How Will Family Living Affect My 2017 Budgets?

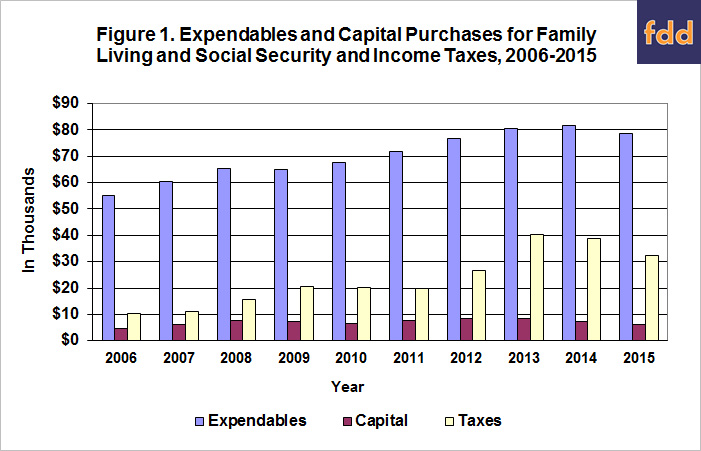

In 2015, the total noncapital living expenses of 1,377 farm families enrolled in the Illinois Farm Business Farm Management Association (FBFM) averaged $78,538–or $6,545 a month for each family. This average was 3.9 percent lower than in 2014. Another $6,241 was used to buy capital items such as the personal share of the family automobile, furniture, and household equipment. Thus, the grand total for living expenses averaged $84,779 for 2015 compared with $88,936 for 2014, or a $3,173 decrease per family.

Income and social security tax payments decreased about 16.4 percent in 2015 compared to the year before. The amount of income taxes paid in 2015 averaged $32,438 compared to $38,801 in 2014. Net nonfarm income continued to increase, averaging $40,662 in 2015. Net nonfarm income has increased $11,048, or 37 percent in the last ten years.

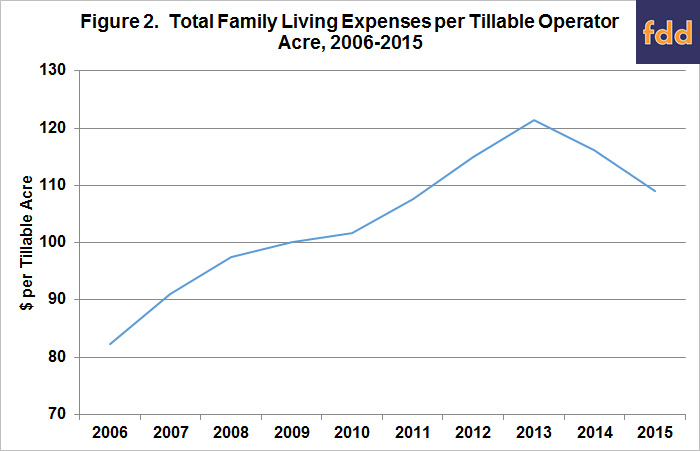

In Figure 2, total family living expenses (expendables plus capital) are divided by tillable operator acres for 2006 to 2015. In 2006, all of the family living costs per acre averaged about $82 per acre. This increased to $109 per acre in 2015. The 10-year average is $104 of total family living expense per acre. If we compare this to the 10-year average of net farm income per acre of $197, then 55% of the net farm income per acre is family living expense. If we look at the average year over year increase for the last ten years for family living per acre, the annual increase was 2.8% per year. The five-year annual increase per year would average 1.6%. Therefore, as you work on your crop budgets, keep in mind that 55 cents on 200 bushels per acre corn is about equal to the average total family living expense per acre.

When you take total family living expenses minus net nonfarm income this equals $57 per acre in 2015 and was $63 per acre for the five-year average. This would be the part of family living that is covered by the farm income. In addition, there is another $42 per acre in social security and income taxes to be covered by the farm in 2015. The five-year average for these taxes was $42 per acre. 29 cents on 200 bushels of corn per acre is equal to the 2015 family living cost that would be covered by the farm. Another 21 cents on 200 bushel corn per acres is equal to the 2015 social security and income taxes.

More information about Farm and Family Living Income and Expenditures can be found here.

The author would like to acknowledge that data used in this study comes from the local Farm Business Farm Management (FBFM) Associations across the State of Illinois. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,600 plus farmers and 60 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM field staff provide on-farm counsel with computerized recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office located at the University of Illinois Department of Agricultural and Consumer Economics at 217-333-5511 or visit the FBFM website at www.fbfm.org.

References

Krapf, B., D. Raab, and B. Zwilling. "Farm and Family Living Income and Expenditures, 2012 through 2015." llinois FBFM Association and Department of Agricultural and Consumer Economics, University of Illinois, October 2016.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.