The Dairy Safety Net Debate of 2013 Part I: Questions and Answers

Key Findings

- A margin insurance safety net program would succeed in providing needed financial relief to farmers and would provide by far the greatest support in times of severely low income-over-feed-cost margins.

- Neither margin insurance program meets the conditions for an insurance product. The specification of a fixed premium structure over the life of the farm bill combined with the ability of the producer to annually choose a margin insurance level creates incentives to adversely game the program to one’s financial advantage.

- Despite farms working collectively to improve margins by reducing the milk supply, financial penalties and production responses to dairy market stabilization will differ based on an individual farm’s milk value and costs of production.

- Free-rider incentives provided by the dairy market stabilization program would encourage non-participating farms to increase their milk output and capitalize on enhanced market prices thereby limiting program effectiveness.

In a previous farmdoc daily post (see here) we suggested that a compromise solution to the ongoing U.S. House and Senate debate over the form and substance of a new dairy safety net is a combination of the current Milk Income Loss Contract (MILC) program, augmented to be inclusive of more medium and small scale dairy farms, and a slightly modified income-over-feed-cost (IOFC) margin program, offering support for larger scale dairy farms. Today’s post is part one of a two part series where we provide more information as to why we think this is a better way forward and what we believe are the overlooked and missing details to those safety net programs originally authored by the House and Senate.

Over the past 18 months, the missing details of the dairy safety net programs have been carefully addressed as part of an ongoing research program at The Ohio State University, Department of Agricultural, Environmental and Development Economics (see here, here, and here). In this two part series we will summarize our conclusions with regard to our research and modeling efforts. The big questions to be addressed in today’s farmdoc daily post include:

- Will margin insurance work as a safety net for U.S. dairy farmers?

- Is margin insurance really an insurance product?

- Would dairy market stabilization affect all farms equitably?

In Thursday’s farmdoc daily post we will conclude by addressing the following questions:

- Who benefits with an all-inclusive safety net program?

- How much of a safety net for dairy farms should society provide?

- Is there a better way forward?

In addressing these questions we will demonstrate that the devil is not in the details, but in the absence of the details. Each problem represents a major issue policy makers should consider before advancing alternative safety net programs as proposed by either the U.S. House or Senate.

Will Margin Insurance Work As A Safety Net?

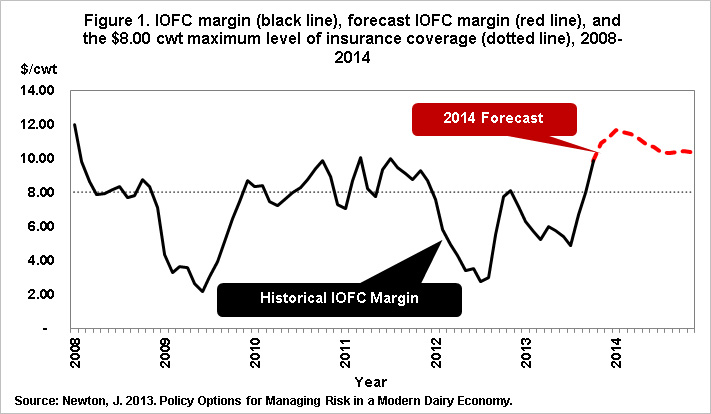

Either program in the U.S. House or Senate Farm Bill would work as a safety net against low IOFC margins. The $4.00 per cwt margin insurance is available at little to no cost at all and would provide financial assistance only during the most catastrophic of margin environments. For farms who are more risk adverse, or whose balance sheet requires more protection against less severe declines in the IOFC margin, additional supplemental buy-up coverage is available up to $8.00 per cwt. The $8.00 IOFC supplemental coverage allows a farm to insure up to 96% of the historical average margin. Figure 1 shows the historical and forecast IOFC margin, 2008 through 2014.

