High Corn and Soybean Return Outlook for 2021

The U.S. Department of Agriculture released 2021 corn and soybean supply balance sheets for the first time in the May World Agricultural Supply and Demand Estimates (WASDE) report. In the report, the market year average (MYA) prices for 2021 are projected at $5.70 per bushel for corn and $13.85 per bushel for soybean. The 2021 projections are high relative to historical prices. We estimated gross revenue and returns for corn and soybeans on high-productivity farmland in central Illinois using these 2021 MYA projections. At those prices, returns for corn and soybeans will be at record levels, similar to returns from 2010 to 2012.

Market Year Average Prices

The May WASDE report contains a projection of $5.70 per bushel for corn in 2021. This 2021 MYA price is for the marketing year that begins in September 2021 and ends in August 2022. It is a national price, representing the average cash price received by all U.S. farmers for corn.

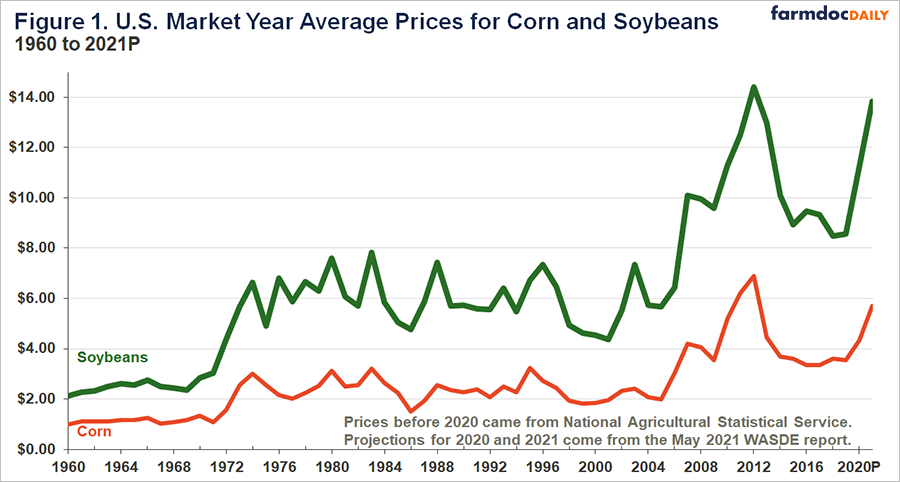

A $5.70 price would be the third-highest price in history (see Figure 1). Only the $6.22 MYA price in 2011 and the $6.89 price in 2012 exceed $5.70 per bushel (see Figure 1). From the 2012 high, corn prices declined, averaging below $4.00 from 2014 to 2019. Since 2019, corn prices rose to a projected MYA average of $4.35 per bushel for the 2020 marketing year that goes through August 2021, and are projected to increase further for the 2021 marketing year.

Similar to corn, the 2021 marketing year for soybeans begins in September 2021 and ends in August 2022. If it occurs, the $13.85 price for 2021 will be the second-highest price on record (see Figure 1). The highest price of $14.40 per bushel occurred in 2012. From the 2012 high, soybean prices declined, averaging below $9 per bushel in 2018 and 2019. Prices then increased to $11.25 per bushel projected for 2020 MYA. A further increase to $13.85 per bushel is projected for 2021, which would be $5.28 per bushel higher than the 2019 price, an increase of 61%.

Actual prices can vary from those projected in the first WASDE report. Last year, for example, the first estimate of the 2020 MYA corn price was $3.20 per bushel. The latest projection from the May 2021 report is $4.35 per bushel for the 2020 MYA corn price, $1.15 per bushel higher than the initial estimate. Similarly, the first projection of the 2020 MYA price for soybeans was $8.20, with the current forecast of the 2021 MYA price at $11.25 per bushel.

Many momentous events occurred in the past year. The introduction of the coronavirus resulted in control measures, resulting in negative impacts on many industries including agriculture. Mitigating these COVID-induced impacts have been robust export demand for soybeans and corn, with exports to China being considerable. COVID control measures now appear to be in the past. Currently, USDA is projecting a supply and demand situation that will result in very tight ending stocks at the end of the 2021 marketing year, particularly for soybeans.

WASDE price estimates are reasonable at this point, with the caveat that unexpected events do occur in agriculture like those that transpired in 2020. In addition, normal variations in price will occur because of growing season conditions in the U.S. Prices likely will be lower than WASDE projections if weather is conducive to high yields. Conversely, prices could be higher if 2021 yields are low. As always at this time of the year, the actual price can vary considerably from the projection, as can be observed by the range in prices generated by the Price Distribution Tool, which is described in a May 11, 2021 farmdoc daily article.

