Case Study: Farm Program Value Over Two Years

Agricultural Risk Coverage at the Individual Level (ARC-IC) will make payments in 2019 for farms that are entirely prevented plant or farms with low yields. Farmers weighing ARC-IC may follow a strategy to find a payment maximizing combination of farms to enroll in ARC-IC (see farmdoc daily, February 18, 2020). An important caveat to this strategy of maximizing ARC-IC payment in 2019 is that the focus is solely on the value of 2019 payments, which may far exceed payments from the other programs in 2019. In making the two-year program decision, consideration should also be given to the 2020 payments, which are relatively uncertain. This article utilizes a case study of two farm units that trigger ARC-IC payments in 2019. In this study we evaluate what 2020 prices and yields would offset the value of the 2019 ARC-IC payment if those acres were instead enrolled in the other farm programs.

The 2019 Versus 2020 Question

For some unplanted or low yielding farms, ARC-IC will make larger payments in 2019 than the other programs: Price Loss Coverage (PLC) and Agriculture Risk Coverage at the County Level (ARC-CO). In the following case study, two FSA farm units are evaluated. In 2019, ARC-IC is estimated to make a payment exceeding PLC/ARC-CO choices by $39 per base acre over 240 total farm acres in Farm Unit A, and make a payment exceeding PLC/ARC-CO Choices by $33 per base acre over 440 total farm base acres in Farm Unit B. Note that the enrollment decision made will apply for both the 2019 and 2020 program years. A question then is: Will these farm units forgo potential PLC and ARC-CO payments in 2020 that exceed $39 per base acre for Farm Unit A or $33 per base acre for Farm Unit B while ARC-IC makes no payments? There is a possibility of this occurring but that possibility seems small.

ARC-IC Multi-Farm Case Study

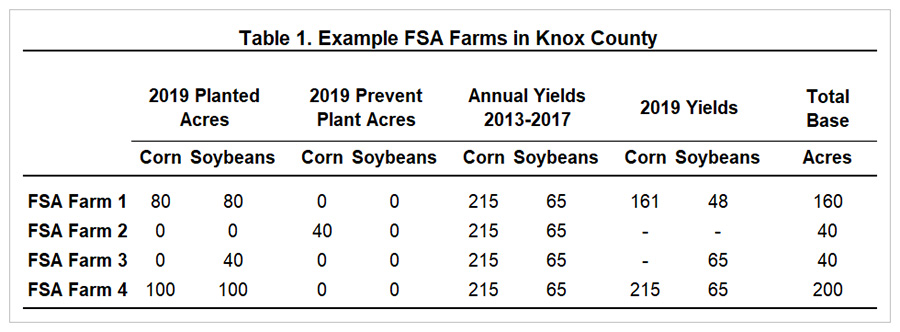

Consider an example set of farms in Knox County. Table 1 shows pertinent farm information necessary to calculate ARC-IC payments in 2019: the 2019 planted and prevent acres, the 2019 yields, the yields for 2013 through 2017, and base acres. For simplicity, farm yields of 215 bushels per acre for corn and 65 bushels per acre for soybeans are used each year from 2013 to 2017 when the crop was planted. These 2013-2017 yields are used in calculating benchmark revenue for corn and soybean. Knox County county-level yields over the five-year period from 2013 through 2017 are 213 bushels per acre for corn and 61 bushels per acre for soybeans, so production on the example farms is very similar to the county average over the five-year period. This analysis is conducted using the 2018 Farm Bill What If Tool.

FSA Farm 1 has 160 base acres. The planted acres on this farm have been evenly split between corn and soybeans dating back to 2013. Following that pattern, 80 acres were planted to corn and 80 acres were planted to soybeans in 2019. There were no prevent plant acres. The farm yields were approximately 25% below the historical average for the farm, coming in at 161 bushels per acre for corn and 48 bushels per acre for soybeans. Individually, this farm triggers an ARC-IC payment of $46 per base acre or $7,394 for the farm, and payment rate is capped at the maximum payment level.

FSA Farm 2 has 40 base acres. The planted acres on this farm have rotated between corn and soybeans annually dating back to 2013. Following that pattern, 40 acres were intended for corn in 2019 but all 40 acres intended for corn were prevented plant. Individually, this farm triggers an ARC-IC payment of $54 per base acre or $2,158 for the farm, and payment rate is capped at the maximum payment.

FSA Farm 3 has 40 base acres. The planted acres on this farm have rotated between corn and soybeans annually dating back to 2013. Following that pattern, 40 acres were planted to soybeans in 2019. The farm yield in 2019 was average for the farm at 65 bushels per acre, the same is the historical average. Individually, this farm does not trigger an ARC-IC payment.