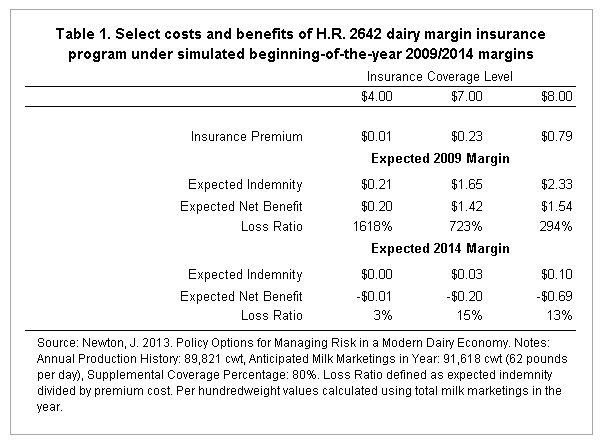

To demonstrate the effectiveness of the proposed margin insurance plan in providing income support consider the expected costs and benefits of margin insurance for a 400 cow dairy as implied by milk and feed futures at the beginning of 2009 (Table 1). While the net expected benefits for the representative farm were $0.20 for the basic $4.00 coverage, the farm could purchase $8.00 supplemental coverage for $0.79 and expect to receive an indemnity payment of $2.33, realizing net benefits of $1.54 per cwt ($2.33-$0.79). Extrapolating the $1.54 on all of the farm milk marketings the net expected benefits represent a payment of $140,856 during a single calendar year for this 400 cow operation.

During times of anticipated favorable margins, as is the case leading into 2014 (Figure 1), the margin insurance program would be expected to pay less in indemnities and the returns would be unlikely to exceed the cost of insurance premiums for all coverage levels. Note that if the purchase decision for 2014 were to be made at the time of this article, the minimum level of $4.00 coverage, with the lowest participation costs, would provide the highest net expected benefits of participation. Given these results, the answer to the question is yes: margin insurance would succeed in providing financial assistance to farmers and would provide by far the greatest support when IOFC margins are severely low.

Is Margin Insurance Really An Insurance Product?

Sound insurance practices require setting premiums to take into consideration the likelihood of loss and the anticipated level of loss. Given the complex task of determining the likelihood of loss and the anticipated level of loss, setting insurance premiums that are actuarially fair is not a simple matter. Unfortunately, the margin insurance programs as proposed do not follow sound insurance principles when it comes to premiums reflecting the anticipated risk environment in milk and feed markets. The proposed margin insurance programs do not use a rating method to update premiums as is customary with products such as crop insurance or livestock gross margin insurance. Instead a feature of these margin insurance programs is the specification of a fixed premium structure over the life of the farm bill combined with the ability of the producer to annually choose to participate, and at what coverage level, in the margin insurance program.

Why is this an issue? Our research has identified that publically available information from Chicago Mercantile Exchange futures for milk and feed can be used to forecast near-term IOFC margins. Using this information, when futures indicate the probability of indemnity payments is high, dairy farmers who recognize that their expected benefits exceed their premiums may be more likely to purchase supplemental margin protection at a higher coverage level. Alternatively, when the anticipated margin risk is low, producers who recognize that their expected benefits are less than their premiums may be more likely to opt-out or purchase less insurance coverage (i.e. compare expected benefits of $8.00 coverage during 2009 and 2014 in Table 1).

As currently structured, this annual selection feature allows farms to jump in and out of supplemental coverage and is equivalent to buying crop insurance very late in the growing season when yields are easily anticipated. Identifying almost certain losses and then buying insurance coverage for these losses effectively transform margin “insurance” into a strategic game, pitting the knowledge of the producer against the taxpayer as the underwriter of the indemnity payout. Adverse gaming incentives will lead to significantly high loss ratios and windfall indemnity payments from the taxpayer to dairy farmers. Thus the answer to our question is no: This program does not meet the conditions for an insurance product in that premiums are not calculated in a manner conforming to actuarial science and as such do not adjust to reflect the anticipated risk environment facing the insurance underwriter, i.e., the U.S. taxpayer.

Would Dairy Market Stabilization Affect All Farms Equitably?

