2014 Farm Bill Decisions: Payment Yield Update Option

The 2014 farm bill provides the owner of a Farm Service Agency (FSA) farm with a one-time option to update the farm’s payment yield for covered crops. This article will discuss this decision. It concludes by recommending that all producers consider updating yields if updated yields are higher than current yields; however, updated yields may be surprisingly low. For a broader policy discussion of the payment yield update option, see the April 3, 2014 farmdoc article by Nick Paulson, Jonathan Coppess and Todd Kuethe titled “2014 Farm Bill: Updating Payment Yields,” available here.

Decision Framework

- Decision rests with the owner of the FSA farm.

- Decision is on a covered crop-by-covered crop basis. Yields can be updated for one, some, or all covered crops on a FSA farm that were eligible for the direct payments under the 2008 Farm Bill, except for upland cotton.

- Choices are:

-

- retain 2013 counter-cyclical payment yield, or

- update payment yield to 90% of simple average of covered crop’s yield per planted acre on the FSA farm for each of the 2008 through 2012 crop years

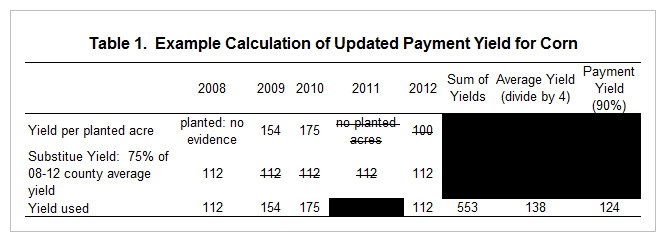

- A year is excluded from the calculation if no acres were planted to the covered crop.

- A “substitute yield” is used when the FSA farm yield for a year is less than 75% of its 2008-2012 average county yield. The substitute or minimum yield for an individual year is 75% of the 2008-2012 average county yield per planted acre. A file showing substitute yields for the payment yield update can be found here.

- The payment yield update decision is independent of the decision to reallocate base acres. Payment yield can be updated without reallocating base acres, and vice versa.

- If a payment yield does not exist for a covered crop for which base acres are allocated or for a covered crop planted on generic (former cotton) base acres, a payment yield will be established for the FSA farm by considering the crop’s payment yield on similarly situated FSA farms.

- Table 1 contains an example of a corn yield update scenario. It includes most of the above situations. Note the role of the substitute yield, planted-no evidence situation, and no planted acres situation.

Background on Current Counter-Cyclical Yields

Current counter-cyclical payment yields are either the payment yields in place at the end of the 1996 farm bill or updated yields to reflect 1998-2001 yields. The choice was given to farmers by the 2002 farm bill, but farmers were also required to update their farm’s base acres using 1998-2001 reported acres if they updated their counter-cyclical yields. Yields were updated on about 39% of base acres. The 1996 farm bill payment yields largely reflected 1981-1985 yields and were also the direct payment yields. The updated 1998-2001 payment yield could be based on two options with one being 93.5% of the crop’s 1998-2001 average yield per planted acre for the FSA farm. For an extensive discussion of this decision, see C. Edwin Young, David W. Skully, Paul C. Westcott, and Linwood Hoffman. “Economic Analysis of Base Acre and Payment Yield Designations Under the 2002 U.S. Farm Act.” Economic Research Report ERR-12. September 2005.

Comparisons of Relevant Yields

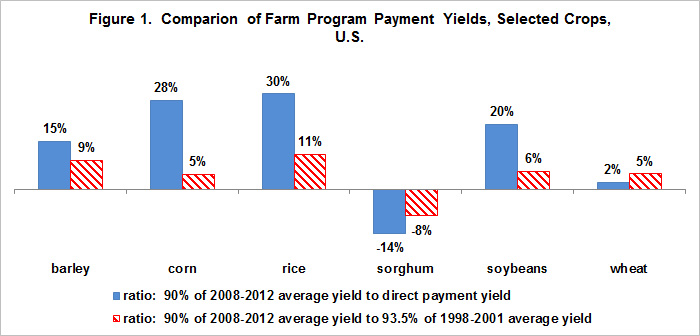

Figure 1 provides a national perspective on 2 important features of the yield update decision: (1) time dependency of the yield update option and (2) the value of being able to update on a crop-by-crop basis. The figure compares 90% of the 2008-2012 average U.S. yield per planted acre to average U.S. direct payment yield and 93.5% of the 1998-2001 average U.S. yield per planted acre. As expected, more recent yields are generally higher, but the magnitude varies by crop and sorghum is an exception. Thus, the yield update option likely varies by crop, which makes the crop-by-crop decision feature valuable. Also and again unsurprisingly, the option generally is more valuable if 2013 counter-cyclical yields are direct payment yields and not 1998-2001 yields. Thus, the value of the yield update option will vary by FSA farm.

Summary Observations

- Although payments yields will be used only for the Price Loss Coverage (PLC) program for 2014 through 2018 crops, all owners can update payment yields and are encouraged to take advantage of this option. These payment yields may be used by future farm bills.

- The decision appears to be straightforward: update yield if the updated yield exceeds the current counter-cyclical yield.

- However, producers may be surprised at how low their updated yield is. Primary reason is the widespread drought of 2012 and locale specific production problems in the other crop years in combination with using a simple as opposed to Olympic average (which removes high and low values). Furthermore, the exclusion of any year in which no acres were planted to the covered crop on a FSA farm means its updated yield may be based on as few as 1 year.

This publication is also available at http://aede.osu.edu/publications.

References

Paulson, N., J. Coppess, and T. Kuethe. "2014 Farm Bill: Updating Payment Yields." farmdoc daily (4):60, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 3, 2014.

Young, C. Edwin, David W. Skully, Paul C. Westcott, and Linwood Hoffman. "Economic Analysis of Base Acre and Payment Yield Designations Under the 2002 U.S. Farm Act." Economic Research Report No. (ERR-12) 46 pp, September 2005. http://www.ers.usda.gov/publications/err-economic-research-report/err12.aspx

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.