Historical Analysis of the Frequency of Triggering Enhanced Coverage Option (ECO) Payments

The Enhanced Coverage Option (ECO) is a new crop insurance program that will be available for the first time in 2021. ECO can be used to supplement the coverage provided by an underlying individual plan of insurance such as Revenue Protection (RP). It is an area product that covers county-level losses between 95% (or 90%) and 86% of the county guarantee (see farmdoc daily from November 24, 2020 for additional information on ECO).

Since the optional coverage levels are relatively high, ECO will tend to trigger payments more often than coverage at lower levels. Thus premiums, even after subsidies are taken into account, may seem relatively high (see farmdoc daily from December 8, 2020 for example premium quotes). Today’s article provides a historical look at the frequency in which a product like ECO would have triggered payments in Illinois over the past 30 years (1990-2019).

Data and Analysis

The historical analysis of ECO is based on historical price and yield data from 1990 to 2019 which mimics the prices and yields that will be used to indemnify ECO moving forward.

Yield data for 1990 to 2019 were obtained from an “Area Plan Historical Yields” utility available from the Risk Management Agency (RMA). To establish yield trends to use as guarantees, county yields from the National Agricultural Statistical Service (NASS) from 1970 to 1989 were added to the SCO yields. These NASS yields were adjusted to reflect the fact that SCO yields typically are higher than NASS yields. A simple linear trend was fit to actual yields to calculate county yield guarantees for each of the 30 years in the historical analysis.

Price data includes the average futures settlement prices that are used to determine projected and harvest prices each year. For corn, the projected price is the average settlement price for the December contract during February of the same calendar year. The harvest price for corn is the average settlement price on the December contract during October. For soybeans, the projected price is the average settlement price for the November contract during February while the harvest price is the average of the same contract during October.

The historical yield and price data are then used as 30 “outcomes” for the ECO and SCO programs. In today’s article, we limit the analysis to ECO/SCO being used with a Revenue Protection policy, so that ECO/SCO provide county revenue coverage with a guarantee increase. For each year, the actual revenue (harvest price times actual yield) is compared to the revenue guarantee (higher of harvest or base price times trend yield). The proportion of years in which actual revenues fall below 95% or 90% of the guarantee represent years when ECO would have triggered payments at those coverage levels. We also compute the proportion of years when actual revenues are less than 86% of the guarantee, or years when the max ECO payment, and SCO payments, would have been triggered. These proportions are estimates of the frequency of ECO and SCO triggering payments in the future.

Historical Frequency of ECO and SCO Payments

Frequencies will be shown for all counties in Illinois. There will be differences in frequencies. Future outcomes may result in different spatial distributions. The average of payment frequency across counties is likely a more robust measure of the likelihood of ECO and SCO payments.

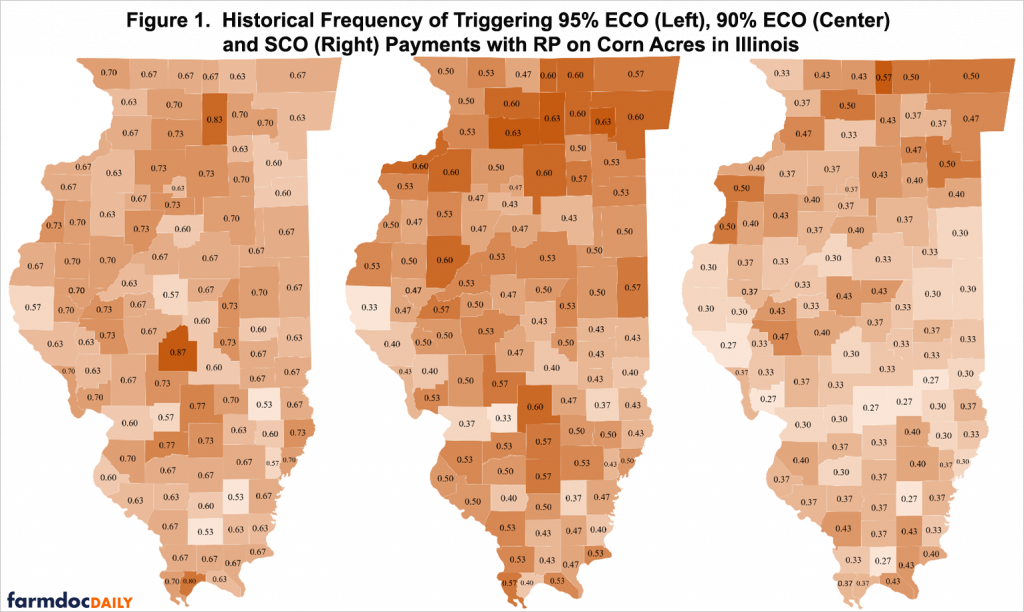

Figure 1 shows the estimated frequency of ECO and SCO payments being triggered on corn acres in Illinois counties when used with RP (ECO-RP, SCO-RP). The frequency of 95% ECO-RP payments on corn acres averages 67% across all 101 counties in Illinois, suggesting payments would be triggered roughly in 2 out of every 3 years. Payments would be expected to occur in more years than not. Frequencies for the individual counties range from 53% to 87%.

The frequency of 90% ECO-RP payments averages 50% across all Illinois counties, suggesting payments would be triggered roughly 1 out of every 2 years. Frequencies for individual counties range from 33% to 63%.

