How Well Have Farmers Done in Choosing Between ARC-CO and PLC

This article calculates what payments would have been if farmers had elected all ARC-CO (Agriculture Risk Coverage – county) and PLC (Price Loss Coverage) base acres into the program that made the higher payment per base acre. Maximum payment exceeded actual payment by 7%, implying farmers captured 93% of potential ARC-CO plus PLC payments. In dollar terms, forgone payments averaged $0.34 billion per year for the 2014-2020 crop years. An early farm bill proposal is to pay the higher of these two commodity program payments. This historical analysis suggests this proposal has a $3.4 billion 10-year cost ($0.34*10), the budget period used for the farm bill.

Procedures

ARC-CO and PLC were program options for the 2014-2020 crop years. Farmers made 2 program decisions over this period. One was for the 2014-2018 crop years. The other for the 2019-2020 crop years. Payments made to program commodities planted on generic base acres for the 2014-2017 crop years are removed. These payments were to upland cotton base acres, not to a program commodity base acres. A third program option is ARC-IC (ARC-individual farm). ARC-IC has never had more than 3.9% of total base acres (2019 and 2020). The decision is thus between ARC-CO and PLC in most situations. Each program option is briefly discussed in the Appendix.

For each decision period, actual payments by ARC-CO (PLC) are divided by the base acres in ARC-CO (PLC). The program with the higher payment per base acre is identified. Maximum potential payment for each decision period is obtained by multiplying for each crop (1) the higher payment per base acre and (2) total ARC-CO plus PLC base acres. Maximum payment for a program commodity in both periods is summed to obtain the program commodity’s 2014-2020 maximum payment.

To illustrate the calculation for corn for the 2014-2018 decision period, ARC-CO made $122 in actual payments per ARC-CO base acre after removing payments to generic base. PLC’s comparable value was $77 per PLC base acre. ARC-CO payment was higher. Base acres in ARC-CO (PLC) were 90.06 (6.39) million, for a total of 96.45 million. Maximum potential payment is $11.77 billion ($122 per base acre times 96.45 million ARC-CO plus PLC base acres), or 2.8% higher than the actual ARC-CO plus PLC payments of $11.45 billion for 2014-2018 (2.8% = [($11.77-$11.45) / $11.45].

Findings – All Program Commodities

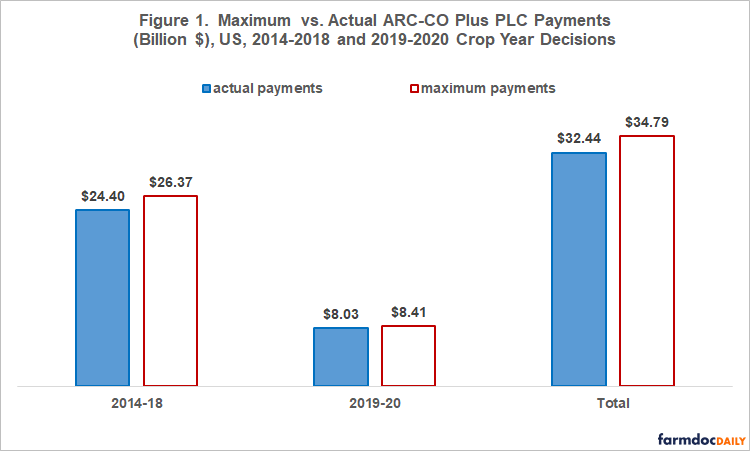

Actual ARC-CO plus PLC payments for the 2014-2020 crop years totaled $32.44 billion (see Figure 1) for all program commodities. If all ARC-CO plus PLC base acres of a crop had been in the program that paid more per base acre in each decision period (2014-2018 and 2019-2020), total payments would have been $34.79 billion, or 7% higher. Maximum exceeded actual payments by a similar value in both decision periods: 8% for 2014-2018 vs. 5% for 2019-2020. Foregone payments totaled $2.35 billion ($34.79 – $32.44) over the 7 crop years. Average annual foregone payment was $0.34 billion ($2.35 billion / 7 years).