FSA Farm 4 has 200 base acres. The planted acres on this farm have been evenly split between corn and soybeans dating back to 2013. Following that pattern, 100 acres were planted to corn and 100 acres were planted to soybeans in 2019. There were no prevent plant acres. The farm yields in 2019 were average for the farm at 215 bushels per acre for corn and 65 bushels per acre for soybeans. Individually, this farm does not trigger an ARC-IC payment.

Note that only FSA Farm 1 (low yields) and FSA Farm 2 (prevent plant) would trigger ARC-IC payments individually. If only those two farms were enrolled in ARC-IC, the payment would be $48 per base acre or $9,600 for both farms. Note that the ARC-IC program only pays on 65% of base acres while ARC-CO and PLC pay on 85% of base acres. The 2018 Farm Bill What If Tool applies these acreage rates and produces a per base acre rate that applies to all acres on the farm and is comparable across the three programs. Enrolling FSA Farm 3 in addition to FSA Farms 1 and 2 would reduce the payment rate to $47 per base acre but spread payment across 40 additional base acres for a total farm payment of $11,280. This is an example of the strategy evaluated in a previous article (see farmdoc daily, February 18, 2020). If the farmer elected to enroll all four FSA farms in ARC-IC the payment rate would be further reduced to $36 per base acre but spread across 200 additional base acres for a larger total farm payment of $18,000. In this case study, two farm units are evaluated:

- Farm Unit A: FSA Farm 4 does not exist, optimal combination for ARC-IC is FSA Farms 1, 2, and 3.

- Farm Unit B: All four FSA farms exist, optimal combination for ARC-IC is FSA Farms 1, 2, 3, and 4.

2019 Payment Comparison

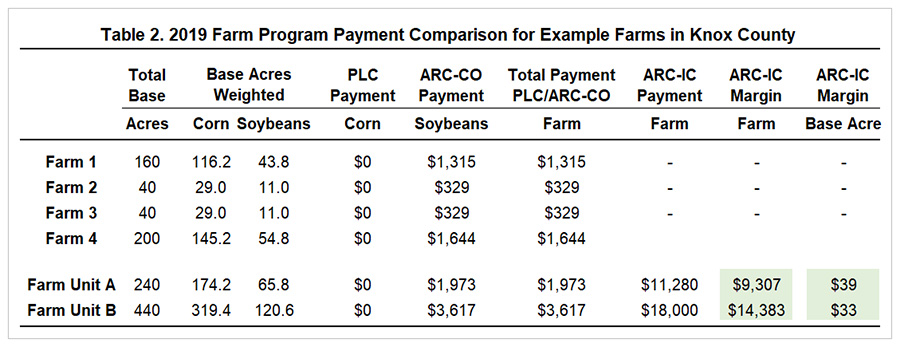

Based on projections for 2019 national market year average (MYA) prices of $3.85 for corn and $8.75 for soybeans from the February World Agricultural Supply and Demand Estimates (WASDE) report, neither crop is expected to receive a PLC payment for the 2019 program year. The MYA prices would have to fall below $3.70 for corn and $8.40 for soybeans to begin triggering a PLC payment. Utilizing the MYA prices and county yields expected for the 2019 program year, ARC-CO is expected to make a payment of $30 per base acre for soybeans and $0 per base acre for corn in Knox County. Given that ARC-CO is expected to make a payment on soybean base acres in 2019 and PLC is not, we determine a farmer not enrolling in ARC-IC would enroll soybean base acres in ARC-CO.

The Gardner-farmdoc Payment Calculator (https://fd-tools.ncsa.illinois.edu/arcplc) can be used to estimate the general likelihood for farm program payments with the ARC-CO and PLC programs. For corn, there is a larger likelihood of PLC payments in both 2019 and 2020 we determine a farmer would select PLC as the alternative choice for corn base acres.

Because ARC-CO and PLC are crop level programs, the allocation of base acres by commodity is needed to calculated payments. Base acres represent the number of acres of a given commodity that are eligible to receive farm program payments on an FSA farm. Base acres may not align with what is currently planted on the farm. In Illinois, base acres are more heavily weighted toward corn. For 2019, corn base acres represent 65% of total corn and soybean base acres in the state although planted acres were split almost evenly between the two crops. In Knox County, this is even more pronounced, corn base acres are 72.6% of total corn and soybean base acres in 2019. This ratio of base acres is applied to the FSA farms in both farm units.

