Evaluating the Actual Production History Yield Exclusion Provision of the 2014 Farm Bill

A recent hearing before the House Agriculture Committee and subsequent press reports have raised the profile of a crop insurance provision in the 2014 Farm Bill. That provision requires USDA to provide farmers the option to elect to exclude low yields in their actual production history (APH) in cases where a trigger based on the historic county yield average is met. Due to the central role that APH plays in maintaining the integrity of crop insurance, fundamental changes in its calculation raise significant questions about its impact.

Background

Section 11009 of the Crop Insurance title of the Agricultural Act of 2014 (the 2014 Farm Bill) amends the section in the Federal Crop Insurance Act (FCIA) that provides the Federal Crop Insurance Corporation (FCIC or Corporation) with the authority to calculate a producer’s APH for insurance coverage (7 U.S.C. 1508(g)(4)). APH is used to establish the producer’s insurable yields, making it a fundamental component to crop insurance and the Farm Bill adds a new authority for adjusting a producer’s APH. Due to the complex nature of this revision, the new provisions added by section 11009 of the 2014 Farm Bill are provided here in their entirety (emphasis added):

(C) Election to exclude certain history.–

- (i) In general.–Notwithstanding paragraph (2), with respect to 1 or more of the crop years used to establish the actual production history of an agricultural commodity of the producer,

- the producer may elect to exclude any recorded or appraised yield for any crop year in which the per planted acre yield of the agricultural commodity in the county of the producer was at least 50 percent below the simple average of the per planted acre yield of the agricultural commodity in the county during the previous 10 consecutive crop years. (emphasis added)

- (ii) Contiguous counties.–In any crop year that a producer in a county is eligible to make an election to exclude a yield under clause (i), a producer in a contiguous county is eligible to make such an election.

- (iii) Irrigation practice.–For purposes of determining whether the per planted acre yield of the agricultural commodity in the county of the producer was at least 50 percent below the simple average of the per planted acre yield of the agricultural commodity in the county during the previous 10 consecutive crop years, the Corporation shall make a separate determination for irrigated and non-irrigated acreage.

Equally or more important is the revision contained in section 11009 of the Farm Bill that includes this new exclusion in the existing requirement that FCIC adjust the premium of any producer electing to revise APH. This required adjustment in premium must “reflect the risk associated with the adjustment made in the actual production history of the producer.” (7 U.S.C. 1508(g)(4)(D)) (emphasis added). The statute requires FCIC to “fix adequate premiums for all plans of insurance . . . at such rates as the Board determines are actuarially sufficient to attain an expected loss ratio of not greater than . . . 1.0.” (7 U.S.C. 1508(d)(1)). Generally, this requirement is understood as requiring FCIC to run the crop insurance program on an actuarially sound basis such that for every dollar paid out in indemnities for losses, the FCIC takes in a dollar in premium (including the government-paid premium assistance and a reasonable reserve to cover losses).

Notably, Section 11009 was not contained in either version of the 2014 Farm Bill as debated and passed in the House and Senate. Instead, the provision was added during conference negotiations. USDA noted in the hearing that it hadn’t anticipated this change and was surprised by its inclusion. Both the legislative history and USDA comments suggest that this provision was a late revision with minimal opportunity for feedback from, and analysis by, those within the crop insurance program.

Discussion

Revising the calculation of APH raises significant questions about the impact it will have both on the rating for, and premium paid by producers who exclude yields, as well as the crop insurance system as a whole. In essence, the idea is to exclude the consequences of a really bad outcome on the producer’s APH in cases when the area in which the producer insures is also subject to worse than typical yield outcomes. The argument advanced is that low area yields somehow signal that producer risks are not typical and should be excluded from the calculation of the producer’s APH. It has been cast by others as analogous to calculating the costs of car insurance, but allowing the option to exclude any collisions that were the result of winter weather when considering premiums as those are “not the driver’s fault.”

