Small Refinery Exemptions and Ethanol Demand Destruction

Small refinery exemptions (SREs) represent the latest controversy to engulf the Renewable Fuel Standard (RFS). When the U.S. Congress first created the RFS in the Energy Policy Act of 2005 (P.L. 109-58) it included a temporary exemption for small refineries from the mandate through 2011. Under the Obama Administration, SREs were rarely granted after 2011. This changed radically under the Trump Administration, which granted a total of 48 SREs retroactively for 2016 and 2017. As detailed in this farmdoc daily article (July 12, 2018), SREs effectively reduced the conventional ethanol mandate for 2017 from 15 billion gallons to 13.9 billion gallons. This was not only a large reduction in absolute terms, but it also resulted in the conventional mandate being set below the E10 blend wall. If similar numbers of SREs are granted for 2018 and 2019, comparable reductions in the effective conventional ethanol mandate should be expected (assuming the SRE volumes are not reallocated to non-exempt obligated parties).

While there is no doubt that SREs have opened a backdoor mechanism for EPA to reduce the statutory and obligated RFS volumes, there is sharp disagreement about the impact of SREs on the physical consumption of ethanol. On one side, obligated parties, mainly refiners, argue that physical ethanol demand has been unaffected. On the other side, the corn ethanol industry argues there has been substantial destruction of demand in the physical ethanol market due to the SREs. The purpose of this article is to investigate the impact of SREs on demand for ethanol in the physical market.

Analysis

There are two key questions for the analysis of the impact of SREs on the physical demand for ethanol. First, what measure should be used to detect the impact? Second, what is the relevant time window? With respect to the first question, we do not want to examine the physical consumption of ethanol directly because ethanol use has trend and seasonal components. Instead, we want to remove trend and seasonal effects by examining consumption of ethanol relative to something else. In this case, there is an obvious something else—the consumption of gasoline. By dividing ethanol consumption by gasoline consumption, we obtain the blend rate for ethanol, a measure that should be normalized to systematic trends and seasonality, at least in recent years.

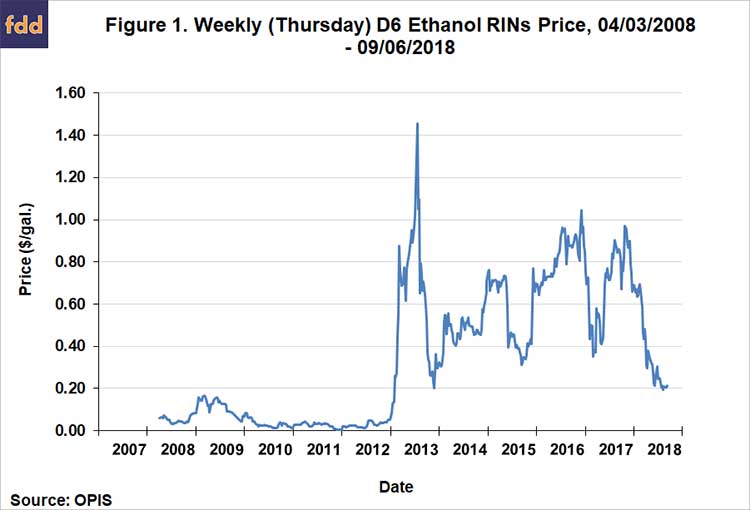

Determining the time window for the analysis is not as clear-cut. With the exception of two SREs reportedly granted for 2018, all of the SREs granted to date were retroactive for 2016 and 2017, and therefore, could not have impacted physical ethanol demand after the fact. However, the argument made by many in the corn ethanol industry is that the impact on ethanol consumption of SREs is indirect through incentives provided by D6 ethanol RINs. The granting of SREs did increase the supply of RINs substantially, with the EPA estimating that the size of the RIN bank ballooned to over 3 billion gallons. Naturally, this caused a large decline in RIN prices, which is then argued to have reduced incentives for physical blending of ethanol. Based on this logic, the relevant time window should start when the SREs were granted and D6 RIN prices dropped. Figure 1 presents weekly D6 RIN prices from April 3, 2008 through September 6, 2018. The figure shows that D6 prices were around $0.90 per gallon in November 2017 and then plummeted to the current level of around $0.20 per gallon. This suggests the impact of SREs on the physical demand for ethanol, if any, should start around December 2017.

