Interest Rates in 30-Year Perspective: The Case of U.S. 10-Year Treasury Rates

On Wednesday, June 13, 2018, the Federal Reserve increased the Federal funds rate for the 2nd time in 2018 and 7th time since December 2015. It also signaled that 2 more hikes were likely this year. The specter of increasing interest rates has caused concern about its impact on farm income via higher borrowing costs for production inputs and on the value of land. While the Federal Reserve has control over the Federal funds rate, it can only influence other interest rates. To obtain perspective on these other interest rates, this article reviews the last 30 years of U.S. 10-year Treasury bond interest rates, which is currently the most watched market-determined interest rate. This review underscores that the Federal funds rate and market rates do not always move together. More importantly, it underscores the importance of taking inflation into account when discussing interest rates.

Procedures and Data

Annual average constant maturity interest rate for the U.S. 10-year Treasury bond is examined in this article. Inflation is measured as the year-over-year change in the Gross Domestic Product implicit price deflator. The GDP deflator is the broadest measure of inflation for a country. Source for both variables is the Federal Reserve Bank of St. Louis. The analysis includes the last 30 years of complete data (1988-2017). Also included are (1) the average daily value of the 10-year Treasury interest rate from January 1 through June 13, 2018 and (2) the annualized value of the increase in the GDP deflator from the last quarter of 2017 to the first quarter of 2018.

Nominal Rate

The annual average nominal 10-year Treasury constant maturity interest rate declined steadily from 1988 until 2012 (see Figure 1). Since 2015, the year the Federal Reserve began to raise interest rates; it has increased from 2.14% to 2.84% so far in 2018. Its total increase of 0.70 percentage points compares with a 1.75 percentage point total increase in the Federal funds rate.

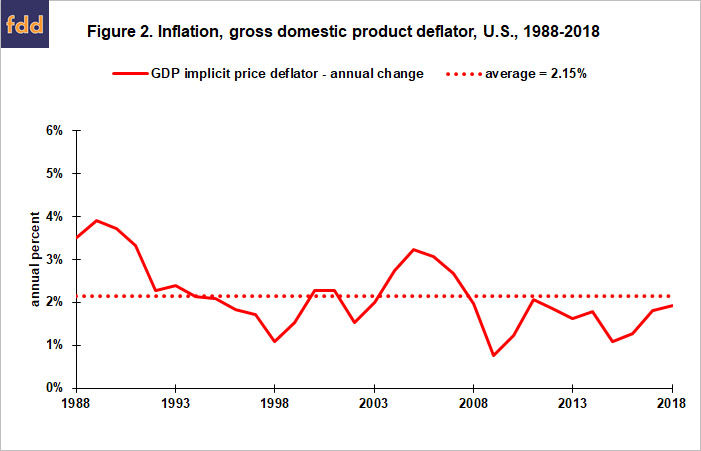

Inflation

Annual change in the GDP implicit price deflator has bounced around its average value of 2.15% since the early 1990s (see Figure 2). Since 2000, its range has been from +0.76% in 2009 to +3.22% in 2005. Inflation has been increasing slowly since 2015.

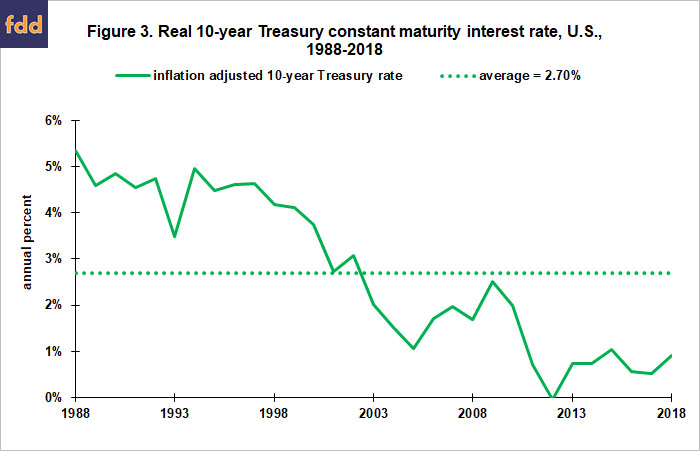

Real Rate

The real interest rate was calculated by subtracting the annual change in the GDP deflator from the 10-year Treasury rate for a year. Since annual change in the GDP deflator exhibits no trend, nominal and real 10-year Treasury rates have the same trend. Both were above their average over the first half of the analysis period and below their average over the second half (see Figures 1 and 3). The real 10-year Treasury rate is essentially the same in 2018 (so far) as in 2015.

Summary Observations

- The Federal Reserve has increased the Federal funds rate by a total of 1.75 percentage points since December 2015, but the 10-Year U.S. Treasury rate has risen only 0.70 percentage points.

- This comparison illustrates that the Federal Reserve can only influence, not set, market-determined interest rates.

- Moreover, the inflation-adjusted real 10-year Treasury rate has changed little since the Federal Reserve began raising the Federal funds rate in 2015.

- This point underscores the importance of considering inflation when assessing interest rates.

- Rising interest rates take on more importance when both inflation and real rates increase together.

- The current real 10-year Treasury rate is 1.8 percentage points below its average real value since 1988 and roughly 4 percentage points below its highest real value since 1988.

- Thus, in assessing the future of U.S. interest rates, it is important to keep one eye on inflation and the other eye on real interest rates.

Data Source

Federal Reserve Bank of St. Louis. Federal Reserve Economic Data. June 14, 2018. https://fred.stlouisfed.org

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.