Reviewing the U.S.-Korea Free Trade Agreement

While overshadowed by concerns about North Korea, trade discussions loomed large in President Trump’s recent trip to Asia. Earlier statements from the Administration have raised concerns about the bilateral free trade agreement with South Korea. The South Korea-U.S. Free Trade Agreement (KORUS FTA) has substantial implications for U.S. agriculture and is reviewed in this article.

Background

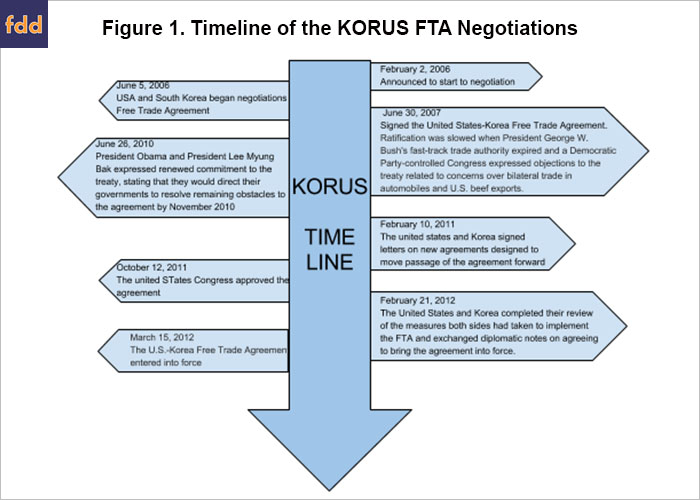

In June 2006, the United States and the Republic of Korea began negotiating a bilateral trade agreement; negotiations concluded April 1, 2007, with an agreement signed on June 30th (citation). The agreement was considered the largest U.S. free trade agreement since the North American Free Trade Agreement (NAFTA). At first, the agreement was stalled in Congress over concerns about both the automobile sector and U.S. beef exports. A re-negotiated version provided additional time for the U.S. to lower tariffs on Korean cars and it was signed in December 2010 (citation). The final South Korea-U.S. Free Trade Agreement (KORUS) agreement was ratified by the U.S. Congress in late 2011 and went into force March 15, 2012. Figure 1 illustrates the timeline for the KORUS FTA.

Among other things, KORUS FTA increased the number of goods that could enter Korea duty-free to 80 percent from 13 percent (USITC, 2013). The agreement also contained a number of market access commitments in the service sectors, and addressed non-tariff measures. It also included rules on labor, environment and competition policy (USITC, 2013).

