Reviewing the Latest Cotton Proposal

Congress is attempting to reach an agreement on funding the government for the remainder of fiscal year 2018; a short-term continuing resolution passed just before the holidays expires on January 19, 2018 (DeBonis and Werner, 2017). Congress is also considering an emergency appropriations bill to provide assistance for hurricane and wildfire disasters (H.R. 4667). Included within the $81 billion disaster bill passed by the House is a provision to amend the 2014 Farm Bill and designate seed cotton as a covered commodity. Previous farmdoc articles have discussed cotton policy under the 2014 Farm Bill and the efforts by the cotton industry to make cotton base acres directly eligible for ARC and PLC payments (see, farmdoc daily, January 28, 2016, February 15, 2017, April 27, 2017, May 11, 2017 and September 13, 2017). With implications for the upcoming farm bill debate, this article reviews the latest effort.

Background

According to Cotton, Inc., a research and marketing company funded by U.S. growers of upland cotton, the cotton plant is farmed as an annual crop but is actually a warm-season woody perennial shrub (Cotton, Inc., Agricultural Production). The plant produces cotton fibers or lint in a boll after the plant flowers. The boll is harvested by machine after the plant has been defoliated by the farmer and the fiber is removed from the plant; the harvested fiber contains both lint and cottonseeds. Known as “seed cotton” this harvested crop is taken to a gin where the cotton fiber (lint) is separated from the cottonseed, converting the harvested crop into two different products that can be marketed.

From a farm policy perspective, cotton farmers have received Federal support in a variety of ways. Prior to the Agricultural Act of 2014, upland cotton was considered a covered commodity with base acres; the base acres of upland cotton were eligible to receive payments from the commodity programs authorized in the farm bill, such as direct payments and counter-cyclical payments. As with all covered commodities on decoupled base acres, farmers with upland cotton base could receive payments for upland cotton regardless of whether upland cotton was planted on those base acres. The Congressional Budget Office (CBO) May 2013 Baseline for Farm Programs reported that there were 17.96 million upland cotton base acres prior to the 2014 Farm Bill; that farm bill removed upland cotton from the list of covered commodities due to the World Trade Organization dispute with Brazil (CBO, May 2013 Baseline).

In addition to the commodity payment programs, upland cotton was also a loan commodity that was eligible for a marketing assistance loan (MAL) or a loan deficiency payment (LDP). Farmers with harvested upland cotton could take out a nonrecourse loan on the pounds of harvested cotton at the statutory loan rate. Unlike the payment programs that used decoupled base acres, the loans are on actual pounds of harvested cotton and the provisions of the program appear to be designed for the cotton lint rather than the seed cotton. As with all marketing loans, if prices fall below the loan rate ($0.52 per pound), the farmer could repay at the lower price or forfeit the crop and keep the loan. While this basic assistance was also provided to other loan commodities, including covered commodities such as corn, wheat and soybeans, upland cotton receives special repayment rates that were established using prevailing world market prices which are adjusted lower for quality factors, marketing and transportation costs. The 2014 Farm Bill continued the loan program for upland cotton, but modified the loan rate to range between 45 and 52 cents per pound.

Extra long staple cotton was also listed as a loan commodity with a separate loan rate ($0.7977 per pound) and defined in the 2008 Farm Bill as “having characteristics needed for various end uses for which United States upland cotton is not suitable” (P.L. 110-234, section 1001(7)). The 2014 Farm Bill continued this definition for extra long staple cotton as well as the separate loan rate.

The 2014 Farm Bill also provided transition assistance for producers of upland cotton, which amounted to a portion of the direct payments under the 2008 Farm Bill for the 2014 crop year and on limited bases for the 2015 crop years where the Stacked Income Protection Plan (crop insurance policy) was not available. In the loan program, it also provided for payment of cotton storage costs and included special marketing loan provisions for upland cotton that include a special import quota, preferential tariff treatment and economic adjustment assistance to users of upland cotton. Extra long staple cotton also received special competitive provisions to help increase exports and seed cotton was specifically provided recourse loans for the 2014 to 2018 crops of upland cotton and extra long staple cotton.

Finally, USDA initiated “one-time” payments for ginning assistance in 2016 (USDA Press Release, June 6, 2016). This program provided cost-share assistance to cotton farmers based on 2015 cotton acres with regional payment rates based on 40% of the average ginning cost in the region (FSA, Cotton Ginning Cost Share Program). FSA estimated average assistance of $8,100 per producer. CBO indicated that this resulted in $328 million in outlays in fiscal year 2016 (CBO, June 2017 Baseline). This was included in CBO’s report of actual outlays for upland cotton of $781 million in FY2016, which included $329 million in marketing loan benefits and $51 million in economic adjustment assistance.

