Changes in Working Capital

An earlier article reviewed liquidity measures (farmdoc daily, March 20, 2015). This article reviews working capital and the current ratio over a relatively short time period for a group of Illinois grain farms. Of interest is that this group of grain farms is divided into age groups which allow a look at the source of the changes in working capital as it differs by age group. The number of observations from this group of grain farms in each year is: 2009 – 2,382; 2010 – 2,383; 2011 – 2,400; 2012 – 2,421 and 2013 – 2,398

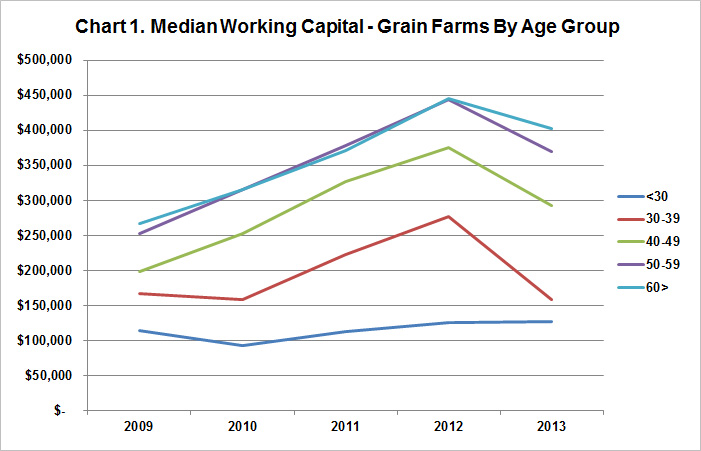

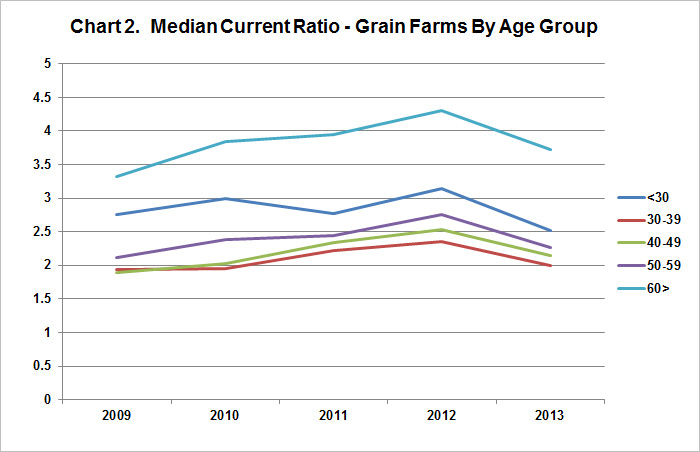

But first a bit of review is in order. The Farm Financial Standards Council definition of working capital is that it is ‘a theoretical measure of the amount of funds available to purchase inputs and inventory items after the sale of current farm assets and payment of all current farm liabilities. The amount of working capital considered adequate must be related to the size of the farm business.’ Since it is a measure at a point in time it does not recognize that current farm assets are liquidated over a period of time and that all current farm liabilities are due over a similar period. By common convention, current farm assets and current farm liabilities are based on a one-year time horizon. The measure is a dollar amount and is difficult to compare across farm businesses. The data shown in the two charts in this article represent the median working capital and the median current ratio as an average can be skewed by observations with no current liabilities.

The observable trends from Chart 1 reveal that the median working capital tends to increase as the farm operator’s age increases. There appears to be only minor differences between the 50-59 age group and the over age 60 group. These two upper age groups have presumably had a longer career in farming and have the capacity to generate greater earnings and presumably have retired a greater amount of debt over their careers. The under age 30 group shows the least level of working capital. This group also shows a steadier level of working capital over the period shown as compared to the other age groups. With the exception of the under age 30 group, all age ranges show an increasing level of working capital from 2009 to 2012. Again, with the exception of the under age 30 group, all groups show a decrease in working capital from 2012 to 2013 with this one-year decrease more apparent in the 30-39 age group.

The Farm Financial Standards Council interpretation of the current ratio is that it ‘indicates the extent to which current farm assets, if liquidated, would cover current farm liabilities.’ The current ratio like working capital is measured at a point in time and does not recognize that current farm assets are liquidated over a period of time and that all current farm liabilities are due over a similar period. By common convention, current farm assets and current farm liabilities are based on a one-year time horizon. The measure is a ratio and is comparable across farm businesses but will vary with the type of farm business – ie, grain, dairy, beef, and hog.

Chart 2 reveals that the over age 60 group has a median current ratio that is consistently at a higher level than the other age groups over the period. The remaining four age groups are consistent over the period but at a lower level. Remember that businesses with limited current assets and limited current liabilities can have a strong current ratio but will have limited amounts of liquidity. This could very well be the case with the four lower age groups.

Summary

Financial liquidity and measures of financial liquidity will be ‘front and center’ for the near future as we navigate our way through lower levels of farm earnings. And to put things in perspective – all things in life are temporary…if they are going well, enjoy them, they will not last forever…if they are not going well, plan accordingly…those times will not last forever either.

The authors would like to acknowledge that data used in this study comes from the local Farm Business Farm Management (FBFM) Associations across the State of Illinois. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,700 plus farmers and 60 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel with computerized recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office located at the University of Illinois Department of Agricultural and Consumer Economics at 217-333-5511 or visit the FBFM website at www.fbfm.org.

References

Raab, D., B. Zwilling, and B. Krapf. "A Different Way to Evaluate Profitability." farmdoc daily (5):52, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 20, 2015.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.