A further complication is that there are different methods for computing the ethanol blend rate, depending on the particular data series used. We follow Radich and Hill (2011) and compute three ethanol blend rates to determine whether the results are sensitive to different assumptions about the relevant data from the U.S. Energy Information Agency (EIA). All three measures are computed on a monthly basis because monthly EIA ethanol and gasoline consumption data are more accurate than weekly data because the monthly data is based on more comprehensive surveys.

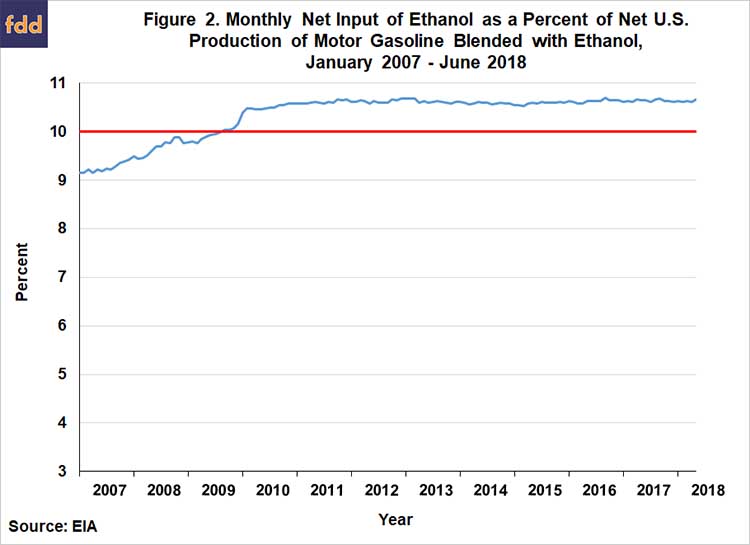

The first measure of the ethanol blend rate is presented in Figure 2 for January 2007 through June 2018. The EIA surveys refiners and blenders in the U.S. about the net input of ethanol into gasoline and this is used in the numerator. The EIA also surveys refiners and blenders about the net production of motor gasoline that is blended with ethanol. In other words, if a gallon of gasoline contains ethanol then it is counted towards the denominator of this measure. Based on this data, the ethanol blend rate started relatively high, a bit higher than 9 percent in 2007, rose quickly to around 10.5 percent in 2010, and then stayed remarkably stable through June 2018. The blend rate exceeds 10 percent with this measure because higher ethanol blends such as E15 and E85 are included in the accounting but 100 percent petroleum gasoline (E0) is not. There does not appear to be any perceptible change in the ethanol blend rate with this measure starting in December 2017. In fact, the average ethanol blend rate for the seven months from May 2017 through November 2017, 10.6 percent, is exactly the same as the seven months between December 2017 and June 2018.

A potential limitation of the previous measure of the ethanol blend rate is that it does not reflect ethanol blended outside of the refiners and blenders surveyed by the EIA, and as noted above, the data series on gasoline does not reflect E0 consumption. Both could bias the measure of the blend rate. The second measure of the ethanol blend rate attempts to correct for these two sources of bias by using more inclusive measures of physical ethanol and gasoline consumption. Rather than being a direct survey estimate, ethanol consumption for this measure is implied based on the ethanol balance sheet as follows:

Domestic Use = Beginning Stocks + Production + Imports – Exports – Ending Stocks.

This measure of physical ethanol consumption in theory includes all domestic sources (E10, E15, and E85) in the numerator of the blend rate. However, it also may be subject to more measurement error since consumption is implied. In this sense, it is analogous to the computation of feed and residual use on a corn balance sheet. Finished motor gasoline consumption is implied in a similar manner by the EIA, and therefore E0 consumption is included in the denominator of the blend rate.

