MILC only program. In fact, based on the simulation results all farms (large and small) would benefit more from a counter-cyclical MILC program when margins are favorable. It is only when IOFC margins fall to low levels would an IOFC program be preferred to MILC.

When IOFC margins are poor the MILC-Insurance program would provide two times the support of MILC for the 5000 farms in this analysis. For example, given 2013 margins combined program would provide $32-48 million dollars while MILC would only provide $23 million dollars. The difference in the MILC-Insurance program payments is due to the $6.00 and $6.50 supplemental insurance cap, with $6.50 coverage providing an additional $16 million in revenue support to dairy farmers.

The solid black line represents the mean first-stage IOFC margin, the shaded region represents to middle 50% of first-stage IOFC observations, and the dashed line represents the actual IOFC margin calculated using announced USDA prices for all-milk, corn, soybean meal, and alfalfa hay. Catastrophic scenario corresponds to 01/15/2009, Mean Reverting to 01/15/2008 and Above Average to 01/15/2010.

During the catastrophic margin outcome the average per cwt payment from a counter-cyclical payment program is approximately $1.06 for herds under 99 head. The effective support price declines rather sharply for farms that produce more than 2.985 million pounds annually. For farms with 100-499 head the revenue support was $0.75 per cwt, for farms with 500-999 head the revenue support was $0.33 per cwt, and for farms with 1000+ dairy cows the expected MILC benefit is only $0.08 per cwt. This pattern, albeit not as extreme, is also observed in other price scenarios and in each example the largest farms receive the smallest share of total benefits. Given these results it is evident why some argue that coverage provided via MILC is inadequate and outdated (Thraen 2007; D’Antoni and Mishra 2011).

By design the disparity in per cwt benefits is eliminated when analyzing the DFA and MILC-Insurance program. Under the DFA margin insurance program farms electing similar coverage options have similar net benefits per cwt. Under MILC-Insurance the benefits per cwt are similar when farms participate in the IOFC program, and are only $0.20-$0.50 per cwt less than those under a margin insurance only program. The key benefit of a MILC-Insurance program relative to insurance only is found during favorable margin years: For example, during the above-average scenario the expected benefits per cwt for DFA were near zero for farms who elected to remain in the program; meanwhile, under the MILC-Insurance program not only did farms not opt-out of a government safety net, but they received benefits up to $0.04 per cwt.

Relative to program preference, we find that with a $6.00 MILC-Insurance program smaller farmers would elect to remain in the MILC program compared to the IOFC program. The reason small farms may elect MILC over margin insurance is the MILC is a no cost to participate program; thus even if margin indemnities are higher than MILC payments, after paying premiums MILC benefits are actually higher than IOFC insurance indemnities. When $6.50 coverage is offered the expected benefits of IOFC exceed those of a MILC program ($4 million pound cap). This pattern of preferring MILC to IOFC insurance does not continue as the herd size grows. The reason large farms would prefer the margin insurance over the MILC during poor margin outcomes is the 4 million pound benefit constraint results in the effective revenue support per cwt dropping as farm size increases.

Results indicate that the MILC-Insurance program would provide benefits to both small and large dairy farm operators by allowing them to choose their safety net annually. This new alternative would provide greater support to small farmers compared to the existing MILC program by expanding eligible pounds. For farmers growing a majority of their feed the target price MILC program provides a safety net to their primary revenue risk – milk price. For larger dairy farms (and farms who purchase feed) the IOFC program provides the ability to mitigate both milk and feed price variability. Thus the opportunity to participate in one or the other provides a continuous safety net program in any IOFC environment for all dairy farmers.

From fiscal perspective, this program would also reduce the costs by as much as 60% compared to DFA if IOFC coverage from $4.00 to $6.00 is offered. These cost savings fall to just under 40% when $4.00 to $6.50 coverage is offered. Finally, by offering insurance coverage only up to $6.50 a stand-alone margin insurance program may not mute market signals implicit during low IOFC margin events compared to an $8.00 insurance option. By directing market signals to the dairy farmers they can respond to negative price signals not by liquidating their herd completely, but by reducing output. A slight reduction in output, while supporting dairy farm revenue with $6.50 insurance coverage, would provide dairy farm stability and serve to prevent rapid declines in the U.S. milking herd similar to those witnessed in 2009.

Summary

As means to end the stalemate between supporters of the House and Senate dairy titles we propose serious consideration on a new dairy safety-net program. This program will: (i) work for small and large-scale dairy farm managers alike; (ii) be fiscally responsible, providing more support than the current MILC yet costing significantly less than the currently debated programs; and (iii) does not mute market supply and demand signals. This new policy alternative which we title MILC-Insurance would accomplish all of these goals by increasing eligibility of MILC to 4 million pounds per fiscal/calendar year and by allowing farms an option to choose annually between MILC and a stand-alone margin insurance program as their elected safety net.

The MILC-Insurance program saves money relative to the stand-alone margin insurance program by capping insurance at $6.00-$6.50 per cwt. With the savings the revenue can be redirected to an expansion of the MILC program; effectively offering the best of both programs (counter-cyclical revenue support or catastrophic margin insurance). Farms would no longer have an incentive to opt-out of the margin insurance and would instead opt for the no-cost MILC program when anticipated margins are favorable. This would allow all farms, regardless of size or management style, to participate in a government sponsored safety net program. Such a program, which offers continuous support, may prevent ad-hoc disaster payments in the future.

References

Bozic, M., Newton, J., Thraen, C.S., Gould, B.W. 2012. Mean-reversion in Income Over Feed Cost Margins: Evidence and Implications for Managing Margin Risk by US Dairy Producers. Journal of Dairy Science. 95:7417-7428.

D'Antoni, J.M., and A.K. Mishra. 2011. Assessing Participation in the Milk Income Loss Contract Program and its Impact on Milk Production. Paper presented at the Agricultural and Applied Economics Association's 2011AAEA and NAREA annual meeting, Pittsburgh, PA.

Newton, J., Thraen, C. and Bozic, M. 2013. Whither Dairy Policy? Evaluating Expected Government Outlays and Distributional Impacts of Alternative 2013 Farm Bill Dairy Title Proposals. Paper presented at the Agricultural and Applied Economics Association's 2013 annual meeting, Washington, DC.

Thraen, C.S. 2007. Dairy Policy - How MILC changes the Dairy Support Price. OSUE Dairy Policy and Markets Briefing Paper, Department of Agricultural, Environmental and Development Economics. The Ohio State University

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.