Crop Insurance Performance of Soybeans

Conversations with farmers suggest that some are considering lowering coverage levels or eliminating crop insurance on soybeans. Doing so would conserve cash and many farmers note that they have received few payments on soybean policies. Herein, loss performance on soybean policies is evaluated. The drought year of 2012 has large impacts on how one views crop insurance experience. I suggest caution when considering lower coverage levels or eliminating soybean crop insurance.

Background on Loss Ratios

Loss ratios are used to judge the actuarial performance of crop insurance. A loss ratio equals total payments from crop insurance divided by total premiums paid for crop insurance. A loss ratio of 1.0 indicates that insurance payments equal total premiums. Loss ratios over 1.0 indicate that crop insurance payments exceed total premiums while loss ratios under 1.0 indicate that insurance payments are less than total premiums.

When determining rates, the Risk Management Agency (RMA) has a goal of achieving a loss ratio slightly below 1.0. Losses on crop insurance should average slightly less than total premiums over time. However, performance will vary markedly from a loss ratio of 1.0 in any given year. In drought years, for example, loss ratios exceed 1.0 by large margins. Yields and revenues are highly correlated across farms, leading to correlated crop insurance losses, and dramatically different loss performance from year-to-year.

Farmers do not pay the total premiums associated with crop insurance because the Federal government pays a portion of total premiums as part of Federal safety net. This factor has an impact on how farmers view the performance of crop insurance. If a loss ratio of 1.0 occurs, farmers will actually have paid less into crop insurance than they have received.

To illustrate, total premiums on soybean policies in Illinois were $163 million in 2016. Farmers paid $69 million, or 42% of total premiums. Given that farms paid 42% of premiums, loss ratios above .42 result in farmers receiving more in payments than farmer-paid premiums. The .42 is a rough gauge as Federal support varies by type of crop insurance and coverage level. Federal support for crop insurance decreases with higher coverage levels. As a result, the .42 breakpoint will vary from farm to farm.

Loss Ratios for Corn and Soybeans in Illinois

Figure 1 shows loss ratios for corn and soybeans insured in Illinois from 2000 to 2016. The most pronounced item in this figure is the high losses associated with 2012, the drought year. In this year, the loss ratios were 6.14 for corn and 1.21 for soybeans. In 2012, August rains occurred which led to relatively good soybean yields compared to corn yields. As a result, soybeans had lower losses than corn. Since 2012, loss ratios for both corn and soybeans have been much lower. Loss ratios were very low in 2016: .15 for corn and .13 for soybeans. Data for 2017 is not complete. However, low loss ratios are expected for 2017.

Over the 2000 to 2016 period, loss ratios averaged .82 for corn and .49 for soybeans. The much lower loss ratio for soybeans is associated with the much lower loss ratio in 2012. Taking 2012 out of the calculation, loss ratios are much nearer each other: .48 for corn and .45 for soybeans.

Without considering drought years, loss ratios are fairly close to the .42 value where farmers pay about the same as they receive for crop insurance. It is the inclusion of disaster year that causes crop insurance payments to exceed farmer-paid premium. In the Midwest, the frequency and severity of large droughts have a significant impact on the actuarial performance of crop insurance.

Soybean Loss Ratios Across Illinois

Illinois averages in Figure 1 mask variability in loss ratios across Illinois. Figure 2 shows loss ratios by county for soybean policies averaged over the years from 2000 to 2016. Loss ratios tend to be lower in northern and central Illinois. In these counties, there may be farmers that have received few crop insurance payments on soybeans in recent years. Loss ratios tend to be higher in southern Illinois than in the northern and central Illinois.