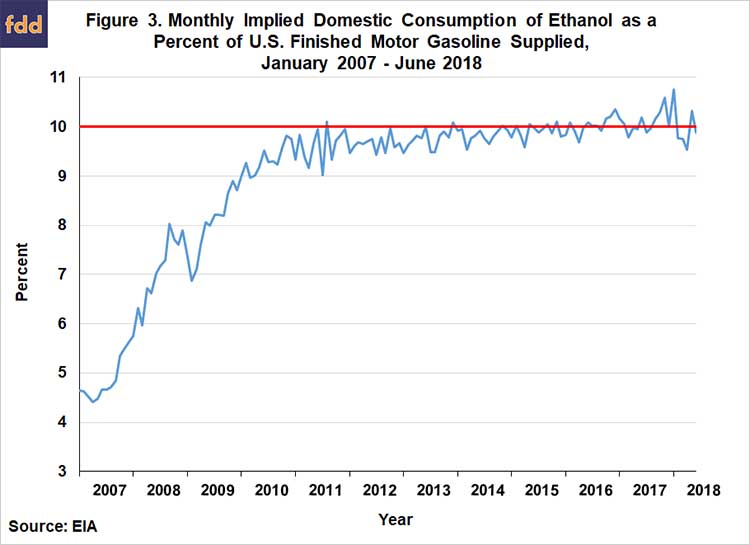

Figure 3 presents the second (“implied”) measure of the ethanol blend rate on a monthly basis over January 2007 through June 2018. As expected, this measure is noisier than the first one. It also starts at a much lower level because of the large amounts of E0 that were being consumed in the early part of the sample. This measure of the ethanol blend rate started to consistently hit 10 percent in 2013 and has basically been in a fairly tight range near 10 percent ever since. There is an unusual amount of volatility in this measure of the blend rate starting in November 2017 when it hit 10.6 percent, reached another peak of 10.8 percent in January 2018, dropped back to 9.5 percent in April 2018, and then recovered back to near 10 percent. It is possible that some of the decline in this measure of the blend rate in early 2018 was related to SREs and the D6 incentive effect, but since the decline in the blend rate was not sustained, a more likely explanation is volatility associated with unusually large amounts of ethanol shipped by rail for the surging ethanol export market. The coverage of ethanol in rail transit in EIA surveys is uncertain, and while in transit this would increase implied domestic ethanol consumption. Once the railed ethanol is counted in exports it would show up as a drop in implied domestic ethanol consumption. This explanation is consistent with the fact that the average ethanol blend rate declined very slightly from 10.1 percent for the seven months from May 2017 through November 2017 to 10.0 percent for the seven months between December 2017 and June 2018.