As an initial matter, one aspect that the Farm Bill amendment makes absolutely clear is that there is no discretion on the part of FCIC when it comes to the premium charged for any producer availing themselves of this exclusion: it must be adjusted to reflect the risk associated with the adjustment. In other words, if dropping a bad year from the APH changes the risk associated with insuring the producer, which it is presumed to do, then the producer must pay for that change in the premium. FCIC has no discretion on whether to make the adjustment to the producer’s premium. An important discretionary issue for FCIC will be how to make the adjustment and what premium to charge any producer making this election. It is also a question for FCIC as to how they will rate premiums charged to other producers in the county (and any contiguous county) where the option to exclude years is available. For example, is there a point where enough producers elect to exclude yields in a county that it impacts the premiums for all producers in that county, including those that do not elect to exclude yields?

While concerns have been raised that USDA is not moving fast enough to implement this change, a series of questions surrounding this provision highlights both the complexity of the change as well as the need for caution in its implementation. As a partial listing, the following are some initial questions that RMA would need to address during the implementation of this revision.

- How to define contiguous counties: in particular, which counties constitute contiguity in this situation? For example, are two counties contiguous if only joined at corners, or if sharing a border through a body of water, or sharing borders but not CRD status; or if a contiguous county does not have suitable data for calculation of its own rolling average, etc.? There are few precedents for using other counties’ data in crop insurance. Loss costs are first calculated within county, while other features of crop insurance are also calibrated within crop-county first. It could be the case that a contiguous county allows exclusion, but the county in which the producer resides has experienced higher than typical yields –excluding one of which would still increase the producer’s APH. There is not an associated producer eligibility test beyond the county performance over a 10-year history that itself may not represent current acreage or practice conditions in that county.

