A Reminder on NAFTA and Agriculture

Recent news from the Trump Administration has sowed confusion about the President’s intentions with respect to the North American Free Trade Agreement (NAFTA) (see e.g., Appelbaum and Thrush). Early this week, President Trump suggested that the United States would pull out of NAFTA. Later in the week, he said the US will stay in NAFTA, but that the agreement would be reopened for renegotiations (see e.g., Landler and Appelbaum). NAFTA is a trade agreement between the Canada, Mexico, and the United States and was put in place in 1994 (see e.g., USTR). For Midwest farmers, renegotiating NAFTA is a concern because Canada and Mexico import significant amounts of corn and soybeans.

Imports of Corn and Soybeans by Canada and Mexico

Imports of corn by Canada and Mexico have increased since 1994 when NAFTA was passed. In 1991 to 1993, Canada imported 38 million bushels of corn. Canada’s corn imports have varied over time but have generally grown (see Figure 1). The highest quantity of corn imports, 155 million bushels, occurred in 2001 and 2002. From 2014 to 2016, Canada imported an average of 47 million bushels per year.

Mexico is a substantially larger market for corn than Canada. From 1991 to 1993, Mexico imported 67 million bushels of corn. Similar to Canada, Mexico’s imports of corn increased after 1994 (see Figure 1). From 2014 to 2016, Mexico imported an average 513 million bushels of corn per year.

Not all of these imports of corn by Canada and Mexico came from the U.S., but it is safe to assume that a large portion of the imports did. From 2014 to 2016, the U.S. produced an annual average of 14,322 million bushel of corn. Exports were 1,996 million bushels, or 14% of total production. Together Canada and Mexico’s imports of 560 million bushels constitutes 28% of total US corn exports. Reduction of these imports would have a disproportionately large impact on corn prices, as the relationship between demand quantities and prices are inelastic: a percentage quantity change results in a larger percentage change in price.

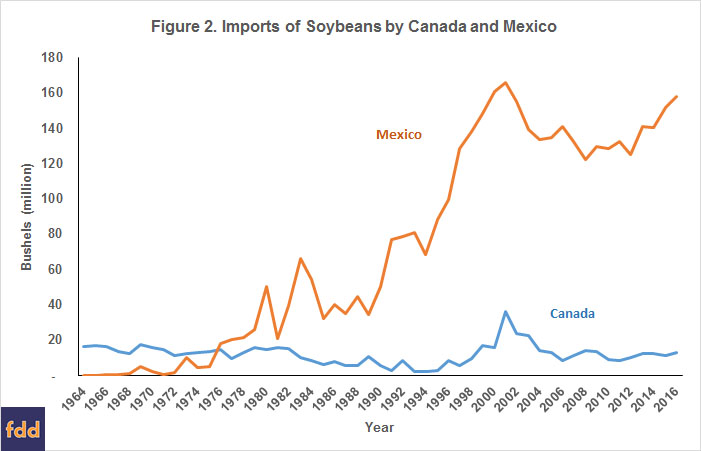

Similar to corn, soybean imports into Canada and Mexico have substantially increased since the passage of NAFTA in 1994 (see Figure 2). From 1991 to 1993, soybean imports into Canada averaged 4 million bushels, growing to 12 million bushels on average in 2014-2016. Soybean imports into Mexico grew from an average of 79 million bushels per year from 1991 to 1993, to 150 million bushels per year from 2014 to 2016.

Soybean production in the U.S. averaged 4,053 million bushels from 2014 to 2016. For the same time period, exports averaged 1,931 million bushels of soybeans representing 48% of production. If trends continue, over 50% of the soybean crop produced in the Unites States will be exported in the near future. Taken together, Canada and Mexico’s soybean imports of 162 million bushels represent 8% of the exports from the U.S. Similar to corn, a reduction in soybean exports would result in a large change in soybean prices.

Commentary and Summary

Exports are important sources of use of corn and soybeans, and particularly so for soybeans. Mexico and Canada are important customers of U.S. products. Potential disruptions in the movements of grains could have negative impacts on prices.

The importance of export to domestic agriculture is likely to grow in the future. Technological changes will continue to occur in the United States, leading to higher yields and more corn and soybean supply. At this point, one of the areas of continued growth in use of U.S. corn and soybeans is likely to be exports. If exports do not grow, negative impacts can be anticipated for corn and soybean prices.

Being a reliable supplier is an important characteristic of agricultural exporters. If an exporter is not viewed as reliable, other countries may look elsewhere for grain supplies. Some reactions along these lines have taken place because of trade discussions coming from the U.S. Early in 2017. For example, Mexico has threatened to place a tax on U.S. corn imports in response to the President’s comments about NAFTA and has also begun to buy corn from Argentina and Brazil (see e.g., Rapoza). Whether these efforts have long term negative impacts on U.S. agricultural trade remains to be seen.

References

Appelbaum, Binyamin, and Glenn Thrush. "Trump's Day of Hardball and Confusion on Nafta." The New York Times, April 27, 2017. https://nyti.ms/2pphZ7p

Landler, Mark, and Binyamin Appelbaum. "Trump Tells Foreign Leaders That Nafta Can Stay for Now." The New York Times, April 26, 2017. https://www.nytimes.com/2017/04/26/us/politics/nafta-executive-order-trump.html

Rapoza, Kenneth. "Food Fight: Mexico Targets American Corn In Trump 'Trade War'." Forbes, February 17, 2017. https://www.forbes.com/sites/kenrapoza/2017/02/17/food-fight-mexico-targets-american-corn-in-trump-trade-war/#4c98b8fa57ba

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.