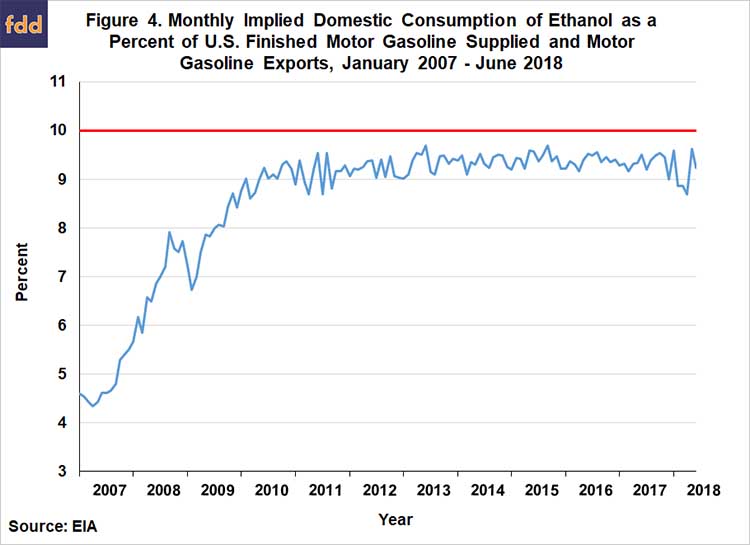

A third measure of the physical blend rate for ethanol takes into account gasoline exports. Some ethanol is likely blended in gasoline that is exported but it is not separately counted in EIA data. Therefore, in order to have the broadest possible measure of gasoline supplies, this third measure simply adds gasoline exports to the denominator of the second measure of the blend rate. Figure 4 presents the exports-included ethanol blend rate on a monthly basis over January 2007 through June 2018. Not surprisingly, this measure closely resembles the second measure, but with somewhat lower percentages due to the inclusion of gasoline exports in the denominator. This measure shows a slightly larger decline during the period in question, dropping from an average of 9.4 percent over the seven months from May 2017 through November 2017 to an average of 9.1 percent for the seven months between December 2017 and June 2018. However, this decline can be explained by surging gasoline exports, which reached record levels that exceeded 1 billion gallons each month between November 2017 and April 2018, and therefore, would depress this measurement of the ethanol blend rate.

Overall, the three measures of the ethanol blend rate provide a consistent picture of the impact of SREs on physical consumption of ethanol. There is little if any evidence that the blend rate for ethanol was reduced as the waivers went into effect. If there has been any ethanol “demand destruction” to date it was very small, perhaps a drop in the ethanol blend rate of a tenth, which equates to only about 140 million gallons of ethanol consumption on an annual basis. This may seem counter-intuitive given the magnitude of the impact of SREs in reducing the conventional ethanol mandate and the precipitous drop in D6 RINs prices that followed. The answer turns out to be straightforward and something that has been discussed in several previous farmdoc daily articles (e.g., January 30, 2015, February 3, 2016, February 17, 2016, March 15, 2017). The essential insight is that the demand for ethanol fundamentally consists of two segments, one for E10 and one for E15 and E85.

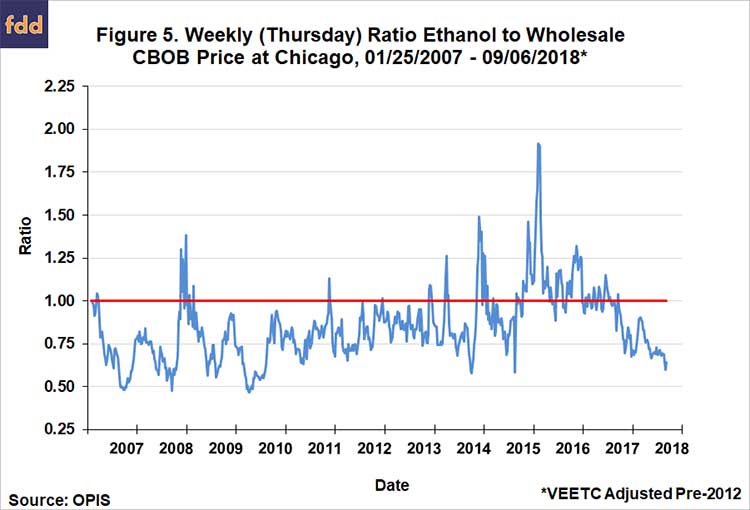

The value of ethanol in E10 is based on two components: i) an energy (MPG) penalty relative to petroleum gasoline because ethanol has a lower energy content; and ii) an octane premium based on the generally lower price of ethanol relative to petroleum sources of octane. The analysis found in this farmdoc daily article (March 15, 2017) shows that the energy penalty and octane premium for E10 almost exactly offset one another over time. This means that all else constant the breakeven price of ethanol in E10 is equal to the price of petroleum gasoline. With this background, consider Figure 5, which shows the ratio of weekly wholesale prices in Chicago for ethanol and CBOB gasoline blendstock from January 25, 2007 through September 6, 2018. Pre-2012 ethanol prices are adjusted for the blender tax credit that was in place (VEETC). What this figure reveals is that ethanol prices since late 2017 have become very cheap relative to gasoline. In recent weeks, the ratio has fallen all the way to 0.60, which is near historical lows. This is the reason ethanol demand in the form of E10 has not been affected by SREs and low D6 RIN prices. Put differently, ethanol is a highly price competitive in the E10 gasoline blend in the U.S. at the present time and the conventional ethanol mandate up to the E10 blend wall is non-binding.