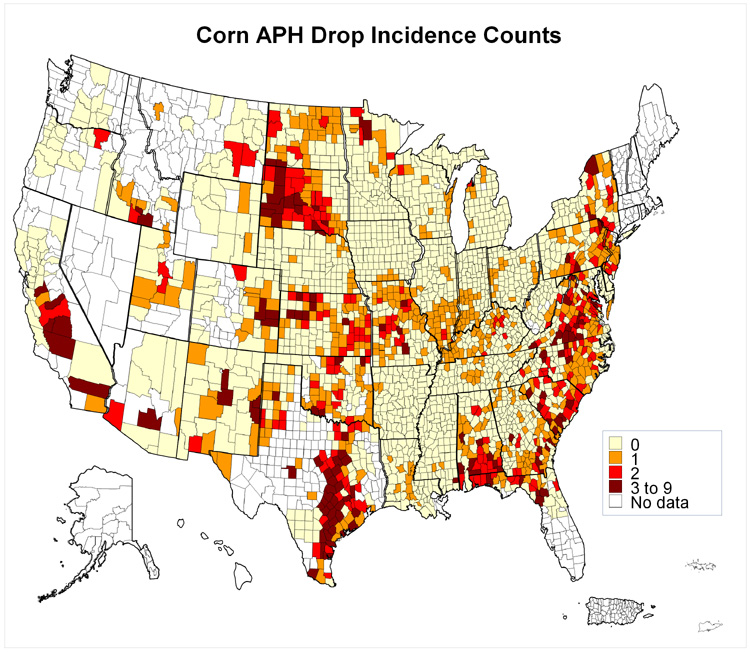

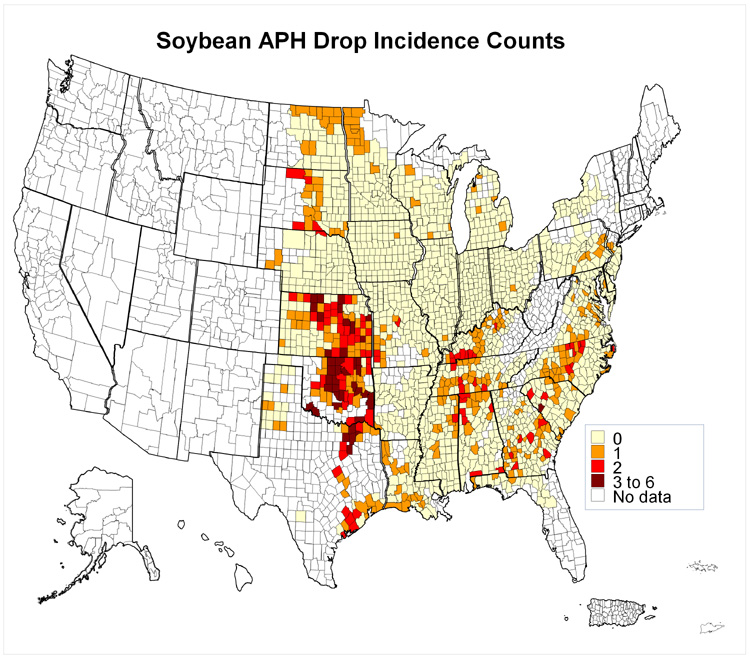

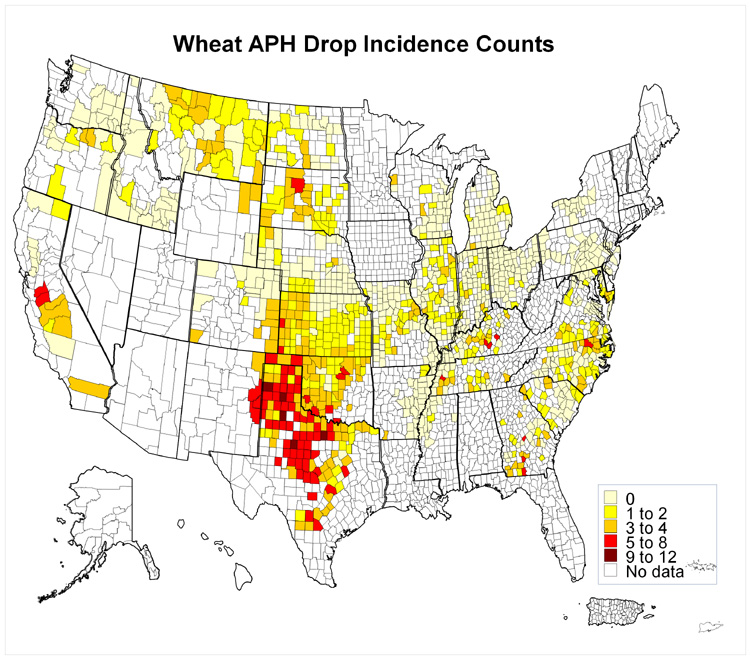

- Will there be a limit on the number of yields that a producer can elect to drop? Simple tabulations of the frequency since 1995 that NASS-based data indicate potential eligibility to drop years result in the potential to seriously limit usage of historic data in some areas. The figures below for corn, soybeans, and winter wheat demonstrate the general concentration and ranges of times that county yields are below 50% of the preceding 10-year rolling averages. To construct these, a county had to have a yield, but its average could be missing a year or two and be filled in with its CRD yield. RMA could choose other approaches, but this seems to be a reasonable first approximation.

- Once a yield is excluded, can it be re-included in the producer’s APH in future years if later found to be advantageous, and, if so, are there any limitations on that re-inclusion? It could be the case that the excluded yield is later found to be higher than a subsequent yield, or be needed to meet other eligibility requirements for other programs or yield calculations.

- Will there be any secondary requirements on the producer’s yields to qualify for the election to exclude, or any differential treatment for those producers in a county where an election is permitted but the producer’s yield was higher than typical for that producer?