Discussion

Returning to the proposal for seed cotton in the House-passed disaster funding bill, it would open up and amend the 2014 Farm Bill by adding a definition of seed cotton as the “unginned upland cotton that includes both lint and seed” and designating it as a covered commodity for purposes of base acres and payments (H.R. 4667, Section 3001). The reference price for seed cotton is $0.367 per pound and a loan rate is established at $0.25 per pound.

A payment yield is also authorized to be established for the farm. First, the farmer has a one-time option of updating the farm’s upland cotton payment yield based on 90% of the 2008 through 2012 crop year yields (planted acres) for upland cotton. The seed cotton payment yield will equal to 2.4 times either this updated yield or the farm’s payment yield for upland cotton established by the 2008 Farm Bill.

The bill also requires the owner of the farm to allocate all generic base acres on the farm. If there is no history of planted covered commodities during the 2009 to 2016 crop years on the farm (not just generic base on the farm), the generic base acres become unassigned crop base and are ineligible for any program payments. For all other farms with generic base acres, those acres can be allocated in one of three ways: (1) 80% to seed cotton base; (2) the average seed cotton acres planted or prevented from being planted during the 2009 to 2012 crop years; or (3) to covered commodities pursuant to the reallocation formulas of the 2014 Farm Bill. This effectively ends the generic base acres system created in 2014; all generic base acres should be reallocated to seed cotton base, other covered commodities or unassigned base that is ineligible for payments. The farmer thereafter elects either ARC or PLC for the base acres and they become eligible for payments if payments are triggered.

Because seed cotton has never been a covered commodity, a price series does not currently exist and thus must be defined, including the calculation for it. Labeled an effective price for seed cotton, The calculated prices will be used to trigger any payments under the PLC program and reference price. This formula uses existing marketing year average prices that are determined by NASS for upland cotton lint (UpCMYA) and cottonseed (CsMYA). These price values are weighted by the share of cotton lint and cottonseed production, all variables measured in pounds. This weighting is accomplished by the variables designated (UpCLP) for total U.S. pounds of upland cotton lint production and (CsP) for total U.S. pounds of cottonseed production.

- ((UpCMYA*UpCLP)+(CsMYA*CsP))/(UpCLP+CsP)

Finally, any farm that enrolls seed cotton base acres in either ARC or PLC under these provisions is ineligible for the Stacked Income Protection Plan for upland cotton (STAX) that was a crop insurance policy created for cotton farmers in the 2014 Farm Bill (see, farmdoc daily, June 30, 2016).

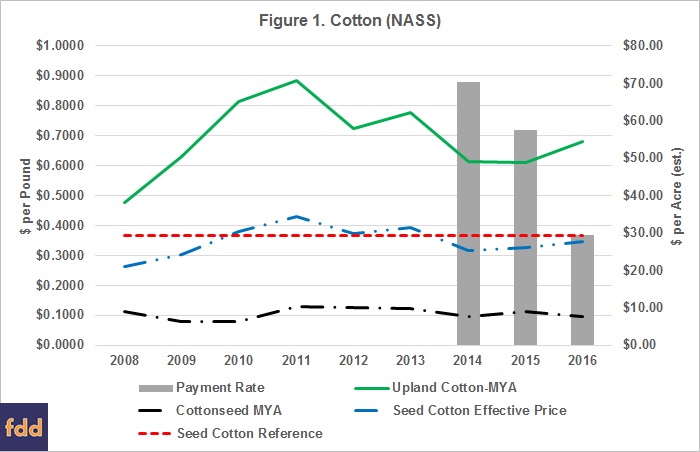

National Agricultural Statistics Service (NASS) Quick Stats data is used to estimate the PLC program operation for seed cotton under the provisions of the House bill. First, Marketing Year Average (MYA) prices for upland cotton and cottonseed are provided in Figure 1, as well as the effective price for seed cotton per the bill’s formula and the proposed reference price for seed cotton. This data indicates that seed cotton would have triggered payments on base acres in the 2014 through 2016 crop years. Using 90% of the average yield per planted acre for upland cotton from 2008 to 2012 (576 pounds per acre) and the 2.4 factor provided in the legislation, the U.S. average payment yield for seed cotton is estimated to be 1,383 pounds per acre. Estimated payment rates by year are $70.46, $57.53 and $29.55, respectively, in crop years 2014 through 2016.

In order to better understand the proposed seed cotton program and get a sense of what it might mean for the upcoming farm bill, forecasted prices and yields from CBO’s June 2017 baseline are used to calculate payment estimates in Figure 2 (see, CBO June 2017 Baseline; farmdoc daily, July 14, 2017). CBO forecasts for MYA prices for upland cotton and cottonseed are used to calculate the effective price for seed cotton, and that effective price is compared to the proposed reference price to estimate payment rates for the 2018 through 2027 crop years used in the baseline. A factor of 85%, representing payment acres (85% of base acres), is used to estimate the payments per seed cotton base acre.