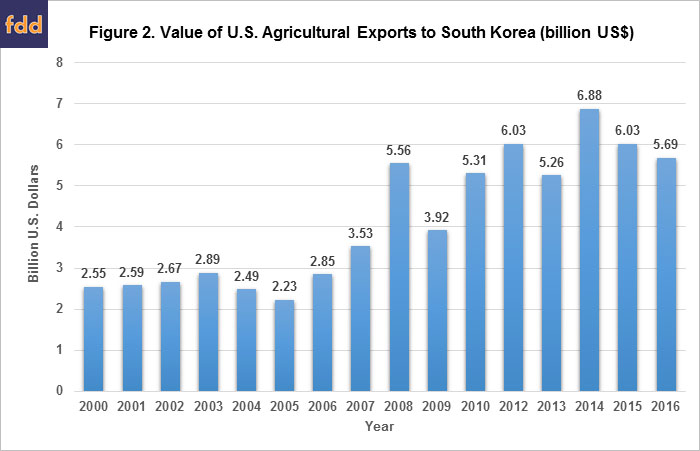

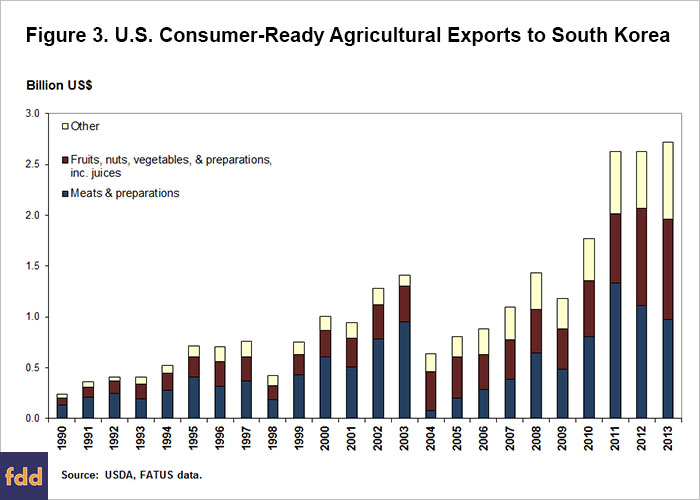

The United States is the chief agricultural exporter to South Korea, and South Korea is our sixth largest agricultural market (FAS, 2016). From 2002 through 2004, the United States exported an average of $2.6 billion per year of agricultural products to South Korea. By 2016, the value of these exports reached $5.69 billion dollars. The majority of agricultural products sold to South Korea are bulk commodities, such as corn, wheat and soybeans, but includes higher-valued agricultural products such as cattle hides, fruits and vegetables. Figures 2 and 3 illustrate U.S. agricultural exports to South Korea.

Livestock Exports

South Korea is the US beef industry’s second-largest export market, comprising 17% of all U.S. beef exports (citation). The U.S. had been the largest beef exporter to Korea until mad cow disease was discovered in the U.S. herd in late 2003, resulting in Korea banning U.S. beef exports in 2004 (USITC 2013). The market reopened to U.S. beef exports in 2008, but exports lagged those from Australia, and faced a revitalized domestic Korean meat sector (Giamalva, 2013). Meat export trends are illustrated in figure 4.

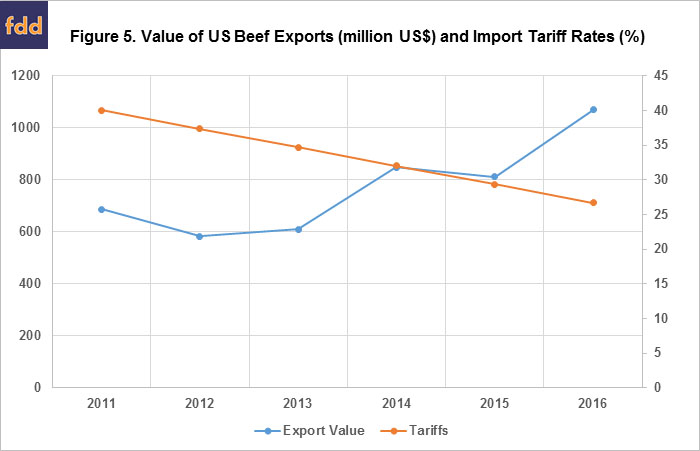

KORUS is helping increase U.S. competitiveness and allowing the industry to rebuild this important export market. Market access has improved. Beginning in 2012, Korea reduced its import tariff on U.S. beef by 2.7% each year for 15 years (USDA-FAS 2011; USDA-ERS, 2017). By 2017, the tariff, which had been at 40%, was down to 24% and is scheduled to be eliminated by 2026 (ibid). The tariff reduction and value of US beef exports are illustrated in figure 5. The U.S. Meat Export Federation had previously estimated that these tariff reductions would increase the value of U.S. beef exports to South Korea to more than $1 billion per year from its 2015 level of $810 million (Meat and Poultry, 2017). Under KORUS, exports were above $1 billion in 2016 on a volume of 169,000 metric tons (Beef Magazine, 2017). Growth in U.S. beef exports is led by chilled U.S. beef, which increased 55% from 2015 to 2016 to nearly 25,000 metric tons. U.S. exports of frozen beef also showed impressive growth, last year increasing over 2015 by 45% to an estimated 132,000 metric tons (ibid). This growth pushed the U.S. share of Korea’s beef market to 42%, up from 35% in 2015 (BeefUSA 2017).