- Similarly, will there be any further qualifications or differentiation for counties that were just barely below 50 percent of the 10 year simple average as compared to those counties that are substantially below? For example, should counties with a year’s yield that is much nearer to zero be treated differently that those with yields at 49 percent? One option would be to have that difference calculated in the premium through something like a severity test. This feature could be important because of the definitional use of “per planted acre” and the use of NASS data to make the determination. Because NASS can and often does adjust yields after the fact, a related question is what would happen when NASS subsequently adjusts the yields later and the county no longer qualifies under the 50 percent standard (or vice versa)?

- Because a 10-year simple average of county yields is not the same as a trend, how will FCIC treat counties where the most recent 5 years have been extremely high compared to the 10 year average, or vice versa where the first 5 years were significantly higher than the last 5 years. In other words is there any differentiation based on when the yields were high or low, as this will also influence how long and how likely it could be for the county to meet its eligibility again? If, for example, a county has a lower than typical ten year average, it is more difficult to meet the test case in the future than if its recent average is high. Substantial changes in practices (such as changes in acres, irrigation, etc.) can significantly impact county yields, yet provide no improvement in the estimation of the severity of the yield deviation.

- How will FCIC treat counties with insufficient data or with too few producers in the county growing the crop such that their yields effectively determine the county’s yields?

- Presumably the requirement that this exclusion is reflected in the premium adjustment implies that the excluded year’s yields will remain in the rate yield but only be dropped from the APH yield, thereby requiring the consideration of rate adjustments for consistency with implied coverage under the rate yield.

- In cases in which current authority provides the producer with an option to use a plug or substitute yield, how will this exclusion work with other elements of the rating system?

- Are there regional differences in the operation of this provision, particularly taking into account different sales closing dates (especially relevant in regions where final NASS yields are not typically reported for previous years until after sales closing dates)?

- How will FCIC treat years or producers that are missing data within the 10 consecutive crop years, as well as other anomalies or incongruence between the county and producer data?

- How far back does this provision go and how many years does NASS or FCIC have to calculate a rolling average? For example, some producers under rotations can use 30 year histories in their APH databases to accumulate 10 crop years.

A final, fundamental question with this change is the impact it could have on producers across the country and the crop insurance system as a whole. It has been suggested that this should be an easy thing for RMA to implement, but the questions and issues raised above would seem to indicate that it is not at all straight forward, and could have important impacts back to the ratings system. In fact, this appears to be a very complicated change to some basic functions of crop insurance that would appear to require caution and care in its implementation.

Conclusion

The 2014 Farm Bill appears to make a substantial change to the crop insurance program through an amendment that permits farmers to elect to exclude yields from their APH if they are in a county (or contiguous to a county) where the county’s average yield is below 50 percent of the average county yields for the previous 10 consecutive crop years. The provision raises many questions about how it will operate and what impact it will have on producers who elect to drop a yield. It also raises questions about the impact this change could have on producers in the county where such an election can occur and for the actuarial soundness of the crop insurance system as a whole. These are not insignificant questions considering how many producers rely on crop insurance as the cornerstone of the farm safety net. At the very least, FCIC must adjust the premiums paid by producers making this election to reflect the increased risks associated with the change, but many other questions remain. Future articles will explore further some of the impacts this change might have as well as other issues raised by further analysis of the provision.

References

Gonzalez, S. "USDA implementation of crop insurance programs questioned." Agri-Pulse Communications, July 11, 2014. Accessed on September 5, 2014: http://www.agri-pulse.com/USDA-implementation-crop-insurance-programs-questioned-7102014.asp

Tomson, B. "House lawmakers rip USDA on farm bill progress." POLITICO website, July 11, 2014. Accessed on September 5, 2014: http://dyn.politico.com/printstory.cfm?uuid=66E27AD0-CE5D-4277-8F73-1B609C37EB97

Agricultural Adjustment Act of 1938 & Federal Crop Insurance Act. As Amended Through P.L. 113-79, Enacted February 7, 2014. Accessed on September 5, 2014: http://www.ag.senate.gov/download/federal-crop-insurance-act

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.