Insurance Coverage of Corn and Soybean Production Cost since 1980

Overview

Since 2006, crop insurance has been the dominant crop safety net program. However, the prosperity that has characterized this period may be coming to an end. Thus, crop insurance may perform differently in the future than during the past few years. Therefore, this post examines the performance of crop insurance since 1980 on an important metric: how well has insurance covered the cash plus land cost of producing corn and soybeans.

Data

Beginning with 1975, the U.S. Department of Agriculture (USDA), Economic Research Service has surveyed farmers about their cost of producing the major program field crops, including corn and soybeans (see here). This study specifically examines cash cost plus the charge for land. Cash costs include, among others, seed, fertilizer, chemicals, custom operations, fuel, repairs, and hired labor. Farms often borrow money for their cash plus land costs to cash flow production between the planting and harvesting of a crop. Thus, these costs are a common concern for banks and other providers of credit. It is important to note that the USDA cost of production data are not strictly comparable over time due to changes in the survey methodology and information collected. Nevertheless, the data set provides a reasonable perspective on the cost of producing these crops over time.

The average U.S. cash plus land cost for a year was divided by the average yield per planted acre reported by farms in the USDA survey. This average cost per bushel is then compared with the insurance price for the year at various insurance coverage levels. The insurance prices are from the USDA, Risk Management Agency (see here). Because the overwhelming majority of farms purchase the harvest price option (HPO), this insurance feature was modeled by calculating a 5-year Olympic moving average (removes the high and low) of yield. If the yield for a year was less than the 5-year Olympic average, then the harvest insurance price replaced the plant insurance price. To allow for the calculation of the 5-year Olympic average, the study begins with 1980. Last, because the insurance prices are futures prices, the cash minus futures basis was calculated to adjust the futures price to a cash price. The cash price used in this calculation was the crop year average price reported by USDA, National Agricultural Statistics Service (see here ). The cash price averaged $0.35 under the corn insurance futures price and $0.43 under the soybean insurance futures price over 1980-2012.

Corn

This discussion focuses on 85% insurance — the highest available individual farm insurance. In every year since 2006, 85% insurance more than covered the average U.S. cash plus land cost of producing corn (see Figure 1). In contrast, during the 27 years from 1980 through 2006, 85% insurance covered on average only 95% of the cash plus land cost for corn. Moreover, the cost coverage ratio was less than 100% in 74% of these 27 years. Thus, in the great majority of years prior to 2007, a farm with the average cash plus land cost of producing corn could not cover this cost even when purchasing 85% insurance. The lowest corn cost coverage ratio was 67% in 1987.

Soybeans

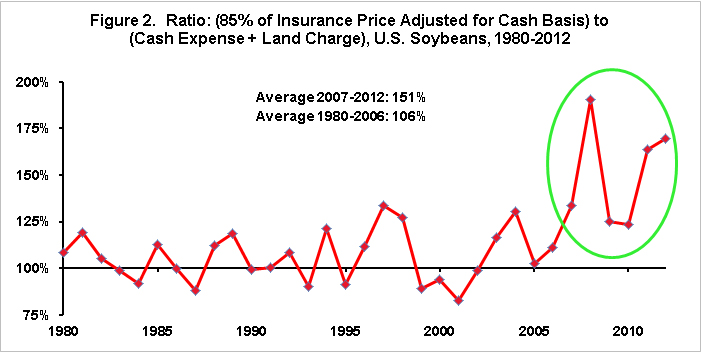

The same picture emerges for soybeans as for corn except that 85% insurance covered a larger share of cash plus land cost. Eighty-five percent insurance covered on average 151% of the cash plus land cost for the 2007-2012 soybean crops (see Figure 2). In contrast to corn, 85% insurance also on average covered average soybean cash plus land cost even prior to 2007 (average cost coverage was 106%). Nevertheless, in 41% of the years prior to 2007, 85% insurance did not cover the average cash plus land cost of producing soybeans. Perhaps the best illustration of the higher cost coverage offered by insurance for soybeans is that, between 1980 and 2006, 80% insurance would on average have covered the average cash plus land cost of producing soybeans.

Summary Observations

A notable difference exists in the cost coverage performance of insurance for corn and soybeans before and after 2007. During the last 6 years, 85% insurance has more than covered the average U.S. cash plus land cost of producing corn and soybeans. Especially for corn, this was not the case prior to 2007. The decline in corn and soybean prices over the last 6 months suggests that insurance’s cost coverage performance over the next few years may be closer to that prior to 2007 than during the last 6 years. In short, farmers, credit suppliers, insurance providers, and policy analysts need to be careful about assuming that insurance will cover the cash plus land cost of producing corn and soybeans. Moreover, this study examines the average cost of producing in the U.S. Thus, the concern over the cost coverage of insurance is even more relevant for farms with above average cash and land cost of production.

The preceding observations suggest that farms and their credit providers may have interesting conversations this winter about the appropriate level of insurance. Credit providers may want higher levels of insurance to increase the cost coverage ratio. In contrast, farms may want to purchase lower levels of insurance because their premiums are higher for 80% and especially 85% insurance not only because coverage is higher but also because federal subsidy levels are lower. It is therefore not clear that farmer spending on insurance will decline even with the lower prices, which translates into lower insured values and thus lower premiums, everything else constant. Everything else constant does not hold in this situation since the cost coverage ratio is likely to be lower.

Another potentially important observation is the historical difference in the cost coverage ratio between corn and soybeans. The higher cost coverage ratio for soybeans probably reflects the lower cash costs per acre associated with producing soybeans relative to corn. The combination of lower cash costs plus a potentially greater cost coverage ratio may push farms to substitute some soybeans for corn in their rotation, especially for high cash cost farms. A common topic of policy discussion for Title 1 commodity programs is the planting distortions associated with fixed target prices. Relatively little discussion has surrounded the potential issue of planting distortions among the various program crops caused by crop insurance.

Last, this study reinforces why credit lenders are vocal supporters of crop insurance. For corn and in particular soybeans, crop insurance offers significant coverage of cash costs associated with producing a crop. A growing policy concern has been the perceived increasing role of dealer credit to farms for purchasing inputs. While we certainly do not understand the potential implications of this situation, crop insurance, especially at high levels of insurance, potentially mitigates this concern, at least for the initial year. But, insurance prices are reset each year and will fully follow prices lower. Thus, high cash cost producers may ultimately find themselves in trouble if they cannot adjust costs to lower prices in one year. Hence, it is important for farms to have a strategic plan for cost flexibility. An associated policy implication is that crop insurance has a hole as a safety net program — multiple year declines in price and revenue. Thus, it is important for the current farm policy debate to consider what is the appropriate multiple year safety net that complements insurance.

This publication is also available at http://aede.osu.edu/publications.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.