Crop Insurance Decisions for 2018

The price discovery period used to determine projected prices and volatility factors for federally sponsored corn and soybean crop insurance products for 2018 is completed. For the majority of the Cornbelt, the approved Projected Price (PP) for corn is $3.96 and the volatility factor is .15. For soybeans, the Projected Price is $10.16 with a volatility factor of .14. For comparison, the 2017 prices and (volatility factors) were $3.96 (.19) and $10.19 (.16) for corn and soybeans respectively. The Projected Prices are used to determine a guarantee revenue based on futures prices, and do not reflect local basis. The Projected Price for corn is determined by averaging the closing December futures price during the trading days of February, and for soybeans by averaging the November Futures closing prices during February. The volatility factors are determined by an average of the most recent five trading days’ implied volatility estimates, scaled for the interval of time from now until the middle of October — the month during which average prices are used to determine Harvest Prices. For both corn and soybeans, the projected prices are nearly identical to those in 2017, but the volatility factors have materially declined. The volatility factor summarizes the market’s estimates of the likelihood for price movements of various magnitudes, and has corresponding impacts on premiums paid for Revenue and Harvest Price related products. All else equal, lower volatilities result in lower premiums and vice versa, though other ratings changes from year to year often outweigh the direct effects.

At the time of this writing — near the beginning of the insurance period, the November 2018 soybean futures price is about $.15 above its Projected Price, while corn is only slightly above its Projected Price. When actual futures prices are above the projected prices, there is a lower likelihood for experiencing an insured revenue shortfall, but the harvest price option increases in relative value. When actual futures prices are lower than the projected price, there is a decreased likelihood that products with the harvest price option embedded will result in an increase in guarantee value. Importantly, the prices of crop insurance products do not change in response to different price paths experienced during the establishment of the PP even though the values of coverages provided are affected, and the relative desirability of products.

The question faced each year at this point on the calendar is: How can one sensibly evaluate their crop insurance options for their own case, reflecting current insurance information, current price expectations, and their own farm’s operating conditions? The following materials provide one approach for evaluating the most important crop insurance product and election choices facing corn and soybean producers using the University of Illinois iFARM crop insurance evaluator.

The case presented is for McLean Co., a large and high yielding county in central Illinois. This case, and similar analyses for approximately 750 other counties throughout the midwest for both corn and soybeans under both basic and enterprise elections are available here at the farmdoc website in the crop insurance section.

Importantly, there can be large differences in premiums even over short distances or among contiguous counties, and over the choice of unit and APH endorsement. Thus, while the case farm information provided is helpful in understanding the relationships among choices, it is important to compare to conditions that most closely match your own case. It is also important to carefully discuss final options and decisions with a qualified insurance agent to insure accurate information about the specific costs.

The case farm information from McLean County, Illinois and starting price conditions are shown in the table below. It is assumed that the farm qualifies for the Trend Adjusted APH endorsement which takes its average Corn APH from 187 to 196. The case shown is for an Enterprise Unit over 320 acres (the online version can be selected for any county/crop of interest and toggled across units, and at actual acreage). The county standard deviation of yields is estimated to be about 35.4 bu./acre and the farm yield risk is about 8 bu./acre higher. Some basic risk information is given related to yield risk (e.g., 1 in 10 years the farm yield will be below 138, 1 in 5 years the county will be less than about 167 and so on), and the average gross revenue with no insurance is calculated at approximately $708/acre. The gross revenue calculation reflects the negative correlation between the yield and prices, as well as simulated local basis conditions and starting prices. The average futures price reflected in the is a result of the process used to model the price distribution implied by the options markets for the settlement period and can differ from current futures prices at any point in time. This number updates regularly as market conditions change as well. Consistent with RMA rules, the APH and Trend APH are rounded to nearest whole bushels, and other features of the indemnity calculations are maintained to comply within RMA rules and procedures. The table below shows the case farm information for McLean in more detail.

The next table shows approximate premiums and guarantee values for the available products, unit decisions, and coverage levels in this county for the case farm shown. The area products are calculated assuming maximum protection levels in all cases, and maximum protection factor of 1.2 for Area products. Importantly, the revenue guarantee levels are calculated with reference to the underlying Projected Price which does not account for local basis.

