IFES 2013: 2013 Farm Policy Update

This is a presentation summary from the 2013 Illinois Farm Economics Summit (IFES) which occurred December 16-20, 2013 at locations across Illinois. A complete collection of presentations including PowerPoint Slides (PPT), printable summaries (PDF) and interviews are available here.

The current Farm Bill process has now been underway for over 2 years. In 2012, the 2008 Farm Bill was extended for 1 year as larger budget issues delayed the standard process. In 2013, both the Senate and House have passed Farm Bills which are currently being reconciled in a Conference Committee comprised of members from both chambers.

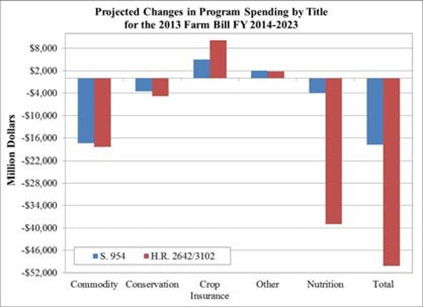

Both versions are credited with achieving savings relative to existing programs via changes to the Commodity, Nutrition, and Conservation, and Crop Insurance Titles. These proposed changes suggest a shift in farm program focus from income supports to risk management where the federal crop insurance program serves as the main safety net for crop producers.

Existing commodity programs – direct and counter-cyclical, ACRE, and SURE – are eliminated in both Farm Bill proposals. The Senate version replaces these programs with the combination of both price supports and a shallow-loss revenue program. The House version would offer producers the choice between price supports with updated target prices for eligible commodities, or a county- level shallow-loss revenue program. In addition, a new crop insurance program – the Supplemental Coverage Option – is created in both versions.

The price support programs in the Senate and House Farm Bills differ along two important dimensions. The Senate price support program bases payments on historical base acreage and sets the reference price levels equal to a percentage of the rolling average of national marketing year average prices. Thus, reference prices would adjust with the market. In contrast, the House price support program would continue to use fixed price support levels and base payments on planted acreage. Thus, price support payments would be tied to, or “coupled” with, farmers’ production decisions.

The shallow loss revenue programs base their guarantees on Olympic averages of recent yields and national cash prices, and have payment limits and eligibility rules based on adjusted gross income. In contrast, supplemental insurance coverage bases its guarantee on insurance (futures) prices and trend yields and will not be subject to payment limitations, but will require the producer to pay a subsidized portion of the premium.

Thus, these new and modified programs will require producers to make choices among programs which offer varying forms of price and yield risk protection. Furthermore, their individual crop insurance purchases may also influence the risk protection offered by the supplemental insurance coverage option and their choice among the modified commodity programs.

The two versions of the Farm Bill achieve a substantially different level of savings out of the food assistance programs, mostly from the Supplemental Nutrition Assistance Program (SNAP, formerly known as food stamps). More importantly, the policies that each uses to achieve those savings have significant political implications for passing the Farm Bill through the House and the Senate and getting it signed into law by the President.

Despite more than 2 years of debate, the likelihood of a Farm Bill being passed in 2013 is still very uncertain. The Farm Bill Conference Committee is currently working towards creating a Farm Bill keeping in mind the December 13th deadline for the Budget Committee.

References

- The slides for this presentation can be found at:

- http://www.farmdoc.illinois.edu/presentations/IFES_2013

- Other publications:

- Chite, R.M. "The 2013 Farm Bill: A Comparison of the Senate-Passed (S. 954) and House-Passed (H.R. 2642, H.R. 3102) Bills with Current Law." Congressional Research Service, Washington, DC. http://www.fas.org/sgp/crs/misc/R43076.pdf

Appendices

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.