For a sense of the baseline impact, figure 3 uses the per base acre payment estimates from Figure 2. Those payments are multiplied by an estimate of total seed cotton base acres (excluding sequestration). It is difficult to determine total base acres enrolled at this time and the estimate calculates total payments using 80% of total generic base acres (14.066 million base acres). This may be a conservative estimate if farmers can add seed cotton base with the formula or it could overestimate if significant generic base acres are reallocated to other commodities or to unassigned base. It is the most straight-forward method for estimating total payments, with the aforementioned caveats.

Concluding Thoughts

First and foremost, it has to be acknowledged that this proposal is a highly unusual and potentially consequential change to farm policy. It sets a rare precedent by opening a farm bill and revising the standing statutory provisions through any appropriations vehicle; more so given it is a temporary supplemental appropriation for natural disasters. Given the operation of payment programs, any payments for seed cotton for the 2018 crop year would not be made until October 2019 which is fiscal year 2020; thus the changes are unlikely to score in any CBO estimates of the disaster bill other than the potential for allocation of some generic base acres into the unassigned category and an estimated reduction in payments. In other words, this change could score savings. Moreover, when CBO makes the 2018 baseline estimate it will necessarily include seed cotton payment estimates and thus increase the commodity title baseline for the upcoming farm bill debate but without the offset requirement if this provision were added during a farm bill debate.

In fact, it has all the appearances of that rare “free lunch” under budget rules but it does raise tougher, long-term questions. Among these are the impacts on the settlement with Brazil in the WTO dispute and the political consequences for farm programs in general; the latter concern increases if Congress seeks reductions in farm bill outlays and spending in the future. It also raises difficult questions about the integrity of the process and the wisdom of the policy; policy changes made without the benefit of hearings or debate, nor consideration in the course of regular order. By establishing a precedent, this move could have a far more significant impact and cost that is not accounted-for under budget rules. These are matters, however, unlikely to weigh heavily on any of the negotiations and decision-making of the moment.

References

"Agricultural Production," Cotton Incorporated, accessed January 11, 2018, http://www.cottoninc.com/product/NonWovens/Nonwoven-Technical-Guide/Agricultural-Production/.

"CBO's June 2017 Baseline for Farm Programs," Congressional Budget Office, released June 29, 2017, accessed January 11, 2018, https://www.cbo.gov/sites/default/files/recurringdata/51317-2017-06-usda.pdf.

"CBO's May 2013 Baseline for Farm Programs," Congressional Budget Office, released May 14, 2013, accessed January 11, 2018, https://www.cbo.gov/sites/default/files/recurringdata/51317-2013-05-usda.pdf.

"Cotton Ginning Cost Share Program," U.S. Department of Agriculture, Farm Service Agency, accessed January 11, 2018, https://www.fsa.usda.gov/programs-and-services/cgcs/index.

"USDA Provides Targeted Assistance to Cotton Producers to Share in the Cost of Ginning," U.S. Department of Agriculture, accessed January 11, 2018, https://www.usda.gov/media/press-releases/2016/06/06/usda-provides-targeted-assistance-cotton-producers-share-cost.

Coppess, J., C. Zulauf, G. Schnitkey, and N. Paulson. "Reviewing Cottonseed Provisions in the Senate Agriculture Appropriations Bill." farmdoc daily (7):168, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, September 13, 2017.

Coppess, J., C. Zulauf, G. Schnitkey, and N. Paulson. "Reviewing the June 2017 CBO Baseline." farmdoc daily (7):127, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 14, 2017.

Coppess, J., G. Schnitkey, C. Zulauf, and N. Paulson. "The Cottonseed Conundrum." farmdoc daily (7):77, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, April 27, 2017.

DeBonis, Mike and Erica Werner, "Senate passes stopgap spending bill, allowing Congress to avert partial government shutdown." Washington Post, December 21, 2017, https://www.washingtonpost.com/powerpost/after-passing-tax-overhaul-gop-returns-to-infighting-as-shutdown-deadline-looms/2017/12/21/dfad1890-e659-11e7-ab50-621fe0588340_story.html?utm_term=.2eb0e96ee810.

Paulson, N., and G. Schnitkey. "Use of the SCO and STAX Insurance Programs in 2015." farmdoc daily (6):123, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 30, 2016.

Zulauf, C., G. Schnitkey, J. Coppess, and N. Paulson. "Farm Safety Net Support for Cotton in Perspective." farmdoc daily (7):87, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 11, 2017.

Zulauf, C., G. Schnitkey, J. Coppess, and N. Paulson. "Cottonseed and U.S. Oilseed Farm Program Issues." farmdoc daily (6):18, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 28, 2016.

Zulauf, C., J. Coppess, N. Paulson, and G. Schnitkey. "U.S. Oilseeds: Production and Policy Comparison." farmdoc daily (7):28, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 15, 2017.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.