Farmers’ Use of Implement Dealer Financing

In a previous article, we estimated that implement dealers provided 27% of the agricultural sector’s long term non-real estate debt in 2016 (farmdoc daily, May 9, 2008). This post examines the use of implement dealer credit by farm type, as well as the average interest rate and loan size of implement dealer credit compared to other lending sources.

Sources for Detailed Farm Loan Data

While many lenders, such as commercial banks or the Farm Credit System, report aggregate lending to farmers, it is difficult to measure other lending relationships, such as borrowing from individuals. For these types of lending relationships, economists typically rely on surveys of farm operators. The best source for national-level aggregate farm debt is the Agricultural Resource Management Survey (ARMS) jointly produced by USDA Economic Research Service and National Agricultural Statistics Service. The annual ARMS survey asks farmers detailed information on the terms, age, interest rate, and lender type for (up to five) outstanding loans.

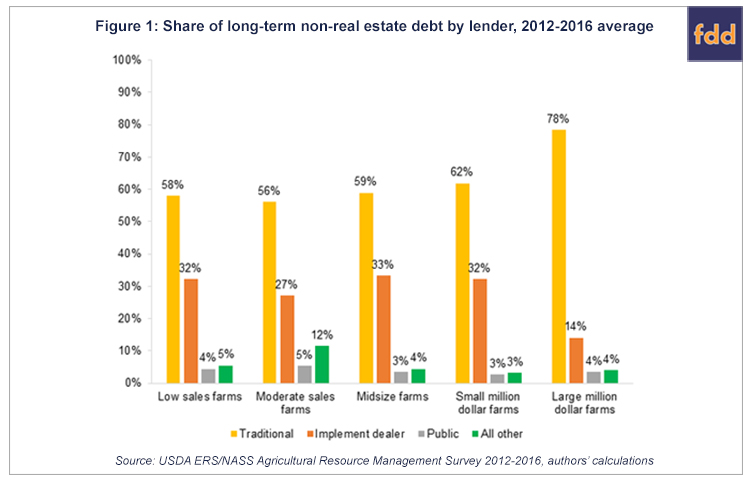

Figure 1 shows the average share of long term non-real estate debt by lender type for five classes of farm size based on gross cash farm income (GCFI). Low sales farms have GCFI below $150,000. Moderate sales farms have GCFI between $150,000 and $350,000 and midsize farms have GCFI between $350,000 and $1,000,000. Smaller million dollar farms have GCFI up to $5,000,000 and larger million dollar farms have GCFI beyond $5,000,000.

Similar to our previous article (farmdoc daily, May 9, 2008), traditional lenders include commercial banks, credit unions, the Farm Credit System, and Famer Mac. Public lenders include the Farm Service Agency (FSA), Small Business Administration (SBA), and other government programs, and the remaining lenders are captured by “all others.”

For all but the largest farms, implement dealers supply roughly one third of long term non-real estate debt. For the largest farms (based on GCFI), implement dealer financing accounts for 14% of long-term non-real estate debt. The largest farms obtain a greater share of long-term non-real estate from traditional lenders.

For all but the largest farms, implement dealers supply roughly one third of long term non-real estate debt. For the largest farms (based on GCFI), implement dealer financing accounts for 14% of long-term non-real estate debt. The largest farms obtain a greater share of long-term non-real estate from traditional lenders.

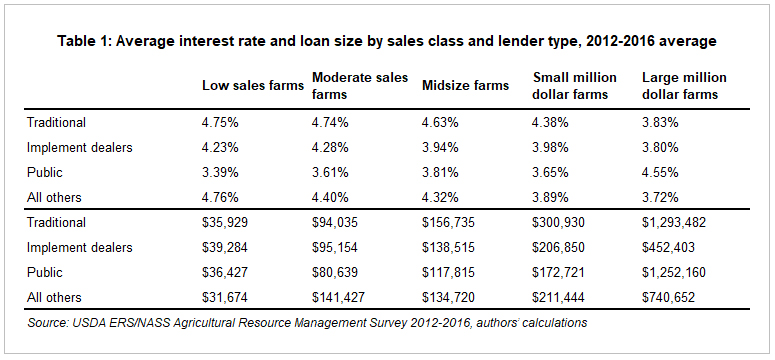

As shown in Table 1, the terms of the loans suggest that, on average, the largest farms borrow traditional lenders at lower interest rates. This may reflect the lower risk of larger producers, stronger relationships with traditional lenders from previous loan history, or the ability to provide greater financial information. These advantages may also explain why the largest farms have fewer incentives to use implement dealer financing, compared to other lender types.

In addition, Table 1 suggests that for all farm sizes, implement dealers charge a lower interest rate than traditional lenders, on average. But the difference evaporates as sales volume increases. Low sales farms that choose financing from an implement dealer received an interest rate that on average was more than half a percent lower than those that received financing from a traditional lender (52 basis points). For the largest farms, the difference is less than 3 basis points.

Regional Concentration of Implement Dealer Financing

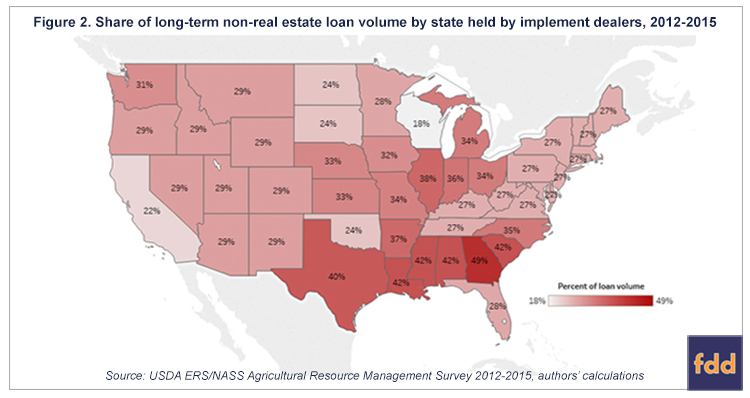

Figure 2 shows the state-level variation in the share of long-term non-real estate lending by implement dealers. Across the Cornbelt region, implement dealers account for roughly one third of long-term non-real estate loans. The use of implement dealer financing is particularly pronounced in Southeastern and Delta states, with a market share between 37% and 49%.

Conclusion

Conclusion

For all but the largest farms, implement dealers supply roughly one third of long term non-real estate debt. The largest farms are more likely to use traditional lenders for long term non-real estate debt. This may be due to the similarity of loan terms between implement dealers and traditional lenders for the largest farms.

Disclaimer

The views expressed herein are those of the authors and are not attributable to the USDA, the Economic Research Service, or the National Agricultural Statistics Service. This research was conducted while Kevin Patrick was employed at the Economic Research Service.

References

Kuethe, T., J. Ifft, and K. Patrick. "The Rise in Implement Dealer Financing." farmdoc daily (8):84, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 9, 2018.

Ifft, Jennifer; Kuethe, Todd; Patrick, Kevin. 2017. “Nontraditional Lenders in the U.S. Farm Economy.” Presentation at the 2017 Agricultural and Rural Finance Markets in Transition, October 2-3, 2017, Minneapolis, Minnesota. https://ageconsearch.umn.edu/record/263908?ln=en

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.