As is the case across the majority of the corn production region, the Enterprise policies shown in the table above are often considerably less expensive than Basic or Optional coverage under each of the policy options, both because of the lower risk represented, and the higher subsidy rates associated with Enterprise coverage. Moreover, the policies with the Harvest Price Exclusion are also considerably less expensive. Under Revenue Protection Harvest Price Exclusion (RP-HPE), the guarantee level is dependent on current projected prices and does not increase if harvest prices are higher. Under traditional Revenue Protection (RP), if the Harvest price is higher than the projected price, the guarantee increases to reflect the higher price. As noted earlier, November Soybean futures prices are above the projected price, thereby increasing the relative attractiveness of RP relative to RP-HPE at the time of signup due to the partial increase in expected revenue implied by that difference. Corn futures likewise are slightly higher, but the relative effect is more muted as the prices only differ by a few cents. Even though it occurred 6 years ago, the experience in 2012 when harvest prices were significantly elevated due to the drought effects on yield, the RP products continue to be far more popular than HPE products. The Area Yield Protection policy is triggered directly by the county yield shortfall from its guaranteed fraction of the county’s expected yield, but paid as a limited fraction of the shortfall. ARP or Area Risk Protection policies can result in very high payments, but also carry fairly high initial premiums as a result. While the presentation herein focuses on Enterprise units, comparable analyses considering Basic units are available at the farmdoc website for those interested.

The following table provides the average payments per acre expected if this year’s conditions were repeated over and over, a large number of times across all possible outcomes, and the average across all iterations calculated. As shown in the table, the payments increase as election levels increase reflecting the increased value of coverage for all insurance products. The Yield Protection policy (YP) for example, would be expected to make average payments of $27.19/acre at the 85% election level over a large number of times. Of course, many years the payments will be zero, and some years the payments would be much higher. Notice that the RP policy always is expected to make larger payments than the RP-HPE policy, (but not always by as much as the difference in premium costs depending on the county – in this case the difference is positive). Under an 85% election, for example, RP would be expected to make indemnity payments of $38.80 per acre on average over a large number of years, while the RP-HPE policy would make average payments of $25.34. The Area policies (rightmost 3 columns) begin with 70% coverage options and range to 90% unlike farm-level policies that have maximums of 85%. The highest coverage ARP policies also have the highest expected average payments due to the protection factor allowing a 1.2 scaling of payments to help offset the farm-to-county basis risk that remains due to imperfect correlation between the farm and the county yields – in other words, the payments may occur when not needed, and not occur in years where they are more needed to offset low on-farm revenues.

Next, a table is provided with the frequency of payment, or the fraction of years that at least some payment would occur. As can be seen in the table, the YP policy makes payments in about 24.58% of years at an 85% election and virtually never gets triggered at lower coverage levels. The revenue policies increase in frequency faster as coverage levels are increased due to the possibility of price movements also generating claims even under near typical yields. In the case of RP at 85%, a farm with these characteristics would expect to a claim in about 32% of the years. Group policies, while they tend to pay in high frequencies at high elections, are less correlated with revenue shortfalls and thus may provide less risk protection despite the often higher frequencies of being triggered, especially at the highest election levels.

The next table combines information from the previous tables and presents the net cost of insurance expected over time given the starting conditions of the farm and the insurance provisions for this year. Net cost is defined as the farmer paid premium less the average payment received. A negative “cost” indicates that the product pays back more on average than it costs — as would often be expected given the overall target loss ratio of approximately 1.0, and the fact that the farmer paid portion of the premium is subsidized to encourage participation.

As shown in the table, Revenue Protection pays back on average about $27 more than its premium cost while under RP-HPE a producer in McLean County would expect to gain $20.33/acre over the long run. Although sometimes counterintuitive, numbers that are more negative represent greater expected returns and are thus more preferred. Higher positive numbers are associated with larger net costs through time. A zero would be a breakeven policy that paid back just what it cost over time. YP would pay back about $21 more that its premium costs, but not necessarily be as correlated with revenue shortfalls. Given the very high premiums for Area policies in McLean, the high payments roughly offset the initial costs and return more than the premium on average for ARP and ARP-HPE, but only barely cover the average cost of AYP. Interestingly, even a few counties away from McLean with similar expected yields can have substantially different patterns, especially in terms of the Area products. Given the subsidy structure, the general findings in most counties is that the average cost of insurance is negative through time as expected, and also that higher coverage options are usually preferred on an actuarial basis.