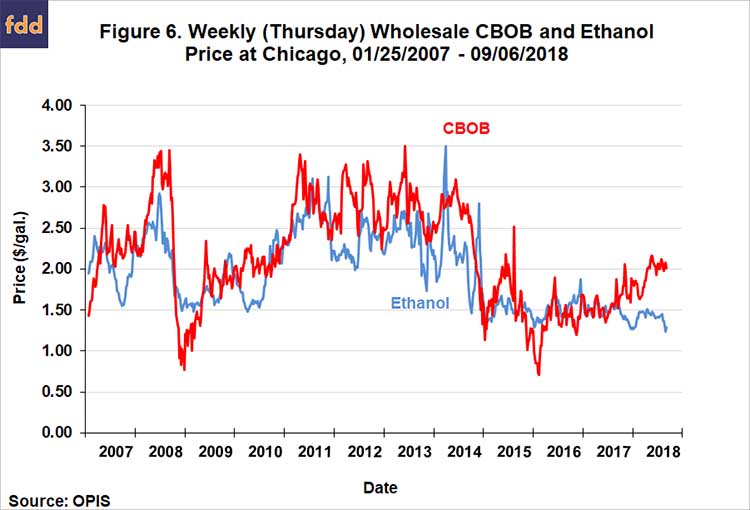

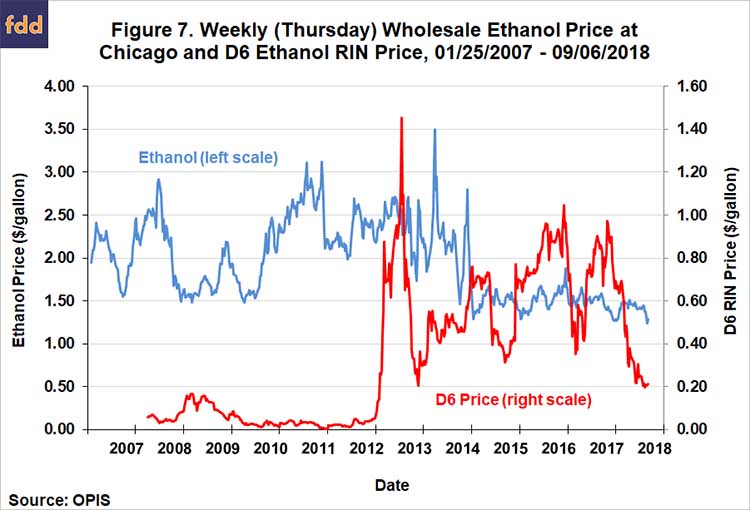

One possible concern with the above conclusion is that the timing of the precipitous drop in the ethanol/gasoline price ratio since late 2017 roughly matches the drop in D6 RIN prices shown in Figure 1. If D6 prices are positively related to ethanol prices as many claim (“the incentive effect”) then the fall in the price ratio could simply be due to a D6-driven decline in ethanol prices. This is not the case. Figure 6 shows the underlying ethanol and CBOB gasoline prices used to compute the price ratio in Figure 5. It is clear that the fall in the ethanol/gasoline price ratio since late 2017 is almost entirely due to the jump in gasoline prices, as ethanol prices moved in a narrow sideways range. Figure 7 provides further evidence in this regard by plotting the wholesale ethanol price versus the D6 ethanol RIN price. The lack of correlation is obvious.

The story for E15 and E85 is quite different from E10. While there is some controversy in this regard, it is generally acknowledged that the additional octane in E15 and E85 does not provide extra value, and therefore, there is no offset to the energy (MPG) penalty for these higher ethanol blends. Further, the energy penalty is larger for E15 and E85 simply because the ethanol content is higher than for E10. This means that, unlike E10, higher ethanol blends are not price competitive at the pump without a subsidy. D6 RINs (in theory) provide the subsidy needed to incentivize drivers to purchase E15 and E85, and therefore, the demand for higher ethanol blends above the E10 blend wall depends on D6 RIN prices. If SREs drove D6 RIN prices below the level necessary to incentivize E15 and E85 consumption, then demand for this segment of physical ethanol consumption would be reduced by SREs. A recent study by Lade, Pouliot, and Babcock (2018) suggests this is precisely what happened. However, consumption of E15 and E85 is so small and difficult to measure that it barely registers in the aggregate statistics on physical ethanol consumption. With at most a few hundred million gallons of ethanol consumed in E15 and E85, cutting demand in this segment has little overall effect.