Findings – Individual Program Commodity

Wheat accounted for $1.27 billion or over half of the $2.35 billion in 2014-2020 foregone payments (see Figure 2). Foregone payments also exceeded $100 million for corn, sorghum, soybeans, and seed cotton. Seed cotton did not become a covered program commodity until the 2018 crop year, so its foregone payments occurred over 3, not 7 years.

The 5 program commodities with the largest foregone payments also have the largest number of base acres. Another metric for examining foregone payments is foregone payment per enrolled base acre. A much different rank order emerges (see Figure 3). Crambe has the highest average foregone payment per base acre per year of $12.00, with mustard next at $5.31. Among program commodities with at least 1 million ARC-CO plus PLC base acres, sunflowers had the highest average foregone payment per base acre per year of $4.43. Wheat’s high foregone payments for 2014-2020 reflects a combination of roughly 63 million base acres, second only to corn’s 96 million base acres, plus a higher than average foregone payment per base acre per year of $2.91.

The 2 crops with the highest average per crop year actual commodity program payment over the 2014-2020 crop years [(peanuts ($149) and long-grain rice ($117)] have the 2 lowest foregone payments per base acre per year in Figure 3. This finding implies that paying the higher of ARC-CO and PLC payment per base acre would have somewhat reduced the difference in payment per base acre across program commodities.

Summary Observations

As with most analyses, assumptions are made to simplify this analysis. A key assumption is that average ARC-CO (PLC) payment per base acre for base acres in ARC-CO (PLC) is the same as average ARC-CO (PLC) payment per base acre for base acres in the other program, i.e. PLC (ARC-CO).

Given the preceding assumption, farmers captured 93% of total potential payments by ARC-CO and PLC over the 2014-2020 crop years.

Foregone payments totaled $2.35 billion over the 7 crop years. Assuming the 2014-2020 experience is an accurate reflection of future foregone earnings, the 10 year budget cost of paying farmers the higher of ARC-CO or PLC payment per base acre is estimated to be $3.4 billion. This is new expenditure money that Congress would have to provide or redirect from some other spending line. A 10-year budget period is used by Congress when scoring the cost of farm bill proposals.

Paying the higher of ARC-CO or PLC payment per base acre would have resulted in a somewhat more equal payment per base acre across the 23 current program commodities.

Appendix – Description of Program Options

ARC-CO pays when county revenue declines below 86% of a county benchmark based on revenue from the market for 5 recent crop years. PLC pays when US market year price is below 100% of a reference price set by Congress. ARC-IC pays when average per acre actual revenue from all program crops planted on an ARC-IC farm unit is less than 86% of the per acre benchmark revenue for the ARC-IC farm unit. An ARC-IC farm unit is the sum of a producer’s share in all FSA farms the producer enrolls in ARC-IC in a state. ARC benchmark revenue is determined using 5-year Olympic averages (removes high and low values) of county (ARC-CO) or farm (ARC-IC) yield and US market year price. The effective reference price is a floor on a year’s price. PLC payment yield is fixed by farm for each program crop. ARC-CO and PLC pay on 85% of base acers while ARC-IC pays on 65% of base acres. ARC-CO and ARC-IC have a 10% per acre payment cap while PLC has a payment cap dependent on the difference between a crop’s reference price and loan rate. Crop insurance’s Supplemental Coverage Option (SCO) is available only if PLC is elected. Situations when ARC-IC is an option to consider are discussed by Zulauf, et al. in an October 29, 2019 farmdoc daily article.

References and Data Sources

US Department of Agriculture, Farm Service Agency. 2021, December. ARC/PLC program. https://www.fsa.usda.gov/programs-and-services/arcplc_program/index

Zulauf, C., B. Brown, G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. “The Case for Looking at the ARC-IC (ARC-Individual) Program Option.” farmdoc daily (9):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 29, 2019.

Disclaimer: We request all readers, electronic media and others follow our citation guidelines when re-posting articles from farmdoc daily. Guidelines are available here. The farmdoc daily website falls under University of Illinois copyright and intellectual property rights. For a detailed statement, please see the University of Illinois Copyright Information and Policies here.