Debt Use by Farms with Crop Insurance

There is a growing concern over the recent rise in farm debt use, largely based on the role farm debt played in the sector-wide boom and bust of the 1970’s and early 1980’s. This post addresses the link between Federal Crop Insurance (FCI) and farm debt use.

Data

We examine several uses of debt at the farm level using data from the USDA’s Agricultural Resource Management Survey (ARMS). ARMS is an annual survey of farm and ranch operators jointly sponsored by the Economic Research Service (ERS) and the National Agricultural Statistics Service (NASS) of the USDA. The survey collects farmer-reported information on farm finances, resource use, and household economic wellbeing. The primary sampling unit is all establishments that sold, or normally would have sold, at least $1,000 of agricultural products during the year.

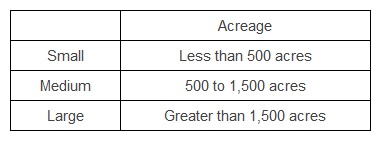

We limit our analysis to farms with over $250,000 in sales and farms for which the primary operator’s principal occupation is farming (or “farm businesses” in USDA nomenclature). We further limit our sample to farm businesses that specialized in field crop production, including wheat, corn, soybeans, sorghum, rice, tobacco, cotton, peanuts, other cash grains, and oilseeds. In other words, we limit our analysis to farms that are most likely to participate in FCI. The survey respondents represent a population of approximately 228,000 farm businesses, and these farms can be further classified into three categories by acreage:

Farm Debt use by farm size with Federal Crop Insurance

Our analysis shows that farms are more likely to participate in FCI as acreage increases. Approximately 62% of small field crop farms participated in FCI. However, 85% of medium farms and 92% of large farms participated in FCI in 2011. Farm debt is highly concentrated in farms that participated in FCI. Among field crop farm businesses, roughly 88% ($47.9 billion) of farm debt was held by farms that participated in FCI. Small-acreage farms that participated in FCI held $5.6 billion in debt, comprising almost 80% of all debt held by small-acreage farms. Medium-acreage farms that participated in FCI held $16.7 billion in debt, accounting for about 82% of total debt in that acreage category. Large-acreage farms participating in FCI accounted for $25.6 billion in debt, or approximately 95% of all debt held in the large-acreage category.

Probability of Default

We calculated the probability of default for field crop farm businesses using a measure similar to a credit score (Brewer et al., 2012 here). The probability of default is influenced by the farm’s repayment capacity, solvency, and liquidity. Using this measure, farms that participated in FCI had a higher default risk. About 36% of FCI-participating farms had greater than 1% probability of default compared to about 22% of non-FCI-participants. The average probability of default was 1.9% for farms without FCI compared to 2.2% for those farms with FCI coverage.

Summary

An increasing share of U.S. farms use Federal Crop Insurance as a risk management tool, and the majority of field crop farm debt is held by farms that participate in FCI. As farms increase in acreage size, debt is increasingly concentrated in farms with FCI coverage. Farms that participate in FCI are more leveraged and have a higher probability of default. FCI participation and its relation to farm debt use could have positive or negative effects on the farm sector. There is a potential increase in access to credit by creditworthy farmers which would increase investment and add value to the farm economy. Alternatively, farmers may take on higher levels of debt than they would have without FCI which potentially leads to repayment issues.

This post is based on a recent Choices article published by the Agricultural and Applied Economics Association. It is available here: Ifft, J., T.H. Kuethe, and M. Morehart (2012) “Farm Debt Use by Farms with Crop Insurance” Choices 28 (3).

The views expressed are those of the authors and should not be attributed to ERS or the USDA.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.