Implications

There is widespread interest in whether small refinery exemptions (SREs) under the RFS have “destroyed” demand for ethanol in the physical market. It seems obvious that this would be the case since SREs have the effect of waiving more than a billion gallons of the conventional ethanol mandate under the RFS. However, analysis of data on ethanol and gasoline consumption in the U.S. shows there is little if any evidence that the blend rate for ethanol has been reduced by SREs. If there has been any ethanol “demand destruction” to date it was very small, perhaps a drop in the ethanol blend rate of a tenth, which equates to only about 140 million gallons of ethanol consumption on an annual basis. The reason for this counter-intuitive result is that all but a tiny sliver of ethanol in the U.S. is consumed in the form of E10 and the price of ethanol in recent months has been very low relative to gasoline. The price competitiveness of ethanol in E10 means that the conventional ethanol mandate is non-binding up to the E10 blend wall.

This finding does not preclude SREs from having an impact on ethanol demand in the future or a demand impact on other biofuels at the present time. First, if the price of ethanol increases sharply, say, due to corn supply problems at some point in the future, then ethanol could become expensive enough relative to gasoline that the conventional mandate would become binding even for E10. SREs could result in some destruction of physical demand for ethanol under this scenario. Second, SREs have in all likelihood reduced the demand for ethanol in the form of E15 and E85. While the magnitude of this impact is very small at the present time, it also means that further expansion of the demand for higher ethanol blends is not in the cards so long as SREs are granted (and not reallocated). Third, the demand for biomass-based diesel in all likelihood has been reduced in direct proportion to the impact of SREs on total obligated gasoline and diesel gallons because the biomass-based diesel mandate is highly binding. This form of “demand destruction” from SREs will be explored in a future farmdoc daily article.

References

Coppess, J. and S. Irwin. “EPA 2019 RFS Proposed Rulemaking: What You See Is Not What You Get.” farmdoc daily (8):128, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 12, 2018.

Federal Register, Vol. 83, No.132, Proposed Rules. July 10, 2018. https://www.gpo.gov/fdsys/pkg/FR-2018-07-10/pdf/2018-14448.pdf

Federal Register, Vol. 75, No.236, Rules and Regulations, December 10, 2010. https://www.gpo.gov/fdsys/pkg/FR-2010-12-09/pdf/2010-30296.pdf

Irwin, S. and D. Good. "On the Value of Ethanol in the Gasoline Blend." farmdoc daily (7):48, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 15, 2017.

Irwin, S., and D. Good. “More on the Competitive Position of Ethanol as an Octane Enhancer.” farmdoc daily (6):31, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 17, 2016.

Irwin, S. and D. Good. “The Competitive Position of Ethanol as an Octane Enhancer.” farmdoc daily (6):22, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 3, 2016.

Irwin, S., and D. Good. “Further Evidence on the Competitiveness of Ethanol in Gasoline Blends.” farmdoc daily (5):17, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 30, 2015.

Lade, G.E., S. Pouliot, and B.A. Babcock. “E15 and E85 Demand Under RIN Price Caps and an RVP Waiver.” CARD Policy Brief 18-PB-21, Iowa State University, March 2018. https://www.card.iastate.edu/products/publications/pdf/18pb21.pdf

Radich, T., and S. Hill. “Issues and Methods for Estimating the Share of Ethanol in the Motor Gasoline Supply.” U.S. Energy Information Administration, October 6, 2011. https://www.eia.gov/workingpapers/pdf/ethanol_blend_ratio.pdf

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.