Updating ARC-CO and the Next Bill: Market and Policy Design Considerations

U.S. farm safety net policy is evolutionary (Zulauf and Orden). One evolutionary trait is updating reauthorized programs to reflect not only performance issues but also changes in markets, budget constraints, the political process, and policy objectives since the last farm bill. For example, target prices and loan rates have been routinely adjusted to reflect changes in market prices of both individual crops and all crops. This article examines the impact of the decline in market prices since 2012 on the design of the ARC-CO (Agriculture Risk Coverage – county) program.

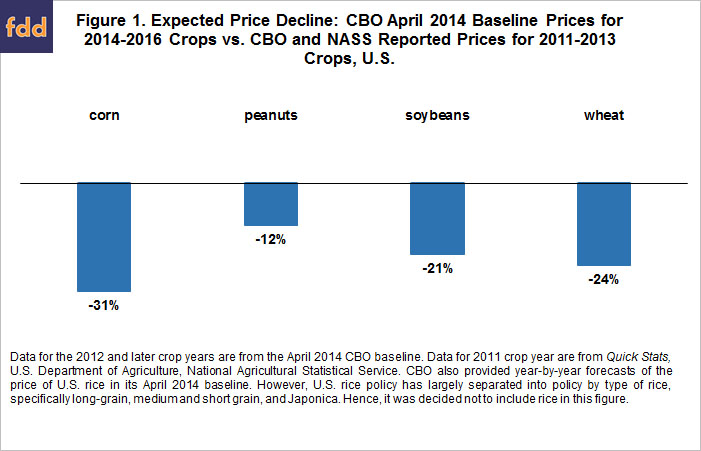

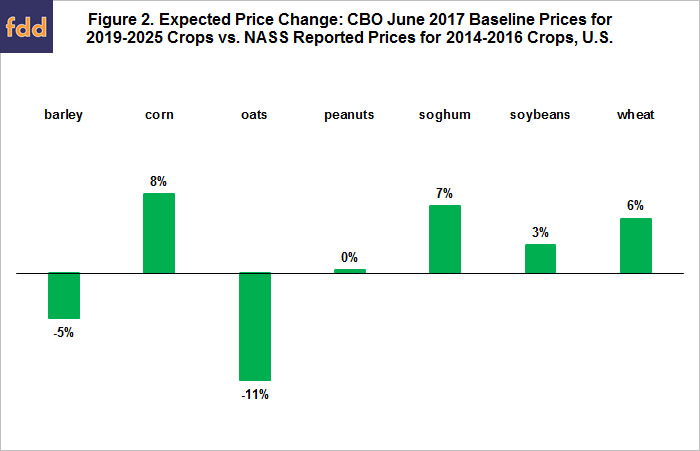

Market – Policy Situation: (1) ARC-CO is a revenue based program, where a decline in revenue that triggers assistance is defined as county revenue less than 86% of benchmark market revenue based on the 5 prior crop years (ARC-CO is discussed further in data note 1). (2) When the 2014 farm bill was enacted, large market price declines were expected for many crops, including corn, soybeans, and wheat (see Figure 1). (3) However, prices are currently expected to remain relatively stable over the crop years associated with the next farm bill (see Figure 2).

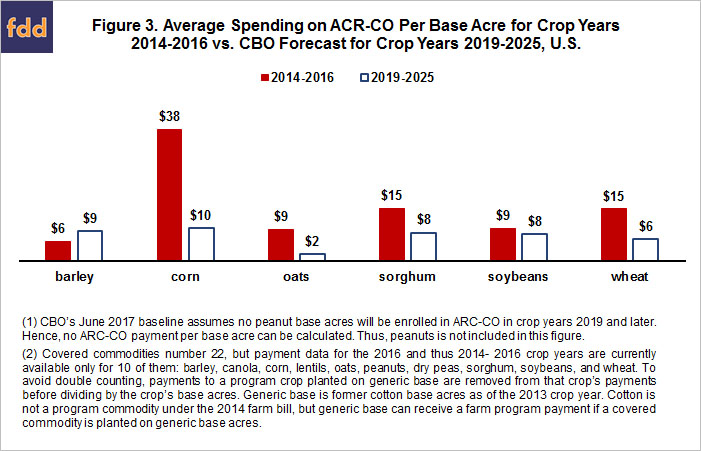

Impact on ARC-CO: Due to the change in market price behavior, ARC-CO is expected to pay less per base acre for most crops over the new farm period than it has paid over the 2014-2016 crop years (see Figure 3). Payment per base acre averages -37% less across the 6 crops in Figure 3, with corn, soybean, and wheat payments expected to decline -75%, -18%, and -58%, respectively. Payments are expected to increase only for barley. The forecasted payments for the 2019-2025 crop years, the expected time frame of the next farm bill, are from the June 2017 CBO (Congressional Budget Office) baseline.