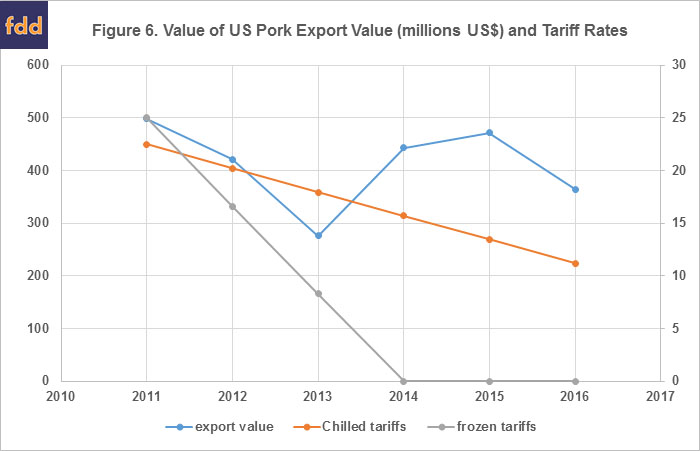

For pork, the U.S. faces significant competition from the EU, Mexico, Canada and Chile in the Korean market (National Hog Farmer 2017). Korean tariffs have been reduced to zero as of 2016 on more than 90 percent of U.S. pork imports; a reduction from rates of 22.5% and 25% before KORUS. Duties on fresh pork bellies and other fresh cuts are subject to a safeguard tariff that will be phased down over 10 years, leading to unlimited duty-free access by 2023 (FAS 2011). In response, U.S. pork exports are expanding; exports increased by 31% in volume and 39% in value in the first quarter of 2017 (Feedstuffs, 2017). The value of US pork exports and the tariff rates are illustrated in figure 6.

South Korea was the tenth-largest market for U.S. poultry and eggs, purchasing a total of $122 million in 2014 (USDA-Press Release, 2017)). Pursuant to KORUS, Korea has reduced import tariffs on eggs from 27% and they are scheduled to go to zero by 2024. Korean tariffs on imports of chicken will decline from the current 20% to zero between 2022 and 2024 (FAS 2011). Poultry and egg products to Korea were hampered, however, by an outbreak of bird flu earlier this year. Korea banned poultry and egg imports from the U.S. in March, but then lifted the ban in August (Polansek, 2017). Prior to the bird flu ban, egg imports had been growing at a rapid pace, in part due to South Korea’s flock reductions due to its own incidents of bird flu.

The KORUS agreement has also doubled the amount of access for U.S. dairy products. The tariff-rate quota established for cheese is growing at an annual rate of 3%, and tariffs over that quota amount are being eliminated for cheddar by 2022, and by all cheeses by 2027. The TRQ for evaporated milk and milk powder has an initial duty-free quantity of 5,000 tons, growing 3 percent annually in perpetuity. The agreement establishes a TRQ of 200 tons for butter and a TRQ of 700 tons for infant foods, with both of these quotas growing at 3 percent, and becoming duty free in 10 years (FAS 2011). As a result of these changes, South Korea is now the second largest market for US cheese after Mexico. U.S. cheese shipments to South Korea totaled nearly 94 million lbs. in 2016, about 15 percent of total U.S. cheese exports, and these exports are still growing, up 48 percent over the first half of 2017, compared to January-June 2016. The world’s other three major cheese suppliers are Australia, the European Union (EU) and New Zealand. All three have free trade agreements with South Korea, raising concerns that a repeal of KORUS would have significantly negative impacts on the competitiveness of U.S. dairy exports (US Dairy Export Council 2017).

Impact on Grains and Oilseeds

Tariffs on Korea’s imports of U.S. corn were set to zero immediately after KORUS went into effect. Although Korea already imported large quantities of feed corn at zero tariff under its autonomous quota before KORUS, Korea could legally discontinue the zero tariff at any time and revert back to the WTO tariff of 5 percent for the first 6.1 million tons, and 328 percent for any imports above this quantity; KORUS fixed the tariff at zero (FAS 2011).