County revenue losses on corn acres in IL would exceed 14%, triggering the max ECO-RP payment (regardless of whether 95% or 90% coverage is elected), and SCO-RP payments, with an average likelihood of 37%, or just over 1 out of every 3 years. The historical frequency of triggering max ECO-RP, and SCO-RP, payments ranges from 27% to 57% across individual counties.

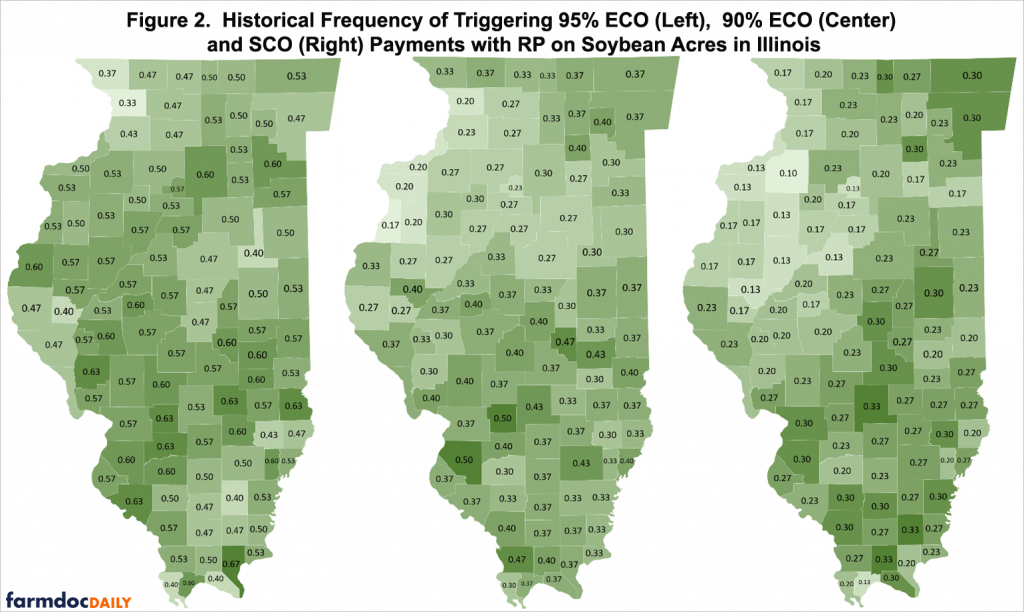

Figure 2 shows the estimated frequency of payments being triggered for 95% ECO-RP, 90% ECO-RP, and SCO-RP for soybeans across Illinois counties. Compared with corn, ECO and SCO payments on soybean acres are less likely.

The frequency of 95% ECO-RP payments averages 53% across all counties in Illinois, or approximately 1 out of every 2 years. Frequencies range from 33% to 67% across individual counties.

The frequency of 90% ECO-RP payments for soybeans averages 34% across all counties in Illinois, suggesting payments would be triggered roughly 1 out of every 3 years. Historical frequencies range from 17% to 50% across individual counties.

Maximum ECO-RP, and SCO-RP, payments are triggered with an average frequency of 23%, or just over 1 out of every 5 years. The frequency of triggering the max ECO and SCO payments ranges from 10% to 33% across individual counties in Illinois.

Discussion

The ECO is a new insurance product for 2021 that provides county-based coverage to supplement a farmer’s underlying individual plan of insurance. Premium rates for ECO coverage may be perceived as relatively high, particularly when the 95% coverage level option is chosen. For example, the premium quote for 95% ECO-RP will likely be greater than the premium for an underlying RP policy at an 85% coverage level.

This implies a more than doubling of total premium expenses if ECO is used. Historical experience with the Supplemental Coverage Option (SCO) suggests somewhat limited interest in supplemental county-based coverage (see farmdoc daily from January 31, 2020). Whether ECO will garner greater interest given the large impact on total premium expenses remains an open question.

The premiums for ECO reflect the high coverage levels available – 95% and 90%. At these high coverage levels, the likelihood of losses sufficient to trigger payments increases significantly relative to lower coverage levels. For corn in Illinois, 95% ECO-RP payments have historical odds of being triggered of at least 50% in all counties, with an average historical frequency across counties of 67%. The average historical frequency of 90% ECO-RP payments being triggered is 50%. ECO payments would reach their maximum limit, and SCO payments would be triggered, with an average historical frequency of 37%.

Soybeans have a lower likelihood of triggering ECO payments relative to corn. The average historical frequencies for 95% and 90% ECO-RP being triggered are 53% and 34%, respectively, for soybeans in Illinois. ECO payments would hit the max, and SCO payments would be triggered, with an average historical frequency of 23%.

Thus, while premium costs may be relatively high, ECO is a program that will tend to trigger payments quite often. It may be prudent to consider ECO, particularly as an option to increase the amount of price risk protection while continuing to use an individual policy as the main underlying plan of insurance.

Finally, we note that there are fairly significant differences in the historical frequency of payments across individual counties. With more years of data included in calculating frequencies, the differences across counties may converge to be closer to one another. In any case, the difference in frequencies highlight that, in any given year, some counties might trigger ECO and SCO payments and others will not.

References

Paulson, N., G. Schnitkey, K. Swanson and C. Zulauf. “The New Enhanced Coverage Option (ECO) Crop Insurance Program.” farmdoc daily (10):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 24, 2020.

Schnitkey, G., N. Paulson, K. Swanson and C. Zulauf. "Premiums for the Enhanced Coverage Option." farmdoc daily (10):208, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, December 8, 2020.

Zulauf, C., G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. "Historical Look at SCO (Supplemental Coverage Option) Participation." farmdoc daily (10):18, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 31, 2020.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.