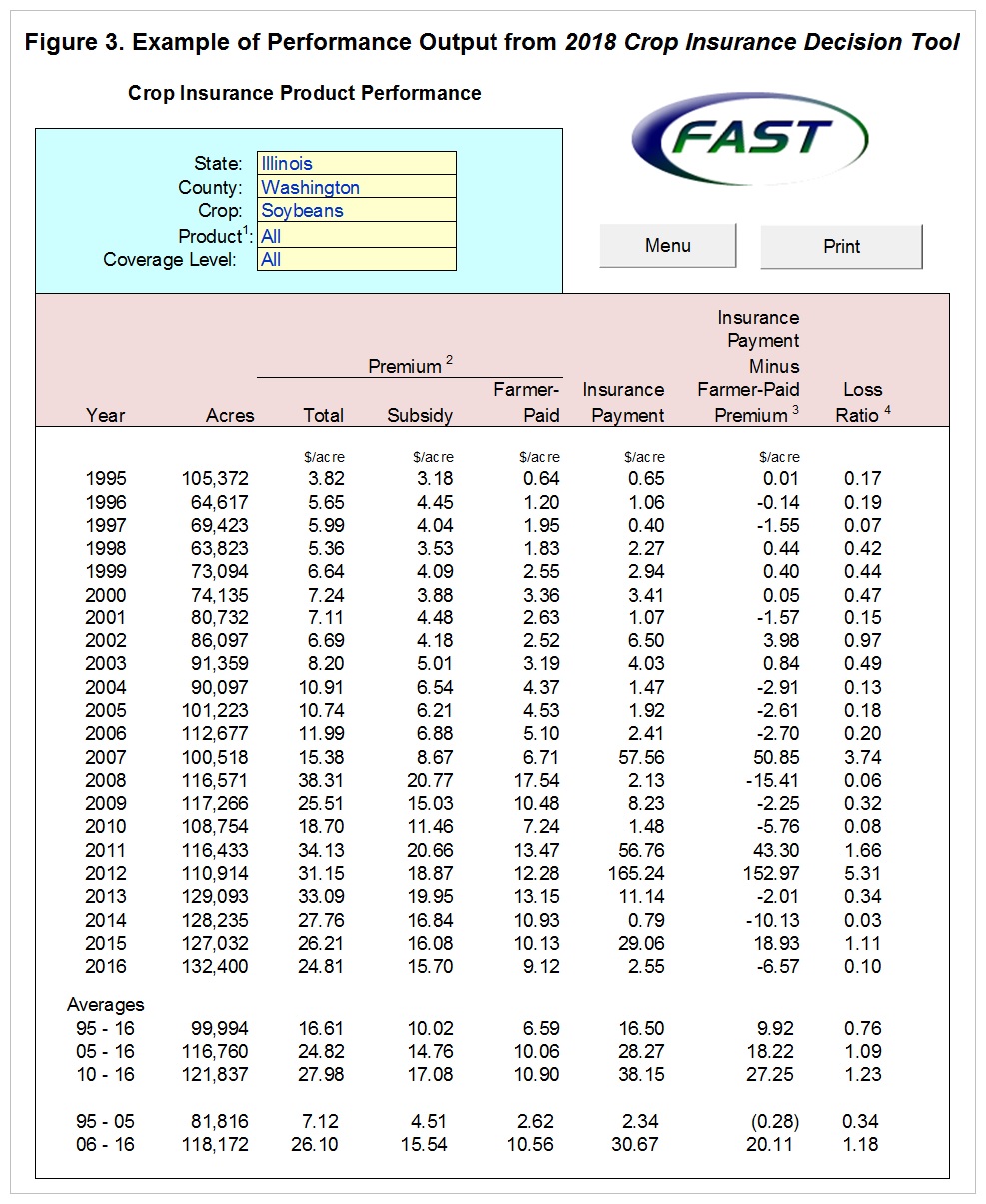

Some of the difference in performance across Illinois has to do with the impacts of the 2012 drought. The 2012 drought was centered in Missouri and southern Illinois, resulting in much higher loss ratios in southern Illinois. To illustrate, take the county with the highest average loss ratio from 2000-2016 and the county with the lowest loss ratio. Washington County had an average loss ratio of .93 from 2000-2016, the highest in the state (see Figure 2 and southwest Illinois). Washington County’s 2012 loss ratio for soybeans was 5.31. On the other hand, Christian County has an average loss ratio of .16 from 2000 to 2016, the lowest in Illinois (see Figure 2, approximately in the middle of the state). Christian County’s 2012 loss ratio was .16.

More detail on crop insurance performance by county is available in the 2018 Crop Insurance Decision Tool a Microsoft Excel spreadsheet available for download from farmdoc. Users can evaluate performance for counties by product and coverage levels. Figure 3 shows an illustration for all soybean products in Washington County, Illinois.

Commentary

While payments have been low in recent years, particularly in northern and central Illinois, I suggest caution when considering lowering coverage levels or eliminating crop insurance on soybeans. Much of the recent low payments are associated with exceptional soybean yields. It is possible that something has happened in soybean genetics or soybean production leading to higher yields. A session was devoted to this topic at our recent Illinois Farm Economic Summit meetings. At that session, Scott Irwin concluded that “the biggest factor explaining high soybean yields in recent years is simply exceptionally good growing season weather” (farmdoc daily, December 29, 2017). This session did not explicitly address yield risk. However, if exceptional weather has caused high yields, a return to more adverse conditions could lead to low soybean yields.

Consequently, recent low loss experience on soybean crop insurance policies does not mean that low loss experience will persist. Low soybean yields are possible, perhaps through adverse weather conditions or some pest related problem. Low prices are possible. Heightened price risk may exist as trade policies come under scrutiny. In any case, there is a possibility of widespread yields or revenue losses.

Furthermore, note that crop insurance has paid something in all years. The lowest loss ratio in Illinois was .13 in 2016. Even in 2016, some farmers in Illinois suffered losses large enough to result in crop insurance payments.

References

farmdoc, 2018 Crop Insurance Decision Tool. Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, Released January 9, 2018. http://farmdoc.illinois.edu/pubs/FASTtool_special_cropins2018_Spring.asp

Irwin, S. "IFES 2017: What Is Up with Soybean Yields?" farmdoc daily, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 29, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.