U.S. wheat for milling also received a zero tariff immediately after KORUS came into effect. Korea’s imports of U.S. wheat were subject to a 1.8% WTO tariff or the autonomous Tariff-Rate Quota of 1 percent. Although this tariff reduction was small, it provided a comparative advantage relative to our primary wheat export competitors in Canada and Australia (FAS 2011).

The USDA’s Foreign Agricultural Service suggests that the greatest potential benefit for the US soybean sector is likely to come from improved access to Korea’s 300,000-ton market for food quality soybeans. Under KORUS, Korea immediately eliminated its 5% tariff on food use soybeans. In addition, Korea established a tariff-rate quota for food-grade identity-preserved soybeans, used in the production of tofu. Prior to the agreement, imports of soybeans for soybean curd processing went through the state trading entity, which reportedly charged $250-per-ton markup on these soybean imports. Korean tariffs on soybeans for crushing have fallen to zero with the implementation of KORUS, and Korean tariffs on imports of crude soybean oil are falling from the pre-KORUS level of 5.4% to zero by 2022 (FAS 2011).

The above numbers understate the effect of KORUS on grains and oilseeds. KORUS has also increased demand for U.S. livestock exports which themselves are a source of demand for corn, wheat and soybeans (farmdoc daily, March 23, 2017).

As this review demonstrates, trade agreements like KORUS places U.S. agriculture on a competitive footing with other major agricultural exporters like Canada, Australia, New Zealand and the EU, all of whom now also have free trade agreements with South Korea. Terminating KORUS would risk U.S. producers being left behind in this growing market, with the potential for significant harm to the farm sector.

References

American Farm Bureau Federation, "Implications of South Korea-U.S. Free Trade Agreement on U.S. Agriculture," Economic Analysis Team (Dec. 2014), available online: http://www.uskoreacouncil.org/wp-content/uploads/2014/12/AFBKORUSFTAReport.pdf

John Giamalva, "Korea's Demand for U.S. Beef," U.S. International Trade Commission, Journal of International Commerce and Economics (January 2013), available online: https://www.usitc.gov/journals/KoreasDemandforUSBeef.pdf

Paulson, N., K. Baylis, J. Coppess, and G. Schnitkey. "Another Look at Agricultural Trade: Direct and Indirect Corn Exports." farmdoc daily (7):53, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 23, 2017.

Tom Polansek, "South Korea lifts ban on U.S. poultry, egg imports: USDA," Reuters, Health News (August 17, 2017), available online: https://www.reuters.com/article/us-health-birdflu-usa/south-korea-lifts-ban-on-u-s-poultry-egg-imports-usda-idUSKCN1AX2SH

Statista.com, "Value of U.S. Agricultural Exports to South Korea from 2000 to 2016," available online: https://www.statista.com/statistics/221203/value-of-us-agricultural-exports-to-south-korea-since-2000/

U.S. Dept. of Agriculture, Economic Research Service, "Animal Product Markets," (updated October 6, 2017), available online: https://www.ers.usda.gov/topics/international-markets-trade/countries-regions/south-korea/animal-product-markets/

U.S. Dept. of Agriculture, Foreign Agricultural Service, "KORUS Fact Sheet," (March 2011) available online: https://www.fas.usda.gov/sites/development/files/korus_detailed_fact_sheet_03-11.pdf

U.S. Dept. of Agriculture, "South Korea Lifts U.S. Poultry Ban," Press Release (August 17, 2017), available online: https://www.usda.gov/media/press-releases/2017/08/17/south-korea-lifts-us-poultry-ban

U.S. International Trade Commission, "U.S.-Korea Free Trade Agreement: Effects on U.S. Small and Medium-Sized Enterprises," Investigation No. 332-539, Publication 4393 (May 2013), available online: https://www.usitc.gov/publications/332/pub4393.pdf

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.