Revenue Projections

WASDE price forecasts are used to project revenue and returns for high-productivity farmland in central Illinois. Figure 2 shows gross revenue for corn from 2000 to projections for 2021. Historical revenues come from central Illinois farmers enrolled in Illinois Farm Business Farm Management (FBFM) and are available in the management section of farmdoc (here). Gross revenue includes crop revenue (yield times average price). Other revenue includes commodity title payments, crop insurance payments, and ad hoc government payments. In recent years Market Facilitation Program (MFP) and Coronavirus Food Assistance Program (CFAP) payments have been significant ad hoc government programs.

For 2021, the trend yield of 218 bushels per acre is used in projecting corn revenue. A corn price of $5.70 per bushel is used, the same as given in the May WASDE report. From 2000 to 2019, average prices received by central Illinois farmers exceeded the MYA price by $.04 per bushel. Uncertainty in estimates does not warrant making this minor adjustment. Given this price and yield forecast, gross revenue is forecast at $1,247 per acre. At this point, other revenue is projected to be $0 per acre.

The $1,237 gross revenue for corn in 2021 will be the highest on record if it occurs. The next highest revenue occurred in 2012 — the drought year — when revenue was $1,192 per acre. In 2012, $295 of gross revenue came from crop insurance payments. Projections for 2021 differ from 2012 in that all revenue in 2021 is projected from crop revenue.

Corn’s 2021 gross revenue is higher than 2019 and 2020 revenues. Gross revenue was $893 per acre in 2019 and $1,071 in 2020. In both those years, other revenues from MFP and CFAP payments were significant sources of gross revenue.

Figure 3 shows historic and projected gross revenues for soybeans. For 2021, gross revenue for soybeans is projected at $942 per acre based on a 68 bushel per acre trend yield and a $13.85 soybean price. The soybean price is the same as the WASDE projection contained in the May report. From 2000 to 2019, soybean prices received by central Illinois farmers averaged $.28 per bushel higher than MYA prices. Adding this adjustment would increase projected gross revenue.

If it occurs, the $942 gross revenue for soybeans will be the highest on record. The previous high was set in 2020, when gross revenue was $855 per acre. The $855 per acre includes $45 per acre of other payments, many of which were CFAP payments. The next highest revenue occurred in 2018 when gross revenue from soybeans averaged $819 per acre.

Operator and Land Returns

Operator and land return projections were made using the revenues described above and non-land cost projections contained in a farmdoc daily article (January 26, 2021). Operator and land returns represent a return to both the farmer and landowner. Under a cash rental situation, subtracting the cash rent from operator and land return gives the farmer return.

Operator and land return for corn is projected at $657 per acre (see Figure 4). If it occurs, the $657 return will be the highest on record, exceeding the previous high of $574 per acre set in 2012. Operator and land return for soybeans is projected at $574 per acre. The 2021 return would be the highest on record, exceeding the previous high of $496 per acre set in 2020.

Operator and farmland returns were relatively high from 2010 to 2012 (see figure 4). From 2012, revenues declined, and operator and land returns were low. Returns in 2020 and projected for 2021 are similar to those from 2010 to 2012.

Summary

High prices and high returns are possible for 2021. As always, much can happen between now and harvest-time in the fall. Still, prices and returns point to an optimistic outlook.

An optimistic outlook leads to the usual questions that will be faced later this summer and into fall when planning for 2022 production will begin in earnest. Given that high prices continue into the fall, cash rents and other input costs will face upward pressures. Typically, high returns also lead to increases in farmland prices, a situation that may already be occurring. Rising rents and costs will then raise questions of how long higher corn and soybean prices will last and whether we will return to corn prices below $4.00 per bushel and soybean prices below $10.00 per bushel. If — or perhaps more realistically, when — commodity prices decline, will rents and costs have overshot return levels, then leading to difficult adjustments in the future?

While those issues may have to be faced in the future, the focus now likely needs to be on current growing conditions. Adding to the financial strength of farms remains a very good possibility for 2021.

References

Schnitkey, G., C. Zulauf, K. Swanson and N. Paulson. "Chances of Lower Harvest Time Prices on Corn and Soybeans Futures Contracts in 2021." farmdoc daily (11):75, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 11, 2021.

Schnitkey, G., K. Swanson, C. Zulauf and N. Paulson. "Revised 2020 and 2021 Crop Budgets Indicate Higher Returns." farmdoc daily (11):12, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 26, 2021.

Schnitkey. "Revenue and Costs for Illinois Grain Crops, Actual for 2014 through 2019, Projected for 2020 and 2021." Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 2021.

USDA, World Agricultural Outlook Board. World Agricultural Supply and Demand Estimates (WASDE). https://www.usda.gov/oce/commodity/wasde

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.