2018 Third Quarter RIN Update

Today’s post provides the third quarterly update on RIN generation for 2018. Generation figures and projections are based on available data from EPA’s EMTS through September of 2018, with annual projections compared with the target mandate levels outlined in the final rulemaking for 2018. The previous RIN updates (farmdoc daily, July 26, 2018; May 23, 2018) provided summary net generation estimates for the first and second quarters of 2018.

Advanced RIN Generation

Through September, more than 196 million D3 RINs have been generated, an average pace of 21.8 million per month. An additional 1.5 million D7 RINs have been generated, coming primarily from cellulosic diesel and also some heating oil. According to the EMTS data, no D7 RINs have been generated since June. These generation figures would put projected cellulosic RIN generation at close to 265 million for the year. While this continues to fall short of the 288 million gallon cellulosic mandate level for 2018, the pace of monthly generation of D3 RINs increased during the third quarter. If the third quarter pace continues, generation could exceed 270 million for the year. However, it remains likely that cellulosic waiver credits may be needed for 2018 compliance.

Figure 1 plots monthly D4 RIN generation relative to implied monthly mandate needs (annual mandate divided by 12) using data from the EMTS through September 2018. Gross generation of D4 RINs now total more than 2.75 billion, averaging nearly 306 million per month for the year. Since 2014, generation of D4 RINs in the second half of the year has been at least 20% higher than over the first six months. Third quarter generation continued that trend, averaging 328 million per month compared with 295 million per month through June. Extending the pace of third quarter generation through the end of the year, generation of D4 RINs in 2018 could still approach 3.9 billion for the year. This would provide sufficient D4 RINs to meet the 2.1 billion gallon (3.15 billion RIN) mandate for 2018, while also providing surplus D4 RINs to apply towards the total non-cellulosic advanced mandate.

The pace of generation of D5 RINs increased in the third quarter, particularly in August and September, and is now averaging just over 10.2 million per month through September. Similar to D4 RINs, generation of D5 RINs typically increases in the second half of the year. In 2016, 38% more D5 RINs were generated in the second half of the year than in the first half. In 2017, the pace of generation increased by over 75% in the second half of the year. The observed increase in third quarter generation follows the historical trend, and implies total generation of D5 RINs could still reach or exceed 100 million in 2018.

Combining the D4 and D5 RIN generation projections results in a total estimated gross generation at or slightly exceeding the 4.01 billion RIN non-cellulosic advanced mandate level for 2018 (4.29 billion total advanced less the 288 million cellulosic). Retirements of a portion of those RINs due to biodiesel exports and non-compliance purposes will ultimately reduce the amount available for compliance.

Data from the EIA reports a total of 66.9 million gallons (100.4 million RINs) of biodiesel exports through July. Historically, biodiesel exports are higher from March through October, a pattern that seems to be continuing in 2018. The data suggests that total exports in 2018 could approach 100 million gallons (150 million RINs).

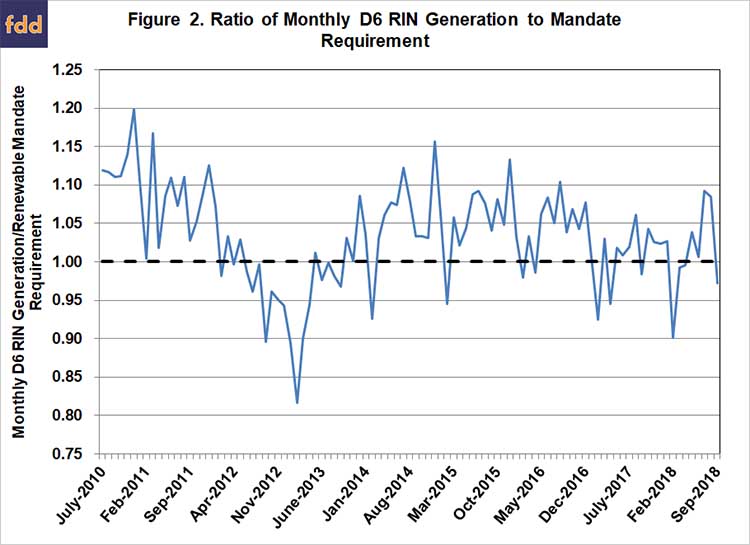

D6 RIN Generation

Figure 2 plots D6 RIN generation relative to implied mandate needs through June 2018. Monthly gross generation increased again in the third quarter, averaging 1.31 billion per month from July through September, and more than 1.26 billion per month for the year. This remains above the pace of generation over the first half of 2017, and suggests that gross generation could approach 15.3 billion D6 RINs in 2018.

While this rate of generation would be sufficient to cover the 15 billion RIN renewable gap portion of the overall mandate for 2018 (19.29 billion total less the 4.29 billion advanced mandate), a portion of these D6 RINs will be unavailable for compliance due to ethanol exports and other non-compliance retirements.

Annual exports of denatured ethanol for fuel use have averaged between 460 and 560 million gallons since 2014. Through August of 2018, 485 million gallons of denatured ethanol exports have been reported (USITC). Denatured ethanol exports reached their highest level of 561 million gallons in 2016. Through August of that year, denatured ethanol exports were at 370 million gallons, more than 100 million gallons behind the current pace in 2018. The data for 2018 point towards a record setting year for denatured ethanol exports, suggesting levels exceeding 700 million gallons.

Summary

Data on RIN generation from EPA’s EMTS through the third quarter of 2018 indicates that the rate of gross generation of all categories of RINs is at or slightly above that experienced in 2017 and, similar to previous years, has strengthened in recent months relative to earlier in the year. Gross generation will likely be sufficient to meet compliance requirements for all but the cellulosic portions of the RFS mandates for 2018.

However, the pace of exports of biodiesel and denatured ethanol in 2018 has also exceeded those experienced in recent years, and are on pace to reach record levels. Exports and other non-compliance retirements will ultimately reduce the amount of 2018 RINs available for use towards mandate compliance.

Assuming a loss of around 150 million D4 RINs due to export in 2018 would put net generation of non-cellulosic advanced RINs in the neighborhood of the 4.01 billion mandate level towards which D4 and D5 RINs can be applied. Gross generation of 15.3 billion D6 RINs coupled with 700 million gallons in denatured ethanol exports would put net generation at around 14.6 billon, falling 400 million RINs short of the 15 billion RIN renewable gap component of the overall mandate. This suggests that RIN generation rates need to continue to increase through the last quarter of 2018, the rate of exports needs to decline, or carryover RINs from previous years may be required for 2018 compliance.

References

Environmental Protection Agency. "Renewable Fuel Standard Program: Standards for 2018 and Biomass Based Diesel Volume for 2019; Final Rule." Federal Register 82(237), December 12, 2017. https://www.gpo.gov/fdsys/pkg/FR-2017-12-12/pdf/2017-26426.pdf

Environmental Protection Agency. “Public Data for the Renewable Fuel Standard.” https://www.epa.gov/fuels-registration-reporting-and-compliance-help/public-data-renewable-fuel-standard

Paulson, N. "2018 First Quarter RIN Update." farmdoc daily (8):94, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 23, 2018.

Paulson, N. "2018 Mid-Year RIN Update." farmdoc daily (8):138, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, July 26, 2018.

USITC Interactive Tariff and Trade DataWeb. https://dataweb.usitc.gov/scripts/user_set.asp

U. S. Energy Information Administration. "Petroleum & Other Liquids: Exports." Released April 30, 2018; accessed October 25, 2018. http://www.eia.gov/dnav/pet/pet_move_exp_dc_NUS-Z00_mbbl_m.htm

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.