2014 Farm Bill: Historical Likelihood of County ARC and SCO Payments for Corn in Illinois

The 2014 Farm Bill created new commodity and crop insurance programs, allowing producers more flexibility in how they create a risk management portfolio. The new commodity title includes both price-based (Price Loss Coverage) and revenue-based (Ag Risk Coverage) program options. The Supplemental Coverage Option is a new insurance program which provides coverage for a portion of the producer’s crop insurance deductible. More details on the new commodity program options can be found here. Details on SCO can be found here and here.

One of the factors adding to the complexity of program decisions facing producers is that commodity program choice can impact eligibility for SCO coverage – specifically, farms enrolled in either ARC program option will not be eligible to use SCO. As we await program regulations from the Farm Service and Risk Management Agencies, producers are beginning to consider potential strategies and make comparisons among the new program options. Today’s posts focuses on the County ARC and SCO programs for corn acres in Illinois. An analysis of historical price and county yield data is performed to examine the likelihood of County ARC and SCO payments being triggered on corn acres in Illinois counties.

Historical Analysis

Illinois county yield data and national marketing year average prices for corn from 1972 through 2013 were collected from NASS. Corn futures price data was also used to collect base and harvest insurance prices over the same time period. This historical data was then used to put together an historical analysis of the county ARC and SCO programs from 1977 through 2013 (the 1972 to 1976 data was needed to develop county ARC revenue guarantees beginning in 1977).

For each year in the analysis, actual revenues or yields were compared to the respective program guarantees to determine if program payments would have been triggered. County ARC triggers payments if actual revenue (MYA price times county yield) falls below 86% of the benchmark revenue (based on previous 5 years of MYA prices and county yields). SCO triggers payments if actual revenue (harvest price times county yield) or yield falls below expected revenue or yield (based on county trend yields and base insurance prices).

The historical analysis was done under the following assumptions:

- The minimum corn price used in setting the ARC program benchmark price was $2.35 from 1972 through 2006, and $3.70 from 2007 through 2012. The $2.35 price represents the average MYA corn price from 1972 through 2006 and was also the price which would have triggered payments under the repealed counter-cyclical program.

- County trend yields used to determine expected yield or revenue for the SCO program were estimated using a simple linear trend regression over the 1972 to 2013 period.

Results and Discussion

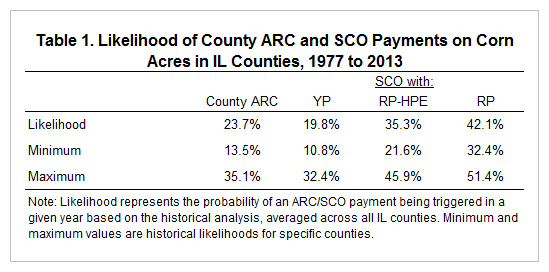

Table 1 below reports the likelihood of County ARC and SCO payments being triggered on corn acres over the historical period. The likelihoods reported are averages across all the estimated likelihoods for individual counties in Illinois. County ARC payments for corn would have been triggered roughly 1 out of every 4 years across counties in Illinois. The likelihood of SCO payments being triggered varies by the type of SCO coverage. When SCO is coupled with a yield protection policy (YP), payments were estimated to occur in 19.8% of years or roughly one out of every 5 years. The likelihood of SCO payments being triggered increases when coupled with revenue policies. SCO combined with revenue protection with the harvest price exclusion triggered payments across IL counties in 35.3% of the years included in the analysis. The average likelihood of SCO payments when combined with revenue protection increases to just over 42%.

Also reported in table 1 are the minimum and maximum likelihoods of program payments being triggered in Illinois counties. The likelihood of County ARC payments being triggered ranges from just 13.5% to over 24% of the years in the historical analysis. The range of likelihoods for SCO payments being triggered is also provided in table 1. SCO with YP triggered payments in as few as 10.8% to as many as 32.4% of the years included in the analysis. The likelihood of SCO payments when combined with RP ranges from 32.4% to over 50%.

The maps in figures 1 through 4 illustrate the county-level likelihoods of program payments being triggered, illustrating the variation in historical program performance across all Illinois counties. From figure 1, the greatest historical likelihood of County ARC payments being triggered is focused in some central and southern IL counties. Figure 2 shows that counties in southern IL had the greatest historical likelihood of having SCO payments triggered when combined with an YP policy. The likelihood of SCO payments being triggered when combined with RP-HPE and RP plans increases relative to SCO use with YP, and no general pattern emerges in terms of regions of IL where SCO payments may be more likely when coupled with revenue insurance. Comparing County ARC to SCO, ARC was estimated to have a greater likelihood of payments being triggered compared with SCO combined with yield insurance, but a lower likelihood of payments being triggered compared with SCO combined with an individual revenue plan.

Note that while SCO coverage does change with the level of coverage chosen for the individual insurance plan, the likelihood estimates reported in table 1 and illustrated in figures 1 to 4 do not change since the trigger remains at 86% of expected yield or revenue. Only the amount of coverage, or potential size of the SCO payment, would change at difference insurance plan coverage levels.

Conclusions

Based on historical price and yield data, the likelihood of County ARC program payments tends to exceed that of SCO payments when coupled with yield insurance. However, SCO payments when couple with revenue insurance have a greater historical likelihood of being triggered than the County ARC program. This provides some additional information for producers and landowners to consider when making choices among programs.

In Illinois, crop producers have strong preference for revenue insurance products at the higher end of the available coverage level range (see recent post here). If one assumes that farmers do not significantly alter their crop insurance choices, the analysis in this post shows that IL producers will need to compare the potentially lower likelihood of County ARC payments with the greater likelihood of SCO program payments when used with revenue insurance with the different premium costs associated with individual coverage alone versus individual coverage plus SCO.

Additional analysis will be performed as information becomes available regarding specific regulations about the programs from the Farm Service and Risk Management Agencies. The historical likelihood estimates provided in today’s post do not allow for comparisons between the timing and potential size of net program payments.

Future posts will continue to examine the historical analysis for individual counties to identify conditions under which each program option triggers payments. Premium rate information for the SCO program from RMA will be required for a more thorough comparison of the expected net benefits associated with the various available forms of supplemental coverage. Ultimately, producers will need to compare specific strategies which might involve the use of the combination of a commodity program with crop insurance of different types and coverage levels.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.