Riding the Feeder Cattle Roller Coaster

Futures prices were limit-down for 5 days in a row in mid-December 2014, the most limit-move days in a livestock contract since the BSE (mad cow) selloff in December 2003. Daily price limits in feeder cattle futures were increased from 3 cents per pound ($3/cwt) to 4½ cents per pound ($4.50/cwt), with provisions for additional expansions if needed; complete details are presented here.

For the 22 trading days in December 2014, the January 2015 feeder cattle futures contract had 10 days with price moves up or down of 3 cents per pound or more. And on the first trading day of January 2015, prices closed limit-up at the new 4½ cent daily limit, starting out the New Year with a bang (Figure 1). In contrast, February 2015 live cattle futures have had just 2 limit days (both down) since December 1, and February 2015 hog futures have had none.

So why have feeder cattle prices been so volatile lately? It helps to think about feeder cattle prices as the “shock absorber” between fed cattle prices on one end, and corn prices on the other. When buying feeder cattle, feedlots look at the gross feeding margin, which is the difference between the amount received when fed cattle are marketed and the amounts paid for corn and feeder cattle, the two major inputs.

Cattle feeders have little direct influence over fed cattle prices and corn prices, but feeder cattle prices are different. If the gross feeding margin is positive, feedlots have room to bid up feeder cattle prices; if the margin is negative, feedlots eventually back away, which puts downward pressure on feeder cattle prices. A concise overview of cattle feeding margins with detailed examples is available here and the importance of feeding margins was highlighted in an earlier farmdoc daily article (farmdoc daily, September 12, 2014).

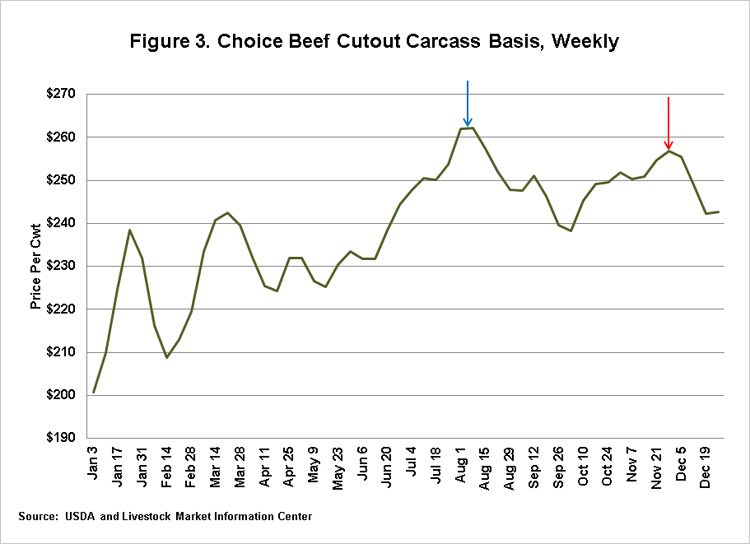

With this in mind, let’s look at what has been happening to fed cattle and corn prices. Fed cattle prices climbed to record levels in 2014 (Figure 2), due to tight supplies of beef and strong demand from domestic and overseas consumers. However, beef prices stalled at the beginning of December (Figure 3), leading to the downturn in fed cattle prices shown by the red arrow in Figure 2, and the selloff in feeder cattle futures in Figure 1.

In contrast, beef prices fell nearly twice as much in August and September 2014 (blue arrow in Figure 3) as in December 2014 (red arrow in Figure 3), and lower beef prices dragged down fed cattle prices, but it caused only a blip in feeder cattle prices. What made December different?

The answer is corn prices, which dropped 50 cents per bushel or more between early August and the mid-September harvest lows. Those lower corn prices offset the effects of lower fed cattle prices in the gross feeding margin calculation, so that feeder cattle prices remained firm. It was a much different story in mid-December. Corn prices were $1.00 per bushel higher than the harvest lows and had been putting pressure on feeder cattle prices. When beef and fed cattle prices weakened, feeder cattle prices had nowhere to go but down.

Feeder cattle futures have since recovered about one-half of the mid-December losses, and the question on many minds is, “Where do we go from here?” The events of the past month are a useful lesson to buyers and sellers of feeder cattle. While it’s tempting to watch just fed cattle prices or just corn prices, it’s important to keep an eye on both markets – or better yet, on gross feeding margins – to gauge the future direction of feeder cattle prices.

References

CME Group. "An Introduction to Cattle Feeding Spreads", released January 2014, accessed January 9, 2015. http://www.cmegroup.com/trading/agricultural/files/AC-378_CattleFeedingWhitePaper_r2.pdf

CME Group. "Increased Daily Price Limits for Feeder Cattle Futures and Expansion Capability of Daily Price Limits for Feeder Cattle Futures and Live Cattle Futures." Special Executive Report S-7266, released December 17, 2014, accessed January 9, 2015. http://www.cmegroup.com/tools-information/lookups/advisories/market-regulation/files/SER-7266.pdf

Peterson, P. "Cattle at the Crossroads." farmdoc daily (4):175, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 12, 2014.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.