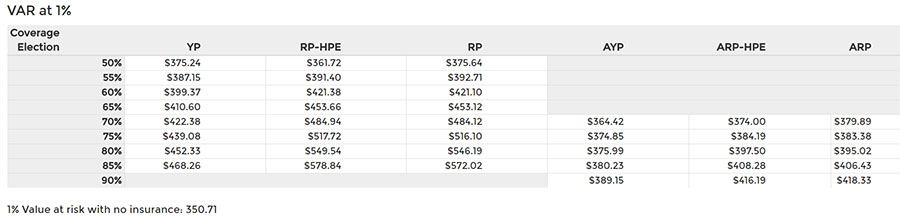

Net cost does not provide a complete picture of the impact of insurance usage however as it is also important to understand the impact of insurance on the likelihood of experiencing particularly low revenues. For example, one might be most interested in which insurance allows a farmer to bid most for cash rent, or insure that all variable costs can be covered, or do the best job of offsetting particularly low revenue outcomes under hedged production, and so on. One way to begin to understand this type of impact is to examine the VARs or “Values at Risk” under different insurance contracts.

A 5% gross revenue VAR, for example, shows the value at which 5% of the possible outcomes fall below, and 95% of the outcomes exceed – in other words a 1 in 20 worst event. A 1% VaR shows a characteristic of “extreme risk” representing a 1 in 100-year analog probability. The table below shows the 1% VARs for the various insurance products and elections to better help appreciate the relatedness of payments to revenue shortfall. Notice that with no insurance, the 1% VAR for revenue is about $350 meaning that in 1% of the cases, revenue would be below that value. Using YP 85% insurance increases the lower tail to about $468. Using ARP-HPE would increase that extreme outcome to about $416 However, the RP policies add well over $200 to the lowest 1% of the outcomes compared to no-insurance. Importantly, RP and RP-HPE do a far better job of “cutting off the low tail” of the revenue distribution and provide substantially better downside risk protection due to their ability to trigger based on either yield or price level movements. Thus, a producer considering covering say, $550 in total production costs would thus likely find higher elections of the revenue products most appealing and be less likely to use the group products, despite their higher average payments.

The final information presented in the graph below helps summarize the impacts across the lower tail of the revenue distribution. The bottom axis gives levels of gross revenue with insurance payments, less premiums paid. The vertical axis shows the probability of occurrence. Because distributions with higher likelihood of higher revenue are preferred, lines to the bottom and right are preferred to those above and to the left in this graph. The dark blue line provides the possible revenue outcomes with no insurance. For example, there is about a 15% chance of revenue with no insurance being below $540 and a 30% chance of revenue being below $610, and so on without insurance.

Purchasing insurance has two types of consequences on the revenue distribution — first, it shifts the whole schedule left by the amount of the premium. Then, it adds back payments to outcomes covered by insurance, there by shifting specific portions of the revenue distribution back to the right. Ideally, insurance should make payments when revenue is lowest and not make payments when revenue is highest resulting in an overall shift in the revenue distribution to the right at lower revenue levels, and resulting in lower revenues when only premiums are paid and no indemnities are paid (top portion of the curves are not shown in the graph, but would be shifted to the left of the no-insurance case). As can be seen in the graph, ARP-HPE at a 90% shifts the distribution to the right by its large average payments, but does little to cut off the severe low revenue outcomes. YP (omitted from the graph) has almost no effect compared to no insurance, roughly covering its own cost, but not much more or less. RP 85% and RP-HPE 85% (largely hidden behind the RP line) do the best job of “cutting off the tail” of the revenue distribution with minimum revenues of roughly $590 or more, guaranteed in most cases. The group products in general are interesting in that they pay back more than premiums over a large range of revenues, but do not protect against particularly severe revenue shortfalls. Further, in years with high crop revenue they actually cost the most in terms of total revenue due to their higher initial premiums.

Similar patterns to these results occur with soybeans, although with more muted magnitudes, and in many locations with relatively less valuable Area Protection options. These cases, and cases involving Basic units are also provided at the farmdoc website for most counties covering the majority of the corn belt plus Maryland.

Crop insurance is increasingly viewed as providing the cornerstone for active risk management programs, and its importance is elevated in environments with higher input costs and greater margin risk. The differences in underlying rates and starting price and volatility conditions can substantially impact the relative performance of the alternatives from year to year, and across different operations within a given year. Hopefully the iFARM Crop Insurance Tools will provide producers with insights needed to make informed crop insurance decisions most suitable for their own operations.

Note: The views expressed herein are solely the authors’ opinions and do not necessarily reflect those of entities with whom professionally affiliated. All errors and omissions are the author’s alone.

Visit the crop insurance tools section of farmdoc on the web at: http://farmdoc.illinois.edu/cropins/

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.