In 2019, the total payments from PLC and ARC-CO would be $1,973 for Farm Unit A and $3,617 for Farm Unit B as shown in Table 2. These payments are significantly lower than the expected 2019 ARC-IC payments of $11,280 and $18,000, respectively, for the two farm units. The 2019 ARC-IC marginal value is $9,307 for Farm Unit A and $14,383 for Farm Unit B. For PLC and ARC-CO to be the better program selections for the two-year period, the 2020 payments from those programs would have to exceed $39 per base acre for Farm Unit A and $33 per base acre for Farm Unit B across all farm unit base acres.

2020 Payment Comparison

It is unlikely that the same combination of FSA farms that results in a high ARC-IC payment in 2019 will make a payment in 2020 because, in most situations, it is unlikely for low yields or prevent plant to occur on the same farms in 2020. The assumption of no ARC-IC payment in 2020 is recommended.

Farm Unit A and Farm Unit B would not generate ARC-IC payments in 2020 given the following assumptions: farms are planted to the crop on their standard rotation as noted earlier and there is no prevent plant in 2020, the farms achieve normal yields in 2020, the 2018 yields added to the benchmark revenue calculation (2014 through 2018 for 2020 instead of 2013 through 2017 in 2019) are the same as what was assumed for the 2013 through 2017 period, and national MYA prices for 2020 are the same as projected for 2019, $3.85 for corn and $8.75 for soybeans.

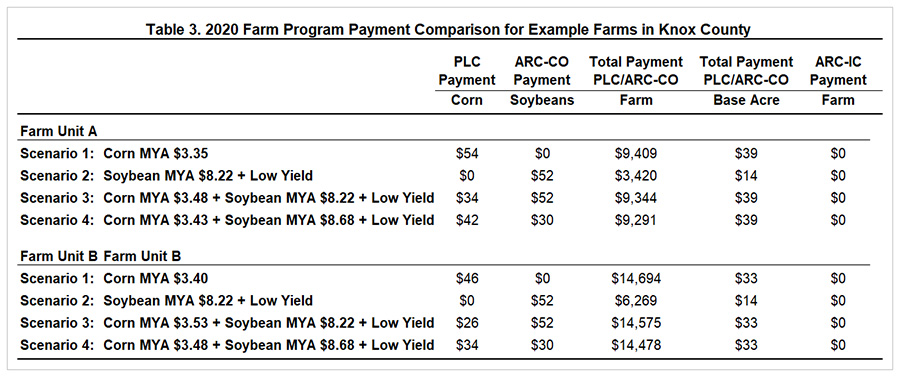

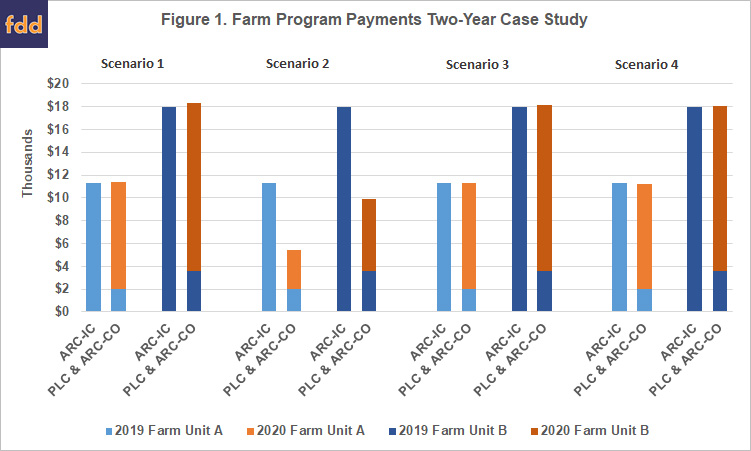

Assuming a corn PLC yield at the Knox County average PLC yield, the 2020 national MYA price for corn would have to be $3.35 to generate a PLC payment of $54 per corn base acre. This equates to $39 over all Farm Unit A base acres and would be large enough to offset the 2019 ARC-IC margin. For Farm Unit B, 2020 national MYA price for corn wouldn’t have to be quite as low to offset the 2019 ARC-IC margin. At $3.40 a PLC payment of $46 would be made on corn base acres, equating to $33 over all Farm Unit B base acres. Notably, these 2020 MYA prices would not generate 2020 ARC-IC payments for Farm Unit A or Farm Unit B. These PLC payments are shown as scenario 1 in Table 3 and Figure 1.

