Where Is Your Net Worth?

Net Worth is measured as all assets less all liabilities. If you consider that your liabilities are claims on your assets by your lenders, then you can consider the liabilities are the part of your business that your lenders own. With that in mind, your net worth is the part of your business that you own.

There is much published about the current ratio and working capital. These two measures are indications of the amount of liquid cash (or near cash) available for use. The current ratio is calculated as current assets divided by current liabilities while working capital is current assets minus current liabilities. This work takes an additional step and examines three components of net worth from a group of farms that are members of the Illinois FBFM. This gives an idea of the source of net worth on the balance sheet. This balance sheet data is measured at fair market value and spans a 14 year period from 2002 to 2015. All farm types are included: grain, beef, dairy, hog.

The ‘current’ part of net worth is working capital (current assets minus current liabilities). There is an intermediate (intermediate assets minus intermediate liabilities) and a long term part (long term assets minus long term liabilities) of net worth as well. The work in this article considers these three components and how they have changed over time. This gives perspective on past economic times as we look to the financial management of our balance sheets in the future.

The three components of net worth as percentages are relative to each other and total 100%. Since they total 100% and are relative, if one component increases then one of the other components (or both) must decrease.

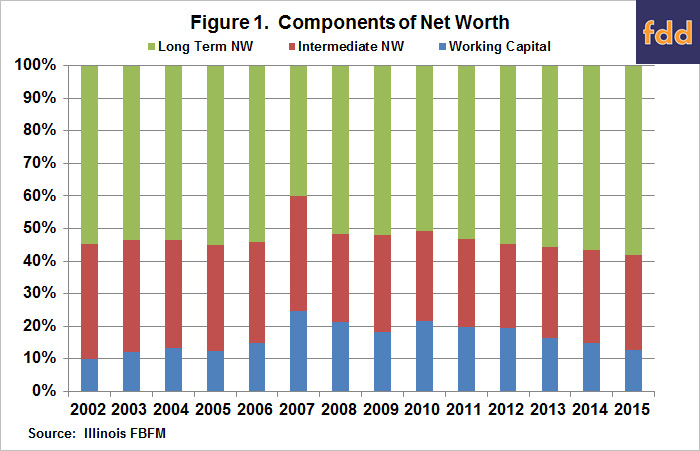

Figure 1 shows a chart that presents this information for each year and also the changes in these three components over time.

Working capital as a percent of total net worth ranges from a high of 25% in 2007 to a low of 10% in 2002. The high in 2007 coincides with an increase in grain prices that resulted from the ethanol mandate put in place in 2005 and then expanded in 2007. A great deal of the current assets on balance sheets comes from crop inventories. Any crop in inventory at the end of the year is valued at current prices. Thus, changes in commodity prices affect current assets and in turn working capital. Fluctuations in operating notes and accounts payable also impact working capital.

Intermediate term net worth as a percent of total net worth ranges from a high of 35% in 2002 and 2007 to a low of 26% in 2012. Intermediate asset values are most affected by machinery values and livestock values. Increases or decreases in the amount of intermediate term borrowing impact intermediate term net worth.

Long term net worth as a percent of total net worth ranges from a high of 58% at the present in 2015 to a low of 40% in 2007. With the exception of 2007, the long term component of net worth is above 50% for all years in this data. Land values have been remarkably strong and steady which bolster the percentage of total net worth that traces to long term net worth. The amount of long term debt influences long term net worth as well. Long term debt has increased over the period but land values have increased at a more rapid rate.

The authors would like to acknowledge that data used in this study comes from the local Farm Business Farm Management (FBFM) Associations across the State of Illinois. Without their cooperation, information as comprehensive and accurate as this would not be available for educational purposes. FBFM, which consists of 5,700 plus farmers and 60 professional field staff, is a not-for-profit organization available to all farm operators in Illinois. FBFM staff provide counsel along with recordkeeping, farm financial management, business entity planning and income tax management. For more information, please contact the State FBFM Office located at the University of Illinois Department of Agricultural and Consumer Economics at 217.333.5511 or visit the FBFM website at www.fbfm.org.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.