Dairy Market Stabilization Program (DMSP) is designed to increase dairy market prices and IOFC margins by encouraging producers to reduce the volume of milk they send to market. This is achieved by participating farms donating the revenue from milk sales over-base and using the funds for demand enhancing programs such as food donations. Through the operation of DMSP, all dairy producers participating in the margin insurance program would work together to accelerate margin recovery and effectively limit the safety net program cost to taxpayers. How much each dairy farmer contributes to improve margins, however, would not be evenhanded.

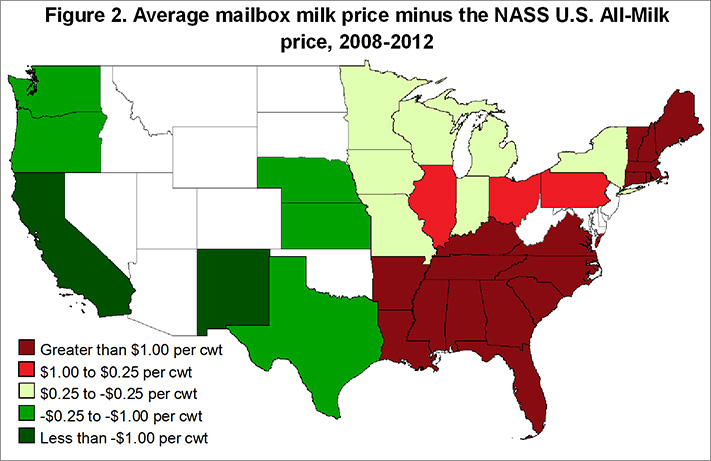

For farms purchasing margin insurance DMSP cutbacks would range from 2 to 8 percent of milk marketings and are effectively a 2 to 8 percent tax on gross revenue. This tax will impact all dairy producers differently. Dairy producers earning a higher than average mailbox milk price per cwt due to better management, better milk quality, higher component levels, higher premiums, or higher class I revenue will have higher DMSP revenue reductions. In figure 2 we’ve mapped the average difference between the state mailbox milk price and the U.S. all-milk price for 2008-2012; the greater that difference is the higher are the likely DMSP revenue reductions. Additionally, dairy producers with lower costs of production may find it easier to endure the negative margin on milk shipped over-base and “blow through the penalty” if the net benefit from insurance indemnities outweigh insurance premiums and foregone DMSP revenue.

Farms not purchasing margin insurance would receive “free-rider” benefits of DMSP enhanced milk prices without having to cut back on milk shipped to the market. In fact, arguments can be made that non-participating farms, in anticipation of DMSP enhanced prices, would increase their milk output to capitalize on higher market prices thereby limiting DMSP effectiveness and potentially prolonging the duration of low IOFC margins. Farms participating in the program would not have this free-rider luxury and would have to not only stabilize the current market supply and demand conditions but also cushion the impact of additional milk that may come online in future months.

Considering the regional variations in milk value and costs of production along with free-rider incentives, the answer to our question on functional equity is no: DMSP may trigger greater revenue reductions on the highest valued milk, and farms with lower costs of production may find it easier to endure negative margins on milk shipped over-base. Additionally, non-participating farms would benefit from enhanced milk prices and margins without having to reduce their milk output. As a result, despite participating farms working collectively to improve margins by reducing the milk supply, financial consequences and production responses to DMSP would not be equitable.

Summary

In today’s post we’ve demonstrated that margin insurance would offer an effective safety net to support dairy IOFC margins. However, we also recognize that the insurance program does not meet the conditions for an insurance product in that premiums do not reflect the anticipated risk environment of milk and feed markets. We also revealed that DMSP may result in some farms carrying a higher financial burden of accelerating margin recovery. Finally, our research supports the view that DMSP effectiveness may be marginalized, and the duration of low IOFC margins extended, as non-participating farms undergo price induced supply expansions.

In Thursday’s post we will continue this evaluation of proposed programs by presenting results of our distributional analysis of margin insurance to identify who is most likely to benefit from an “all-inclusive” safety net. We will augment our distributional analysis by including dairy farm financial data on net household income by herd size provided by USDA Economic Research Service. Finally, we will conclude the series by demonstrating that choice in a dairy farm safety net, in the form of a combined MILC and insurance program, can offer a better way forward for the U.S. dairy industry.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.