US Federal Debt

Objective of this article is to put the concern over US Federal debt into perspective. US Federal debt has grown substantially both in dollar terms and relative to US Gross Domestic Product (GDP), but history suggests Federal debt is unlikely to have a greater than normal impact on Federal policy and spending until interest expense becomes a much higher share of Federal outlays. The data in this article are from the St. Louis Federal Reserve Bank. Follow-up articles will examine the related topics of US interest rates and the US labor market.

US Federal Debt since World War II

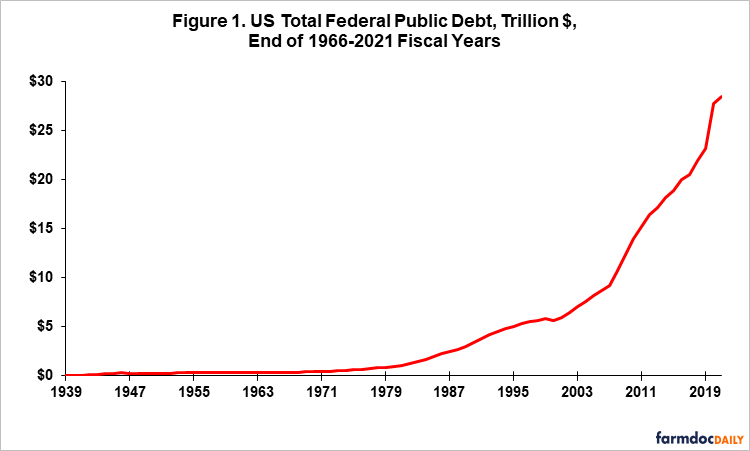

As of June 30, 2021; US Federal public debt totaled $28.4 trillion (see Figure 1). Rate of growth materially increased in the mid-1970s. Annual growth has averaged 9.1% since 1975 vs. 2.3% from 1946 through 1975. Since 1975, Republicans have been President 24 years; Democrats 21 years. Democrats (Republicans) controlled 12 (10) 2-year sessions of the Senate. The breakout is the same for control of the House.

Ratio of US Debt to GDP

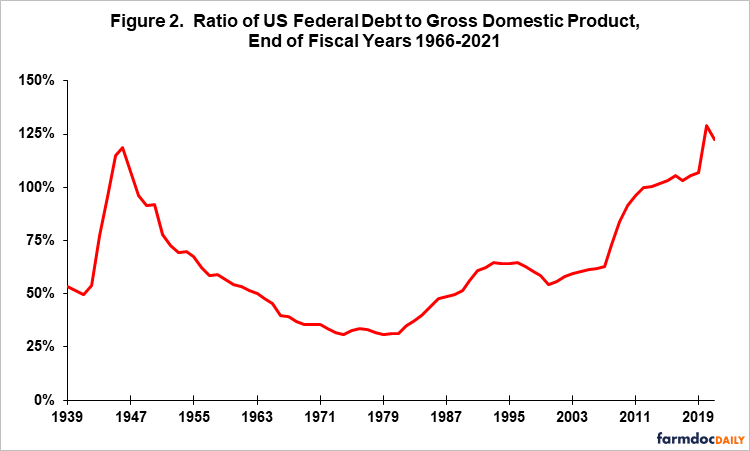

Another key measure of government debt is its ratio to GDP. This ratio declined steadily after World War II, reaching a low of 31% in 1974 (see Figure 2). The ratio began to increase in 1982. After plateauing at 55% – 65% during 1990-2007, the ratio has since doubled to 123% as of June 30, 2021. Two major economic disruptions explain much but not all of this doubling: (1) the 2008-2010 US real estate crisis and associated recession and (2) the COVID-19 pandemic starting in early 2020.

Federal Interest Outlays

Current conventional economic wisdom is that the concern with government debt comes with interest payments on the debt. Unsurprisingly given the growth in Federal public debt, Federal outlays for interest have also grown (see Figure 3). Federal interest outlays are 15 times higher in 2021 than 1975; Federal public debt is 49 times higher. Compared with 2007, 2021 Federal interest outlays are 1.5 times higher while Federal public debt is 3.1 times higher. The difference in growth of Federal interest outlays and debt reflects the long-run decline in interest rates that began in the early 1980s.

Ratio of Interest to Total US Federal Outlays

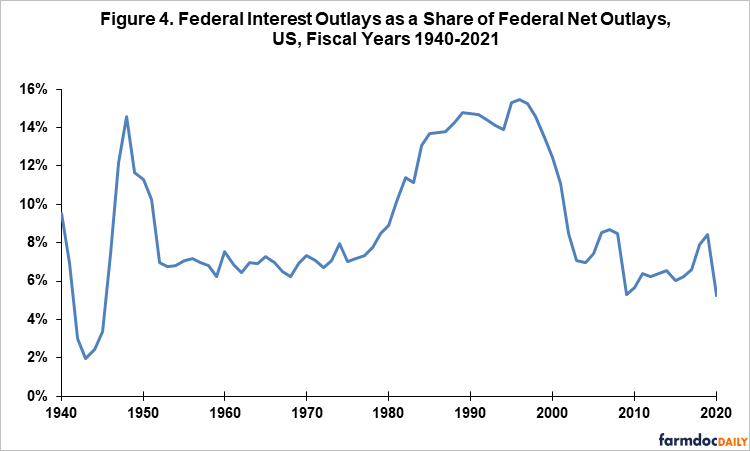

Ratio of interest outlays to total US Federal outlays since FY1940 divides into two regimes (see Figure 4). From 1980 to 2000, the ratio averaged 13.5%. In all other years since 1940, the ratio averaged 7.2%. The 1980-2000 regime was a period when Federal debt and budget deficits were major constraints on US policy and spending as various laws were enacted to limit the increase and/or cut Federal spending. In 2021, interest is 5.2% of total Federal Outlays. This ratio is probably abnormally low due to the huge spending on COVID 19 relief. However, even in 2019, the ratio was 8.4%, still substantially below the 1980-2000 level.

Summary Observations

Since the mid-1970s, the US has pursued a policy of increasing national debt, whether measured in dollars or relative to GDP. This increase has transcended Republican and Democratic control of the Presidency and Congress.

US Federal COVID assistance is large, but not out of character in the post-1975 context.

Despite the growth in US Federal spending post 1975, declining interest rates has meant the current ratio of US interest outlays to total US government outlays is not out of line with its long run average.

More importantly, the ratio of Federal interest to Federal outlays does not suggest US Federal debt, more accurately interest outlays for the debt, will have a greater than normal impact on US policy and spending in the near term unless interest outlays materially increase as a share of total Federal outlays.

Debt per se is rarely the sole cause of economic stress. Economic stress usually occurs when high debt combines with an unexpected, negative event. A potential key risk for the US is an increase in interest rates translating into higher Federal interest payments that impact the formation and spending on Federal policy. A follow-up article will examine the US interest rate context.

Data Source

Federal Reserve Bank of St. Louis. 2021, December. Federal Reserve Economic Data (FRED). https://fred.stlouisfed.org

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.