Summary Observations

- ARC-CO was designed when prices for many crops were expected to trend lower over time.

- A multiyear downtrend in prices increases the likelihood of a 14% decline in revenue, thus triggering payment by ARC-CO. Payments by ARC-CO were nearly a given at the time the 2014 farm bill was enacted, at least for corn, soybeans, and wheat (see Figure 1).

- At present, more stable prices and revenues are expected, prompting the policy question of whether ARC-CO should be updated to reflect the change in market outlook.

- This policy question is consistent with an evolutionary trait of U.S. farm policy to adjust farm programs when market conditions change sufficiently.

- This policy question is also important because it is most common for prices and revenue to vary but not trend up and down. Thus, unlike when the 2014 farm bill was written, it is now possible to discuss how ARC-CO should be structured to maximize its contribution to the farm safety net under “more normal” market conditions.

- Expectation of no large downtrend in price / revenue points to a market environment with smaller variations in revenue. This observation in turn points to a policy option of raising ARC-CO’s coverage level above 86%, thus reducing the revenue decline that triggers payment. Other general types of policy options include ? (1) change ARC-CO’s 5-year calculation window so it more likely includes higher price years, such as 2011-2013 and (2) increase its 10% per acre payment cap (Paulson, Schnitkey, Zulauf, and Coppess discuss this option).

- Increasing ARC-CO’s payment per acre will likely increase the cost of commodity programs, but the increase is also likely to be limited as long as current expectation of notably higher per acre payments by Price Loss Coverage (PLC) than ARC-CO hold (see CBO, July 2017, and Coppess, Zulauf, Schnitkey, and Paulson). With low ARC-CO participation, outlays for ARC-CO will be limited–barring significant market price changes that differ from expectations. Thus, some budget latitude may exist for considering ARC-CO policy options.

Data Note:

(1) ARC-CO’s benchmark revenue is calculated using 5-year Olympic averages (high and low values removed) of U.S. crop year price and county yield. Payment thus is determined on a county-by-county, not national basis. Payment is made on 85% of base acres. Per acre payment is capped at 10% of benchmark revenue. A limit exists on the market orientation of ARC-CO. If average price for a crop year is at or below a crop’s reference price, the reference price replaces the crop year price in determining the 5-year Olympic average price in the revenue benchmark. Thus, the reference price is a floor on the price used to calculate the revenue benchmark. An individual farm version of ARC also exists, commonly designated ARC-IC. Participation in ARC-IC accounts for less than 1% of all U.S. base acres.

References

Data Source

Congressional Budget Office. "CBO's April 2014 Baseline for Farm Programs." April 14, 2014. https://www.cbo.gov/sites/default/files/recurringdata/51317-2014-04-usda.pdf

Congressional Budget Office. "CBO's June 2017 Baseline for Farm Programs." June 29, 2017. https://www.cbo.gov/sites/default/files/recurringdata/51317-2017-06-usda.pdf

Coppess, J., C. Zulauf, G. Schnitkey, and N. Paulson. "Reviewing the June 2017 CBO Baseline." farmdoc daily (7):127, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 14, 2017.

Paulson, N., G. Schnitkey, C. Zulauf, and J. Coppess. "Analysis of the ARC-CO Payment Cap for Corn, Soybeans, and Wheat." farmdoc daily (7):212, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 16, 2017.

U.S. Department of Agriculture, National Agricultural Statistical Service. Quick Stats. November 15, 2017. https://quickstats.nass.usda.gov/

Zulauf, C. and D. Orden. "80 Years of Farm Bills: Evolutionary Reform." Choices: Online Magazine. Included in article theme, "Looking Ahead to the Next Farm Bill." Agricultural and Applied Economics Association. 4th Quarter 2016. http://www.choicesmagazine.org

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.