ARC-CO payments in Knox County for 2020 would top out at $52 per soybean base acre at 10% of benchmark revenue (adjusted for 85% of base acres). Assuming trend level county yields, national 2020 MYA price for soybeans would have to drop to $7.22 to reach the maximum payment level with ARC-CO. ARC-CO payments for soybeans could also occur as a result of lower MYA price combined with lower than trend yields. For example, if 2020 county yield is 56.4, the same as the estimated FSA yield for Knox County in 2019 (see farmdoc daily, February 18, 2020), the maximum $52 payment per base acre is reached at a MYA price of $8.22. Regardless of scenario to reach that point, the maximum ARC-CO payment of $52 per soybean base acre would not be large enough to offset the 2019 ARC-IC margin on Farm Unit A or Farm Unit B. When spread over all base acres on both farm units, this would only equate to a $14 per base acre payment, short of the $39 needed for Farm Unit A and short of the $33 needed for Farm Unit B. Notably, these combinations of 2020 MYA prices and yields applied at the farm level would not generate 2020 ARC-IC payments for Farm Unit A or Farm Unit B. These ARC-CO payments are shown as scenario 2 in Table 3 and Figure 1.

Considering the contribution of the maximum $52 per base acre soybean payment, we revisit what conditions would be necessary to generate a PLC payment for corn large to offset the remaining ARC-IC margin. For Farm Unit A, 2020 MYA price for corn has to drop to $3.48 generating a PLC payment of $34 per corn base acre. For Farm Unit B, 2020 MYA price for corn has to drop to $3.53, generating a PLC payment of $26 per corn base acre. This combination of PLC and ARC-CO payments are shown as scenario 3 in Table 3 and Figure 1.

Many combinations of PLC corn payments and ARC-CO soybeans payments in 2020 could exceed the 2019 ARC-IC margin. Combinations that result in moderate payments for both crops may seem more plausible although still not probable as it would take a combination of low yields for soybeans, low 2020 MYA price for soybeans, and low 2020 MYA price for corn. For example, the low soybean county yield and a MYA soybean price of $8.68 would trigger an ARC-CO payment of $30 on soybean base acres and a MYA corn price of $3.43 would trigger a PLC payment of $42 on corn base acres. The combination of these occurrences would be enough to generate payments of $39 across all of Farm Unit A base acres, shown as scenario 4 in Table 3 and Figure 1.

Case Study Summary

There are situations in which ARC-IC is the optimal farm program choice for the 2019 and 2020 program year decision, particularly farms that are entirely prevent plant or farms that experienced substantially lower yields in 2019. Including FSA farms in the ARC-IC farm unit that are not triggering an ARC-IC payment individually can be a good strategy for maximizing the 2019 ARC-IC payment. However, the larger and more diverse the ARC-IC farm unit becomes, the less likely it is the unit would experience a farm output in 2020 that would result in an ARC-IC payment for 2020. Even when conditions would result in 2020 PLC and ARC-CO payments large enough to exceed the 2019 ARC-IC margin, the two farm units in the case study did not trigger ARC-IC payments for 2020 under the same conditions.

Although there are many combinations of conditions that would result in PLC corn payments and ARC-CO soybean payments for 2020 to exceed the 2019 ARC-IC margin, it would take a combination of low yields for soybeans, low 2020 MYA price for soybeans, and low 2020 MYA price for corn.

As demonstrated using two farm unit example, the exact price and yield turning points will vary from farm situation to farm situation depending on the ratio of base acres assigned to specific commodities, the farm PLC yields, and county. This case study can be replicated to determine those turning points on any farm unit.

Conclusion

For farm units that expect a considerable ARC-IC payment for 2019, farmers should carefully weigh the possibility for 2020 payments from PLC and ARC-CO, including that ARC-IC pays on 65% of the base acres for all covered crops on the farm with base as compared to 85% of the individual crop base for PLC or ARC-CO, while assuming no ARC-IC payment in 2020.

In general, we can conclude that 2020 MYA prices would have to drop substantially from current projections, although within the realm of possibility. Taking ARC-IC may provide upside in 2019 payments but the trade-off is giving up the downside risk of considerably lower prices in 2020 that would trigger larger payments in ARC-CO or PLC. That is, in part, why this decision is dependent on the anticipated likelihood of considerably lower prices in 2020. Notably, farmers utilizing other forms of downside price protection may weight this trade-off differently than those who are not.

More information on the farm programs is available farmdoc‘s Farm Bill Tool Box.

Reference

Schnitkey, G., B. Brown, C. Zulauf, K. Swanson, J. Coppess and N. Paulson. “Multi-farm ARC-IC Tool and Other ARC-IC Information.” farmdoc daily (10):30, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 18, 2020.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.