NAFTA Trade Is Important for Meat Industry

The 2016 election cycle created a lot of confusion about the importance and benefits of trade in general. In particular, a good bit of the election year rhetoric focused on trade within the NAFTA trade bloc (U.S., Canada and Mexico). In a recent farmdoc daily article (April 28, 2017), Schnitkey, Baylis and Coppess highlighted the importance of trade with Canada and Mexico for U.S. corn and soybean farmers, focusing specifically on imports of corn and soybeans by those two countries. However, in addition to examining feed grain and oilseed trade, it’s important to examine meat trade as well.

Growth in trade of animal products has been quite dramatic over the last three decades and U.S. agricultural producers, those engaged in animal agriculture and those engaged in feed grain and oilseed production, have benefitted. In particular, U.S. crop producers have benefitted because the increase in U.S. meat exports has encouraged expansion of U.S. animal agriculture and thereby boosted demand for U.S. produced feed grains and oilseeds.

To see this more clearly, it’s helpful to examine how dramatic the shift has been in U.S. meat exports. In the mid-1980s U.S. beef exports to all destinations totaled less than 500 million pounds. In 2016, U.S. beef exports were 2.55 billion pounds and are projected to hit 2.7 billion pounds in 2017. Looking at the individual country data from USDA indicates that about 12 percent (308 million pounds) of all U.S. beef exports were shipped to Canada in 2016. The U.S. shipped even more beef to Mexico than Canada as beef exports to Mexico totaled 394 million pounds, about 15 percent of all U.S. beef exports, in 2016. Combined, the two NAFTA trading partners absorbed 27 percent of all U.S. beef exports in 2016. Looking at rankings of U.S. beef export customers, Japan (26 percent) was the largest beef export customer and South Korea (18 percent) was the second largest. Mexico and Canada were the third and fourth largest U.S. beef export customers, respectively, in 2016.

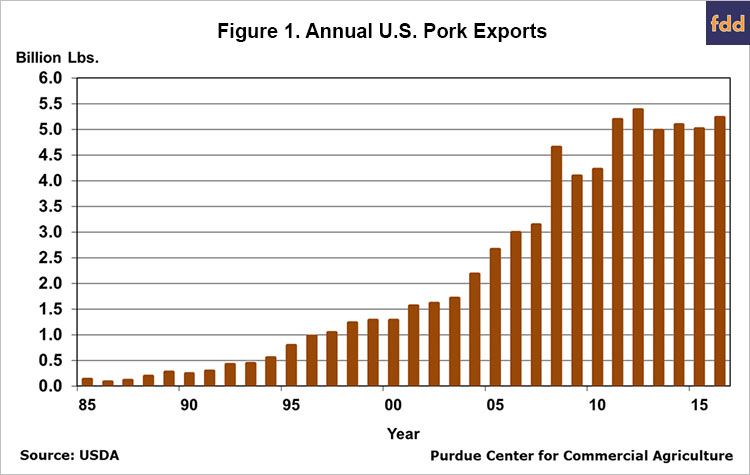

In the mid-1980s U.S. pork exports were even smaller than U.S. beef exports, totaling just 129 million pounds. By 2016 U.S. pork exports were more than 40 times as large as in 1985, reaching a total of 5.2 billion pounds (Figure 1). In 2016, approximately one out of five pounds of pork produced in the U.S. was exported. And the U.S. pork industry was much larger than it was in 1985. U.S. pork production in 1985 totaled 14.7 billion pounds compared to 26.1 billion pounds in 2016, so pork exports were absorbing a much, much larger share of a much larger industry.

Looking at the individual country data, the largest single customer for U.S. pork in 2016 was Mexico. U.S. pork exports to Mexico totaled 1.6 billion pounds during 2016, which was almost 31 percent of U.S. pork exports. Pork exports to Canada in 2016 totaled 537 million pounds, approximately 10 percent of U.S pork exports. On a combined basis, Mexico and Canada absorbed approximately 41 percent of U.S. pork exports. In comparison, the next largest U.S. pork customer, Japan, received 23 percent of U.S. pork shipments in 2016.

Growth in poultry exports as a source of demand for an expanding poultry industry has been phenomenal as well. In 1985, ready-to-cook exports of poultry (chicken and turkeys) as a percentage of production was less than 3 percent. By 2016 poultry exports were 7.4 billion pounds, approaching 15 percent of total production (Figure 2). And, like pork, this represented an increasing percentage of an industry that had grown much larger over the course of three decades. In 1985 chicken and turkey production, combined, totaled 16.9 billion pounds. By 2016, combined chicken and turkey production was nearly three times as large as it was in 1985, totaling 47.2 billion pounds.

Examining the individual country trade data reveals that the largest single customer for U.S. poultry exports in 2016 was Mexico followed by Canada. Mexico was the recipient of 21 percent of all U.S. poultry exports in 2016 while Canada was the destination for over 5 percent of U.S. poultry exports. Combined, the two NAFTA trading partners purchased over one-quarter of all U.S. poultry exports in 2016.

Trade benefits both importers and exporters. This cursory examination of recent U.S. meat trade patterns focused on exports alone, but that is not intended to downplay the value to consumers of increased product choices provided by imports. However, this review does make clear how important meat trade has become to U.S. animal agriculture producers and the potential impact a disruption in trade with NAFTA partners Canada and Mexico would have on the U.S. animal agriculture sector and, in turn, producers of feed grains and oilseeds.

References

Schnitkey, G., K. Baylis, and J. Coppess. "A Reminder on NAFTA and Agriculture." farmdoc daily (7):78, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 28, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.