Owning Corn and Soybeans beyond Harvest in 2014/15

Corn and soybean prices have declined sharply in recent months based on prospects of very large U.S. crops and increasing year-ending stocks. Prices have declined faster and to lower levels than generally expected and are now near the lows experienced since the recent price boom started in 2007. As a result, many producers have judged current prices to be “too low” and will choose to own some of their production beyond harvest. The purpose of this article is not to determine if ownership should be retained, but to explore the expected cost of retaining ownership in various forms. The goal of producers will be to select the lowest cost form of ownership that is available. The magnitude of those costs, however, does provide some guidance on the magnitude of price increases needed to make ownership profitable.

We begin with a discussion of the various ways that producers can own corn and soybeans, in the sense of being exposed to movements in cash and/or futures prices. Here we consider three alternatives: on-farm storage, off-farm storage, and replacing harvest cash sales with a long futures position. The expected cost of maintaining a long position in the corn and soybean markets after harvest will vary depending on the form of ownership selected.

While not considered here, ownership of crops beyond harvest can be retained by other methods that would have similar outcomes to off-farm storage or ownership of futures. For example, ownership could be retained through the use of delayed pricing contracts as an alternative to off-farm storage. A delayed price contract allows for delivery of the crops at harvest time (and relinquishing ownership of the crops) with pricing to occur later based on the cash price at the time of pricing. We recently surveyed a small sample of grain elevators in central Illinois, and these surveys revealed that service charges associated with delayed pricing at harvest this year are very similar to storage charges.

Ownership could also be retained through the use of basis contracts rather than direct ownership of futures. A basis contract allows for delivery of the crops at harvest, with basis fixed at the current level and pricing to occur later based on the price of a specified futures contract. The cost is essentially the same as owning futures directly since the outcome depends on the direction and magnitude of change in futures prices. Basis contracts have the advantage of no exposure to margin calls and also typically allow the producer to receive some portion of the cash price at the time of delivery. Finally, owning call options rather than futures/basis contracts would be a way to limit downside price risk. Those options, however, are rather expensive. At-the-money March 2015 call options are currently priced at about $.20 for corn and $0.46 for soybeans. Additional option strategies are possible that use a combination of calls and puts in an effort to hold down these costs.

For corn, short term on-farm storage costs occur in several categories. We base our estimates on research at Kansas State University and Iowa State University. These include: the cost of drying corn to a lower moisture content than would be required for immediate sale, shrinkage associated with additional drying and with storage, additional handling of the crop, maintaining the quality of the crop during storage, and interest on the value of the stored crop. Long term on-farm storage costs also include the investment costs associated with construction of the facilities. Here, only the variable costs associated with using existing facilities are considered. Off-farm storage costs consist of the drying and shrinkage charges for drying corn to lower moisture content than would be required for immediate sale, direct storage charges, and interest on the value of the stored crop. On- and off-farm storage cost items are similar for soybeans, except that drying to lower moisture content for storage rather than immediate sale is typically not required for soybeans. For both crops, the cost of owning futures contracts consists of a small commission fee for trading futures and the potential basis appreciation that is foregone by having ownership in the futures rather than cash market.

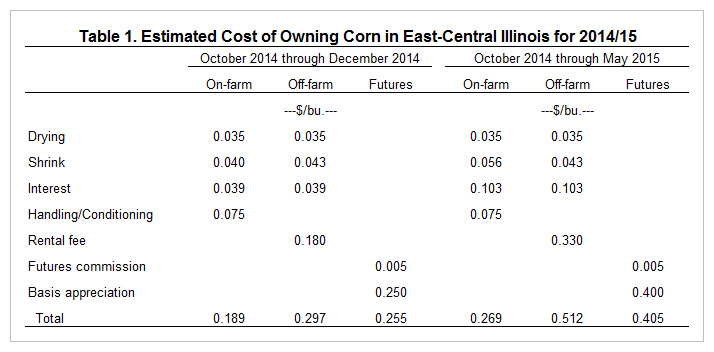

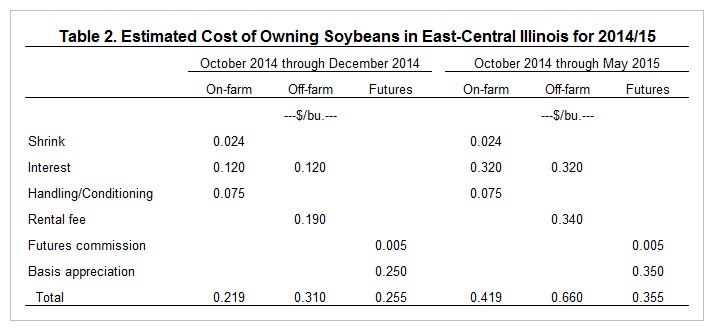

Expected costs of owning corn and soybeans can vary substantially from area-to-area and from farm-to-farm within an area. The relative magnitude of potential ownership costs for corn and soybeans for the three alternative forms of ownership are illustrated in Tables 1 and 2 for conditions that might be typical in east-central Illinois this year. Estimated costs are presented for two different storage horizons-from harvest (October 1) through the end of the calendar year and from harvest through May 2015. These cost estimates are based on the following conditions/assumptions:

- The harvest delivery prices are $3.10 for corn and $9.60 for soybeans,

- Corn sold at harvest is dried and shrunk to 15 percent moisture while stored corn is dried and shrunk to 14 percent moisture,

- The cost of drying corn is $.035 per point of moisture removed for both on- and off-farm storage,

- Shrink of 1.0 percent plus 0.1 percent/month occurs for corn stored on the farm,

- Shrink is 1.4 percent per point of moisture removed for off-farm storage,

- Total shrink of 0.25 percent occurs for soybeans stored on the farm,

- Interest on the value of the stored crop is charged at 5 percent per year,

- The corn basis appreciates by $0.20 by the end of December (relative to March 2015 futures) and $0.40 by the end of May 2015 (relative to July 2015 futures),

- The soybean basis appreciates by $0.20 and $0.35, respectively, and

- Off-farm storage costs, based on a recent survey of central Illinois elevators, consist of a minimum fee of $0.18 for corn and $0.19 for soybeans and $0.03 per month after December 31.

The most cost uncertainty centers on potential basis appreciation from harvest forward. Basis patterns have been extremely erratic in the previous five years as supply, demand, and prices have varied considerably. The basis appreciation assumed here reflects expectations for basis at the end of December 2014 and May 2015 to be typical of basis in previous crop years when crops were in a modest surplus. In addition, it is a little confusing to compare physical storage costs to the cost of foregone basis appreciation from owning futures. One way to think of the comparison is that with physical storage, the producer gains the basis appreciation but incurs significant costs. Conversely, physical storage costs are avoided by owning futures at the sacrifice of basis appreciation. The question, then, which are larger, storage costs or basis appreciation?

The cost estimates summarized in Tables 1 and 2 indicate that owning corn and soybeans beyond harvest this year will not be inexpensive and that the cost of retaining ownership could vary considerably by form of ownership. Short term costs for corn, for example, range from $0.19 per bushel to almost $0.30 per bushel. Long-term costs for soybeans range from $.355 to $.66 per bushel. Not surprisingly, the use of existing on-farm storage facilities is likely to have the lowest cost for short-term ownership of both crops, but by a relatively small margin. On-farm storage is the lowest cost form of ownership by a much wider margin in the longer-term – $.24 cheaper than off-farm storage. Based on the expectations for basis appreciation used here, the lowest cost form of long-term ownership for soybeans is with futures–$.31 cheaper than off-farm storage. Off-farm storage appears likely to be the most expensive form of ownership for both crops for both time horizons. Again, those costs are elevated for the longer-term horizon due to the accumulated interest opportunity costs. For producers without operating loans, the opportunity interest cost might be less than estimated here, making off-farm storage more competitive with owning futures.

Implications

With the recent sharp downtrend in corn and soybean prices and profits, there is a renewed interest in the cost side of the ledger. We focus here on the cost of owning corn and soybeans beyond harvest in east-central Illinois and find that ownership this year will not be inexpensive regardless of the form taken. The results of the analysis indicate that the lowest cost will be for on-farm storage in both the short-term and longer-term for corn and for soybeans in the short-term. These results are not surprising. However, for longer-term ownership of soybeans, replacing cash sales at harvest with futures ownership appears to be the lowest cost of ownership. This result is likely to be surprising to many producers. While ownership “on paper” in the futures markets is widely considered to be a highly speculative strategy, if a producer has already decided to own soybeans beyond the end of 2014 it is actually a reasonable alternative. Note that our results cannot be generalized to all areas and all farms, but the analysis does provide a framework for identifying the lowest cost form of ownership.

The analysis also does not answer the bigger question of whether ownership should be retained after harvest. Some will appropriately point out that in the example presented here, the expected basis appreciation for corn in both the short- and longer-term and for soybeans in the short-term exceeds the estimated on-farm cost of storage. That price structure suggests that if on-farm storage is available, corn in particular could be stored and forward priced (hedged) to generate a positive storage return.

References

Dhuyvetter, K.C., J.P. Harner, III, J. Tajchman, and T.L. Kastens. "The Economics of On-Farm Storage." MF-2474 (Revised), Kansas State University Agricultural Experiment Station and Cooperative Extension Service, September 2007. Accessed September 17, 2014: http://www.ksre.ksu.edu/bookstore/pubs/MF2474.pdf.

Edwards, W. "Grain Storage Alternatives: An Economic Comparison." FM-1879 Revised, Iowa State University Extension and Outreach, October 2013. Accessed September 17, 2014: http://www.extension.iastate.edu/agdm/crops/pdf/a2-35.pdf.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.